Carpets & Rugs Market Size, Share & Growth Report 2032

Carpets & Rugs Market - by Material (Wool, Natural fiber, Cotton, and Synthetic [Nylon, Polyester, Polypropylene]) by Product (Knotted, Tufted, Hand-loomed, and Machine-loomed) by Application (Office, Hotel, Automotive, and Residential) and by Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

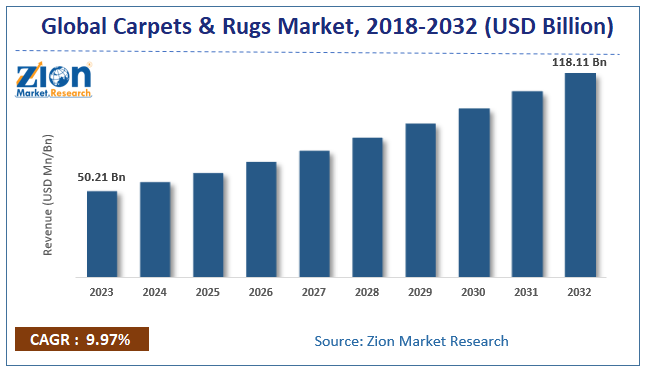

| USD 50.21 Billion | USD 118.11 Billion | 9.97% | 2023 |

Carpets and Rugs Market: Industry Perspective

The global carpets and rugs market size was worth around USD 50.21 billion in 2023 and is predicted to grow to around USD 118.11 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.97% between 2024 and 2032. The report offers a valuation and analysis of the Carpets & Rugs Market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 204 to 2032 based on value (USD Billion).

Key Insights

- As per the analysis shared by our research analyst, the carpets & rugs market is anticipated to grow at a CAGR of 9.97% during the forecast period (2024-2032).

- The global carpets & rugs market was estimated to be worth approximately USD 50.21 billion in 2023 and is projected to reach a value of USD 118.11 billion by 2032.

- The growth of the carpets & rugs market is being driven by rising demand for stylish, comfortable, and functional flooring solutions in residential, commercial, and hospitality spaces.

- Based on the material, the wool segment is growing at a high rate and is projected to dominate the market.

- On the basis of product, the knotted segment is projected to swipe the largest market share.

- In terms of application, the office segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Carpets & rugs are mainly utilized for covering floors for the purpose of decoration. These products are produced through the use of many of the raw materials such as nylon, polypropylene, polyester, jute, and cotton. Carpets & rugs are available in myriad designs and colors due to the changing lifestyles of the customers.

Market Growth Drivers

An increase in renovation activities along with swift urbanization will steer the market trends. Rising interest among end-users toward interior decoration activities will proliferate the market size in the years ahead. Apparently, the surge in the number of construction activities in developing countries will embellish the expansion of the carpets and rugs industry over the assessment period. Apart from this, the rise in the significance of organized retail activities across the globe is likely to offer new growth opportunities for the industry over the forecast timespan. Nonetheless, high raw material costs will put brakes on the industry expansion over the forecast timeframe.

Moreover, artistic and functional features of products will open new vistas of growth for the carpets and rugs industry over the forecast timeframe. Thriving transport activities and a surge in residential construction as well as commercial construction projects will pave the way for the expansion of the carpets and rugs industry over the projected timeframe.

Recent Development

- On April 22, 2025, Natco Home Group announced the acquisition of the Orian Rugs brand from its parent company, SP Orian, LLC. This strategic move united the last two remaining U.S. manufacturers of woven rugs, forming a stronger and more consolidated presence in the home furnishings market.

- In December 2024, Benuta, Europe’s largest online rug store, implemented Constructor’s e-commerce search and product discovery platform to personalize and elevate the online shopping experience. Additionally, Benuta will leverage Constructor’s AI Shopping Assistant, an innovative conversational tool, to help customers easily discover rugs and home accessories that suit their tastes.

- In August 2024, STARK and Missoni launched a new rug collection, extending their collaboration that started in 2005. The collection includes nine stocked rug styles, five custom designs, and a signature custom SPA rug made with STARK’s durable Performance Acrylic fiber. Additionally, 10 carpet styles and a selection of 100 custom colors, available in wool, silk, and silky nylon, provide a highly tailored luxury experience.

Carpets and Rugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Carpets and Rugs Market |

| Market Size in 2023 | USD 50.21 Billion |

| Market Forecast in 2032 | USD 118.11 Billion |

| Growth Rate | CAGR of 9.97% |

| Number of Pages | 230 |

| Key Companies Covered | Victoria PLC, Mohawk Industries Incorporation, Tai Ping Carpets International Limited, Dixie Group Incorporation, and others. |

| Segments Covered | By Material, By Product, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Continue Market Dominance Over Forecast Timeframe

The carpets & rugs market in North America is anticipated to register noteworthy growth with manufacturers focusing on producing low-cost carpets & rugs. A prominent surge in construction activities taking place across the U.S. is anticipated to bolster the expansion of the carpets & rugs industry in North America over the forecast timeframe. Apparently, huge customer preference in interior designing is one of the major aspects driving the market size in the region. Apparently, surging renovation activities in the real estate industry across the U.S. will produce high product penetration across the region in the foreseeable future.

Carpets and Rugs Market: Competitive Analysis

The global carpets and rugs market is dominated by players like:

- Victoria PLC

- Mohawk Industries Incorporation

- Tai Ping Carpets International Limited

- Dixie Group Incorporation

The global carpets & rugs market is segmented as follows:

By Material

- Wool

- Natural fiber

- Cotton

- Synthetic

- Nylon

- Polyester

- Polypropylene

By Product

- Knotted

- Tufted

- Hand-loomed

- Machine-loomed

By Application

- Office

- Hotel

- Automotive

- Residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global carpets and rugs market size was worth around USD 50.21 billion in 2023 and is expected to reach USD 118.11 billion by 2032.

The global carpets and rugs market is expected to grow at a CAGR of 9.97% during the forecast period.

North America is expected to dominate the carpets and rugs market over the forecast period.

Leading players in the global carpets and rugs market include Victoria PLC, Mohawk Industries Incorporation, Tai Ping Carpets International Limited, and Dixie Group Incorporation, among others.

The carpets and rugs market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed