Automotive Steering Angle Sensor Market Size, Share, Trends, Growth 2034

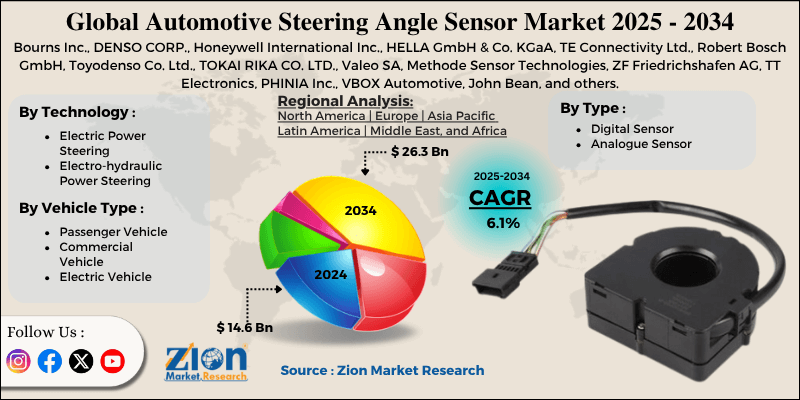

Automotive Steering Angle Sensor Market By Technology (Electric Power Steering and Electro-hydraulic Power Steering), By Type (Digital Sensor and Analogue Sensor), By Vehicle Type (Passenger Vehicle, Commercial Vehicle and Electric Vehicle), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.6 Billion | USD 26.3 Billion | 6.1% | 2024 |

Automotive Steering Angle Sensor Industry Perspective:

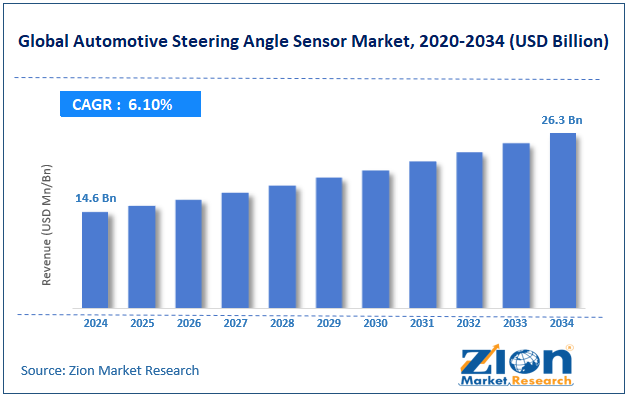

The global automotive steering angle sensor market size was worth around USD 14.6 billion in 2024 and is predicted to grow to around USD 26.3 billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global automotive steering angle sensor market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034).

- In terms of revenue, the global automotive steering angle sensor market size was valued at around USD 14.6 billion in 2024 and is projected to reach USD 26.3 billion by 2034.

- The increasing demand for safety and safety regulation imposed by the governments are expected to drive the automotive steering angle sensor market over the forecast period.

- Based on the technology, the electric power steering segment is expected to capture the largest market share over the projected period.

- Based on the type, the digital sensor segment holds the major market share.

- Based on the vehicle type, the passenger vehicle segment holds the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Automotive Steering Angle Sensor Market: Overview

A steering angle sensor (SAS) analyzes where the steering wheel is and how fast it is turning. It then sends that information to the car's computer to make sure it stays steady and under control. This sensor is a key feature of modern systems like Electronic Stability Control (ESC) and Driver-Assistance Systems (ADAS). These technologies use the data to maintain the car's movement steady and improve safety measures. Hall-effect sensors or magnetic sensors like Giant Magneto-Resistance (GMR) are used in modern SAS devices.

One approach, for instance, combines a gear system and magnets to find the exact turns of the steering wheel, even if the automobile starts in the middle of a turn. The sensor translates the mechanical rotation into an electrical signal. This signal is then delivered to other modules through vehicle communication (like CAN bus) and processed, usually in a microprocessor.

Automotive Steering Angle Sensor Market Dynamics

Growth Drivers

Why growing adoption of ADAS & vehicle safety systems drives the market growth?

The automotive steering angle sensors market is rising because more individuals are using vehicle safety systems and Advanced Driver Assistance Systems (ADAS). This is mainly because these sensors are needed to keep cars safe, stable, and easy to drive. These are all essential parts of modern automotive safety measures and self-driving technology. ADAS technology, such as lane departure warning, adaptive cruise control, blind-spot recognition, and autonomous driving systems, all need accurate steering angle data to work correctly. These systems evaluate how the driver is steering, ensure the car stays straight, and take control or assist when needed to keep everyone in the vehicle safe.

New global laws, including those that require lane-keeping aid and electronic stability control (ESC), also need to specify precisely how much the steering angle can be adjusted. Car makers need to add modern safety systems that use steering sensors to make roads safer and reduce accidents and deaths. This makes people want to buy more.

Restraints

Why does the high component & development cost hinder market growth?

The automotive steering angle sensor market isn't growing as quickly as it should since parts and development are so expensive. This is because parts and materials are costly, and research and development expenses are also high. The cost of steering angle sensors is rising because they require expensive raw materials and are difficult to produce. Adding more than one sensor for accuracy and backup increases production costs.

Also, a significant amount of money needs to be spent on research and development to create accurate, reliable, and current steering angle sensors. This includes designing, testing, and prototyping. Companies must continuously generate new ideas because technology is changing so quickly, and this process requires more money.

High costs impact smaller car producers and those who wish to sell to price-sensitive customers more than others. This makes it harder for them to deploy these sensors on a broad scale. When costs go up, cars can become more expensive. This can make people less likely to buy them, which can restrict the expansion of the market.

Opportunities

How does the growing innovative product launch offer a potential opportunity for the industry growth?

The rising innovative product launch offers a potential opportunity to the automotive steering angle sensor market during the forecast period. For instance, in May 2024, Melexis added the MLX90427 to its magnetic position sensor range. The product is designed for embedded position sensor applications that require high functional safety levels.

In addition to providing customer stray field immunity and EMC resilience, the cost-effective MLX90427 has an SPI output with four unique modes. It has three modes: rotary, joystick, and rotary stray field with internal angle computation, as well as one for raw data output. It is well-suited for steer-by-wire applications.

Challenges

How does the integration & system complexity pose a major challenge to market expansion?

The Automotive Steering Angle Sensor (SAS) business is having problems growing since integrating and setting up systems is hard. Electronic power steering (EPS), electronic stability control (ESC), and advanced driver assistance systems all need to read the steering angle sensors accurately. To ensure the data can be provided in real time without problems, errors, or compatibility issues, this integration requires significant work. Magnetic interference, such as between the steering angle sensor and the torque sensor, can reduce detection precision when sensors and parts are adjacent. Better design strategies are needed to avoid these difficulties.

Also, once the sensors are installed and serviced, they need to be thoroughly calibrated to ensure they can reliably read the angle of the steering wheel. If the calibration isn't done correctly, the safety systems might not function properly, and the automobile could behave in unexpected ways, potentially causing harm. As ADAS capabilities improve, calibration becomes more complex, complicating and increasing the cost of integration with vehicle systems.

Automotive Steering Angle Sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Steering Angle Sensor Market |

| Market Size in 2024 | USD 14.6 Billion |

| Market Forecast in 2034 | USD 26.3 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 213 |

| Key Companies Covered | Bourns Inc., DENSO CORP., Honeywell International Inc., HELLA GmbH & Co. KGaA, TE Connectivity Ltd., Robert Bosch GmbH, Toyodenso Co. Ltd., TOKAI RIKA CO. LTD., Valeo SA, Methode Sensor Technologies, ZF Friedrichshafen AG, TT Electronics, PHINIA Inc., VBOX Automotive, John Bean, and others. |

| Segments Covered | By Technology, By Type, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Steering Angle Sensor Market: Segmentation

The global automotive steering angle sensor industry is segmented based on technology, type, vehicle type and region.

Based on the technology, the global automotive steering angle sensor market is bifurcated into electric power steering and electro-hydraulic power steering. The electric power steering segment is expected to capture the largest market share over the projected period. One of the main reasons the automotive steering angle sensor market is growing is that more and more people are using electric power steering (EPS) systems. EPS systems need steering angle sensors because they provide specific information about the steering wheel's position, making it easier to manage, handle, and implement safety measures.

Based on the type, the global automotive steering angle sensor industry is bifurcated into digital sensor and analogue sensor. The digital sensor segment holds the major market share. Digital sensors are more accurate and durable than analog sensors, which is essential for modern automotive safety and autonomy features like electronic stability control and lane-keeping assist. Their new features make it easier to connect with complex car systems, aiding the development of electric and hybrid vehicles that require sophisticated sensor technology. Digital sensors also make data more accurate, longer-lasting, and more sensitive to electromagnetic interference, which makes vehicles safer and more efficient.

Based on the vehicle type, the global automotive steering angle sensor market is bifurcated into passenger vehicle, commercial vehicle and electric vehicle. The passenger vehicle segment holds the largest market share over the projected period. There is an increasing demand for these sensors in passenger cars because technologies like lane-keeping assist, electronic stability control, and adaptive cruise control require exact steering angle readings to enhance vehicle safety.

Also, the market potential grows as more people adopt electric cars (EVs) and hybrid vehicles, which rely heavily on advanced steering angle sensors for better steering control and efficiency.

Regional Analysis

Why does North America dominate the market over the projected period?

North America region is expected to dominate the automotive steering angle sensor market. The growth in the region is driven by more people using technology and stricter safety rules. The United States is the leader in the regional market, followed by Mexico and Canada. All three countries have huge production facilities and big car companies.

The region's focus on electric cars and self-driving technologies has accelerated the development of innovative steering system parts. The presence of major companies in the industry and well-established automobile manufacturing infrastructure continues to drive innovation and growth in these countries' markets.

Automotive Steering Angle Sensor Market: Competitive Analysis

The global automotive steering angle sensor market is dominated by players like:

- Bourns Inc.

- DENSO CORP.

- Honeywell International Inc.

- HELLA GmbH & Co. KGaA

- TE Connectivity Ltd.

- Robert Bosch GmbH

- Toyodenso Co. Ltd.

- TOKAI RIKA CO. LTD.

- Valeo SA

- Methode Sensor Technologies

- ZF Friedrichshafen AG

- TT Electronics

- PHINIA Inc.

- VBOX Automotive

- John Bean

The global automotive steering angle sensor market is segmented as follows:

By Technology

- Electric Power Steering

- Electro-hydraulic Power Steering

By Type

- Digital Sensor

- Analogue Sensor

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A steering angle sensor (SAS) analyzes where the steering wheel is and how fast it is turning. It then sends that information to the car's computer to make sure it stays steady and under control. This sensor is a key feature of modern systems like Electronic Stability Control (ESC) and Driver-Assistance Systems (ADAS).

The automotive steering angle sensor market is being driven by several variables such as rising demand for safety, stringent regulation by the governments, growing automotive production, technological advancements, increasing innovative product launch and others.

What are the major challenges restraining the growth of the automotive steering angle sensor market?

The high expenses in R&D poses a significant challenge for automotive steering angle sensor industry growth.

Based on the type, the digital sensor segment is expected to dominate the automotive steering angle sensor market growth during the projected period.

The increasing partnership among the market players and rising innovation pose a major impact factor for the automotive steering angle sensor industry's growth over the projected period.

According to the report, the global automotive steering angle sensor market size was worth around USD 14.6 billion in 2024 and is predicted to grow to around USD 26.3 billion by 2034.

The global automotive steering angle sensor market is expected to grow at a CAGR of 6.1% during the forecast period.

The global automotive steering angle sensor industry growth is expected to be driven by North America region. It is currently the world’s highest revenue-generating market due to the presence of established brands and rising safety regulation by the governments.

The global automotive steering angle sensor market is dominated by players like Bourns Inc., DENSO CORP., Honeywell International Inc., HELLA GmbH & Co. KGaA, TE Connectivity Ltd., Robert Bosch GmbH, Toyodenso Co. Ltd., TOKAI RIKA CO. LTD., Valeo SA, Methode Sensor Technologies, ZF Friedrichshafen AG, TT Electronics, PHINIA Inc., VBOX Automotive and John Bean, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed