Alloy Market For Automotive Market Size, Share, Trends, Growth 2032

Alloy Market - By Type (Aluminum, Steel, Magnesium, Others), By Vehicle Type (Hcv, Passenger Cars, Lcv), By Application (Powertrain, Exterior, Structural, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 322.08 Billion | USD 503.96 Billion | 5.10% | 2023 |

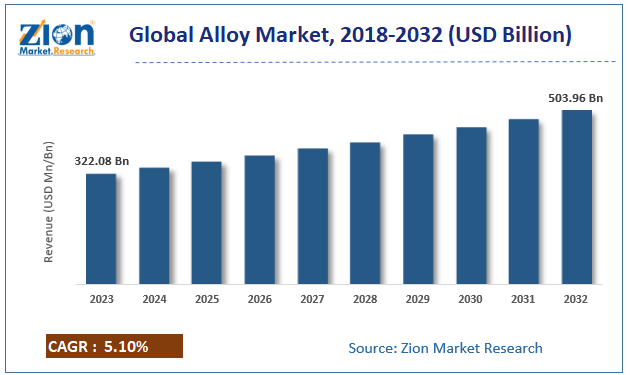

The global alloy market size accrued earnings worth approximately USD 322.08 Billion in 2023 and is predicted to gain revenue of about USD 503.96 Billion by 2032, is set to record a CAGR of nearly 5.10% over the period from 2024 to 2032.

The assessment of the alloy market for automotive dynamics gives a brief thought about the drivers and restraints for the alloy market for automotive along with their impact on the demand over the years to come. Additionally, the report also includes the study of opportunities available in the alloy market for automotive on a global level.

Alloy Market: Growth Factors

An alloy is a combination of two or more metals elements in a solid solution. Alloys have high strength and corrosion-resistant properties. These properties are different from those of the constituent elements.

The global alloy market for automotive is likely to show considerable growth in the years ahead. Alloys have numerous useful properties, such as they reduce a vehicle’s weight considerably. Stringent government norms are being implemented to produce lightweight vehicles, which is accelerating the demand for alloys in the automotive industry. Reduced weight of vehicles leads to better fuel efficiency. Alloys also reduce emissions from vehicles, as weight and emissions have a direct relationship.

Alloys have a wide range of applications in automobiles, such as manufacturing radiators, mounts, crankcase, brackets, crankshaft, housings, cylinder, and oil pumps. Additionally, rapid urbanization is a major growth driver for the global alloy market for automotive. Furthermore, the growing demand for vehicles is a catalyst for market expansion. Rising inflation rates have driven people toward fuel-efficient cars with low operating costs.

Moreover, alloys also improve strength while maintaining a lower weight. However, the high cost of alloys may slow down the global alloy market for automotive growth.

The report gives a transparent view of the alloy market for automotive. We have included a detailed competitive scenario and portfolio of the leading vendors operating in the alloy market for automotive. To understand the competitive landscape in the alloy market for automotive, an analysis of Porter’s Five Forces model for the alloy market for automotive has also been included. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Alloy Market: Segmentation

The study provides a crucial view of the alloy market for automotive by segmenting it based on type, vehicle type, application, and region.

On the basis of type, the market includes aluminum, steel, magnesium, and others. The steel segment shows significant growth potential, due to its high demand in India, China, Thailand, and other developing countries. Moreover, developed countries import steel from developing economies for cost benefits. Steel is an affordable alloy and retains all the desirable properties required for various applications along with emitting fewer greenhouse gases during production. By vehicle type, the global alloy market for automotive includes HCV, passenger cars, and LCV. The passenger cars segment is anticipated to hold a prominent market share in the future. The application segment of the market comprises powertrain, exterior, structural, and others.

All the segments of the alloy market for automotive have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Alloy Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alloy Market Research Report |

| Market Size in 2023 | USD 322.08 Billion |

| Market Forecast in 2032 | USD 503.96 Billion |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 215 |

| Key Companies Covered | Alcoa, ThyssenKrupp, AMG Advanced Metallurgical, Massey Ferguson, ArcelorMittal, Novelis, Norsk Hydro, Kobe Steel, and Constellium |

| Segments Covered | By Type, By Vehicle Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The regional segment comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America, and Europe.

By region, the Asia Pacific region is estimated to register the fastest growth rate and hold a major share of the global alloy market for automotive. This can be attributed to the rapid urbanization and growing regional demand for alloys. Moreover, the rising disposable income of the regional population leads to diverse increased purchase of a wide range of items. India and China are rapidly growing economies and form a huge platform for industrial growth for the Asia Pacific alloy market for automotive.

Numerous car producers have their manufacturing facilities in India, due to the low cost of labor, less number of tax policies, and economical assembly costs. Additionally, government norms to reduce carbon emissions also promote the use of alloys for automobiles across the region.

Alloy Market: Competitive Space

The global alloy market profiles key players such as:

- Alcoa

- ThyssenKrupp

- AMG Advanced Metallurgical

- Massey Ferguson

- ArcelorMittal

- Novelis

- Norsk Hydro

- Kobe Steel

- Constellium

The report segments the global alloy market for automotive as follows:

Global Alloy Market for Automotive: By Type

- Aluminum

- Steel

- Magnesium

- Others

Global Alloy Market for Automotive: By Vehicle Type

- HCV

- Passenger Cars

- LCV

Global Alloy Market for Automotive: By Application

- Powertrain

- Exterior

- Structural

- Others

Global Alloy Market for Automotive: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An alloy is a compound composed of two or more elements, with a minimum of one metal constituent. The combination of these elements results in the formation of a substance whose properties are superior to those of the constituent elements. In order to enhance the strength, durability, corrosion resistance, or other physical and chemical properties of the base metals, alloys are frequently formed.

Numerous factors exert an influence on the alloy market, thereby contributing to its expansion. The market dynamics are susceptible to the influence of industrial, technological, environmental, and economic trends. It is imperative to consider the most recent developments as the situation may have undergone changes since my last update in January 2022.

The Global alloy market size accrued earnings worth approximately USD 322.08 Billion in 2023 and is predicted to gain revenue of about USD 503.96 Billion by 2032.

The Global alloy market is set to record a CAGR of nearly 5.10% over the period from 2024 to 2032.

The regional segment comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America, and Europe.

Some major players of the Global alloy market for automotive include Alcoa, ThyssenKrupp, AMG Advanced Metallurgical, Massey Ferguson, ArcelorMittal, Novelis, Norsk Hydro, Kobe Steel, and Constellium.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed