Automotive Sensors Market Size, Share, Trends, Demand 2032

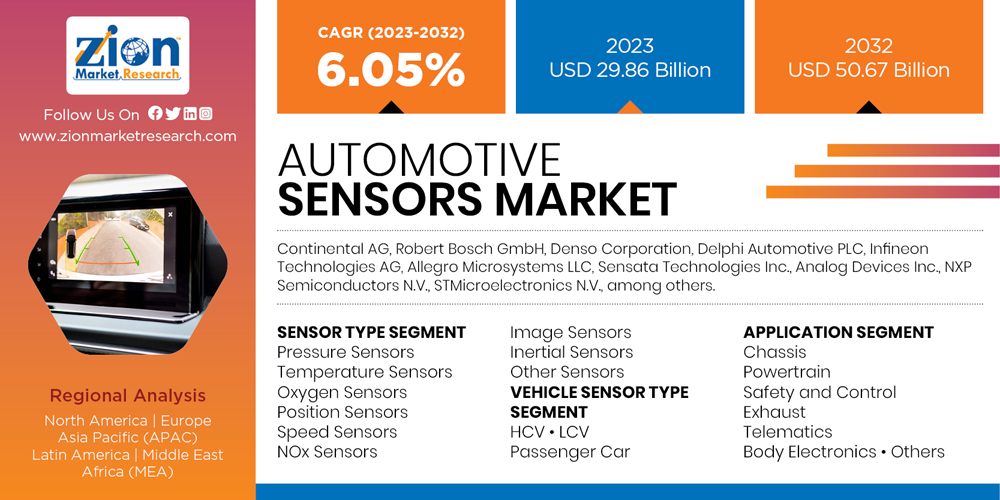

Automotive Sensors Market By Sensor Type (Pressure Sensors, Temperature Sensors, Oxygen Sensors, Position Sensors, Speed Sensors, Nitrogen Oxide Sensor (NOx) Sensors, Image Sensors, Inertial Sensors And Other Sensors), By Vehicle Sensor Type (HCV, LCV And Passenger Car) By Application (Chassis, Powertrain, Safety And Control, Exhaust, Telematics, Body Electronics And Others), and By Region - Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

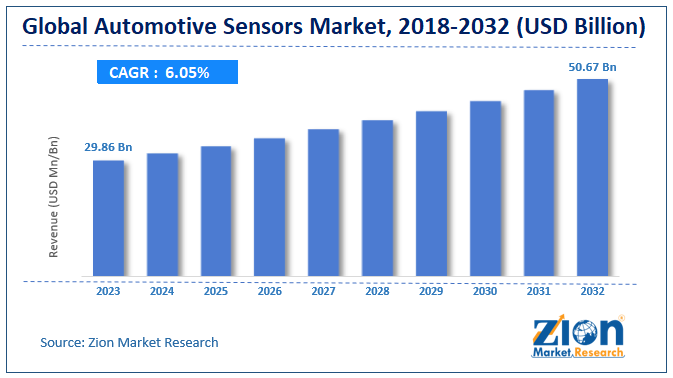

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 29.86 billion | USD 50.67 billion | 6.05% | 2023 |

Automotive Sensors Industry Perspective:

The global automotive sensors market size was worth around USD 29.86 Billion in 2023 and is predicted to grow to around USD 50.67 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.05% between 2024 and 2032.

The report analyzes the global automotive sensors market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive sensors industry.

Automotive Sensors Market: Overview

Intelligent sensors that can be used to control chemical or physical quantity like position or temperature are called automobile sensor. These sensors offer data for control, response and adaptation of functions in a vehicle which increases its efficiency, safety and comfort.

The term "Automotive Sensors Market" refers to the industry that is devoted to the manufacturing, distribution, and development of sensors that are built expressly for use in automobiles. These sensors perform an essential purpose by monitoring a wide variety of factors within autos. These parameters include temperature, pressure, speed, position, proximity, and a number of others. These sensors offer better performance, greater safety features, improved fuel efficiency, and decreased emissions on the vehicle. They do this by collecting data and sending it to electronic control units (ECUs) or other vehicle systems.

There is a large variety of sensor types available on the market, ranging from temperature and pressure sensors to LiDAR and radar sensors. Each of these sensor types plays an important part in a variety of automotive applications, including engine management, advanced driver-assistance systems (ADAS), and navigation. Continual innovation, which is driven by technology breakthroughs, the growing trend towards vehicle electrification, the growing demand for safety features, and the ever-evolving regulatory landscape are the characteristics that define the Automotive Sensors Market sector. The dynamic nature of this sector highlights the major contribution it has made to the continued development of automotive technology.

Automotive Sensors Market: Dynamics

The automotive sensors market will grow at a substantial rate in the projected period. Increase in vehicle safety, performance and passenger comfort along with numerous other advantages, the demand for automotive sensors will rise in the forecast period. Increase in the demand for automotive has propelled the requirement for sensors, thereby supporting the growth of automotive sensor market. With the advancement in technology, the demand for improved sensors is expected to grow for the autonomous vehicles. These sensors are far cheaper and reliable as compared to their older versions.

Rising demand for better vehicle control, improved safety standards and pleasure of driving are some of the factors motivating people to purchase automobiles installed with sensors. Increased standard of living and rise in net disposable income of people have allowed middle class people to afford high end vehicles.

Inclination towards safety standards like driver attention detection, seat belt alarm, active cruise control, airbags, tire pressure, auto emergency braking are expected to drive market growth in the long run. Moreover, stringent rules and regulations by the government on emission reduction, safety, driver assistance, fuel economy and onboard diagnosis systems are some of the factors propelling automotive sensors market growth in the forecast period. Furthermore, development in connected technologies is expected to increase demand for automotive sensors in the near future. However, price competitive market and lack of uniform fabrication process for MEMS is anticipated to hinder market growth.

Automotive Sensors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Sensors Market Research Report |

| Market Size in 2023 | USD 29.86 billion |

| Market Forecast in 2032 | USD 50.67 billion |

| Growth Rate | CAGR of 6.05% |

| Number of Pages | 214 |

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Denso Corporation, Delphi Automotive PLC, Infineon Technologies AG, Allegro Microsystems LLC, Sensata Technologies Inc., Analog Devices Inc., NXP Semiconductors N.V., STMicroelectronics N.V., among others. |

| Segments Covered | By Sensor Type, By Vehicle Sensor Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Sensors Market: Segmentation

The automotive sensors market is segmented into sensor type, vehicle type and application. The vehicle type is segmented into HCV, LCV and passenger car. Passenger car segment is expected to have a significant share in the automotive market. Cheap labor, improving infrastructure, surge in purchasing power along with the rising demand for safer drive, is anticipated to support market growth in the coming years.

Also, position sensor holds a significant share of the automotive sensors market. It is an electronic device that is used to measure position changes in relation to a reference position. The demand for position sensors is estimated to increase, owing to its use in clutch pedal position sensing, brake pedal position sensing, seat and headrest position, and accelerator pedal position. The use of automotive sensors in sunroof position, electric roof position, crash sensing, windscreen wiper position, gear shift position sensing and valve position sensing among others are also expected to drive market growth.

Automotive Sensors Market: Regional Insights

On the basis of region, Asia Pacific will hold a significant share, owing to the increasing population, rise in R&D investments, rise in the manufacturing of automotive are predicted to drive market growth in the anticipated period.

Various trends and dynamics can be observed across a variety of geographical areas, as revealed by regional insights into the Automotive Sensors Market. Significant demand for automotive sensors is being driven by a number of factors in North America, including rigorous rules regarding safety and emissions, the presence of major automobile manufacturers, and a high rate of adoption of new technology. In addition to an increasing emphasis on vehicle electrification and the incorporation of autonomous driving capabilities, the European market is characterized by a similar emphasis on safety and emissions.

This is what is driving the demand for sensors that are specifically specialized to these applications. Within the Asia-Pacific region, the market for automotive sensors is experiencing substantial expansion as a result of fast urbanization, the growth of the middle class population, and the emergence of automotive hubs in countries such as China, Japan, and South Korea. A further factor that contributes to the demand for sensors that are special to electric propulsion systems is the growing production of electric vehicles (EVs) in China, as well as the government's incentives for the adoption of EVs. Growing automotive industries are being driven by increased disposable incomes and advancements in infrastructure in emerging nations in Latin America and the Middle East and Africa, albeit at a somewhat slower rate than in developed ones. To make the most of the numerous opportunities that the Automotive Sensors Market presents in various regions of the world, it is essential for stakeholders to have a solid understanding of the regional nuances that exist.

Automotive Sensors Market: Competitive Space

Renowned automotive sensors market players are:

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Delphi Automotive PLC

- Infineon Technologies AG

- Allegro Microsystems LLC

- Sensata Technologies Inc.

- Analog Devices Inc.

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

The report segments automotive sensors market as follows:

Global Automotive Sensors Market: Sensor Type Segment Analysis

- Pressure Sensors

- Temperature Sensors

- Oxygen Sensors

- Position Sensors

- Speed Sensors

- NOx Sensors

- Image Sensors

- Inertial Sensors

- Other Sensors

Global Automotive Sensors Market: Vehicle Sensor Type Segment Analysis

- HCV

- LCV

- Passenger Car

Global Automotive Sensors Market: Application Segment Analysis

- Chassis

- Powertrain

- Safety and Control

- Exhaust

- Telematics

- Body Electronics

- Others

Global Automotive Sensors Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global automotive sensors market accounted for USD 29.86 billion in 2023 and is expected to reach USD 50.67 billion by 2032.

The CAGR value of the automotive sensors market is expected to be around 6.05% during 2024-2032.

Asia Pacific will hold a significant share, owing to the increasing population, rise in R&D investments, rise in the manufacturing of automotive are predicted to drive market growth in the anticipated period.

Some key players of the global automotive sensors market are Continental AG, Robert Bosch GmbH, Denso Corporation, Delphi Automotive PLC, Infineon Technologies AG, Allegro Microsystems LLC, Sensata Technologies Inc., Analog Devices Inc., NXP Semiconductors N.V., STMicroelectronics N.V.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed