Automotive Torsion Bar Market Trend, Share, Growth, Size and Forecast 2034

Automotive Torsion Bar Market By Application (Suspension Systems, Chassis Systems, Steering Systems, and Stabilizer Bars), By Type (Solid Torsion Bar, Hollow Torsion Bar, and Adjustable Torsion Bar), By Material (Alloy Steel, Aluminum, and Composite), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

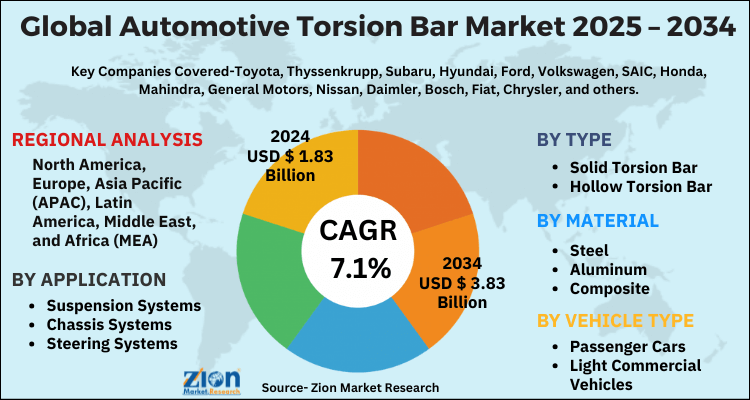

| USD 1.83 Billion | USD 3.83 Billion | 7.1% | 2024 |

Automotive Torsion Bar Market: Industry Perspective

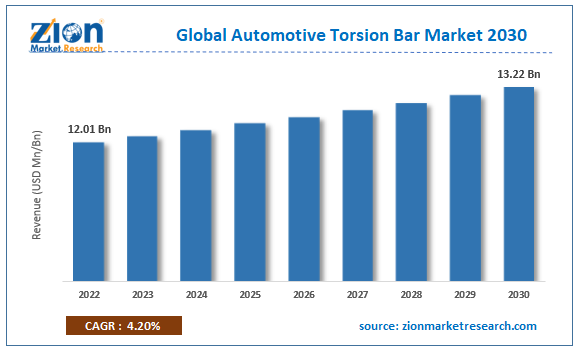

The global automotive torsion bar market size was worth around USD 1.83 Billion in 2024 and is predicted to grow to around USD 3.83 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.1% between 2025 and 2034. The report analyzes the global automotive torsion bar market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive torsion bar industry.

Automotive Torsion Bar Market: Overview

The automotive torsion bar is a crucial component of a vehicle's suspension system, providing stability and support. Unlike traditional coil or leaf spring suspensions, torsion bars are straight bars typically made of steel that twist along their axis to absorb and distribute forces exerted on the vehicle's wheels. Connected to the chassis on one end and the suspension on the other, torsion bars play a pivotal role in managing ride height and ensuring a smooth, controlled ride. One advantage of torsion bar systems is their ability to resist sagging over time, contributing to consistent vehicle height and handling.

Adjustability is another key feature, as manufacturers or vehicle owners can fine-tune suspension settings by adjusting the torsion bar's preload. This adaptability makes torsion bars popular in various vehicle types, including trucks and off-road vehicles. While torsion bar suspensions are known for their durability and ease of customization, they may be stiffer than other suspension types, potentially impacting ride comfort. Overall, the automotive torsion bar is a versatile and reliable suspension element, offering a balance of performance and adjustability for different driving conditions and vehicle requirements.

Key Insights

- As per the analysis shared by our research analyst, the global automotive torsion bar market is estimated to grow annually at a CAGR of around 7.1% over the forecast period (2025-2034).

- Regarding revenue, the global automotive torsion bar market size was valued at around USD 1.83 billion in 2024 and is projected to reach USD 3.83 billion by 2034.

- The global automotive torsion bar market is projected to grow at a significant rate due to increasing demand for enhanced vehicle performance and ride comfort.

- Based on the Application, the Suspension Systems segment is expected to lead the global market.

- On the basis of Type, the Solid Torsion Bar segment is growing at a high rate and will continue to dominate the global market.

- Based on the Material, the Alloy Steel segment is projected to swipe the largest market share.

- By Vehicle Type, the Passenger Cars segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Automotive Torsion Bar Market: Growth Drivers

Increasing demand for enhanced vehicle performance and ride comfort drives the market growth.

The global automotive torsion bar industry is witnessing growth, driven significantly by the increasing demand for enhanced vehicle performance and ride comfort. Torsion bars play a vital role in a vehicle's suspension system, contributing to stability and control during various driving conditions. As consumers increasingly prioritize smoother rides and better handling, automotive manufacturers are incorporating advanced torsion bar technologies to meet these expectations. This demand is particularly notable in segments such as off-road vehicles and trucks, where the torsion bar's ability to provide robust suspension support aligns with the requirements of challenging terrains and heavy loads.

Furthermore, the automotive industry's continuous pursuit of lightweight and durable components is driving innovation in torsion bar materials and design. Manufacturers are exploring advanced alloys and engineering techniques to develop torsion bars that offer high strength while minimizing weight. This not only contributes to fuel efficiency but also aligns with the broader industry trend toward light weighting for improved overall vehicle performance. The versatility of torsion bar systems is another driving factor in the market. Torsion bars provide a customizable suspension solution, allowing manufacturers to fine-tune the vehicle's handling characteristics. This adaptability is particularly valuable as consumer preferences vary, and automakers seek to differentiate their offerings in a competitive market. As a result, the automotive torsion bar market is poised for continued growth, driven by the pursuit of superior vehicle dynamics and the evolving needs of discerning consumers.

Automotive Torsion Bar Market: Restraints

Increasing trend toward alternative suspension technologies may hinder the market growth.

Despite the growth in the global automotive torsion bar industry, a notable restraint is the increasing trend toward alternative suspension technologies. Some vehicle manufacturers are exploring and adopting more modern suspension systems, such as air suspensions or electronically controlled dampers, which offer advanced features like adaptive ride control and automated adjustments. These alternatives provide a wider range of customization and dynamic responses, potentially diverting demand away from traditional torsion bar systems.

Moreover, regulatory standards and emission requirements in the automotive industry pose a challenge for torsion bar manufacturers. As the industry undergoes a significant shift toward electric vehicles (EVs) and hybrid technologies to meet environmental goals, the emphasis on reducing overall vehicle weight and optimizing energy efficiency may favor lighter suspension alternatives. Adhering to stringent emissions regulations while maintaining or improving vehicle performance presents a dual challenge for torsion bar manufacturers, influencing their market dynamics amid the broader industry transition.

Automotive Torsion Bar Market: Opportunities

Growing focus on electric and hybrid vehicles provides growth opportunities

An opportunity in the automotive torsion bar market lies in the growing focus on electric and hybrid vehicles. As the automotive industry undergoes a substantial shift toward electrification to meet environmental regulations and reduce carbon footprints, there is an opportunity for torsion bar manufacturers to innovate and develop solutions that cater to the specific needs of electric and hybrid vehicle suspensions. These vehicles often have unique weight distribution characteristics and engineering requirements, presenting a chance for torsion bar systems to evolve to meet the demands of this changing landscape. Furthermore, the increasing popularity of off-road and recreational vehicles offers another avenue for growth. Torsion bars, known for their durability and robust suspension support, are well-suited for off-road applications. As consumer interest in adventure and outdoor activities rises, manufacturers can capitalize on this trend by designing torsion bar systems that enhance the off-road capabilities of vehicles, catering to the demands of enthusiasts and expanding their market presence in this niche segment. This opportunity aligns with the broader trend of customization and specialization within the automotive industry.

Automotive Torsion Bar Market: Challenges

Increasing demand for lightweight materials and advanced suspension technologies to challenging market growth.

A significant challenge facing the automotive torsion bar market is the increasing demand for lightweight materials and advanced suspension technologies. As the automotive industry gravitates towards electric and hybrid vehicles, there is a growing emphasis on reducing overall vehicle weight to enhance energy efficiency and extend the range of electric vehicles. This trend poses a challenge for torsion bar manufacturers, as they must innovate and develop materials that strike a balance between weight reduction and maintaining the durability and performance characteristics required for effective suspension systems. Additionally, the integration of advanced suspension technologies, such as electronic damping systems and air suspensions, challenges the traditional role of torsion bars, requiring manufacturers to adapt and incorporate smart features to remain competitive in a rapidly evolving market.

Moreover, stringent environmental regulations and emission standards contribute to the challenge. With an increasing focus on sustainability, automotive manufacturers are exploring alternative materials and innovative designs for components, including suspension systems. Torsion bar manufacturers face the challenge of aligning their products with these evolving environmental standards, ensuring compliance while meeting the performance demands of modern vehicles. This dual requirement for sustainability and performance places added pressure on torsion bar manufacturers to navigate a complex landscape of regulatory compliance and technological advancements.

Many automakers were increasing their use of aluminum in vehicle construction to reduce weight. For instance, Ford introduced the aluminum-bodied F-150 in 2015, showcasing a significant shift in materials for one of the best-selling vehicles in the United States. Furthermore, governments around the world have been implementing regulations to improve fuel efficiency and reduce emissions. For instance, in the European Union, there were stringent emission standards and targets that incentivized automakers to adopt lightweight materials to meet regulatory requirements. The U.S. Environmental Protection Agency (EPA) also had fuel efficiency standards that encouraged the use of lightweight materials.

Automotive Torsion Bar Market: Segmentation Analysis

The global automotive torsion bar market is segmented based on application, type, material, vehicle type, and region.

Based on Application, the global automotive torsion bar market is divided into suspension systems, chassis systems, steering systems, and stabilizer bars. Out of these, the suspension system was the largest shareholding segment in the global market. This prominence can be attributed to the fundamental role torsion bars play in providing stability, control, and support within vehicle suspensions. Torsion bars are integral components that contribute to a smooth and balanced ride, making them a crucial element in the suspension systems of various vehicle types. The demand for superior ride comfort and optimized handling in automobiles has led to the widespread adoption of torsion bars within suspension systems, underscoring the segment's dominance in the global market.

On the basis of Type, the global automotive torsion bar market is bifurcated into solid torsion bar, hollow torsion bar, and adjustable torsion bar.

By Material, the global automotive torsion bar market is split into alloy steel, aluminum, and composite. Out of these, alloy steel was the largest shareholding segment in the global market. This prevalence is underscored by the exceptional strength, durability, and cost-effectiveness offered by alloy steel in torsion bar manufacturing. The material's robust properties make it a preferred choice for providing stability and support in automotive suspension systems. This dominance is reflected not only in industry preferences but is also substantiated by market trends, where alloy steel continues to be the leading material in the production of automotive torsion bars, further solidifying its position as the largest shareholding segment in the global market.

In terms of Vehicle Type, the global automotive torsion bar market is categorized into passenger cars, light commercial vehicles, and heavy commercial vehicles. At present, the global market is led by the passenger vehicle segment. This dominance can be attributed to a confluence of factors that highlight the significance of torsion bars in enhancing the performance and handling of passenger vehicles. Torsion bars play a crucial role in providing stability, balance, and structural support, especially in the context of passenger vehicles where comfort and ride quality are paramount. The increasing demand for passenger vehicles, including sedans, SUVs, and hatchbacks, across diverse geographical regions, has propelled the adoption of torsion bars in this segment. Additionally, the ongoing innovations in automotive engineering and the pursuit of optimal driving experiences contribute to the prominence of torsion bars in passenger vehicles. While commercial vehicles and off-road vehicles also rely on torsion bars for specific applications, the widespread use and consumer-driven dynamics within the passenger vehicle segment underscore its primary position in steering the global automotive torsion bar industry.

Automotive Torsion Bar Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Torsion Bar Market |

| Market Size in 2024 | USD 1.83 Billion |

| Market Forecast in 2034 | USD 3.83 Billion |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 217 |

| Key Companies Covered | Toyota, Thyssenkrupp, Subaru, Hyundai, Ford, Volkswagen, SAIC, Honda, Mahindra, General Motors, Nissan, Daimler, Bosch, Fiat, Chrysler, and others. |

| Segments Covered | By Application, By Type, By Material, By Vehicle Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Torsion Bar Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to take the lead in the automotive torsion bar market during the forecast period. The region's dominance can be attributed to several factors, including the robust growth of the automotive industry, particularly in countries such as China and India. China is the world's largest automobile market, accounting for over 30% of global vehicle sales in 2022. The Chinese market is driven by strong economic growth and rising urbanization.

In 2022, China produced over 26 million vehicles and sold over 23 million vehicles. Furthermore, India is the world's fifth-largest passenger vehicle market and the fourth-largest commercial vehicle-manufacturing country. The Indian market is expected to grow at a CAGR of 9.3% from 2022 to 2027. In 2022, India produced over 4.4 million vehicles and sold over 4 million vehicles. SUVs are the most popular segment of the Indian market, accounting for over 30% of sales in 2021. Similarly, Japan is the world's third-largest automaker and a major exporter of automobiles. The Japanese automotive industry is known for its focus on quality, innovation, and fuel efficiency. In 2022, Japan produced over 4.5 million vehicles and sold over 4 million vehicles. As these nations continue to witness a surge in vehicle production and sales, the demand for reliable and cost-effective suspension solutions like torsion bars is expected to escalate. Additionally, the increasing urbanization, rising disposable incomes, and a growing middle-class population in the Asia Pacific region contribute to a higher demand for automobiles, further fueling the market for torsion bars.

Moreover, the shift toward electric vehicles (EVs) and the adoption of advanced automotive technologies in Asia Pacific present a significant opportunity for torsion bar manufacturers. As the region embraces the global trend of electrification, torsion bars can play a pivotal role in the suspension systems of electric and hybrid vehicles. The evolving automotive landscape in Asia Pacific, coupled with a focus on sustainable and efficient transportation solutions, positions the region as a key driver in the growth of the global automotive torsion bar industry in the coming years.

Recent Developments

- In 2023, Draexlmaier, a German automotive supplier, launched a new torsion bar for electric vehicles. This torsion bar is designed to be lighter and more efficient than traditional torsion bars, which is important for electric vehicles as they require more power to accelerate and brake.

- In 2023, Sogefi, an Italian automotive supplier, announced a partnership with Tinsley Bridge, a British company that specializes in torsion bars for passenger cars. This partnership is expected to provide Sogefi with access to Tinsley Bridge's expertise in lightweight materials and design.

- In 2022, ZF Friedrichshafen, a German automotive supplier, acquired Wabco, a Belgian braking technology company. This acquisition is expected to strengthen ZF's position in the automotive torsion bar market, as Wabco had a strong presence in the commercial vehicle segment.

- In 2022, Freudenberg, a German automotive supplier, announced a partnership with Lisi, a French company that specializes in chassis components. This partnership is expected to provide Freudenberg with access to Lisi's expertise in manufacturing and engineering.

- In 2022, Getrag, a German transmission manufacturer, launched a new torsion bar for hybrid vehicles. This torsion bar is designed to handle the additional torque that hybrid vehicles generate.

Automotive Torsion Bar Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the automotive torsion bar market on a global and regional basis.

The global automotive torsion bar market is dominated by players like:

- Toyota

- Thyssenkrupp

- Subaru

- Hyundai

- Ford

- Volkswagen

- SAIC

- Honda

- Mahindra

- General Motors

- Nissan

- Daimler

- Bosch

- Fiat

- Chrysler

The global automotive torsion bar market is segmented as follows;

By Application

- Suspension Systems

- Chassis Systems

- Steering Systems

- Stabilizer Bars

By Type

- Solid Torsion Bar

- Hollow Torsion Bar

- Adjustable Torsion Bar

By Material

- Alloy Steel

- Aluminum

- Composite

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The automotive torsion bar is a crucial component of a vehicle's suspension system, providing stability and support. Unlike traditional coil or leaf spring suspensions, torsion bars are straight bars typically made of steel that twist along their axis to absorb and distribute forces exerted on the vehicle's wheels. Connected to the chassis on one end and the suspension on the other, torsion bars play a pivotal role in managing ride height and ensuring a smooth, controlled ride.

The global automotive torsion bar market is expected to grow due to rising demand for vehicle suspension systems, growth in automotive production, increasing focus on ride comfort and stability, and advancements in lightweight and durable materials.

According to a study, the global automotive torsion bar market size was worth around USD 1.83 Billion in 2024 and is expected to reach USD 3.83 Billion by 2034.

The global automotive torsion bar market is expected to grow at a CAGR of 7.1% during the forecast period.

Asia-Pacific is expected to dominate the automotive torsion bar market over the forecast period. It is currently the world’s highest revenue-generating market owing to robust growth of the automotive industry, particularly in countries such as China and India.

Leading players in the global automotive torsion bar market include Toyota, Thyssenkrupp, Subaru, Hyundai, Ford, Volkswagen, SAIC, Honda, Mahindra, General Motors, Nissan, Daimler, Bosch, Fiat, Chrysler, among others.

The report analyzes the global automotive torsion bar market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automotive torsion bar industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed