Automotive Advanced Driver Assistance System (ADAS) Market Size, Share, Forecast 2034

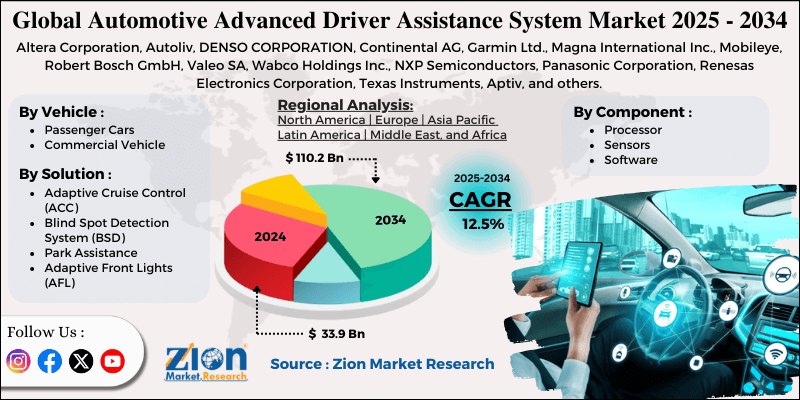

Automotive Advanced Driver Assistance System (ADAS) Market By Vehicle (Passenger Cars and Commercial Vehicle), By Component (Processor, Sensors, Software, and Others), By Solution (Adaptive Cruise Control (ACC), Blind Spot Detection System (BSD), Park Assistance, Lane Departure Warning System (LDWS), Tire Pressure Monitoring System (TPMS), Autonomous Emergency Braking (AEB), Adaptive Front Lights (AFL), and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

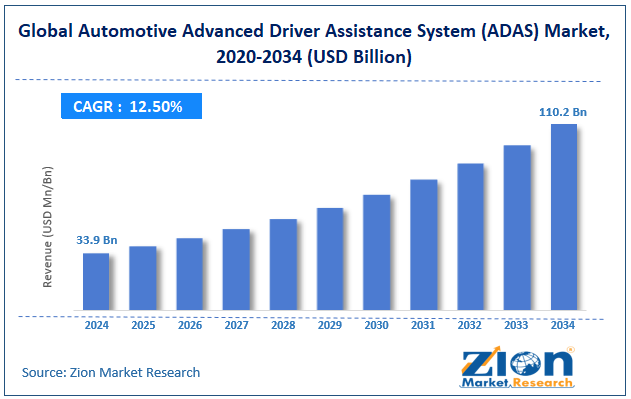

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 33.9 Billion | USD 110.2 Billion | 12.5% | 2024 |

Automotive Advanced Driver Assistance System (ADAS) Industry Perspective:

The global automotive advanced driver assistance system (ADAS) market size was worth around USD 33.9 billion in 2024 and is predicted to grow to around USD 110.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global automotive advanced driver assistance system (ADAS) market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2025-2034).

- In terms of revenue, the global automotive advanced driver assistance system (ADAS) market size was valued at around USD 33.9 billion in 2024 and is projected to reach USD 110.2 billion by 2034.

- The increasing awareness regarding safety among the population drives the automotive advanced driver assistance system (ADAS) industry over the forecast period.

- Based on the vehicle, the passenger car segment is expected to hold the largest market share over the forecast period.

- Based on the component, the sensors segment is expected to dominate the market over the projected period.

- Based on the solution, the Adaptive Cruise Control (ACC) segment is expected to capture a significant revenue share during the anticipated period.

- Based on region, North America is expected to dominate the market during the forecast period.

Automotive Advanced Driver Assistance System (ADAS) Market: Overview

ADAS, commonly known as Advanced Driver Assistance Systems, is an advanced technology equipped in a car that uses sensors, cameras, and other devices to make driving safer, more comfortable, and easier while lowering the risk of human error. They alert the driver or automatically adjust features such as steering and brakes to ensure they remain safe and avoid accidents. The lane departure warning, blind spot detection, and the detection of pedestrians are among the popular ADAS systems that enable a vehicle to have a better sense of its environment.

The growth of the automotive advanced driver assistance system (ADAS) market is influenced by several variables, including increasing emphasis on safety globally, rising road accidents, technological advancements, growing demand for autonomous and semiautonomous vehicles, increasing vehicle production, and others. However, the complexity of integration and calibration hampers the growth of the industry.

Automotive Advanced Driver Assistance System (ADAS) Market: Growth Drivers

How are stringent government regulations propelling the automotive advanced driver assistance system (ADAS) industry expansion?

The global automotive advanced driver assistance system (ADAS) market is witnessing rapid expansion, largely spurred by government regulations aimed at enhancing on-road safety and reducing accidents. Government requirements remain the leading catalyst for ADAS technology uptake, and such regulatory pressures remain leading drivers of both technological advances and market expansion. Regulatory bodies, like Euro NCAP and the NHTSA, have established stringent safety requirements, including mandatory items like Automatic Emergency Braking (AEB) and Lane Keeping Assist, with stringent timing details for conformance. The US Infrastructure Investment and Jobs Act makes AEB mandatory for every US passenger car by 2027.

Meanwhile, the government of India will make ADAS requirements mandatory for every new car with more than eight occupants from April 2026, and for commercial vehicles from October 2026 onwards. This follows similar overall global patterns but from a less extensive base. Prospective extensions due after 2026 might include mass markets and increased feature sets beyond the initial mandate. Thus, the aforementioned facts drive the industry expansion.

Automotive Advanced Driver Assistance System (ADAS) Market: Restraints

Why do high initial costs and complex structure hinder the automotive advanced driver assistance system (ADAS) market growth?

The high cost associated with installing applications in vehicles is expected to impede the growth of the automotive advanced driver assistance system (ADAS) market, as this factor increases the cost of the car. Factors such as the higher cost involved in installing ADAS are leading to higher car costs. The prospect of providing premium features in vehicles incurs additional expenses for consumers in the form of hardware, applications, and telecom service charges, which eventually hamper the growth of the automotive advanced driver assistance system (ADAS) market.

Moreover, the serviceability of the vehicle is difficult and requires skilled workers due to its several electronic components and sensors. The complex structure of systems reduces the shelf life of vehicles. Thus, high initial cost and complex structure are expected to have a significant impact on the growth of the automotive advanced driver assistance system (ADAS) sector.

Automotive Advanced Driver Assistance System (ADAS) Market: Opportunities

How will the introduction of advanced technology foster the automotive advanced driver assistance system (ADAS) industry expansion over the analysis period?

The use of advanced chips significantly contributes to the expansion, performance, and value of the automotive advanced driver assistance system (ADAS) industry. The high-performance semiconductors enable processing, sensor fusion, and artificial intelligence (AI) capabilities essential for today's driver-assist features. Advanced chips enable more processing capability, facilitating real-time processing of massive amounts of sensor inputs from cameras, radar, and lidar. This improves feature speed, accuracy, and reliability of features like adaptive cruise control, lane keep, automatic emergency braking, and more advanced autonomous driving functions. Many of the industry's players continuously supply the industry with innovative product launches.

For instance, in January 2024, Texas Instruments (TI) introduced new semiconductors designed to improve car safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the first industry solution for sat radar architecture, enabling more autonomy levels by boosting sensor fusion and ADAS decision-making. TI's new software-programmable driver chips, DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, enable integrated diagnostics and facilitate support for battery and powertrain system functional safety.

Automotive Advanced Driver Assistance System (ADAS) Market: Challenges

How do cybersecurity & data privacy concerns pose a major challenge to market expansion??

Cybersecurity and privacy challenges are among the major concerns in the automotive advanced driver assistance system (ADAS) industry as vehicles become more networked, data-rich, and software-intensive. The susceptibility of ADAS to cyber hacking, combined with the massive volume of data handled by these systems, gives rise to numerous safety, privacy, and trust issues among consumers. ADAS vehicles collect sensitive data, such as location histories, photographs, video streams, user patterns, and even biometric data of drivers. Misuse or unauthorized access to such information can lead to surveillance, phishing, identity theft, or privacy violation.

Additionally, many privacy concerns hinge on how the information of drivers and occupants is transferred to carmakers, third parties, and the cloud. Transparency deficiencies and insufficient mechanisms of consent provide space for unchecked exploitation of information. Thus, concerns over cybersecurity and data privacy hinder the industry's growth.

Automotive Advanced Driver Assistance System (ADAS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Advanced Driver Assistance System (ADAS) Market |

| Market Size in 2024 | USD 33.9 Billion |

| Market Forecast in 2034 | USD 110.2 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 217 |

| Key Companies Covered | Altera Corporation, Autoliv, DENSO CORPORATION, Continental AG, Garmin Ltd., Magna International Inc., Mobileye, Robert Bosch GmbH, Valeo SA, Wabco Holdings Inc., NXP Semiconductors, Panasonic Corporation, Renesas Electronics Corporation, Texas Instruments, Aptiv, and others. |

| Segments Covered | By Vehicle, By Component, By Solution, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Advanced Driver Assistance System (ADAS) Market: Segmentation

The global automotive advanced driver assistance system (ADAS) industry is segmented based on vehicle, component, solution, and region.

Based on the vehicle, the global automotive advanced driver assistance system (ADAS) market is bifurcated into passenger cars and commercial vehicles. The passenger car segment is expected to dominate the market over the forecast period. Rising demand for high-end passenger cars, like electric and hybrid cars, from global cities, is the major catalyst powering the recorded increase in this segment. Increasing awareness among consumers of safety assist functions, default safety, and safety aspects like ADAS molds this segment. Several Asian Pacific, North American, and European nations have enacted laws mandating the use of various types of ADAS by the passenger car segment. The European Union has set Vision Zero as a goal to reduce road casualty numbers to zero by 2050. The regulatory body has strived to reduce injury and death by 50% by the year 2030. The program also mandates principal safety features like automatic emergency brake, lane departure warning, and attention and drowsiness recognition in newly approved passenger cars in 2022.

Based on the component, the global automotive advanced driver assistance system (ADAS) market is bifurcated into processor, sensors, software, and others. The sensors segment held the highest market share in 2024 and is expected to hold its dominance during the projected period. The sensors play an integral role in ADAS's active functioning. The sensors detect environmental information about the car, including objects, pedestrians, lane markings, and approaching cars, and recognize hazards, reporting them to the systems to provide drivers with information and assistance. ADAS operation heavily depends on sensors and operational efficiency. LIDAR, RADAR, ultrasonic, cameras, and various other sensors work together to implement the desired assistance and safety functions.

Based on the solution, the global automotive advanced driver assistance system (ADAS) market is bifurcated into Adaptive Cruise Control (ACC), Blind Spot Detection System (BSD), Park Assistance, Lane Departure Warning System (LDWS), Tire Pressure Monitoring System (TPMS), Autonomous Emergency Braking (AEB), Adaptive Front Lights (AFL), and Others. The Adaptive Cruise Control (ACC) segment is expected to hold a strong market share over the analysis period. This is because more individuals want safety features, technology is getting better (such as sensor and radar technologies), and the government is making it mandatory for some cars, particularly commercial vehicles, to have ACC systems. This market is growing because of significant advancements in the use of electric and hybrid vehicles.

Automotive Advanced Driver Assistance System (ADAS) Market: Regional Analysis

Why does North America dominate the automotive advanced driver assistance system (ADAS) market over the projected period?

North America is expected to dominate the global automotive advanced driver assistance system (ADAS) market. The largest market for global automotive ADAS (Advanced Driver Assistance Systems) is North America, driven by stringent laws for safety, rapid technology adoption, and high investment by the industry. The region has a high level of awareness among customers and a vibrant ecosystem of auto majors, technology establishments, and regulatory entities, by and large concentrated in the U.S. and Canada. Laws by the NHTSA and other agencies are mandating features like automatic emergency brakes, lane departure warning, and so on in new cars, thereby accelerating ADAS penetration.

Also, innovation clusters in Ontario, Michigan, and Silicon Valley facilitate interactions among auto majors, semiconductor companies, and mobility start-ups, driving leading-edge innovation in AI chips and sensor technology. Additionally, the presence of key players and an increase in their product launches and innovations lead to the expansion of the regional market.

For instance, in September 2024, Aptiv PLC, a global technology leader with a singular focus on making mobility safer, greener, and connected, released a significant update to its online solutions website for the industry-leading Gen 6 Advanced Driving Assistance System (ADAS) Platform. The ADAS Solutions site is a one-stop shop for global auto majors and global Original Equipment Manufacturers (OEMs) seeking more information on Aptiv’s full system ADAS solution that delivers a human-like driving experience on every road and in the widest range of weather and lighting conditions, due to the familiarity of widespread use of AI/ML.

Automotive Advanced Driver Assistance System (ADAS) Market: Competitive Analysis

The global automotive advanced driver assistance system (ADAS) market is dominated by players like:

- Altera Corporation

- Autoliv

- DENSO CORPORATION

- Continental AG

- Garmin Ltd.

- Magna International Inc.

- Mobileye

- Robert Bosch GmbH

- Valeo SA

- Wabco Holdings Inc.

- NXP Semiconductors

- Panasonic Corporation

- Renesas Electronics Corporation

- Texas Instruments

- Aptiv

The global automotive advanced driver assistance system (ADAS) market is segmented as follows:

By Vehicle

- Passenger Cars

- Commercial Vehicle

By Component

- Processor

- Sensors

- Software

- Others

By Solution

- Adaptive Cruise Control (ACC)

- Blind Spot Detection System (BSD)

- Park Assistance

- Lane Departure Warning System (LDWS)

- Tire Pressure Monitoring System (TPMS)

- Autonomous Emergency Braking (AEB)

- Adaptive Front Lights (AFL)

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

ADAS, commonly known as Advanced Driver Assistance Systems, is an advanced technology that is equipped in a car and uses sensors, cameras, and other technologies to make driving safer, comfortable, and easier while lowering the risk of human error.

The Automotive ADAS (ADAS) sector is flourishing due to several factors such as the growing automotive industry, increasing product launches, technological advancements, stringent regulations, growing demand for autonomous vehicles, and Others.

The major challenge for the automotive advanced driver assistance system (ADAS) market is the lack of standardization and complexity in integration.

Based on the component, the sensors segment is expected to dominate the industry growth during the projected period.

The increasing safety regulations and technological advancements, such as AI, are impacting the automotive advanced driver assistance system (ADAS) industry growth over the projected period.

According to the report, the global automotive advanced driver assistance system (ADAS) market size was worth around USD 33.9 billion in 2024 and is predicted to grow to around USD 110.2 billion by 2034.

The global automotive advanced driver assistance system (ADAS) market is expected to grow at a CAGR of 12.5% during the forecast period.

The global automotive advanced driver assistance system (ADAS) industry growth is expected to be driven by the North American region. It is currently the world’s highest-revenue-generating market, driven by innovative product launches and the presence of major players.

The global automotive advanced driver assistance system (ADAS) market is dominated by players like Altera Corporation, Autoliv, DENSO CORPORATION, Continental AG, Garmin Ltd., Magna International Inc., Mobileye, Robert Bosch GmbH, Valeo SA, Wabco Holdings Inc., NXP Semiconductors, Panasonic Corporation, Renesas Electronics Corporation, Texas Instruments, and Aptiv, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

List of Contents

(ADAS)Industry Perspective:Key Insights (ADAS) Overview (ADAS) Growth Drivers (ADAS) Restraints (ADAS) Opportunities (ADAS) Challenges (ADAS) Report Scope (ADAS) Segmentation (ADAS) Regional Analysis (ADAS) Competitive AnalysisThe global automotive advanced driver assistance system (ADAS) market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed