Interconnect Data Center Solution Market Size, Share, Trends, Growth 2034

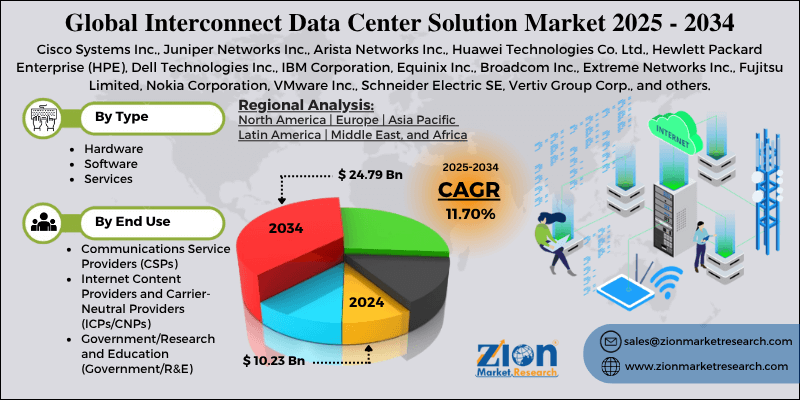

Interconnect Data Center Solution Market By Type (Hardware, Software, Services), By End-Use (Communications Service Providers [CSPs], Internet Content Providers and Carrier-Neutral Providers [ICPs/CNPs], Government/Research and Education [Government/R&E], and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

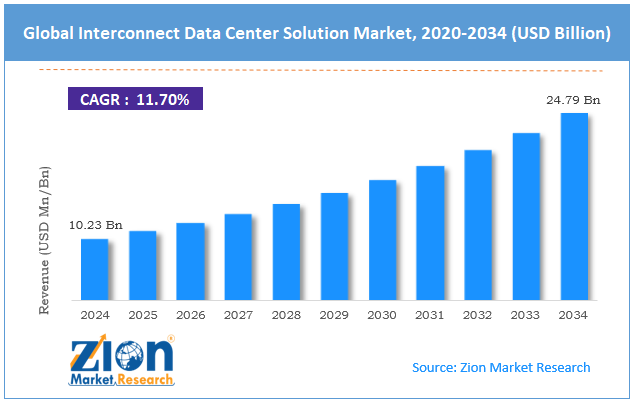

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.23 Billion | USD 24.79 Billion | 11.70% | 2024 |

Interconnect Data Center Solution Industry Perspective:

The global interconnect data center solution market size was worth around USD 10.23 billion in 2024 and is predicted to grow to around USD 24.79 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global interconnect data center solution market is estimated to grow annually at a CAGR of around 11.70% over the forecast period (2025-2034)

- In terms of revenue, the global interconnect data center solution market size was valued at around USD 10.23 billion in 2024 and is projected to reach USD 24.79 billion by 2034.

- The interconnect data center solution market is projected to grow significantly due to the rising demand for high-speed data transfer and low-latency connectivity, the increasing use of IoT and AI-driven applications, and the rise in edge data center deployments.

- Based on type, the hardware segment is expected to lead the market, while the software segment is expected to grow considerably.

- Based on end-use, the Communications Service Providers (CSPs) segment is the dominating segment. In contrast, the Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs) segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Interconnect Data Center Solution Market: Overview

The interconnect data center solution refers to a package of solutions and frameworks that enable uninterrupted connectivity, data exchange, and communication between multiple data centers. These solutions improve performance, redundancy, and scalability by linking cloud, on-premise, and edge infrastructures. They play a key role in enhancing network traffic, supporting digital transformation initiatives, and reducing latency. The global interconnect data center solution market is poised for notable growth due to the increasing adoption of cloud computing, the surge in global data traffic, and the growth of edge computing. The rapid development of private, public, and hybrid cloud environments is a key driver for interconnect data center solutions. Businesses are leveraging multi-cloud tactics to improve cost-efficiency and flexibility, thus creating the need for interconnect solutions that offer secure, high-speed, and scalable connectivity between cloud platforms and data centers.

With the rise of IoT devices, video streaming, and digital services, the worldwide data traffic is growing remarkably. This rise fuels the demand for data center interconnect solutions to manage massive data flow effectively, assuring high bandwidth and low latency for smooth operations. Furthermore, edge computing adoption has amplified as businesses seek to process data close to its source. Interconnect solutions allow edge nodes to communicate continuously with core data centers, supporting applications like smart cities and autonomous systems and facilitating real-time analytics.

Nevertheless, the global market faces limitations due to factors such as high initial deployment costs and the complexity of network integration. Building an interconnect infrastructure demands significant investment in fiber optics, networking equipment, and software integration. High upfront costs restrict adoption, mainly for medium and small businesses with limited IT budgets. Likewise, integrating interconnect solutions with existing heterogeneous IT systems offers challenges. Compatibility issues between modern technologies and legacy infrastructure usually raise deployment costs and time, hampering smooth implementation.

Still, the global interconnect data center solution industry benefits from several favorable factors, such as the growth of hybrid and multi-cloud environments and the expansion of developing economies. As businesses move toward multi-cloud and hybrid models, opportunities increase for interconnect providers to offer secure, scalable, and automated interconnection platforms that effectively incorporate different cloud ecosystems. Additionally, developing regions like Latin America and the Asia Pacific are experiencing speedy digital infrastructure growth. Investments in new data centers create significant opportunities for interconnect solution vendors to increase their presence.

Interconnect Data Center Solution Market Dynamics

Growth Drivers

How is the interconnect data center solution market driven by the rising need for edge computing and low-latency data exchange?

The rise in edge computing solutions, comprising autonomous vehicles, real-time analytics, and smart cities, is fueling the demand for distributed interconnect data center solutions, impacting the interconnect data center solution market. Edge facilities need tight integration with central data centers to promise low-latency data exchange, usually under 10 milliseconds. Organizations like Schneider Electric and IBM are introducing integrated interconnect architectures to link edge and core sites effectively. In addition, telecom giants like AT&T and Verizon are actively investing in micro-interconnect hubs to reinforce edge connectivity for IoT and 5G ecosystems.

How is the growing emphasis on sustainability and energy efficiency propelling the interconnect data center solution market?

Sustainability initiatives are becoming paramount to the deployment and design of interconnect data center solutions. With data centers accounting for nearly 3% of worldwide electricity consumption, businesses are prioritizing green interconnect solutions and renewable-powered operations. Digital Reality introduced its 'Sustainable Interconnection' program, emphasizing carbon-free data exchanges. Governments in regions like North America and the EU are enforcing stringent sustainability compliance, compelling businesses to adopt energy-efficient interconnect infrastructure that supports ESG standards.

Restraints

Data security and cybersecurity concerns negatively impact the market progress

Security risks linked to data transmission over interconnect networks are still a vital barrier. Interconnected data centers are vulnerable to cyberattacks, including data breaches, DDoS attacks, and ransomware. Businesses should invest in advanced encryption, compliance measures, and intrusion detection, raising total costs and complexity. In 2025, Equinix reported a growth in demand for secure interconnect solutions due to multiple high-profile data breaches in Europe and North America, underscoring the challenge of ensuring secure interconnectivity.

Opportunities

How is the adoption of AI and data-intensive workloads creating advantageous conditions for the development of the interconnect data center solution market?

The rise in machine learning, big data analytics, and AI is creating the demand for high-bandwidth and low-latency interconnects. According to IDC 2025 reports, worldwide AI infrastructure expenditure reached $120 billion, indicating strong market potential. Interconnect solutions are vital for connecting GPU clusters, data centers, and high-performing servers effectively. Providers like Dell Technologies and NVIDIA are actively associating with data center operators to deploy AI-enhanced interconnect architectures. This trend promises rising revenue streams for interconnect service providers as businesses scale AI initiatives in the worldwide interconnect data center solution industry.

Challenges

The high cost of deployment and maintenance restricts the market growth

Capital-intensive infrastructure and current operational costs are key barriers. Deploying high-speed fiber-optic networks, cross-connects, and switches usually costs tens of millions per facility. According to 2024 reports, hyperscale interconnect deployments could grow by USD 50 million, potentially limiting adoption by smaller businesses. Energy consumption, cooling, and maintenance further add to costs. In 2025, several mid-sized European companies delayed interconnect projects because of budgetary limitations, highlighting this challenge.

Interconnect Data Center Solution Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Interconnect Data Center Solution Market |

| Market Size in 2024 | USD 10.23 Billion |

| Market Forecast in 2034 | USD 24.79 Billion |

| Growth Rate | CAGR of 11.70% |

| Number of Pages | 213 |

| Key Companies Covered | Cisco Systems Inc., Juniper Networks Inc., Arista Networks Inc., Huawei Technologies Co. Ltd., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., IBM Corporation, Equinix Inc., Broadcom Inc., Extreme Networks Inc., Fujitsu Limited, Nokia Corporation, VMware Inc., Schneider Electric SE, Vertiv Group Corp., and others. |

| Segments Covered | By Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Interconnect Data Center Solution Market: Segmentation

The global interconnect data center solution market is segmented based on type, end-use, and region.

Based on type, the global interconnect data center solution industry is divided into hardware, software, and services. The hardware segment registered a significant share of the market, fueled by strong demand for switches, routers, and optical transmission equipment that assures reliable and fast connectivity. Growing data traffic, hyperscale, and the adoption of data centers and clouds are augmenting investments in advanced networking infrastructure. Hardware continues to be crucial for low-latency, high-speed data transfer, making it the backbone of interconnect solutions. Its prominence continues as businesses prioritize upgrading network capacity and total efficiency.

On the other hand, the software segment holds a second rank, fueled by the adoption of software-defined networking and automation tools. These solutions enhance network management, scalability, and traffic optimization in data centers. Rising demand for centralized control and flexibility supports the segment's sturdy growth.

Based on end-use, the global interconnect data center solution market is segmented into Communications Service Providers (CSPs), Internet Content Providers, and Carrier-Neutral Providers (ICPs/CNPs), Government/Research and Education (Government/R&E), and others. The Communications Service Providers (CSPs) segment holds a dominating position, fueled by the growing demand for expanding 5G networks and high-speed connectivity. CSPs use interconnect solutions to manage immense data traffic, real-time applications, and cloud services. With networks advancing for edge computing and IoT, investment in advanced interconnect systems has elevated, fueling the segmental prominence.

Conversely, the Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs) segment held a second-leading share, impacted by the need for cloud connectivity and fast content delivery. Social media, streaming, and e-commerce growth are driving the demand for high-capacity interconnect solutions. Investments in peering networks and hyperscale data centers further bolster the segment’s ranking.

Interconnect Data Center Solution Market: Regional Analysis

What enables North America's strong foothold in the global Interconnect Data Center Solution Market?

North America is projected to maintain its dominant position in the global interconnect data center solution market due to high cloud adoption, digital transformation, the presence of hyperscale data centers, and rising demand for hybrid and multi-cloud IT. North America holds the leading cloud adoption rates worldwide, with more than 70% of businesses leveraging multiple cloud platforms as of 2024. This propels the demand for interconnect solutions to link private, on-premise, and public cloud environments effectively. Businesses depend on these solutions to promise continuous data transfer, high availability, and low latency in distributed IT infrastructures.

The region houses the prominent hyperscale data center operators like Microsoft Azure, Google Cloud, and Amazon Web Services, which jointly operate thousands of data centers in the United States. These large-scale facilities need strong interconnect solutions to manage enormous data traffic and maintain worldwide network performance. The broader deployment of hyperscale centers offers the region a significant industry benefit.

North American businesses are progressively adopting hybrid IT and multi-cloud strategies, with approximately 60% of prominent companies operating in multiple cloud platforms in 2024. This trend fuels the need for high-performance interconnect solutions to promise smooth data flow and application performance. The emphasis on IT modernization and digital transformation supports North America's industry dominance.

Europe maintains its position as the second-leading region in the global interconnect data center solution industry due to the rapid adoption of cloud technology in businesses, the growth of hyperscale data centers, and advanced networking infrastructure. Europe has experienced significant growth in cloud adoption, with more than 65% of companies using cloud services in 2024. This creates robust demand for interconnect solutions to effectively connect on-premise infrastructure with private and public clouds. The need for low-latency, secure, and continuous data transfer fuels investments in advanced interconnect solutions.

Moreover, economies like the UK, the Netherlands, and Germany have become hubs for carrier-neutral and hyperscale data centers. Prominent providers like Interxion, Equinix, and Digital Reality have increased their footprint in the region, needing strong interconnect solutions. The growth in cross-border content delivery and data traffic services further backs the regional second-leading rank.

Additionally, Europe holds a well-developed high-speed optical network infrastructure connecting major data centers and cities. According to the reports, nearly 85% of large data centers in the region are connected through fiber networks, allowing reliable and fast inter-datacenter communication. This infrastructure backs large-scale cloud operations and multi-data center interconnectivity.

Interconnect Data Center Solution Market: Competitive Analysis

The leading players in the global interconnect data center solution market are:

- Cisco Systems Inc.

- Juniper Networks Inc.

- Arista Networks Inc.

- Huawei Technologies Co. Ltd.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- IBM Corporation

- Equinix Inc.

- Broadcom Inc.

- Extreme Networks Inc.

- Fujitsu Limited

- Nokia Corporation

- VMware Inc.

- Schneider Electric SE

- Vertiv Group Corp.

Interconnect Data Center Solution Market: Key Market Trends

Growth of Edge and Micro Data Centers:

The growth of edge computing is fueling the deployment of regional and micro data centers to process data close to end consumers. Interconnect solutions are transforming to support high-speed and low-latency connectivity between core data centers and edge nodes.

Multi-Cloud and Hybrid Cloud Integration:

Businesses are adopting multi-cloud and hybrid IT strategies, creating the need for unbroken interconnectivity in different cloud platforms. Interconnect solutions now emphasize allowing reliable, secure, and high-performing data transfer between on-premise and cloud environments.

The global interconnect data center solution market is segmented as follows:

By Type

- Hardware

- Software

- Services

By End Use

- Communications Service Providers (CSPs)

- Internet Content Providers and Carrier-Neutral Providers (ICPs/CNPs)

- Government/Research and Education (Government/R&E)

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The interconnect data center solution refers to a package of solutions and frameworks that enable uninterrupted connectivity, data exchange, and communication between multiple data centers. These solutions improve performance, redundancy, and scalability by linking cloud, on-premise, and edge infrastructures. They play a key role in enhancing network traffic, supporting digital transformation initiatives, and reducing latency.

Which key factors will influence the interconnect data center solution market growth over 2025-2034?

The global interconnect data center solution market is projected to grow due to the surging adoption of cloud computing and hybrid IT environments, the growth of hyperscale data centers worldwide, and the growing need for efficient power and cooling infrastructure.

According to study, the global interconnect data center solution market size was worth around USD 10.23 billion in 2024 and is predicted to grow to around USD 24.79 billion by 2034.

The CAGR value of the interconnect data center solution market is expected to be around 11.70% during 2025-2034.

Pricing trends in the interconnect data center solution market are showing a moderate decline due to the commoditization of hardware, increased competition, and the growth of cloud-based subscription models.

North America is expected to lead the global interconnect data center solution market during the forecast period.

The key players profiled in the global interconnect data center solution market include Cisco Systems Inc., Juniper Networks Inc., Arista Networks Inc., Huawei Technologies Co. Ltd., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., IBM Corporation, Equinix Inc., Broadcom Inc., Extreme Networks Inc., Fujitsu Limited, Nokia Corporation, VMware Inc., Schneider Electric SE, and Vertiv Group Corp.

The competitive landscape in the interconnect data center solution market is highly fragmented, with a mix of global hyperscale providers, regional service players, competing on technology, scalability, and service quality, and specialized hardware vendors.

Leading players in the interconnect data center solution market are adopting strategic initiatives such as partnerships with cloud and telecom providers, mergers and acquisitions, investment in advanced technologies to strengthen their market presence, and geographic expansion.

The report examines key aspects of the interconnect data center solution market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed