Bioburden Testing Market Size, Share, Analysis, Trends, Growth Report, 2032

Bioburden Testing Market - By Product Type (Instrument And Consumables), By Test Type (Anaerobic, Aerobic, Spore, And Fungi), By Application (Sterility Testing, Medical Devices, And Raw Material), And By End-User (Biotechnology, Pharma, And CMO), By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1295.34 Million | USD 3,739.01 Million | 12.50% | 2023 |

Bioburden Testing Industry Perspective:

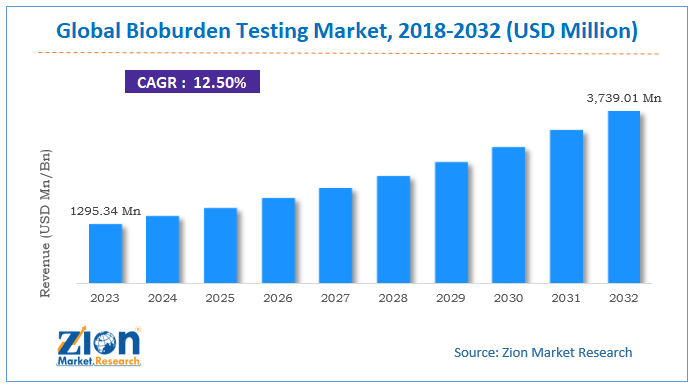

The global bioburden testing market size was worth around USD 1295.34 Million in 2023 and is predicted to grow to around USD 3,739.01 Million by 2032 with a compound annual growth rate (CAGR) of roughly 12.50% between 2024 and 2032.

The report analyzes the global bioburden testing market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the bioburden testing industry.

The report covers a forecast and an analysis of the bioburden testing market on a global and regional level. The study provides historic data for 2018 and 2022 along with a forecast from 2024 to 2032 based on revenue (USD Million). The study includes drivers and restraints of the bioburden testing market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the bioburden testing market on a global level.

In order to give the users of this report a comprehensive view of the bioburden testing market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, R&D, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolio of various companies according to regions.

Bioburden Testing Market: Overview

Measurement of live microorganisms on raw materials, packaging, and medical equipment is part of the bioburden testing procedure, which takes place before sterilization. To guarantee that the entire operation is both safe and effective, this stage is an essential one that contributes to the finalization of the many factors that are necessary for an efficient sterilization process. Microbial limit testing, which is also known as bioburden testing, is a type of testing that is used for quality control purposes in a variety of industries, including the pharmaceutical industry, the medical device industry, and others. The maximum colony forming unit is used to represent bioburden tests, and there are recommendations that have been set for the subject. There are two distinct approaches that can be utilized to accomplish this task: the membrane-filtration method and the plate count method. In order to avoid introducing any new microorganisms into the sample or causing the deaths of the organisms that are already present in the sample, bioburden testing needs to be carried out with extreme caution.

Bioburden Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bioburden Testing Market Research Report |

| Market Size in 2023 | USD 1295.34 Million |

| Market Forecast in 2032 | USD 3,739.01 Million |

| Growth Rate | CAGR of 12.50% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

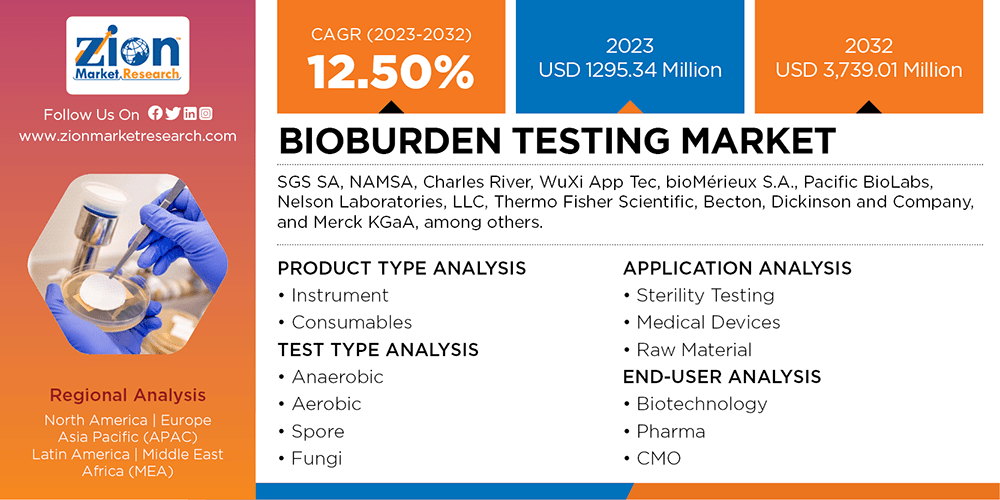

| Key Companies Covered | SGS SA, NAMSA, Charles River, WuXi App Tec, bioMérieux S.A., Pacific BioLabs, Nelson Laboratories, LLC, Thermo Fisher Scientific, Becton, Dickinson and Company, and Merck KGaA, among others. |

| Segments Covered | By Product, By Test Type, By Application, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bioburden Testing Market: Growth Drivers

The quick expansion of the biopharmaceutical industry, the growing number of contract research organizations, and the thriving medical device industry are some of the significant developments that are expected to drive the worldwide bioburden testing market throughout the course of the forecast period. It is anticipated that the expansion of the bioburden testing market will be facilitated in the future by the growing number of product recalls from the market that are a result of microbial contamination. Additional factors that are anticipated to contribute to the expansion of the bioburden testing market throughout the predicted period include the growing concerns regarding the safety of food and beverages as well as supplements. It is anticipated that in the future, various chances for expansion will be created in the market as a result of the enormous expenditure on research and development activities that has been observed in the life sciences industry, as well as the rise in medical prices and the enhancements that have been added to healthcare facilities. However, the progression of the bioburden testing market over the predicted time period may be hampered by the ever-increasing costs of laboratory equipment as well as the laborious technique.

Bioburden Testing Market: Segmentaion

The study provides a decisive view of the bioburden testing market by segmenting the market based on product type, application, test type, end-user, and region. All the segments have been analyzed based on present and future trends in the market, which is estimated from 2024 to 2032. By product type, the market is segmented into instrument and consumables. By application, the market includes sterility testing, medical devices, and raw material. By test type, the market is segmented into anaerobic, aerobic, spore, and fungi. By end-user, the market is segmented into biotechnology, pharma, and CMO.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa with its further divided into major countries including the U.S., Canada, Germany, France, UK, Brazil, China, Japan, India, and Brazil.

Bioburden Testing Market: Competitive Analysis

Some key players of the global bioburden testing market are

- SGS SA

- NAMSA

- Charles River

- WuXi App Tec

- bioMérieux S.A.

- Pacific BioLabs

- Nelson Laboratories

- LLC

- Thermo Fisher Scientific

- Becton

- Dickinson and Company

- Merck KGaA

- Among others

This report segments the global bioburden testing market as follows:

Global Bioburden Testing Market: Product Type Analysis

- Instrument

- Consumables

Global Bioburden Testing Market: Test Type Analysis

- Anaerobic

- Aerobic

- Spore

- Fungi

Global Bioburden Testing Market: Application Analysis

- Sterility Testing

- Medical Devices

- Raw Material

Global Bioburden Testing Market: End-User Analysis

- Biotechnology

- Pharma

- CMO

Global Bioburden Testing Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Bioburden testing process involves measuring of viable microorganism on raw materials packaging and medical devices before sterilization. This is an important step that helps in finalizing the various parameters for effective sterilization process to ensure safety and efficacy of the complete procedure. Bioburden testing is also known as microbial limit testing, which is witnessed across various industries, such as medical devices, pharmaceutical, etc., for quality control purpose.

There are various major factors driving the global bioburden testing market over the forecast timeframe including the rapid expansion of the biopharmaceutical industry, increasing number of contract research organizations, and flourishing medical device industry.

According to the report, the global bioburden testing market size was worth around USD 1295.34 Million in 2023 and is predicted to grow to around USD 3,739.01 Million by 2032.

The global bioburden testing market is expected to grow at a CAGR of 12.50% during the forecast period.

North America is predicted to hold a major revenue share of the global bioburden testing market in the future.

Some key players of the global bioburden testing market are SGS SA, NAMSA, Charles River, WuXi App Tec, bioMérieux S.A., Pacific BioLabs, Nelson Laboratories, LLC, Thermo Fisher Scientific, Becton, Dickinson and Company, and Merck KGaA among others.

The global bioburden testing market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed