Digital Transformation Market Size, Share, Trends Analysis 2032

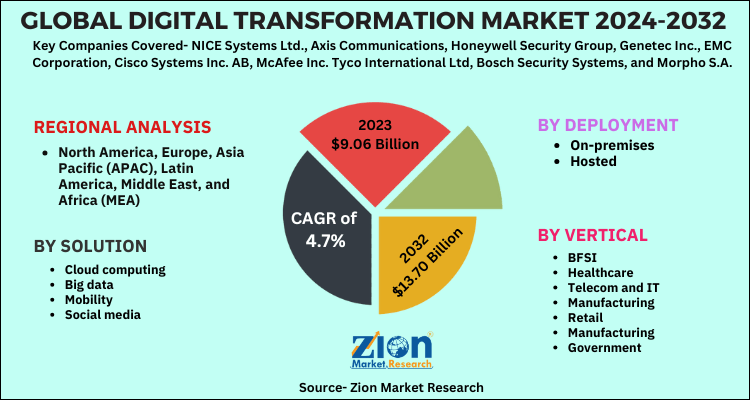

Digital Transformation Market By Solution Analysis (Cloud Computing, Big Data, Mobility, and Social Media), By Deployment (On-premises and Hosted), By Vertical (BFSI, Healthcare, Telecom and IT, Manufacturing, Retail, Manufacturing, and Government), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

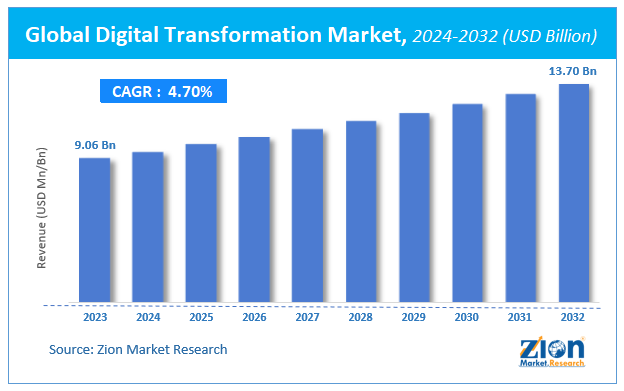

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.06 Billion | USD 13.70 Billion | 4.7% | 2023 |

Digital Transformation Market Insights

According to a report from Zion Market Research, the global Digital Transformation Market was valued at USD 9.06 Billion in 2023 and is projected to hit USD 13.70 Billion by 2032, with a compound annual growth rate (CAGR) of 4.7% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Digital Transformation Market industry over the next decade.

Digital transformation is the profound and accelerating transformation of business activities, processes, competencies and models to fully leverage the changes and opportunities of digital technologies and their impact across society in a strategic and prioritized way. It includes the use of digital technologies such as mobility, social media, and more. These technologies are used by enterprises to improve or add more features to their traditional business processes and also to deepen customer relationships.

Digital Transformation Market: Overview

Companies like Google, Apple, and SAP AG are investing shares in R&D to increase the organic development of their organization, thereby boosting the worldwide digital transformation market. Hence, the battle for creating strong brands and attaining brand positioning has become a core factor to power the digital transformation market growth. These prominent players offer digital transformation solutions and develop new items or enhance their service offerings & products to satisfy the rising user need, positively affecting the digital transformation market. This strategy permits these firms to draw in new users, validate the technology, and hold traditional users.

New product launches by these players also boost the profit margin for the digital transformation market. For instance, Microsoft unrolled Azure location-supported services. This was a replacement Azure cloud service to support the “location of things.” This service empowered Healthcare transformation from manufacturing to retail & Manufacturing because it included geographical info that will better link IoT solutions, smart cities, and infrastructure.

In the retail sector, increasing mobile application and Internet usage are elevating the need for a digital transformation market. Technological improvements in digital electronics paired with their rising application in several sectors like Manufacturing & construction will likely elevate the digital transformation market growth within the years to come. Increasing the marketplace for AR devices like eyeglasses, heads-up displays, and spatial AR will probably spice up the digital transformation market.

COVID-19 Impact Analysis:

The COVID-19 crisis has caused years of change within the way companies altogether sectors and regions do business. Companies have accelerated the digitization of their customer and supply-chain interactions and their internal operations by three to four years and therefore the share of digital or digitally enabled products in their portfolios has accelerated by a shocking seven years. Nearly all companies have set up a minimum of temporary solutions to satisfy many of the new demands on them, and far more quickly than they had thought possible before the crisis.

During the pandemic, Telecom & ITs have moved dramatically toward online channels, and corporations and industries have responded successively. The studies confirm the rapid shift toward interacting with customers through digital channels. They also show that rates of adoption are years before where they were when previous studies were conducted and even more in developed Asia than in other regions.

Digital Transformation Market: Growth Factors

The use of advanced technologies, like cloud, big data, IoT, and analytics, mobility, and social media, has led to transformation & innovation, thereby stimulating growth within the business ecosystem. Digital technologies have altered the legacy approach to business into a contemporary approach. Noticeably, organizations demand a moment, precise, and real-time response from the analysis of massive data to make new products and services, enhance existing ones, and formulate entirely new business models to realize a competitive edge.

Enterprises have started incorporating big data and business intelligence to get real-time information, understand customer requirements, gain actionable insights, and facilitate growth in their overall productivity. Since the adoption of recent technology offers endless opportunities, customers often rate enterprises primarily in terms of digital customer experience. The bulk of companies are adopting digital transformation practices, which majorly specialize in digital interactions with their customers. This factor has led to a rise in demand for digital transformation solutions across various industry verticals.

Digital Transformation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Transformation Market |

| Market Size in 2023 | USD 9.06 Billion |

| Market Forecast in 2032 | USD 13.70 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 210 |

| Key Companies Covered | NICE Systems Ltd., Axis Communications, Honeywell Security Group, Genetec Inc., EMC Corporation, Cisco Systems Inc. AB, McAfee Inc. Tyco International Ltd, Bosch Security Systems, and Morpho S.A., |

| Segments Covered | By Solution, By Deployment, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 - 2023 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Transformation Market: Segmentation Analysis

Segment Analysis by Solution

In terms of solutions, the market is sub-segmented into analytics, cloud computing, mobility, social media, etc. The expansion of the segment is often attributed to the rapidly developing technological landscape that needs businesses to timely upgrade their systems to take care of a viable edge.

In 2023, analytics captured the most significant share due to the increased demand for deriving actionable insights from large volumes of business data generated by organizations. Extensive usage of smart devices & applications in processes resulted in an exponential rise in data generated across several industries and sectors.

Segment Analysis by Deployment

The on-premises segment dominated the market in 2023 accounting for a revenue share of quite 64%. Numerous businesses select premise solutions due to the suitability of customizability offered during their implementation. On-premise solutions offer high-end data security and facilitate easy compliance with various government regulations. The on-premise deployment also offers large organizations better control over confidential data.

However, the hosted segment is predicted to steer the worldwide market registering the fastest CAGR from 2024 to 2032. This will be attributed to the vast advancements in information sharing technologies and therefore the increasing use of mobile devices. Hosted deployment offers increased flexibility, and greater cost-effectiveness, and enables large-scale customization of products and services.

Segment Analysis by Vertical

The BFSI segment accounted for the very best revenue share of over 34% in 2023 and can remain dominant throughout the forecast period. However, the healthcare segment is projected to witness the fastest CAGR from 2024 to 2032. The increasing demand for electronic data across operation channels and patient outreach is probably going to accelerate the acceptance of digital transformation within the healthcare segment. The increasing volume of patient data has led to the event of scalable business models to facilitate efficient patient handling.

These models are expected to facilitate new business strategies and help mitigate risks related to the value of implementing an equivalent. This is often estimated to function as a promising protein for the healthcare segment. Furthermore, digital transformation across the healthcare segment enables better decision-making and enhances the patient experience.

Digital Transformation Market: Regional Analysis

North America has dominated the retail digital transformation market thus far. Factors like growing online payment options and high Internet penetration have had an interesting role in increasing the demand of the digital transformation market within the region for retail digital information. Rising demand from small-sized firms and surging service sectors everywhere in the Asia Pacific are likely to power the charts of the digital transformation market.

Request Free SampleDigital Transformation Market: Competitive Analysis

Request Free SampleDigital Transformation Market: Competitive Analysis

Some of the major players in the global Digital Transformation market include:

- NICE Systems Ltd.

- Axis Communications

- Honeywell Security Group

- Genetec Inc.

- EMC Corporation

- Cisco Systems Inc. AB

- McAfee Inc. Tyco International Ltd

- Bosch Security Systems

- Morpho S.A.

The global Digital Transformation market is segmented as follows:

By Solution Segment Analysis

- Cloud computing

- Big data

- Mobility

- Social media

By Deployment Segment Analysis

- On-premises

- Hosted

By Vertical Segment Analysis

- BFSI

- Healthcare

- Telecom and IT

- Manufacturing

- Retail

- Manufacturing

- Government

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the Global Digital Transformation market size was worth around USD 9.06 billion in 2023 and is expected to reach USD 13.70 billion by 2032.

The Global Digital Transformation market is expected to grow at a CAGR of 4.7% during the forecast period.

Some of the key factors driving the Global Digital Transformation market growth are the indispensable requirement of companies to transform their traditional business operations into digital, and the rapid adoption of mobile devices, IoT solutions, and cloud technology, has led to the increased adoption of digital transformation solutions worldwide.

Asia Pacific is expected to dominate the Digital Transformation market over the forecast period.

Some of the key players in the Digital Transformation market are NICE Systems Ltd., Axis Communications, Honeywell Security Group, Genetec Inc., EMC Corporation, Cisco Systems Inc. AB, McAfee Inc. Tyco International Ltd, Bosch Security Systems, and Morpho S.A.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed