Global Car Safety Market Size, Share, Growth Analysis Report - Forecast 2034

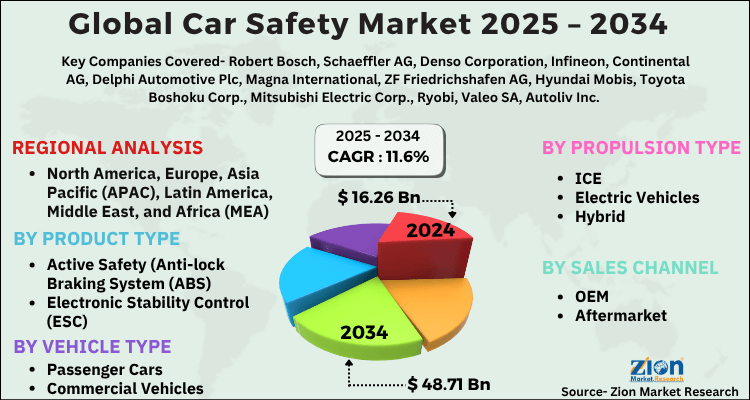

Car Safety Market By Type (Active Safety, Passive Safety), By Occupant Type (Adult Occupant, Pedestrian Safety, Child Safety, Safety Assistance Systems) By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type (ICE, Electric Vehicles, Hybrid), By Sales Channel (OEM, Aftermarket), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

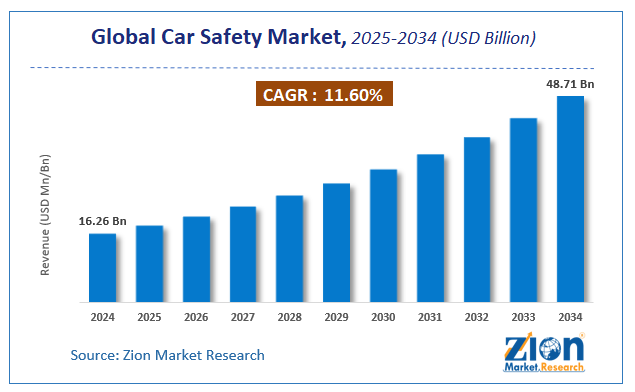

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.26 Billion | USD 48.71 Billion | 11.6% | 2024 |

Car Safety Market: Industry Perspective

The global car safety market size was worth around USD 16.26 Billion in 2024 and is predicted to grow to around USD 48.71 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 11.6% between 2025 and 2034. The report analyzes the global car safety market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the car safety industry.

Car Safety Market: Overview

Car safety regulations are a set of guidelines that are implemented for automotive vehicles, safety systems, and manufacturing equipment. The main aim of imposing such regulations is to control the occurrences of automobile accidents. Car safety regulations are implemented in many countries, where active safety systems play a vital role in restricting such accidents. Active safety systems comprise various subsystems, which include tire-pressure-monitoring systems, anti-lock braking, and electronic stability control. Passive safety systems include seat belts and airbags that help to reduce the risk of injury in an accident.

The growth in the car safety market is mainly due to increase awareness regarding safety systems among consumers thus driving the global car safety market. Other factors that are responsible for the market growth include progressively stringent safety norms, increasing vehicle electrification, and rising production of vehicles. Active safety systems offer advantages such as prevention, pre-crash warning, and post-crash rescue management; these features positively impact the global car safety market. It helps to reduce the harmful effects of road traffic accidents. Companies are focusing on creating an accident-proof vehicle, which will inform the driver about the hazards and warn the driver against disaster; this is anticipated to open up new growth opportunities in the market.

Key Insights

- As per the analysis shared by our research analyst, the global car safety market is estimated to grow annually at a CAGR of around 11.6% over the forecast period (2025-2034).

- Regarding revenue, the global car safety market size was valued at around USD 16.26 Billion in 2024 and is projected to reach USD 48.71 Billion by 2034.

- The car safety market is projected to grow at a significant rate due to Increasing demand for vehicle safety features and stricter safety regulations drive growth. Advancements in ADAS and rising consumer awareness further support the market.

- Based on type, the active safety segment is expected to lead the global market.

- On the basis of occupant type, the adult occupant segment is growing at a high rate and will continue to dominate the global market.

- Based on the vehicle type, the passenger cars segment is projected to swipe the largest market share.

- By propulsion type, the ice segment is expected to dominate the global market.

- On the basis of sales channel, the oem segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Car Safety Market: Growth Drivers

Rising demand for cars with intelligent braking systems drives the market growth

As end users seek to maximize performance, intelligent braking systems (IBS) in all commercial and passenger vehicles are gaining more focus. Sensors in cars equipped with them continuously check the vehicle's circumstances and react in an emergency. An ultrasonic wave emitter and ultrasonic receiver in an intelligent mechatronic system generate and emit ultrasonic waves frontward at a preset distance, providing the distance between the obstacle and the car. Then, a microcontroller is employed to control the vehicle's speed based on the information from the detection pulse to depress the stop pedal and apply extreme braking to the vehicle for safety reasons. Several nations have implemented strict regulations to incorporate intelligent braking systems. For instance, forty nations, headed by Japan and Europe, have agreed to mandate the installation of automated braking systems in new cars and light commercial vehicles by 2019. This is probably going to open up new opportunities for vehicles with IBS and increase demand for the car safety industry.

Car Safety Market: Restraints

Drop in sales and production of cars hinders the industry from growing

Since 2016, there has been a slowdown in both car production and sales as a result of the global economic slowdown and different government financial reform initiatives. For instance, since 2016, the increase in the Federal Reserve interest rate has caused a decline in car sales in the United States. During this time, output has also been falling. The world's vehicle sales are predicted to decline by about 3.1 million units in 2019. Ford stated that new vehicle sales in China decreased by about 28.75% in 2019. GM recorded a 0.9% to 1.2% decline in sales. The potential of the American automotive market declining, as a result, will have a detrimental impact on the expansion of the automotive safety market.

Car Safety Market: Opportunities

Stringent environmental and fuel economy regulations

New technological innovations are disrupting the automotive industry as a result of the strict requirements from customers and regulatory bodies. Several governments are currently concentrating on lowering the number of collisions by incorporating active and inactive safety systems into automobiles. The U.K. government committed in 2019 to requiring lane-keeping technology, advanced emergency braking, and intelligent speed assistance in vehicles by 2022. Similar to this, several nations, including China, India, and the United States, have set strict regulations for automakers to incorporate passive and active safety systems in new cars by 2020. These laws are designed to cut down on mishaps. The majority of makers are using active and passive safety systems in cars to accomplish this, which is driving up demand for the car safety market.

Car Safety Market: Challenges

The high installation cost impedes market expansion

The high installation and replacement cost of the passive safety system is expected to hinder the car safety market growth over the forecast period.

Car Safety Market: Segmentation

The global car safety market is segmented based on type, occupant type, vehicle type, propulsion type, sales channel, and region.

Based on the type, the global market is bifurcated into active safety and passive safety. The active safety segment is expected to dominate the market over the forecast period due to its benefits, such as anti-lock brakes, electronic stability control, or traction control, it also prevents or mitigates traffic accidents by enhancing the general driving experience in a variety of conditions. Several governments have enacted stringent laws requiring the installation of safety features in vehicles. For instance, the deployment of active safety measures in automobiles is required by 2018 according to India's New Car Assessment Program (NCAP). In addition, starting in October 2018, all newly released vehicles must comply with pedestrian safety standards. Similar to this, Europe NCAP created strict guidelines for integrating active safety features to prevent or lessen mishaps. As a result of these regulations, the market for active safety devices will see an increase in demand.

Based on the occupant type, the market is segmented into adult occupant, pedestrian safety, child safety, and safety assistance systems. The adult occupant segment is expected to account for the largest market share during the forecast period. The increase in the number of consumer safety awareness programs and the rising number of road accidents that further result in severe fatalities in the human body will drive the market's development during the forecast period. However, due to increasing disposable incomes, consumers are quickly shifting towards spending more on the different safety features offered in their vehicles. Giants in the business are now able to invest due to it. Additionally, manufacturers offer active and passive safety systems in the automotive industry to improve customer comfort and driving experience, which will improve driving comfort for consumers and open up growth opportunities for the car safety market.

On the basis of Vehicle Type, the global car safety market is bifurcated into passenger vehicles and commercial vehicles.

By Propulsion Type, the global car safety market is split into ICE, electric vehicles, and hybrid.

In terms of Sales Channel, the global car safety market is categorized into OEM and aftermarket.

Car Safety Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Car Safety Market |

| Market Size in 2024 | USD 16.26 Billion |

| Market Forecast in 2034 | USD 48.71 Billion |

| Growth Rate | CAGR of 11.6% |

| Number of Pages | 214 |

| Key Companies Covered | Robert Bosch, Schaeffler AG, Denso Corporation, Infineon, Continental AG, Delphi Automotive Plc, Magna International, ZF Friedrichshafen AG, Hyundai Mobis, Toyota Boshoku Corp., Mitsubishi Electric Corp., Ryobi, Valeo SA, Autoliv Inc. and Tata Motors among others., and others. |

| Segments Covered | By Type, By Occupant Type, By Vehicle Type, By Propulsion Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Car Safety Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the global car safety market during the forecast period. More autonomous vehicles will be introduced in various sectors due to the rise of electric vehicles in the automotive business. The likelihood and potential for the present market for safety systems to grow and expand increases with the number of autonomous vehicles in the market. The market has become cluttered compared to how it was a few years ago because the majority of North American automobiles are already outfitted with the majority of safety systems.

The United States provides at least 3% of the nation's overall gross domestic product, serving as the sole cornerstone of the North American automotive hub. (GDP). The nation is also among the biggest producers of luxury vehicles, with total sales of USD 5 billion in 2021. BMW, a luxury automaker, announced record-breaking sales of more than 336,600 vehicles in 2021. Human error is the main cause of the majority of automobile accidents. Nearly one-third of the traffic-related fatalities in Virginia (220 crashes), according to the National Highway Traffic Safety Administration (NHTSA) branch of the US Department of Transportation, featured alcohol-impaired driving.

In addition to raising awareness about driver assistance technologies, the Canadian government declared the safe testing of every car and the introduction of automated and connected vehicles. For instance, the US Department of Transportation will receive safety solutions data straight from GM through INRIX Inc.'s analytics-assisted cloud-based application as part of the company's Safety View by GM Future Roads & Inrix initiative, which was announced by GM in May 2022.

Recent Developments:

- In May 2020, a German technology firm called ZF Friedrichshafen AG Company acquired WABCO. The deal will help ZF advance the market's current digital platforms and establish itself as a global champion in commercial automotive systems. For heavy-duty commercial cars, WABCO Vehicle Control Systems, a US-based business, offers electronic braking, stability, suspension, and transmission automation systems.

- In December 2021, the world's first system that combines outstanding HMI (Human-Machine Interface) technology with cutting-edge driver and occupant monitoring will be made available by Behr-Hella Thermocontrol GmbH (BHTC), a joint venture between Hella and MAHLE Behr GmbH & Co. KG. The display and climate control devices from BHTC can include cameras that watch for driving distraction, drowsiness, and sudden sickness and will sound an alarm.

- In August 2021, in Limerick, UK, Robert Bosch (Bosch) developed an automotive research and development facility. The emphasis of the events in Limerick will be on automotive electronics and semiconductor goods. Integrated circuits (IC) for adaptive cruise control and radar technologies for automated driving will be among the first things developed at the site.

Car Safety Market: Competitive Analysis

The global car safety market is dominated by players like:

- Robert Bosch

- Schaeffler AG

- Denso Corporation

- Infineon

- Continental AG

- Delphi Automotive Plc

- Magna International

- ZF Friedrichshafen AG

- Hyundai Mobis

- Toyota Boshoku Corp.

- Mitsubishi Electric Corp.

- Ryobi

- Valeo SA

- Autoliv Inc.

- Tata Motors

The global car safety market is segmented as follows:

By Type

- Active Safety

- Passive Safety

By Occupant Type

- Adult Occupant

- Pedestrian Safety

- Child Safety

- Safety Assistance Systems

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion Type

- ICE

- Electric Vehicles

- Hybrid

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Car safety regulations are a set of guidelines that are implemented for automotive vehicles, safety systems, and manufacturing equipment.

The global car safety market is expected to grow due to Increasing demand for vehicle safety features and stricter safety regulations drive growth. Advancements in ADAS and rising consumer awareness further support the market.

According to a study, the global car safety market size was worth around USD 16.26 Billion in 2024 and is expected to reach USD 48.71 Billion by 2034.

The global car safety market is expected to grow at a CAGR of 11.6% during the forecast period.

North America is expected to dominate the car safety market over the forecast period.

Leading players in the global car safety market include Robert Bosch, Schaeffler AG, Denso Corporation, Infineon, Continental AG, Delphi Automotive Plc, Magna International, ZF Friedrichshafen AG, Hyundai Mobis, Toyota Boshoku Corp., Mitsubishi Electric Corp., Ryobi, Valeo SA, Autoliv Inc. and Tata Motors among others., among others.

The report explores crucial aspects of the car safety market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed