Cell Line Development Market Size, Share, Trends, Growth & Forecast 2034

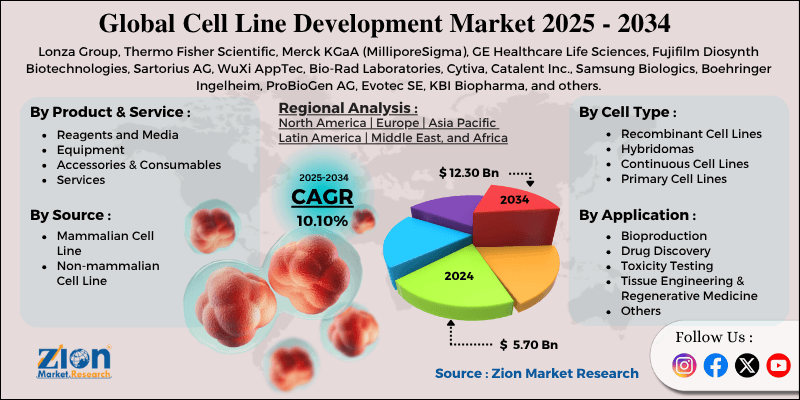

Cell Line Development Market By Product & Service (Reagents and Media, Equipment, Accessories & Consumables, Services), By Source (Mammalian Cell Line, Non-mammalian Cell Line), By Cell Type (Recombinant Cell Lines, Hybridomas, Continuous Cell Lines, Primary Cell Lines), By Application (Bioproduction, Drug Discovery, Toxicity Testing, Tissue Engineering & Regenerative Medicine, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

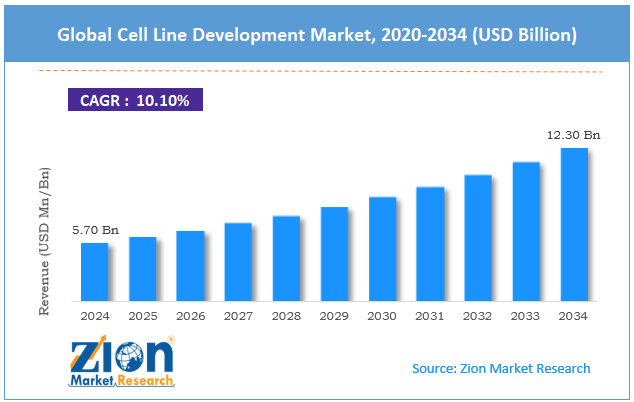

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.70 Billion | USD 12.30 Billion | 10.10% | 2024 |

Cell Line Development Industry Perspective:

The global cell line development market size was approximately USD 5.70 billion in 2024 and is projected to reach around USD 12.30 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global cell line development market is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2025-2034)

- In terms of revenue, the global cell line development market size was valued at around USD 5.70 billion in 2024 and is projected to reach USD 12.30 billion by 2034.

- The cell line development market is projected to grow significantly due to the growth in monoclonal antibody (mAb) production, the expansion of personalized medicine, and increasing investments in the life sciences and biotechnology sectors.

- Based on product & service, the services segment is expected to lead the market, while the reagents and media segment is expected to grow considerably.

- According to the source, the mammalian cell line segment is the largest segment. In contrast, the non-mammalian cell line segment is projected to witness sizable revenue growth over the forecast period.

- Based on cell type, the recombinant cell lines segment is expected to lead the market, followed by the continuous cell lines segment.

- Based on application, the bioproduction segment leads the market while the drug discovery segment registers considerable growth.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Cell Line Development Market: Overview

Cell line development is a crucial process in the pharmaceutical and biotechnology industries, emphasizing creating high-performing and stable cell lines for producing therapeutic vaccines, proteins, and other biologics. The method comprises selecting, engineering, and optimizing cells to assure continuous growth, quality, and productivity. The global cell line development market is expected to expand rapidly, driven by increasing demand for biopharmaceuticals, advancements in genetic engineering, and the adoption of automation and high-throughput screening technologies. The global demand for biopharmaceuticals, which includes monoclonal antibodies, therapeutic proteins, and vaccines, is increasing rapidly due to the rising prevalence of infectious and chronic diseases. Cell line development promises continuous growth and high-quality biologic production to meet this demand.

Hence, the CLD solutions industry is progressing along with biopharmaceutical development. Moreover, technologies such as RNAi, CRISPR, and synthetic biology enable precise genetic modifications in cell lines. These advancements enhance stability, yield, and protein functionality. Subsequently, advanced genetic engineering enhances the effectiveness and efficiency of cell line development.

Furthermore, automated systems and robotic platforms allow speedy screening and optimization of cell clones. This reduces manual labor, accelerates development schedules, and ensures continuous results. High-throughput screening is becoming a vital factor in fueling the market's adoption.

Despite the growth, the global market is impeded by factors such as technical complexity and long development timelines. Cell line development comprises mature methods in genetics, molecular biology, and cell culture. This technical specialization offers a barrier to entry for several companies. Complexity in processes slows the adoption of advanced CLD solutions. Likewise, developing a commercially viable cell line can take months or years. Extended schedules reduce flexibility and delay the commercialization of products. This long development timeline limits the industry's expansion.

Nonetheless, the global cell line development industry stands to gain from a few key opportunities, such as the development of new cell lines and the integration of ML and AI. Engineering cell lines to produce difficult-to-express proteins or next-generation biologics offers differentiation opportunities. Companies can create proprietary solutions with augmented functionality or yields. Novel cell lines can capture niche markets and a competitive advantage. Additionally, AI-based predictive analytics and ML enhance clone selection and culture conditions. This reduces trial-and-error methods and augments development timelines. The adoption of AI represents a technological opportunity to improve the efficacy of cell line development.

Cell Line Development Market Dynamics

Growth Drivers

How is the increasing focus on personalized medicine driving the cell line development market?

The move towards precision and personalized medicine is fueling the demand for customized cell lines, especially in rare disease therapeutics and oncology. The personalized medicine industry is expected to surpass $174 billion by 2026, growing at a CAGR of 11.8% from 2023, indicating its increasing significance.

Modified cell lines are vital for producing patient-specific monoclonal antibodies, gene therapies, and CAR-T therapies. Associations like the University of Pennsylvania and Novartis underscore the focus on optimized cell lines for new-generation therapies, strengthening the growth in the cell line development market.

The rising prevalence of monoclonal antibody therapeutics fuels the market growth

Monoclonal antibodies (mAbs) remain one of the fastest-growing therapeutic categories, fueling significant demand for high-performing mammalian cell lines. The worldwide mAb industry is anticipated to exceed $205 billion by 2026, backed by new approvals in autoimmune, oncology, and infectious diseases.

Companies like AbbVie, Roche, and Pfizer are heavily investing in cell line development to support the growth of their monoclonal antibody (mAb) pipelines. The rapid growth of mAb therapeutics propels advancements and investment in CLD solutions worldwide.

Restraints

A limited skilled workforce hampers the market progress

The cell line development sector experiences a scarcity of trained workforce, regulatory experts, and bioprocess engineers with expertise in advanced CLD technologies. According to the reports, only a fraction of biotech graduates have hands-on experience in mammalian cell line engineering and high-throughput screening; this scarcity restricts companies' ability to scale operations and utilize superior technologies, such as automation or CRISPR. Recent news reports that CDMOs, such as Samsung Biologics and Catalent, are introducing training programs to address workforce gaps. This lack of skilled experts continues to hinder the industry's rapid growth.

Opportunities

How does the adoption of advanced cell line engineering technologies create promising avenues for the cell line development industry growth?

Technologies such as site-specific recombinases, CRISPR-Cas9, and AI-driven cell optimization present significant opportunities for enhancing yield and efficiency. According to Nature Biotechnology (2025), CRISPR integration has reduced development schedules by up to 40%, increasing the attractiveness of these advanced techniques.

Collaborations, such as those between Thermo Fisher Scientific and Beam Therapeutics, present the adoption of these tools at scale in the cell line development industry. Leveraging these solutions enables CLD providers to offer more reliable and faster solutions, which appeal to a broader range of clients worldwide.

Challenges

How is the cell line development market challenged by the risk of low productivity and genetic instability?

Cell lines often undergo genetic drift, experience reduced protein expression over time, and exhibit low transfection efficacy, which can impact their commercial viability. Studies indicate that 25-30% of novel cell lines developed fail to meet production standards. Companies should constantly optimize host cells and vectors to maintain optimal productivity.

Recent reports indicate that Fujifilm Diosynth and Lonza are utilizing automation and AI to stabilize and monitor cell lines. However, these biological concerns remain a significant challenge in cell line development.

Cell Line Development Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cell Line Development Market |

| Market Size in 2024 | USD 5.70 Billion |

| Market Forecast in 2034 | USD 12.30 Billion |

| Growth Rate | CAGR of 10.10% |

| Number of Pages | 216 |

| Key Companies Covered | Lonza Group, Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), GE Healthcare Life Sciences, Fujifilm Diosynth Biotechnologies, Sartorius AG, WuXi AppTec, Bio-Rad Laboratories, Cytiva, Catalent Inc., Samsung Biologics, Boehringer Ingelheim, ProBioGen AG, Evotec SE, KBI Biopharma, and others. |

| Segments Covered | By Product & Service, By Source, By Cell Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cell Line Development Market: Segmentation

The global cell line development market is segmented based on product & service, source, cell type, application, and region.

Based on product & service, the global cell line development industry is divided into reagents and media, equipment, accessories & consumables, and services. The services segment held a dominating share, fueled by high demand for outsourced cell line development, contract research, and optimization from biotech and pharmaceutical companies.

On the other hand, the reagents & media segment progresses considerably, as these are vital for cell culture, high-throughput screening, and genetic engineering, and their consumption scales with biologics production and R&D activities.

Based on the source, the global market is segmented into mammalian cell lines and non-mammalian cell lines. The mammalian cell line segment dominates the market, as it is extensively used for producing complex biologics, such as recombinant proteins, monoclonal antibodies, and vaccines, due to its ability to perform human-like post-translational modifications.

Conversely, the non-mammalian cell line segment holds a second-leading share. They are mainly used for simpler protein production, cost-efficient large-scale manufacturing, and research applications.

Based on cell type, the global cell line development market is segmented into recombinant cell lines, hybridomas, continuous cell lines, and primary cell lines. The recombinant cell lines segment has held leadership since they are widely used for producing monoclonal antibodies, therapeutic proteins, and other biologics with high yield and consistency.

Nonetheless, the continuous cell lines segment ranks second, as they are widely adopted in vaccine production, research, and biologics manufacturing due to their scalability and stable growth.

Based on application, the global market is segmented into bioproduction, drug discovery, toxicity testing, tissue engineering & regenerative medicine, and others. The bioproduction segment captured the largest share, as cell lines are primarily developed for the large-scale production of monoclonal antibodies, vaccines, recombinant proteins, and other biologics.

However, the drug discovery segment holds a secondary position, as cell lines are widely used for target validation, screening, and preclinical research to accelerate the development of new therapeutics.

Cell Line Development Market: Regional Analysis

What enables North America to have a strong foothold in the global Cell Line Development Market?

North America is expected to maintain its leading position in the global cell line development market, driven by the presence of major biopharmaceutical companies, advanced biomanufacturing infrastructure, and robust regulatory support. North America, particularly the United States, is home to several global biotechnology and pharmaceutical giants, including Johnson & Johnson, Pfizer, and Amgen. These companies heavily invest in cell line development for monoclonal and biologics antibodies. Their presence fuels robust demand for advanced CLD solutions and services, strengthening the regional dominance.

Moreover, North America holds well-established biomanufacturing facilities and contract manufacturing/development organizations. These facilities support the large-scale production of biologics, which require high-quality, stable cell lines. The region's infrastructure promises speedy development, commercialization, and scalability, providing it with a competitive advantage. Additionally, regulatory agencies such as the NIH and FDA provide clear guidelines and support for the development of advanced therapies and biologics. These architectures prompt companies to invest in advanced CLD technologies, promising quality and compliance. Regulatory clarity reduces risk and encourages industry growth in North America.

Europe ranks as the second-leading region in the global cell line development industry, driven by the growth of biologics and biosimilars production, advanced research infrastructure and funding, as well as a robust regulatory framework and standardization. The rising demand for biologics and biosimilars is fueling cell line development in the region. The European biologics sector has been growing at a CAGR of 9-10% between 2020 and 2025, especially in Germany, Italy, and France. This growth demands advanced cell line development services for high-yield and stable protein production.

Similarly, European research institutes and universities receive substantial funding for biotechnology and cell line research. For example, the Horizon Europe program allocated more than €95 billion for innovation and research from 2021 to 2027, a portion of which supports cell line development projects, enabling Europe to maintain its competitive research and development capabilities. The region's stringent regulatory environment promises standardized and high-quality cell line production. Good Manufacturing Practice-compliant facilities in economies like the UK, Switzerland, and Germany attract both international and local biotech companies, thus accelerating and reinforcing the region's CLD sector.

Cell Line Development Market: Competitive Analysis

The leading players in the global cell line development market are:

- Lonza Group

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- GE Healthcare Life Sciences

- Fujifilm Diosynth Biotechnologies

- Sartorius AG

- WuXi AppTec

- Bio-Rad Laboratories

- Cytiva

- Catalent Inc.

- Samsung Biologics

- Boehringer Ingelheim

- ProBioGen AG

- Evotec SE

- KBI Biopharma

Cell Line Development Market: Key Market Trends

Adoption of CRISPR and gene editing technologies:

Cell line development increasingly depends on CRISPR and other gene-editing tools to create high-yield, stable, and disease-specific cell lines. These solutions reduce development timelines and improve accuracy, facilitating bioproduction and drug discovery.

Integration of AI and automation in cell line development:

Automation, AI-driven analytics, and robotics are being integrated into CLD workflows for faster cell screening, optimization, and selection. This enhances efficiency, reproducibility, and scalability in commercial production and research.

The global cell line development market is segmented as follows:

By Product & Service

- Reagents and Media

- Equipment

- Accessories & Consumables

- Services

By Source

- Mammalian Cell Line

- Non-mammalian Cell Line

By Cell Type

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

By Application

- Bioproduction

- Drug Discovery

- Toxicity Testing

- Tissue Engineering & Regenerative Medicine

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cell line development is a crucial process in the pharmaceutical and biotechnology industries, emphasizing creating high-performing and stable cell lines for producing therapeutic vaccines, proteins, and other biologics. The method comprises selecting, engineering, and optimizing cells to assure continuous growth, quality, and productivity.

The global cell line development market is projected to grow due to increasing demand for biopharmaceuticals, advancements in genetic engineering tools, and the growing use of CHO and HEK cell lines.

According to study, the global cell line development market size was worth around USD 5.70 billion in 2024 and is predicted to grow to around USD 12.30 billion by 2034.

The CAGR value of the cell line development market is expected to be approximately 10.10% from 2025 to 2034.

Stringent regulatory guidelines (EMA, GMP, FDA) and growing emphasis on environmentally safe and sustainable bioprocessing are shaping market growth.

The bioproduction segment is projected to dominate the cell line development market by 2034.

The stages in the global cell line development value chain include cell line screening & optimization, cell line generation, upstream and downstream process development, cell banking, and commercial-scale manufacturing.

North America is expected to lead the global cell line development market during the forecast period.

The key players profiled in the global cell line development market include Lonza Group, Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), GE Healthcare Life Sciences, Fujifilm Diosynth Biotechnologies, Sartorius AG, WuXi AppTec, Bio-Rad Laboratories, Cytiva, Catalent, Inc., Samsung Biologics, Boehringer Ingelheim, ProBioGen AG, Evotec SE, and KBI Biopharma.

The report examines key aspects of the cell line development market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed