Global 3D NAND Flash Memory Market Size, Share, Report 2034

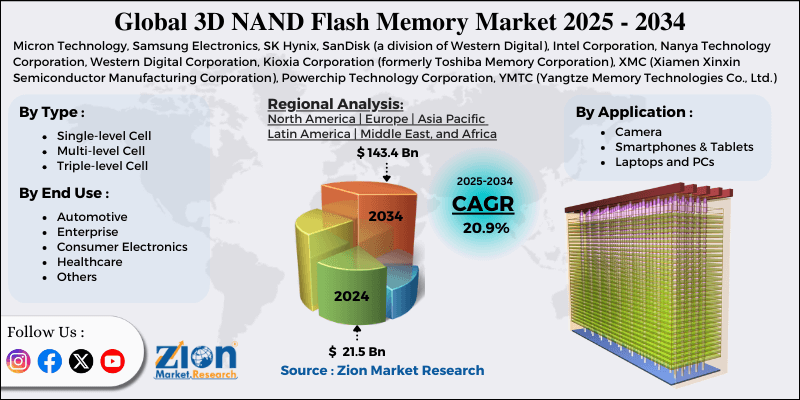

3D NAND Flash Memory Market By Type (Single-level Cell, Multi-level Cell, and Triple-level Cell), By Application (Camera, Smartphones & Tablets, Laptops and PCs, and Others), By End-Use (Automotive, Enterprise, Consumer Electronics, Healthcare, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

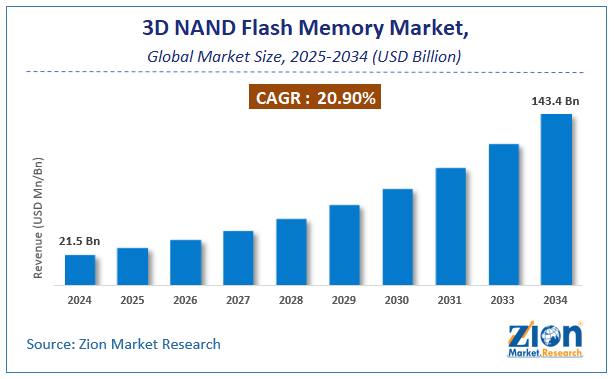

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.5 Billion | USD 143.4 Billion | 20.9% | 2024 |

3D NAND Flash Memory Industry Prospective:

The global 3D NAND flash memory market size was worth around USD 21.5 billion in 2024 and is predicted to grow to around USD 143.4 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.9% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global 3D NAND Flash Memory market is estimated to grow annually at a CAGR of around 20.9% over the forecast period (2025-2034).

- In terms of revenue, the global 3D NAND Flash Memory market size was valued at around USD 21.5 billion in 2024 and is projected to reach USD 143.4 billion by 2034.

- An increasing number of data centers globally is expected to drive the 3D NAND Flash Memory market over the forecast period.

- Based on the type, the triple-level cell segment is expected to capture the largest market share over the projected period.

- Based on the application, the smartphones & tablets segment is expected to capture the largest market share over the projected period.

- Based on the end use, the consumer electronics segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

3D NAND Flash Memory Market: Overview

3D NAND Flash Memory is a type of non-volatile storage that stacks memory cells on top of each other in multiple layers, like floors in a skyscraper, rather than in a flat (2D) planar structure. This 3D architecture addresses the scaling issues of ordinary NAND, allowing it to hold more data, operate more quickly (with less power consumption), last longer, and cost less per GB. It's the standard for SSDs, smartphones, and data centers currently. The 3D NAND Flash Memory market is growing as more people demand data centers, smartphones, and AI-powered apps that can store large amounts of data quickly. Cloud computing, big data analytics, and machine learning applications generate large volumes of data, necessitating denser memory solutions. By stacking 3D NAND vertically, it can fit terabytes of data into a compact space at a lower cost per GB.

3D NAND Flash Memory Market Dynamics

Growth Drivers

Does the rapid expansion of data centers drive growth in the 3D NAND flash memory industry?

The 3D NAND flash memory sector is increasing rapidly as data centers increase. This is because cloud computing, artificial intelligence, big data analytics, video streaming, and IoT applications generate large amounts of data that demand high-capacity, high-performance storage systems. By stacking memory cells vertically, 3D NAND flash enables substantially higher storage density, enabling data centers to deploy multi-terabyte solid-state devices in a limited physical area. As more data center operators transition from traditional hard disk drives to SSDs to speed up data access, reduce latency, and increase reliability, demand for 3D NAND is growing rapidly, as it is the primary memory technology used in SSDs. Furthermore, 3D NAND-based storage is more energy-efficient.

It has a lower total cost of ownership than HDDs, allowing operators to reduce power usage and cooling expenses, which are critical at scale. The rise of hyperscale, colocation, and edge data centers hastens adoption, as these facilities promote compact, scalable, and cost-effective storage structures. As a result, the continued global expansion of data center infrastructure creates sustained, high-volume demand for 3D NAND flash memory, establishing it as a key market driver.

According to the figure given by the Bureau of Labor Statistics, the number of people working in data centers grew from 306,000 to 501,000 between 2016 and 2023.

Restraints

How are the high manufacturing and production costs impeding the growth of the 3D NAND flash memory market?

The 3D NAND flash memory market can't grow as quickly as it could, as the high costs of chip production make it challenging for manufacturers to boost output without losing money. Making 3D NAND chips requires highly advanced fabrication techniques, such as multi-layer vertical stacking, high-precision lithography, and complex etching procedures. All of these need expensive equipment, cleanroom space, and a lot of money. Manufacturers aim to produce chips with more layers to store more data, but this makes the process much more difficult, often resulting in lower yields and higher defect rates that raise the cost per chip.

These increased production costs cut into profit margins, especially when memory prices are volatile or supply is too high. This leads some companies to postpone expanding their capacity or implementing technological advances. Furthermore, growing production costs translate into higher product pricing, limiting penetration into cost-sensitive applications and emerging markets. As a result, despite great end-user demand, the high-cost structure of 3D NAND fabrication constrains supply expansion, lowers pricing competitiveness, and presents major entry hurdles for new or smaller suppliers.

Opportunities

Will the increasing innovative product launches by the combination of major market players offer a potential opportunity for the 3D NAND flash memory industry growth?

The growing number of innovative product launches by major market players is expected to create opportunities for the 3D NAND Flash Memory Market. For instance, in February 2025, Kioxia Corporation and SanDisk Corporation have pioneered cutting-edge 3D flash memory technology, setting industry benchmarks with a 4.8 Gb/s NAND interface speed, higher power efficiency, and increased density. The new 3D flash memory technology was shown off at ISSCC 2025. It uses Toggle DDR6.0 for NAND flash memory, which is one of the newest interface standards. It also uses the SCA (Separate Command Address) protocol, a new way to input command addresses, and PI-LTT (Power Isolated Low-Tapped Termination) technology, which further reduces power consumption.

Challenges

Technical complexity & low yield pose a major challenge to market expansion

The 3D NAND flash memory industry has been struggling to grow, as the technology is very complex and doesn't generate much profit. This is because the manufacturing processes are very sophisticated and become harder to control as the memory layers get thicker. To make 3D NAND, hundreds of very thin memory layers must be stacked on top of each other, and the entire wafer must undergo deep etching, precise alignment, and uniform deposition. Even little changes in the process might cause chips to fail, making them worthless.

This leads to low yield rates, especially when larger node sizes or more layers are first introduced. Low yields significantly increase the cost per functional chip, making it harder to turn a profit and less cost-effective to produce at a large scale. This issue can make it hard to expand capacity, adopt new technologies, and deter companies from investing heavily in new industrial operations. Also, the technical complexity requires extensive process control, specialized equipment, and highly specialized knowledge, which makes operations risky and limits the number of manufacturers that can compete successfully. These restrictions, then, slow the growth of supply, increase price volatility, and ultimately slow the overall growth of the 3D NAND flash memory industry.

3D NAND Flash Memory Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 3D NAND Flash Memory Market |

| Market Size in 2024 | USD 21.5 Billion |

| Market Forecast in 2034 | USD 143.4 Billion |

| Growth Rate | CAGR of 20.9% |

| Number of Pages | 250 |

| Key Companies Covered | Micron Technology, Samsung Electronics, SK Hynix, SanDisk (a division of Western Digital), Intel Corporation, Nanya Technology Corporation, Western Digital Corporation, Kioxia Corporation (formerly Toshiba Memory Corporation), XMC (Xiamen Xinxin Semiconductor Manufacturing Corporation), Powerchip Technology Corporation, YMTC (Yangtze Memory Technologies Co., Ltd.), ADATA Technology, Transcend Information, Silicon Motion Technology Corporation, Phison Electronics Corporation, Macronix International, GigaDevice Semiconductor (Beijing) Inc., SK Hynix System IC, Inc., and Netlist, Inc., among others. |

| Segments Covered | By Type, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America ,The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

3D NAND Flash Memory Market: Segmentation

Type Insights

The triple-level cell segment dominates the market, capturing over 44% of the market share because it provides the perfect balance between price, performance, durability, and storage density. TLC technology can store 3 bits per cell, which is much more than single-level cells (SLC) and multi-level cells (MLC). It also keeps the same level of reliability for most consumer and business applications. TLC-based 3D NAND is a great choice for solid-state drives (SSDs) used in data centers, personal computers, notebooks, and consumer devices, as it is cost-effective and offers high storage capacity.

Application Insights

The smartphones & tablets segment is expected to hold the largest revenue share over the projected period. The market is growing because more people need storage and more devices are being used worldwide. Modern smartphones and tablets may run applications that consume substantial data, including high-resolution photography, 4K/8K video recording, mobile gaming, AI-enabled features, and cloud-based services. All of these need additional storage space on the device itself. Manufacturers are turning to 3D NAND flash in order to meet these needs while keeping device designs small. 3D NAND flash offers higher density and a lower cost per bit than planar NAND.

End-Use Insights

The consumer electronics segment is expected to capture a substantial market share of more than 40%. The growing number of Internet of Things (IoT) devices, such as smart home gadgets, wearables, and appliances, is driving demand for small, reliable, and energy-efficient storage solutions based on 3D NAND. Wearable gear like smartwatches, fitness trackers, and other health-monitoring devices collect and retain a lot of data. 3D NAND technology is well-suited to meeting the storage requirements of these devices because it offers high performance and large capacity.

Regional Insights

North America dominates the market with a revenue share of 42% in 2024. The rise is being driven by the high number of hyperscale data centers, cloud service providers, and advanced enterprise IT infrastructure in the US and Canada. AWS, Microsoft, Google, and Meta are all major tech companies with offices in the area. They all need a lot of high-performance, high-capacity storage for cloud computing, AI workloads, and big data analytics. This has accelerated the adoption of SSD-based storage, increasing demand for 3D NAND flash memory.

Also, North America has many high-end consumer gadgets, such as smartphones, laptops, and gaming devices with ample internal storage. This helps the market grow. Regional demand is driven by ongoing investments in AI, edge computing, and digital transformation, as well as by strong research and development skills and the early adoption of new memory technologies. Even though some production occurs outside North America, it remains an important center of demand and innovation. This is a significant portion of the worldwide 3D NAND flash memory market's revenue.

Does the rapid growth in U.S. data center capacity drive the 3D NAND Flash Memory market?

In the US, hyperscale, colocation, and AI-focused data centers are growing quickly. Cloud providers like AWS, Microsoft, Google, and Meta are leading the way. Cloud computing, AI/ML training, big data analytics, and streaming apps all require substantial high-capacity, high-performance storage to function. As a result, data centers are moving away from traditional hard drives toward architectures based on solid-state drives (SSDs), with 3D NAND flash as the primary storage technology.

Also, U.S. data centers encourage energy efficiency, low latency, and scalability. All of these benefits are achieved with 3D NAND-based SSDs, which offer more storage capacity, higher read speeds, and lower power consumption per gigabyte. The growth of AI workloads and edge data centers increases the need for storage, which raises the amount of NAND content per server. As a result, continued investments and capacity additions in US data centers lead directly to higher shipment volumes and steady revenue growth in the 3D NAND flash memory market. This makes US data center expansion a major structural growth driver.

3D NAND Flash Memory Market: Competitive Analysis

The global 3D NAND Flash Memory market is dominated by players like-

- Micron Technology

- Samsung Electronics

- SK Hynix

- SanDisk (a division of Western Digital)

- Intel Corporation

- Nanya Technology Corporation

- Western Digital Corporation

- Kioxia Corporation (formerly Toshiba Memory Corporation)

- XMC (Xiamen Xinxin Semiconductor Manufacturing Corporation)

- Powerchip Technology Corporation

- YMTC (Yangtze Memory Technologies Co.

- ADATA Technology

- Transcend Information

- Silicon Motion Technology Corporation

- Phison Electronics Corporation

- Macronix International

- GigaDevice Semiconductor (Beijing) Inc.

- SK Hynix System IC

- Netlist

- among others.

The global 3D NAND Flash Memory market is segmented as follows:

By Type

- Single-level Cell

- Multi-level Cell

- Triple-level Cell

By Application

- Camera

- Smartphones & Tablets

- Laptops and PCs

- Others

By End Use

- Automotive

- Enterprise

- Consumer Electronics

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed