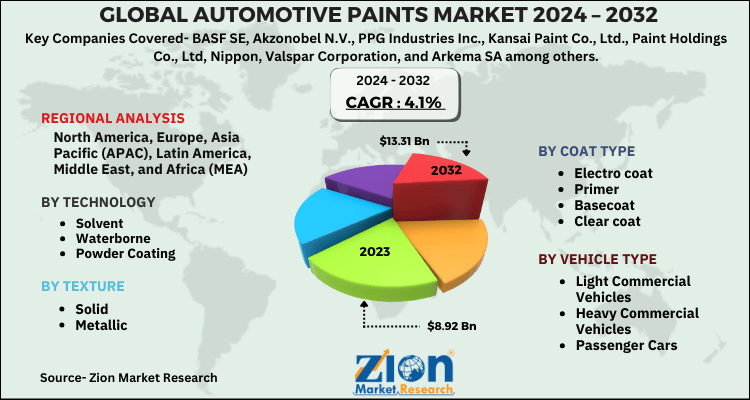

Automotive Paints Market Size, Share, Growth Analysis Report 2032

Automotive Paints Market By Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles, and Passenger Cars), By Coat Type (Electro coat, Primer, and Basecoat), By Technology (Solvent, Waterborne, and Powder Coating), By Texture (Solid And Metallic), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.92 Billion | USD 13.31 Billion | 4.1% | 2023 |

Automotive Paints Market Insights

According to a report from Zion Market Research, the global Automotive Paints Market was valued at USD 8.92 Billion in 2023 and is projected to hit USD 13.31 Billion by 2032, with a compound annual growth rate (CAGR) of 4.1% during the forecast period 2024-2032.

This report explores market strengths, weaknesses, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and prospects that may emerge in the Automotive Paints Market industry over the next decade.

Automotive Paints Market: Overview

Automotive paints are sprayed on automobile surfaces with the assistance of a spray gun. This paint comprises additive pigments, color pigments, binder, and thinner. These are responsible for imparting the necessary viscosity, leveling, appearance, and flexibility to automotive paints. The paint is used in a temperature-controlled environment to quicken the drying process. The automotive paints increase the endurance of the parts of the vehicle and enable them to withstand extreme temperature conditions.

The increase in automobile and automotive sector production and the rise in demand for eco-friendly paints are the major factors fuelling the growth of the market. On the contrary, fluctuations in raw material prices limit the growth of the market.

Automotive paint plays an essential role in the protection of automobile against corrosion, UV rays, oxidization, and acid rains. These paints have low volatile organic compounds (VOC) and high solid content. Automotive paints are easy to apply and are clean and wear resistance. Over the past few years, the automotive paint technology has established in terms of quality, the durability of products and color choices offered to the buyers.

Growing demand for vehicles worldwide has boosted the growth of the automotive paints market. End users prefer to buy vehicles; featuring durable automotive paint is expected to fuel the market growth in the forecast period. However, high prices of raw material may limit the market growth in near future. Nevertheless, altering government rules and regulations for growing environmental awareness would give many significant opportunities for the growth of the automotive paints market in coming years.

COVID-19 Impact Analysis

The global automotive paints market has witnessed a decrease in the sales of vehicles due to the lockdown enforcement placed by various governments to contain COVID-19 spreading. People had no option but to remain indoors, so the sales of vehicles had decreased drastically.

The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the world markets are slowly opening to their full potential and theirs a surge in demand for vehicles and accessories. The market will remain bullish in the upcoming year.

Automotive Paints Market: Dynamics

An increase in vehicle production in countries including China, India, Japan, Indonesia, South Korea, the U.S., and Germany along with the aging of vehicles is likely to upsurge the growth of the market. This trend is likely to remain dominant over the forecast period. Furthermore, demand for automotive paints is anticipated to grow on account of increasing demand for innovative and specialty products in the automobile sector.

Moreover, rising demand for eco-friendly coatings such as powder coatings, UV-cured coatings, and waterborne coatings in emerging economies is anticipated to boost the market in the coming years. However, key raw materials like titanium oxide, pigments, additives, and resins face supply imbalances and price variations, which may affect cost and result in the upswing of automotive paint market prices.

Automotive paint market is segmented on the basis of vehicle type, coat type, texture type, technology and region. On the basis of vehicle type segment market is classified into light commercial vehicles, heavy commercial vehicles, and passenger cars. The coat type comprises of electro coat, base coat, primer coat, and clear coat. Clear coat was the major coat type segment of automotive paint market in 2016 followed by primer, electro coat, and basecoat. The texture type segment is categorized into solid texture and metallic texture. The metallic paints market is expected to grow at fast pace in the forecast period owing to growing demand for attractive glossy finish offered by these paints. In developed countries metallic paints are utilized extensively even for heavy commercial vehicles along with passenger cars and light commercial vehicles; whereas, in the developing countries, solid paints are preferred as heavy commercial paints. On the basis of technology the automotive paint market is segmented into solvent, waterborne, and powder coating.

Automotive Paints Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Paints Market |

| Market Size in 2023 | USD 8.92 Billion |

| Market Forecast in 2032 | USD 13.31 Billion |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 210 |

| Key Companies Covered | BASF SE, Akzonobel N.V., PPG Industries Inc., Kansai Paint Co., Ltd., Paint Holdings Co., Ltd, Nippon, Valspar Corporation, and Arkema SA among others |

| Segments Covered | By Vehicle Type, By Coat Type, By Technology, By Texture, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Paints Market: Segmentation Analysis

The automotive paints market has been segmented based on vehicle type, coat type, technology, texture, and region.

On the basis of technology, the segment market is classified into solvent, waterborne, and powder coating. In 2023, Solvent-borne coatings dominated the market and accounted for around 44.5% of the total volume. Solvent-borne technology is expected to sluggishly grow owing to stringent regulations on VOC emissions, particularly in the developed regions.

Based on coat types, the market is further divided into a base coat, clear coat, a primer coat, and electro coat. Basecoat is likely to grow over the forecast period owing to the only paint type that consists of colors. The coat has maximum contribution in terms of value, as it consists of actual visual properties of color and effects.

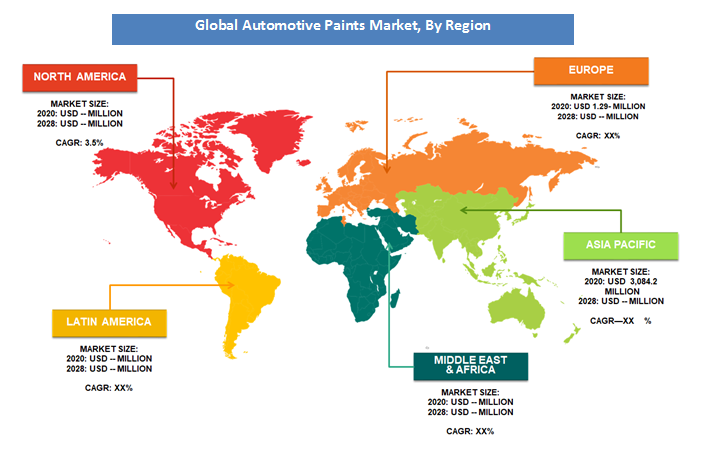

Regional Analysis

In 2016, Asia Pacific was the largest market for automotive paint attributed to recent growth in automotive OEM market in developing countries in the region. Furthermore, favorable macro factors such as largest vehicle production, cheaper labor cost, and government support for manufacturing industry along with the big local market is expected to further boost the market growth in the forecast period. Europe was one of the leading markets for automotive paint in 2016 owing to the presence of leading vehicle producing countries in Europe. Europe was followed by North America, where the U.S. accounts for the largest market in 2016.

Automotive Paints Market: Competitive Analysis

Some of the major players in the global Automotive Paints market include:

- BASF SE

- Akzonobel N.V.

- PPG Industries Inc.

- Kansai Paint Co., Ltd.

- Paint Holdings Co., Ltd

- Nippon

- Valspar Corporation

- Arkema SA

The global Automotive Paints Market is segmented as follows:

By Vehicle Type

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

By Coat Type

- Electro coat

- Primer

- Basecoat

- Clear coat

By Technology

- Solvent

- Waterborne

- Powder Coating

By Texture

- Solid

- Metallic

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Automotive Paints market size was worth around USD 8.92 billion in 2023 and is expected to reach USD 13.31 billion by 2032.

The global Automotive Paints market is expected to grow at a CAGR of 4.1% during the forecast period.

Some of the key factors driving the global Automotive Paints Market growth are increase in Automobile production and rsing demand innovative and eco-friendly automotive paints.

Asia Pacific is expected to dominate the Automotive Paints market over the forecast period.

Some of the major companies operating in Automotive Paints Market are BASF SE, Akzonobel N.V., PPG Industries Inc., Kansai Paint Co., Ltd., Paint Holdings Co., Ltd, Nippon, Valspar Corporation, and Arkema SA among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed