Pharmaceutical Glass Ampoules Market Size, Share, Trends, Growth 2034

Pharmaceutical Glass Ampoules Market By Closure Type (Crimped Closure, Snap-On Closure, Screw-On Closure, Self-Sealing Closure), By Capacity (Less than 1ml, 1ml to 5ml, 5ml to 10ml, 10ml to 20ml, More than 20ml), By Application (Injectable Drugs, Vaccine Storage, Biologics, Ophthalmic Solutions, Parenteral Solutions), By End Use (Pharmaceutical Companies, Contract Manufacturing Organizations, Research Laboratories), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.86 Billion | USD 6.62 Billion | 6.98% | 2024 |

Pharmaceutical Glass Ampoules Industry Perspective:

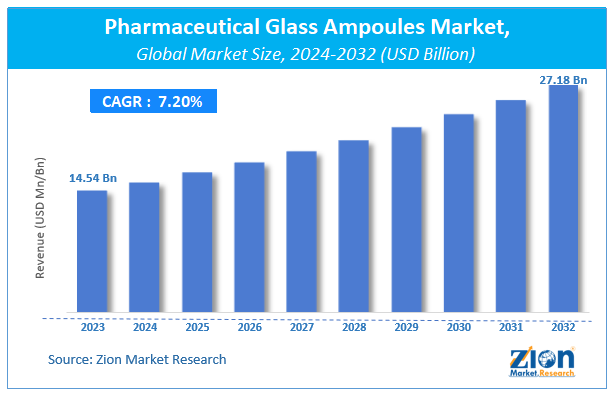

The global pharmaceutical glass ampoules market size was worth around USD 3.86 billion in 2024 and is predicted to grow to around USD 6.62 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.98% between 2025 and 2034.

Pharmaceutical Glass Ampoules Market: Overview

Pharmaceutical glass ampoules are single-dose sealed glass vessels, mainly used to store and preserve vaccines, biological substances, and sterile injectable medicines. These ampoules offer high transparency, brilliant chemical resistance, and superior protection against pollution, increasing their suitability for sensitive pharmaceutical formulations. The global pharmaceutical glass ampoules market is poised for notable growth owing to the development of specialty drugs and biologics, the expansion of injectable drug markets, and regulatory focus on safe packaging. Biologics need contamination-free and precise packaging due to their subtle molecular structures. Glass ampoules offer a trustworthy solution with optimal sterility and chemical resistance. Their adoption is rising along with the biologics industry.

Moreover, the injectable drug sector is progressing remarkably owing to improved patient outcomes and faster therapeutic action. Ampoules are highly favored packaging for a majority of injectable drugs because of their ease of use and hermetic sealing. This directly affects the global ampoule industry favorably. In addition, health authorities like the EMA and FDA are imposing stringent packaging standards for parenteral products. Glass ampoules, being inert and tamper-proof, meet these standards efficiently. This regulatory burden encourages their broader use.

Nevertheless, the global market faces limitations due to factors such as the breakability and fragility of glass and the availability of substitute packaging formats. Glass ampoules are prone to breaking and inherently fragile during handling, storage, or transport. This raises issues over wastage and injury, and increases product loss. Several pharmaceutical companies avoid using this glass due to logistical restrictions.

Furthermore, plastic ampoules, prefilled syringes, and vials are growing as less breakable and convenient alternatives. These options offer comparable sterility with enhanced ease of use and safety. The growth of these substitutes may restrict the adoption of the glass ampoule. Still, the global pharmaceutical glass ampoules industry benefits from several favorable factors, such as digitalization and growth in self-administration and home care trends.

Integration of smart packaging characteristics, such as RFID, QR codes, or tamper-evident seals, adds value to ampoules. They enhance traceability, safety, and patient engagement. Also, ampoules used in pre-dosed kits for home injections are gaining prominence. This offers a niche but a progressing market for safe and compact ampoule packaging.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical glass ampoules market is estimated to grow annually at a CAGR of around 6.98% over the forecast period (2025-2034)

- In terms of revenue, the global pharmaceutical glass ampoules market size was valued at around USD 3.86 billion in 2024 and is projected to reach USD 6.62 billion by 2034.

- The pharmaceutical glass ampoules market is projected to grow significantly owing to the growth in the biosimilars and biologics market, improvements in ampoule manufacturing technology, and increasing pharmaceutical research and development investments.

- Based on closure type, the crimped closure segment is expected to lead the market, while the self-sealing closure segment is expected to grow considerably.

- Based on capacity, the 1ml to 5ml segment dominates the market, while the 5ml to 10ml segment holds a second-leading share.

- Based on application, the injectable drugs is the dominating segment, while the vaccine storage segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the pharmaceutical companies segment is expected to lead the market compared to the contract manufacturing organizations segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Pharmaceutical Glass Ampoules Market: Growth Drivers

How is the regulatory push for tamper-proof and sterile packaging spurring the pharmaceutical glass ampoules market?

Global health regulatory bodies are rapidly imposing stringent rules on pharmaceutical packaging to promise drug integrity and patient safety. Ampoules, being single-use and hermetically sealed, comply with these standards and reduce the risk of pollution, counterfeit problems, and oxidation.

The United States FDA, in its Packaging Report 2024, highlighted sterile barrier integrity and traceability in injectable drug packaging.

Which key technological improvements are fueling the pharmaceutical glass ampoules market?

Technological advancements are changing ampoule production, increasing its speed, enhancing its sustainability, and precision. Manufacturers are integrating automated filling, forming, and sealing solutions, robotic lines, and real-time inspection systems to improve throughput and reduce defects. This scalability has enabled ampoule use to stay cost-effective for large-scale pharma production.

Novel developments comprise the use of advanced vision systems and artificial intelligence for stress testing and crack detection in ampoules, reducing breaking rates. These improvements are notably propelling the growth of the pharmaceutical glass ampoules market.

Pharmaceutical Glass Ampoules Market: Restraints

Recycling and environmental challenges negatively impact market progress

While glass is technically biodegradable, pharmaceutical ampoules pose disposal and recycling challenges due to their biohazard classification and contamination with drug residues. Regulatory obstacles usually prevent these ampoules from entering standard glass recycling streams, leading to a surge in medical waste.

Recent scrutiny regarding healthcare waste management, mainly in Japan and Europe, has resulted in stringent disposal norms. The United Kingdom's NHS introduced new sustainability protocols in February 2025, which discouraged the use of disposable glass ampoules unless a substitute was not feasible, thereby presenting a pushback against ampoule-based designs.

Pharmaceutical Glass Ampoules Market: Opportunities

How do smart ampoules and digital traceability integration benefit the pharmaceutical glass ampoules market?

Digitalization is offering fresh possibilities for ampoule packaging via sterilization, smart labeling, and anti-counterfeiting features. Producers are integrating RFID/NFC tags, QR-based authentication, and laser coding to improve traceability, which is vital in cold-chain drugs and controlled substances.

SGD Pharma and a United States startup introduced a line of 'smart ampoules' with fixed micro-labels for authenticity verification in February 2025, pursuing high-value biologics and drugs. As traceability becomes increasingly inflexible, value-added ampoules emerge as a premium growth domain, significantly impacting the pharmaceutical glass ampoules industry.

Pharmaceutical Glass Ampoules Market: Challenges

Limited customization and innovation in ampoule design restrict the growth of the market

Compared to flexible formats like syringes and vials, glass ampoules offer fewer options for design customization, functional enhancements, and branding. Their narrow-neck and single-use design limits the integration of patient-friendly properties like multi-dose storage, auto-disable mechanisms, or dose-calibrated markings.

Pharmaceutical companies are increasingly favoring packaging that complies with smart drug delivery, patient-centric administration, and digital traceability. While ampoule producers are engaged in adaptation with RFID tagging and laser coding, they still struggle to offer more mature drug delivery systems than other competitors.

Pharmaceutical Glass Ampoules Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Glass Ampoules Market |

| Market Size in 2024 | USD 3.86 Billion |

| Market Forecast in 2034 | USD 6.62 Billion |

| Growth Rate | CAGR of 6.98% |

| Number of Pages | 213 |

| Key Companies Covered | Schott AG, Gerresheimer AG, Nipro Corporation, Stevanato Group, SGD Pharma, AAPL Solutions, Cangzhou Four Stars Glass Co. Ltd., Shandong Pharmaceutical Glass Co. Ltd., Ardagh Group, Hindustan National Glass & Industries Ltd., DWK Life Sciences, Richland Glass Company Inc., Shandong Medicinal Glass Co. Ltd., Accu-Glass LLC, Linuo Group, and others. |

| Segments Covered | By Closure Type, By Capacity, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Glass Ampoules Market: Segmentation

The global pharmaceutical glass ampoules market is segmented based on closure type, capacity, application, end-use, and region.

Based on closure type, the global pharmaceutical glass ampoules industry is divided into crimped closure, snap-on closure, screw-on closure, and self-sealing closure. The crimped closure segment holds a leading market share because of its tamper-evident features and optimal sealing integrity.

Conversely, the self-sealing closure segment holds a second-leading share since it enables repeated needle insertions without compromising sterility, increasing its suitability for multi-dose uses.

Based on capacity, the global market is segmented as less than 1ml, 1ml to 5ml, 5ml to 10ml, 10ml to 20ml, and more than 20ml. The 1ml to 5ml segment dominates the global market owing to its extensive use in packaging anesthetics, biologics, vaccines, and other injectable drugs.

Nonetheless, the 5ml to 10ml segment ranks second since it caters to medicines needing slightly higher doses like analgesics, infusion therapies, and antibiotics.

Based on application, the global pharmaceutical glass ampoules market is segmented into injectable drugs, vaccine storage, biologics, ophthalmic solutions, and parenteral solutions. The injectable drugs segment leads the market since it represents the highest use cases for glass ampoules because of the need for sterility, contamination prevention, and precise dosing.

On the other hand, the vaccine storage segment is also gaining popularity, propelled by the rising global immunization effort and pandemic-associated vaccine production.

Based on end-use, the global market is segmented into pharmaceutical companies, contract manufacturing organizations, and research laboratories. The pharmaceutical companies segment registered a substantial share of the market as they directly produce and package a broader range of injectable drugs, biologics, and vaccines in ampoules.

However, the contract manufacturing organizations segment is the second-leading segment owing to the progressing trend of pharma companies outsourcing production.

Pharmaceutical Glass Ampoules Market: Regional Analysis

Why is Europe dominating the global pharmaceutical glass ampoules market?

Europe is projected to maintain its dominant position in the global pharmaceutical glass ampoules market owing to a robust pharmaceutical manufacturing base, strong healthcare ecosystem, and strict regulatory standards supporting glass packaging. Europe houses some of the leading pharmaceutical manufacturers like Novartis, GlaxoSmithKline, Sanofi, and Roche. This industrial boost directly propels the demand for quality glass ampoules utilized in injectable drug packaging.

Europe holds a well-established healthcare infrastructure with more than 2.7 hospital beds and significant public investment in research. Institutions and governments support large-scale clinical trials and immunization programs. This fuels higher use of ampoules in research centers, hospitals, and therapeutic pipelines.

Furthermore, the European Medicines Agency and local regulators enforce stringent guidelines on drug sterility, packaging safety, and traceability. Glass ampoules meet these standards owing to their tamper-evident design and chemical inertness. Compliance with the EU pharmacopeia fuels their demand for flexible and plastic alternatives.

Asia Pacific maintains its position as the second-leading region in the global pharmaceutical glass ampoules industry due to the expanding pharmaceutical production capacity, growing patient population, and boom in injectable generics and biologics. Asia Pacific is speedily gaining popularity as a pharmaceutical manufacturing hub, with key drug production centers in Japan, South Korea, China, and India. India alone registers for more than 20% of the worldwide generics exports, and China is the leading producer of APIs. This pharmaceutical progress directly fuels the demand for ampoules used in sterile injectable packaging.

Moreover, APAC houses more than 4.7 billion individuals, with growing cases of chronic diseases. The demand for injectable drugs to treat these conditions is increasing. This immense patient base propels the consumption of ampoule-packaged medications in private and public healthcare systems.

APAC is also experiencing significant investment in injectable generic drugs and biosimilars, mainly in South Korea and India. The APAC biosimilars industry was estimated at more than $4.5 billion in 2024, with higher dependency on glass ampoules for storage. This trend supports the region's surging demand in the ampoule industry.

Pharmaceutical Glass Ampoules Market: Competitive Analysis

The leading players in the global pharmaceutical glass ampoules market are:

- Schott AG

- Gerresheimer AG

- Nipro Corporation

- Stevanato Group

- SGD Pharma

- AAPL Solutions

- Cangzhou Four Stars Glass Co. Ltd.

- Shandong Pharmaceutical Glass Co. Ltd.

- Ardagh Group

- Hindustan National Glass & Industries Ltd.

- DWK Life Sciences

- Richland Glass Company Inc.

- Shandong Medicinal Glass Co. Ltd.

- Accu-Glass LLC

- Linuo Group

Pharmaceutical Glass Ampoules Market: Key Market Trends

Growth of personalized medicine and biologics:

The demand for single-dose and sterile packaging is growing with the rise of biologics, individualized therapies, and biosimilars. Glass ampoules offer the required protection for sensitive biological formulations. This trend is driving ampoule use in oncology, hormone-based treatments, and immunology.

Smart manufacturing technologies and automation:

Manufacturers are investing in automated ampoule filing, inspection systems, and sealing to optimize speed and lessen human error. Solutions like robotics, blow-fill-seal (BFS), and AI-based quality control are highly adopted. This drives consistency and productivity in high-volume environments.

The global pharmaceutical glass ampoules market is segmented as follows:

By Closure Type

- Crimped Closure

- Snap-On Closure

- Screw-On Closure

- Self-Sealing Closure

By Capacity

- Less than 1ml

- 1ml to 5ml

- 5ml to 10ml

- 10ml to 20ml

- More than 20ml

By Application

- Injectable Drugs

- Vaccine Storage

- Biologics

- Ophthalmic Solutions

- Parenteral Solutions

By End Use

- Pharmaceutical Companies

- Contract Manufacturing Organizations

- Research Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical glass ampoules are single-dose sealed glass vessels, mainly used to store and preserve vaccines, biological substances, and sterile injectable medicines. These ampoules offer high transparency, brilliant chemical resistance, and superior protection against pollution, increasing their suitability for sensitive pharmaceutical formulations.

The global pharmaceutical glass ampoules market is projected to grow due to growing demand for injectable pharmaceuticals, strict regulations on drug packaging safety, and elevated demand for tamper-proof packaging solutions.

According to study, the global pharmaceutical glass ampoules market size was worth around USD 3.86 billion in 2024 and is predicted to grow to around USD 6.62 billion by 2034.

The CAGR value of the pharmaceutical glass ampoules market is expected to be around 6.98% during 2025-2034.

Europe is expected to lead the global pharmaceutical glass ampoules market during the forecast period.

Leading players are focusing on acquisitions, mergers, and strategic collaborations to enhance technological capabilities and geographic reach. They are also investing heavily in automation and R&D for better operational efficiency and product innovation.

Stringent regulations from agencies like the EMA and FDA regarding drug sterility and packaging safety are driving demand for high-quality pharmaceutical glass ampoules. Moreover, environmental concerns regarding single-use packaging are encouraging producers to adopt sustainable production methods.

Stakeholders should invest in quality assurance systems and advanced manufacturing technologies to meet stringent regulatory protocols. Furthermore, expanding into emerging markets and forming strategic alliances can help capture new growth opportunities.

The key players profiled in the global pharmaceutical glass ampoules market include Schott AG, Gerresheimer AG, Nipro Corporation, Stevanato Group, SGD Pharma, AAPL Solutions, Cangzhou Four Stars Glass Co., Ltd., Shandong Pharmaceutical Glass Co., Ltd., Ardagh Group, Hindustan National Glass & Industries Ltd., DWK Life Sciences, Richland Glass Company, Inc., Shandong Medicinal Glass Co., Ltd., Accu-Glass LLC, and Linuo Group.

The report examines key aspects of the pharmaceutical glass ampoules market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed