Rotary Screw Compressor Market Size, Share, Trends, Growth 2034

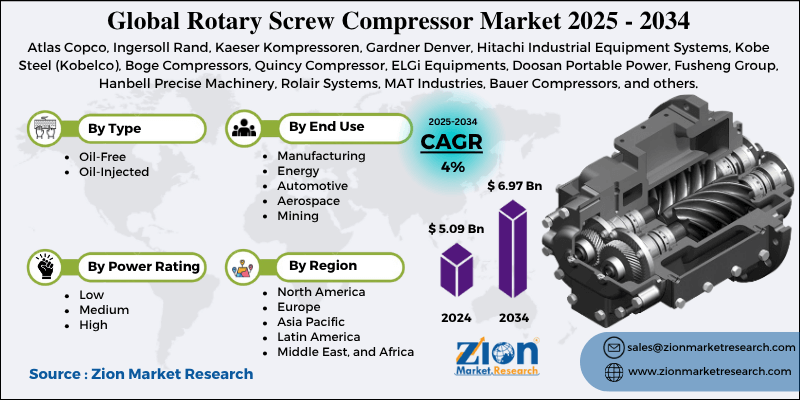

Rotary Screw Compressor Market By Type (Oil-Free, Oil-Injected), By Power Rating (Low, Medium, High), By End Use (Manufacturing, Energy, Automotive, Aerospace, Mining), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

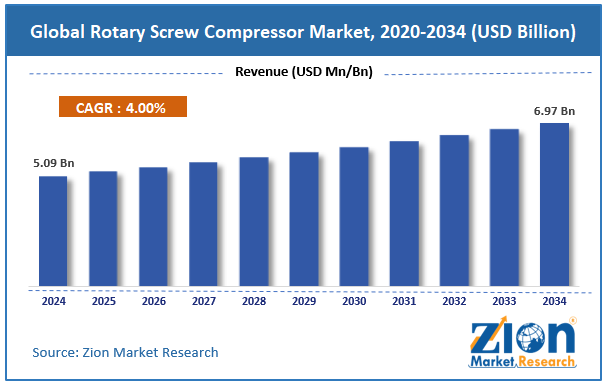

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.09 Billion | USD 6.97 Billion | 4.0% | 2024 |

Rotary Screw Compressor Industry Perspective:

The global rotary screw compressor market size was approximately USD 5.09 billion in 2024 and is projected to reach around USD 6.97 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4% between 2025 and 2034.

Rotary Screw Compressor Market: Overview

A rotary screw compressor refers to the industrial air compressor that utilizes two interlocking helical screws to continuously and efficiently compress air. These compressors are widely used in the automotive, manufacturing, construction, oil, and gas industries, being prominent for their low maintenance and reliability. The global rotary screw compressor market is projected to experience substantial growth, driven by the increasing focus on industrial automation, energy efficiency, and rising demand in the food and beverage industry. Industrial automation is growing remarkably, particularly in developing nations such as China and India. Rotary screw compressors are essential for automated systems in manufacturing due to their efficiency and reliability. Their use in continuous production lines propels persistent demand.

Moreover, corporations and governments are increasingly inclined towards energy-efficient solutions to meet the global sustainability goals. These compressors are highly efficient compared to piston compressors, resulting in a 35% decrease in energy bills. This increases their appeal for investment in energy-intensive sectors.

Additionally, food-grade rotary screw compressors are highly preferred to meet safety and hygiene standards in food processing plants. With global food production anticipated to surge by 70% by 2050, these compressors are becoming more significant. Their oil-free variants prevent contamination, promising compliance.

Although drivers exist, the global market is challenged by factors such as technical complexity and varying raw material prices. These compressors need skilled personnel for maintenance, installation, and troubleshooting. The lack of technical expertise in specific areas may hinder adoption. Poor handling may decrease efficacy or give mechanical failure.

Additionally, the prices of metals such as aluminum, steel, and copper used in compressor manufacturing have been unstable. This impacts the production costs and narrows profit margins for manufacturers. Instability also disturbs long-term planning for suppliers and OEMs.

Even so, the global rotary screw compressor industry is well-positioned due to the adoption of IoT-based compressors and retrofitting modernization projects. Smart compressors with IoT integration are gaining prominence because of predictive maintenance, remote monitoring, and energy optimization. Players like Ingersoll Rand and Atlas Copco are heavily investing in connected technologies. This enhances operational efficiency and generates opportunities for upselling.

Furthermore, aging manufacturing facilities in Europe and North America are experiencing retrofits with energy-efficient machines. Replacing outdated air systems with rotary screw compressors presents a significant market opportunity. Energy rebates also motivate these advancements.

Key Insights:

- As per the analysis shared by our research analyst, the global rotary screw compressor market is estimated to grow annually at a CAGR of around 4% over the forecast period (2025-2034)

- In terms of revenue, the global rotary screw compressor market size was valued at around USD 5.09 billion in 2024 and is projected to reach USD 6.97 billion by 2034.

- The rotary screw compressor market is projected to grow significantly due to the growth in industrial manufacturing activities, the surging adoption in the food and beverage sector, and government regulations for energy conservation.

- Based on type, the oil-injected segment is expected to lead the market, while the oil-free segment is expected to grow considerably.

- Based on power rating, the medium is the dominant segment, while the low segment is projected to witness sizable revenue growth over the forecast period.

- Based on end use, the manufacturing segment is expected to lead the market compared to the energy segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Rotary Screw Compressor Market: Growth Drivers

How does elevated demand from the healthcare and food & beverage industries fuel the rotary screw compressor market?

The pharmaceutical, food, and beverage industries require clean, compressed, and oil-free air to maintain regulatory compliance and hygiene standards. Rotary screw compressors, especially oil-free variants, are broadly used in bottling, food packaging, and cleanroom pharmaceutical applications.

Nestlé announced a global initiative to reduce contamination risks in its production lines by investing in more than 1,000 oil-free compressors at plants in Asia and Europe in February 2025. This demand notably fuels the rotary screw compressor market.

Growth of green manufacturing and renewable energy notably propels the market growth

The shift to renewable energy and green manufacturing requires low-maintenance and reliable compressed air solutions for applications such as solar panel manufacturing, electric vehicle production, and wind turbine assembly. Rotary screw compressors help these industries by offering energy-efficient and consistent performance in automated production surroundings.

For instance, Tesla's report (2024) stated that its Gigafactory operations disclosed a 30 percent increase in the use of VSD screw compressors in its EV powertrain assembly lines and lithium battery production.

Rotary Screw Compressor Market: Restraints

How does easy accessibility of alternative technologies hinder the global rotary screw compressor market?

The industry is experiencing rising competition from the development of air compression solutions, such as centrifugal compressors, hybrid pneumatic-electric systems, and scroll compressors, which offer benefits in specific applications, including ultra-clean operation, compact size, and low noise. These alternatives are gaining attention in niche sectors, such as electronics, medical devices, and laboratory automation.

Hitachi introduced a new series of compact scroll compressors designed for cleanroom and laboratory applications in the APAC region, directly challenging smaller oil-free rotary screw units. These trends decrease the total addressable market for traditional screw compressors in specific verticals.

Rotary Screw Compressor Market: Opportunities

Emergence of hydrogen and electric vehicle manufacturing as new application areas positively impacts market growth

The global shift towards electric mobility and clean energy is presenting new opportunities for rotary screw compressors in the production of fuel cells, hydrogen, and electric vehicles. This drives the global rotary screw compressor industry. Compressors play a vital role in robotic tooling, battery pack assembly, hydrogen storage systems, and the testing of electric vehicle components.

HyGear, a hydrogen solutions firm, announced collaborations with Sullair and Boge Compressors in May 2024 to supply rotary screw compressors for upcoming hydrogen refueling stations in Japan and Europe. This presents a promising prospect in the green industrial transformation.

Rotary Screw Compressor Market: Challenges

How does rapid product lifecycle and technological obsolescence restrict the worldwide rotary screw compressor market progress?

As the market rapidly adopts energy-efficient, AI-integrated, and smart compressors, older compressor models are becoming increasingly obsolete. This presents a dual hindrance: existing consumers must upgrade their regulatory standards and performance, while producers face short product life cycles, which in turn fuels their research and development, as well as inventory management costs.

Ingersoll Rand announced the discontinuation of two models from the 2015 series in 2024 due to compliance issues and inefficiency, which will impact thousands of units in medium-sized factories. Repeated phase-outs also offer compatibility problems with spare accessories and parts, adding complexity to long-term asset management for purchasers.

Rotary Screw Compressor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rotary Screw Compressor Market |

| Market Size in 2024 | USD 5.09 Billion |

| Market Forecast in 2034 | USD 6.97 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 211 |

| Key Companies Covered | Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, Gardner Denver, Hitachi Industrial Equipment Systems, Kobe Steel (Kobelco), Boge Compressors, Quincy Compressor, ELGi Equipments, Doosan Portable Power, Fusheng Group, Hanbell Precise Machinery, Rolair Systems, MAT Industries, Bauer Compressors, and others. |

| Segments Covered | By Type, By Power Rating, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rotary Screw Compressor Market: Segmentation

The global rotary screw compressor market is segmented by type, power rating, end use, and region.

Based on type, the global rotary screw compressor industry is divided into oil-free and oil-injected. The oil-injected compressors segment holds a larger market share due to their greater durability, higher efficiency, and cost-effectiveness in industrial applications. They are broadly used in construction, mining, oil & gas, and manufacturing. Their ability to manage large volumes of compressed air at comparatively low cost increases their preference in sectors.

Based on power rating, the global rotary screw compressor market is segmented as low, medium, and high. The medium segment held a substantial market share and is widely used in various industries, including automotive, general manufacturing, and food processing. They offer an ideal balance of energy and power efficiency, making them suitable for both variable-load and continuous operations. Their widespread application and versatility have increased their preference globally.

Based on end-use, the global market is segmented into manufacturing, energy, automotive, aerospace, and mining. The manufacturing segment captures a leading share of the market due to the continuous demand for compressed air in applications such as metal fabrication, material handling, and assembly lines. Rotary screw compressors are highly preferred for efficient and reliable performance in cyclic operations. With the rising global industrial output, the segment registers leading industry share.

Rotary Screw Compressor Market: Regional Analysis

What factors are contributing to Asia Pacific's dominance in the global rotary screw compressor market?

Asia Pacific is likely to sustain its leadership in the rotary screw compressor market due to strong industrial base, expanding energy and oil & gas sector, and supportive government policies. The Asia Pacific, particularly India, Japan, South Korea, and China, has a larger manufacturing base that relies heavily on rotary screw compressors. China alone contributed more than 28.7% of the worldwide manufacturing output in 2023, according to the World Bank. This industrial scale propels large-volume and consistent demand for compressed air systems.

Moreover, nations like India and China are heavily investing in energy production and oil & gas infrastructure, where rotary screw compressors are vital. For example, India’s oil and gas industry received USD 25 billion in investment approvals in 2023, according to IBEF. Rotary compressors are utilized in pipeline operations, refining, and energy plants in the region.

Likewise, governments in the APAC region are encouraging industrial automation and manufacturing through incentives and subsidies. 'Made in China' by China and 'Make in India' by India are the leading examples. These policies have propelled the installation of new industrial machinery, comprising rotary screw compressors.

Europe continues to hold the second-highest share in the rotary screw compressor industry, driven by a growing focus on sustainability and energy efficiency, broader adoption across diverse sectors, and steady demand from the automotive and aerospace industries. The EU's goal for energy-efficient machines under regulations is motivating companies to use rotary screw compressors with VSD (Variable-Speed Drives). In 2024, more than 60% of compressors sold in the region were energy-efficient models, according to Eurostat. This strict regulatory framework boosts the compressor replacement and upgrade industry.

Furthermore, the region has rigorous safety and air quality regulations for vital sectors such as food processing and pharmaceuticals, which favor the use of oil-free compressors. The EU food and beverage industry was estimated to be worth Euro 1.1 trillion in 2023, requiring contamination-free air in the processing environment. This fuels the escalating demand for reliable and clean compressor systems.

Similarly, Europe holds a dominant automotive and aerospace sector, mainly in France, Germany, and the United Kingdom. These industries rely heavily on rotary screw compressors for precision tasks and a consistent air supply. Europe produced more than 10 million motor vehicles in 2023, promising continuous compressor use in testing and production facilities.

Rotary Screw Compressor Market: Competitive Analysis

The key operating players in the global rotary screw compressor market are:

- Atlas Copco

- Ingersoll Rand

- Kaeser Kompressoren

- Gardner Denver

- Hitachi Industrial Equipment Systems

- Kobe Steel (Kobelco)

- Boge Compressors

- Quincy Compressor

- ELGi Equipments

- Doosan Portable Power

- Fusheng Group

- Hanbell Precise Machinery

- Rolair Systems

- MAT Industries

- Bauer Compressors

Rotary Screw Compressor Market: Key Market Trends

Escalating demand for oil-free compressors:

With stringent environmental regulations and increasing applications in food processing, pharmaceuticals, and cleanrooms, the demand for oil-free rotary screw compressors is on the rise. These models offer low environmental risks and contamination-free air. The segment is witnessing faster CAGR as compared to oil-injected compressors worldwide.

Move to variable-speed and energy-efficient models:

Industries are prioritizing energy-saving compressors with VSDs, or variable-speed drives, to achieve lower operational costs and comply with sustainability objectives. These compressors adjust motor speed in response to air demand, resulting in nearly a 35% decrease in energy use. Increasing electricity costs are driving the prominence of this trend.

The global rotary screw compressor market is segmented as follows:

By Type

- Oil-Free

- Oil-Injected

By Power Rating

- Low

- Medium

- High

By End Use

- Manufacturing

- Energy

- Automotive

- Aerospace

- Mining

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A rotary screw compressor refers to the industrial air compressor that utilizes two interlocking helical screws to continuously and efficiently compress air. These compressors are widely used in the automotive, manufacturing, construction, oil, and gas industries, being prominent for their low maintenance and reliability.

The global rotary screw compressor market is projected to grow due to the expansion of oil and gas exploration projects, increased automation in industries, and growing demand in refrigeration and HVAC systems.

According to study, the global rotary screw compressor market size was worth around USD 5.09 billion in 2024 and is predicted to grow to around USD 6.97 billion by 2034.

The CAGR value of the rotary screw compressor market is expected to be approximately 4% from 2025 to 2034.

Asia Pacific is expected to lead the global rotary screw compressor market during the forecast period.

The key players profiled in the global rotary screw compressor market include Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, Gardner Denver, Hitachi Industrial Equipment Systems, Kobe Steel (Kobelco), Boge Compressors, Quincy Compressor, ELGi Equipments, Doosan Portable Power, Fusheng Group, Hanbell Precise Machinery, Rolair Systems, MAT Industries, and Bauer Compressors.

The report examines key aspects of the rotary screw compressor market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed