Bleached Eucalyptus Kraft Pulp (BEKP) Market Size, Share 2034

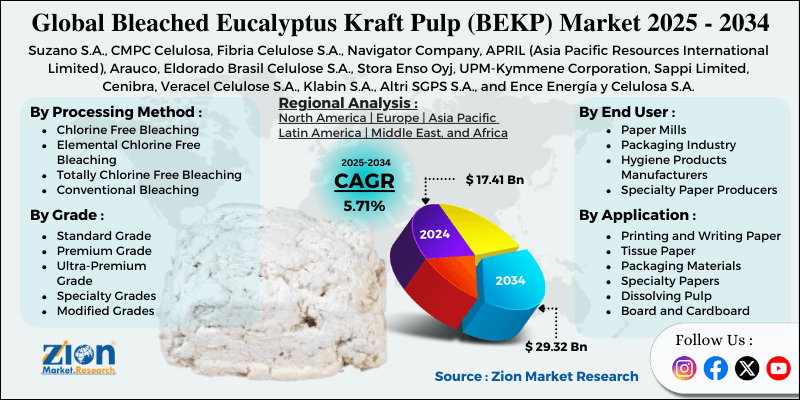

Bleached Eucalyptus Kraft Pulp (BEKP) Market By Grade (Standard Grade, Premium Grade, Ultra-Premium Grade, Specialty Grades, Modified Grades, and Others), By Application (Printing and Writing Paper, Tissue Paper, Packaging Materials, Specialty Papers, Dissolving Pulp, Board and Cardboard), By End-User (Paper Mills, Packaging Industry, Hygiene Products Manufacturers, Specialty Paper Producers), By Processing Method (Chlorine Free Bleaching, Elemental Chlorine Free Bleaching, Totally Chlorine Free Bleaching, Conventional Bleaching), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

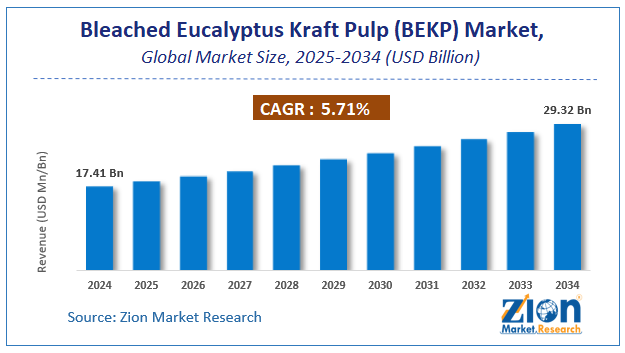

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.41 Billion | USD 29.32 Billion | 5.71% | 2024 |

Bleached Eucalyptus Kraft Pulp (BEKP) Industry Prospective

The global bleached eucalyptus kraft pulp (BEKP) market size was worth approximately USD 17.41 billion in 2024 and is projected to grow to around USD 29.32 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.71% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global bleached eucalyptus kraft pulp market is estimated to grow annually at a CAGR of around 5.71% over the forecast period (2025-2034).

- In terms of revenue, the global bleached eucalyptus kraft pulp market size was valued at approximately USD 17.41 billion in 2024 and is projected to reach USD 29.32 billion by 2034.

- The bleached eucalyptus kraft pulp market is projected to grow significantly due to increasing demand for tissue products, growth in the packaging industry, shift toward sustainable materials, and expanding paper production in developing economies.

- Based on grade, the standard grade segment is expected to lead the bleached eucalyptus kraft pulp market, while the specialty grades segment is anticipated to experience significant growth.

- Based on application, the printing and writing paper segment is expected to lead the bleached eucalyptus kraft pulp market, while the tissue paper segment is anticipated to witness notable growth.

- Based on end-user, the paper mills segment is the dominating segment, while the hygiene products manufacturers segment is projected to witness sizeable revenue over the forecast period.

- Based on the processing method, the elemental chlorine-free bleaching segment is expected to lead the market compared to the totally chlorine-free bleaching segment.

- Based on region, Asia Pacific is projected to dominate the global bleached eucalyptus kraft pulp market during the estimated period, followed by South America.

Bleached Eucalyptus Kraft Pulp (BEKP) Market: Overview

Bleached eucalyptus kraft pulp is a refined cellulose fiber made from eucalyptus wood using the kraft pulping and bleaching process to produce bright, pure, and strong pulp for premium paper manufacturing. The process uses controlled chemical treatment to remove lignin from wood chips while maintaining fiber strength and consistency. Eucalyptus wood serves as an efficient raw material because plantations grow quickly and reach harvest readiness within seven to ten years, thereby supporting sustainable pulp production. The short and uniform fiber structure of eucalyptus pulp creates smooth paper surfaces with excellent print quality, opacity, and formation. Paper producers widely use bleached eucalyptus kraft pulp in office paper, coated paper, printing paper, magazine paper, and premium packaging materials. High brightness levels above ninety percent ISO support a clean white paper appearance. Tissue paper manufacturers blend eucalyptus pulp with softwood fibers to improve softness, absorbency, and comfort in bathroom tissue, facial tissue, and paper towels.

Specialty paper applications include filter paper, label paper, and release paper. Kraft pulp mills recycle chemicals and generate renewable energy, improving cost efficiency and environmental performance. Global trade supplies pulp from South America and Asia to major paper markets worldwide. Sustainable forestry certifications support responsible plantation sourcing. The growing demand for sustainable packaging materials and tissue products is expected to drive growth in the bleached eucalyptus kraft pulp market throughout the forecast period.

Bleached Eucalyptus Kraft Pulp (BEKP) Market Dynamics

Growth Drivers

Rising demand for tissue and hygiene products

The bleached eucalyptus kraft pulp market shows strong growth due to rising global use of tissue paper and hygiene products. Population growth, urbanization, higher incomes, and improving living standards increase demand for bathroom tissue, paper towels, and napkins worldwide. Hospitals, offices, restaurants, hotels, airports, and public facilities consume large volumes of disposable tissue products for daily hygiene needs. Baby care, feminine hygiene, and adult incontinence products use eucalyptus pulp fibers for absorbency, softness, comfort, and reliable performance. Premium tissue products with better softness, strength, and absorbency increase preference for high-quality bleached eucalyptus kraft pulp.

Environmental awareness encourages the adoption of paper-based alternatives, the replacement of plastic items, and the support of sustainable demand for eucalyptus pulp globally. Quick service restaurants, cafes, travel, tourism, and workplace hygiene standards drive steady tissue consumption across commercial spaces globally. Product innovation, E-commerce availability, and improved distribution channels support continued growth across the bleached eucalyptus kraft pulp market.

How are sustainable forestry practices and eucalyptus plantations driving the bleached eucalyptus kraft pulp market expansion?

The global bleached eucalyptus kraft pulp market benefits from large-scale eucalyptus plantation development, supporting sustainable fiber supply and environmental responsibility worldwide. Eucalyptus plantations are well established in tropical and subtropical regions, particularly in Brazil, yielding rapid biomass growth and consistent wood quality for pulp production. Improved eucalyptus genetics and plantation management practices increase yields, wood density, fiber performance, and cost efficiency for bleached eucalyptus kraft pulp producers. Certified plantations located on degraded land support responsible forestry, protect natural forests, and address sustainability expectations across the global pulp and paper industry. Short eucalyptus rotation cycles allow faster investment returns, flexible supply planning, and stable raw material availability for global bleached eucalyptus kraft pulp mills. Advanced silviculture techniques and precision forestry tools improve plantation productivity while reducing environmental impact and operational risks. Long-term sustainability commitments and forest certification programs strengthen market acceptance and support the growing demand of environmentally conscious paper and packaging manufacturers.

Restraints

How are environmental concerns and chemical usage creating regulatory pressures restraining the bleached eucalyptus kraft pulp market growth?

The bleached eucalyptus kraft pulp market faces major challenges from environmental impacts linked to pulp production emissions, wastewater, solid waste, and tightening regulatory requirements worldwide. Kraft pulping releases sulfur compounds like hydrogen sulfide and methyl mercaptan, causing strong odors near mills and creating frequent community and compliance concerns. Bleaching processes, water consumption, and energy use increase environmental pressure as pulp mills require large volumes of water, electricity, steam, and chemical inputs. Wastewater treatment, air emission controls, solid waste handling, and carbon footprint management raise production costs for bleached eucalyptus kraft pulp manufacturers globally. Environmental concerns include greenhouse gas emissions, water scarcity, biodiversity loss, monoculture plantations, fertilizer use, transportation impacts, and long-term ecosystem sustainability risks. Strict air and water regulations require advanced pollution control systems, chemical recovery investments, and continuous monitoring across the global bleached eucalyptus kraft pulp market.

Opportunities

How is the shift toward sustainable packaging creating potential for the bleached eucalyptus kraft pulp market?

The bleached eucalyptus kraft pulp industry shows strong growth opportunities as consumers and businesses seek environmentally friendly paper packaging alternatives worldwide. Government plastic bans and sustainability policies increase demand for paper bags, food containers, corrugated boxes, and molded fiber packaging across global packaging markets. Rapid E-commerce growth boosts the consumption of shipping boxes, protective paper fillers, subscription packaging, and premium unboxing materials using eucalyptus kraft pulp. Food, beverage, cosmetics, and personal care brands adopt high-quality paper packaging for cups, cartons, tubes, and labels, supporting recyclable brand positioning. Luxury retail, gift wrap, shopping bags, and decorative packaging drive seasonal demand for bright, smooth paper made from bleached eucalyptus kraft pulp. Pharmaceutical packaging, beverage cartons, paper bottles, and barrier-coated paper solutions increase pulp use by leveraging safety, performance, and sustainability benefits. Innovation in coatings, design, life cycle assessment, and corporate sustainability goals continues to strengthen long-term demand for bleached eucalyptus kraft pulp.

Challenges

Price volatility and market cyclicality

The bleached eucalyptus kraft pulp market faces major challenges from frequent price swings and changing demand patterns affecting planning, profitability, and long-term investment decisions. Global pulp prices move sharply due to supply-demand imbalances, with large fluctuations occurring within short time periods across markets. New pulp mill capacity additions create oversupply risks, while long construction timelines limit producers' ability to respond quickly to changes in demand. Economic slowdowns reduce paper consumption across tissue, packaging, and printing segments, lowering demand faster than production adjustments allow. Currency exchange movements, freight cost volatility, energy prices, and chemical input costs create uncertainty in the global bleached eucalyptus kraft pulp trade. Rising labor costs, stricter environmental compliance requirements, inventory cycles, and shifting Chinese demand further exacerbate price volatility and market risk.

Bleached Eucalyptus Kraft Pulp (BEKP) Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bleached Eucalyptus Kraft Pulp (BEKP) Market Research Report |

| Market Size in 2024 | USD 17.41 Billion |

| Market Forecast in 2034 | USD 29.32 Billion |

| Growth Rate | CAGR of 5.71% |

| Number of Pages | 220 |

| Key Companies Covered | Suzano S.A., CMPC Celulosa, Fibria Celulose S.A., Navigator Company, APRIL (Asia Pacific Resources International Limited), Arauco, Eldorado Brasil Celulose S.A., Stora Enso Oyj, UPM-Kymmene Corporation, Sappi Limited, Cenibra, Veracel Celulose S.A., Klabin S.A., Altri SGPS S.A., and Ence Energía y Celulosa S.A. |

| Segments Covered | By Grade, By Application, By End User, By Processing Method, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bleached Eucalyptus Kraft Pulp (BEKP) Market: Segmentation

The global bleached eucalyptus kraft pulp market is segmented based on grade, application, end-user, processing method, and region.

Based on grade, the global bleached eucalyptus kraft pulp industry is categorized into standard grade, premium grade, ultra-premium grade, specialty grades, modified grades, and others. Standard grade leads the market due to its suitability for a wide range of paper products and competitive pricing compared to specialty grades.

Based on application, the industry is segmented into printing and writing paper, tissue paper, packaging materials, specialty papers, dissolving pulp, and board and cardboard. Printing and writing paper leads the market due to continued demand for office papers, commercial printing, and publication grades, despite digital transformation.

Based on end-user, the global bleached eucalyptus kraft pulp market is classified into paper mills, packaging industry, hygiene products manufacturers, and specialty paper producers. Paper mills are expected to lead the market during the forecast period due to their large-scale pulp consumption, diverse product portfolios, integrated operations that convert pulp into finished products, and established purchasing relationships with pulp suppliers.

Based on processing method, the global bleached eucalyptus kraft pulp market is divided into chlorine-free bleaching, elemental chlorine-free bleaching, totally chlorine-free bleaching, and conventional bleaching. Elemental chlorine-free bleaching holds the largest market share due to its ability to achieve the high brightness required for premium papers and its environmental advantages over conventional chlorine bleaching.

Bleached Eucalyptus Kraft Pulp (BEKP) Market: Regional Analysis

What factors are contributing to the Asia Pacific's dominance in the global bleached eucalyptus kraft pulp market?

Asia Pacific is estimated to grow at a CAGR of around 4.5% during the forecast period in the bleached eucalyptus kraft pulp market. Asia Pacific leads the bleached eucalyptus kraft pulp market due to large populations, rising incomes, expanding industries, and strong growth in paper consumption. China remains the largest paper and paperboard consumer, using bleached eucalyptus kraft pulp across packaging, tissue, printing, and specialty paper segments. Significant investments in pulp and paper capacity exist across China, although domestic supply remains insufficient, requiring steady imports of eucalyptus pulp. India has experienced rapid growth in paper consumption, supported by rising literacy, expanding education systems, packaging demand, and increased consumer-goods production. Indonesia, Vietnam, and other Southeast Asian countries develop eucalyptus plantations and modern pulp mills serving both domestic needs and export markets.

Japan maintains advanced paper manufacturing with strong demand for high-quality pulp used in specialty papers, packaging, and hygiene products. South Korea supports steady pulp demand through advanced packaging production driven by electronics, automotive exports, and consumer goods manufacturing growth. Australia produces eucalyptus pulp for export markets while supporting domestic paper mills focused on tissue, packaging, and specialty paper products. Expanding middle-class populations across Asia increase daily consumption of tissue paper, paper towels, napkins, and personal hygiene products. Rapid E-commerce growth across China, India, and Southeast Asia drives strong demand for corrugated boxes, protective packaging, and shipping materials. Food service, hospitality, tourism, and quick service restaurant expansion increases paper usage for cups, plates, wrappers, napkins, and takeaway packaging. Urbanization concentrates populations in cities, where offices, retail centers, hospitals, schools, and other institutions require continuous supplies of paper and hygiene products. Education system expansion across Asia increases the consumption of notebooks, textbooks, writing paper, examination materials, and printed educational resources.

Government programs supporting literacy, education, and skill development strengthen long-term demand for paper products in developing Asian economies. Publishing industries across Asia produce books, newspapers, magazines, manuals, and marketing materials serving large multilingual reading populations. Manufacturing sector growth increases demand for industrial packaging, labels, documentation, and transport packaging materials using eucalyptus kraft pulp. Expanding healthcare infrastructure requires reliable supplies of tissue, towels, wipes, and hygiene products supporting steady bleached eucalyptus kraft pulp consumption across the Asia Pacific.

South America maintains a strong production capacity.

South America is estimated to grow at a CAGR of around 9.0% during the forecast period in the bleached eucalyptus kraft pulp market. South America holds a strong position in the bleached eucalyptus kraft pulp market through large plantations, advanced pulp mills, and export-focused production. Brazil leads global eucalyptus pulp production, supported by a favorable climate, fast-growing plantations, and large-scale modern manufacturing facilities. Heavy investment in technology, efficient operations, and capacity expansion improves productivity, quality, and cost competitiveness for bleached eucalyptus kraft pulp exports. Ample land availability supports plantation growth while balancing agriculture, forest conservation, and responsible land management practices across regions. Well-developed ports, railways, and road networks support efficient wood transport and reliable pulp exports to global markets. Biomass energy use from wood residues allows pulp mills to achieve high energy efficiency and lower production costs.

Competitive labor structures, favorable currency movements, and scale advantages strengthen export performance for Brazilian eucalyptus pulp producers. Advanced plantation management, genetic improvement programs, and research partnerships continuously increase yield, fiber quality, and plantation sustainability. Chile supports bleached eucalyptus kraft pulp production in southern plantations, where suitable climatic conditions and efficient pulp-processing infrastructure are available. Uruguay develops modern eucalyptus pulp mills with a strong focus on export markets and international quality standards. Forest certification systems support access to Europe, North America, and other sustainability-focused pulp buyers worldwide. Strong logistics capabilities and shipping expertise ensure dependable supply chains for long-distance pulp exports.

Trade agreements reduce barriers and support market access across Asia, Europe, and North America. Industry collaboration with research institutions improves eucalyptus genetics, processing efficiency, and environmental performance across the region. Sustainability commitments support social responsibility, biodiversity protection, water management, and emissions control across pulp operations. Integration with the forest products industry creates economic clusters that support employment, infrastructure development, and long-term regional economic growth.

Recent Developments

- In June 2025, Bloomberg reported that Brazilian pulp and paper giant Suzano S.A. expanded its global footprint across the United States, China, and Europe while navigating geopolitical trade tensions affecting eucalyptus pulp exports.

- In October 2025, Peroxidos do Brasil began construction of a 25,000-ton-per-year hydrogen peroxide plant at Arauco’s mill to support cleaner pulp bleaching processes and ensure local chemical supply for bleached eucalyptus kraft pulp production.

Bleached Eucalyptus Kraft Pulp (BEKP) Market: Competitive Analysis

The leading players in the global bleached eucalyptus kraft pulp market are

- Suzano S A

- CMPC Celulosa

- Fibria Celulose S A

- Navigator Company

- APRIL (Asia Pacific Resources International Limited)

- Arauco

- Eldorado Brasil Celulose S A

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Sappi Limited

- Cenibra

- Veracel Celulose S A

- Klabin S A

- Altri SGPS S A

- Ence Energía y Celulosa S A

The global bleached eucalyptus kraft pulp market is segmented as follows:

By Grade

- Standard Grade

- Premium Grade

- Ultra-Premium Grade

- Specialty Grades

- Modified Grades

- Others

By Application

- Printing and Writing Paper

- Tissue Paper

- Packaging Materials

- Specialty Papers

- Dissolving Pulp

- Board and Cardboard

By End User

- Paper Mills

- Packaging Industry

- Hygiene Products Manufacturers

- Specialty Paper Producers

By Processing Method

- Chlorine Free Bleaching

- Elemental Chlorine Free Bleaching

- Totally Chlorine Free Bleaching

- Conventional Bleaching

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed