Polyethylene Market Size, Share, Growth Analysis, 2032

Polyethylene Market by Types (High Density Polyethylene, Low Density Polyethylene and Others) by Applications (Wires, Plumbing, Automotives, and Others) by Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa)- Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

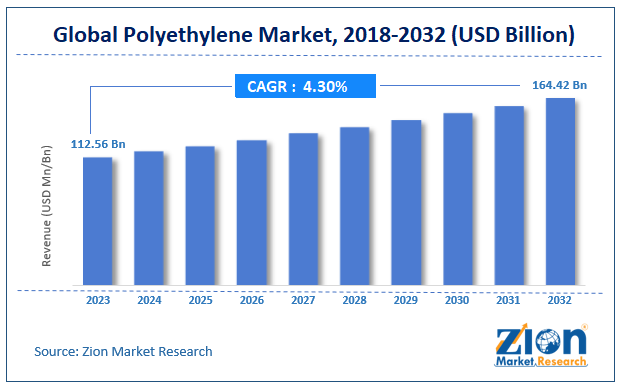

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 112.56 Billion | USD 164.42 Billion | 4.30% | 2023 |

Polyethylene Market: Industry Perspective

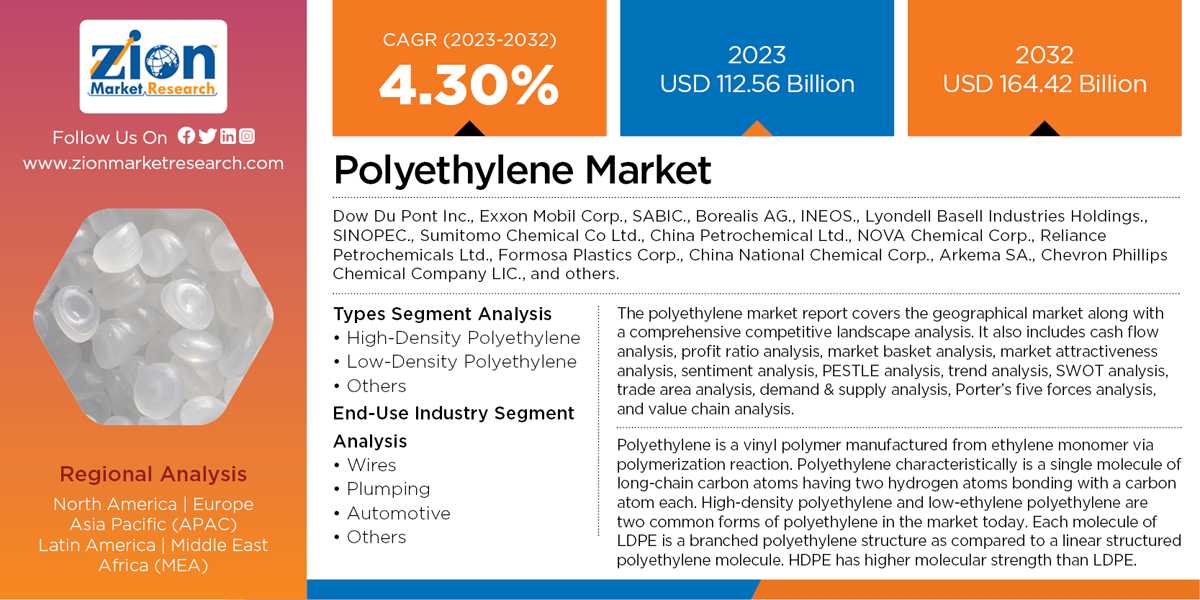

The global polyethylene market size was worth around USD 112.56 billion in 2023 and is predicted to grow to around USD 164.42 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.30% between 2024 and 2032.

Polyethylene Market: Overview

Polyethylene also known as a thermoplastic polymer (polyolefins), has a variable crystalline structure with a wide range of applications. Polyethylene is a vinyl polymer manufactured from ethylene monomer via polymerization reaction. Polyethylene characteristically is a single molecule of long-chain carbon atoms having two hydrogen atoms bonding with a carbon atom each. High-density polyethylene and low-ethylene polyethylene are two common forms of polyethylene in the market today. Each molecule of LDPE is a branched polyethylene structure as compared to a linear structured polyethylene molecule. HDPE has higher molecular strength than LDPE.

Because of its recyclability, easy processing, and low cost, polyethylene is the most common plastics in the world. Applications of polyethylene range from food wraps, bags, bottles, and containers. Polyethylene can be modified into synthetic fibers giving it an elastic property to that of a rubber.

Rising investments in the infrastructure sector, low cost for feedstock, diversifying consumer goods market, increasing investment in the infrastructure domain, the positive economic outlook of developing economies, and low manufacturing (processing) costs are some of the factors driving the global polyethylene market for the forecast period. Global investments in the infrastructure sector are anticipated to reach $ 94 billion by 2040 according to World Bank estimates. Of the total investment, sanitation, electricity, and sustainable living houses will attract the bulk of the infrastructure investment. Rising demand for plastic recycling centers, stringent government regulations toward petrochemical products, fluctuating fossil fuel prices, and demand for green plastics will restrain the polyethylene market growth for the forecasted period 2024 - 2032.

Polyethylene Market: Segmentation

The entire market for polyethylene is segmented in terms of types and applications.

By types, polyethylene market is bifurcated into high-density polyethylene (HDPE), low-density polyethylene (LDPE) and others. HDPE holds the largest market share within global polyethylene market owing to its cheaper manufacturing cost, sturdy properties, and high demand. HDPE is used in wide range of applications like production of bottles and gift containers.

In terms of application, the global polyethylene market is classified as automotive, plumbing, wires, and others.

Polyethylene Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyethylene Market |

| Market Size in 2023 | USD 112.56 Billion |

| Market Forecast in 2032 | USD 164.42 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 220 |

| Key Companies Covered | Dow Du Pont Inc., Exxon Mobil Corp., SABIC., Borealis AG., INEOS., Lyondell Basell Industries Holdings., SINOPEC., Sumitomo Chemical Co Ltd., China Petrochemical Ltd., NOVA Chemical Corp., Reliance Petrochemicals Ltd., Formosa Plastics Corp., China National Chemical Corp., Arkema SA., Chevron Phillips Chemical Company LIC., and others. |

| Segments Covered | By Type, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyethylene Market: Regional Analysis

Regionally, Asia Pacific is the largest market for polyethylene both in terms of volume and revenue. The polyethylene market in the Asia Pacific is propelled by growing middle-class consumers and thriving industries. Production of Poly Vinyl Chloride (PVC) a basic form of polyethylene within Asia Pacific countries is estimated to reach approximately 70 million metric tons by 2032 increasing from 55 million metric tons in 2023 according to the Vinyl Council of Australia. Developing economies like India and China, and transitional economies like Vietnam, Indonesia, and Thailand are amongst the key markets for polyethylene in the Asia Pacific for the forecast period. North America and Europe are key markets for polyethylene in terms of revenue generation. The market of both above regions is anticipated to grow steadily within the forecasted period 2024-2032. The total revenue anticipated for polyethylene in North America is likely to reach approximately $ 48 billion in 2023. Construction and consumer electronics are key sectors driving growth for the polyethylene market in North America and Europe.

Polyethylene Market: Competitive Analysis

The global polyethylene market is dominated by players like:

- Dow Du Pont Inc.

- Exxon Mobil Corp

- SABIC

- Borealis AG

- INEOS

- Lyondell Basell Industries Holdings

- SINOPEC

- Sumitomo Chemical Co Ltd.

- China Petrochemical Ltd.

- NOVA Chemical Corp

- Reliance Petrochemicals Ltd.

- Formosa Plastics Corp

- China National Chemical Corp

- Arkema SA

- Chevron Phillips Chemical Company LIC

The report segments the global Polyethylene Market as follows:

Polyethylene Market: Types Segment Analysis

- High-Density Polyethylene

- Low-Density Polyethylene

- Others

Polyethylene Market: End-Use Industry Segment Analysis

- Wires

- Plumping

- Automotive

- Others

Polyethylene Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyethylene, sometimes known as polythene, is the plastic that is manufactured the most frequently. It is a polymer that is mostly utilized for packaging purposes.

According to a study, the global polyethylene market size was worth around USD 112.56 billion in 2023 and is expected to reach USD 164.42 billion by 2032.

The global polyethylene market is expected to grow at a CAGR of 4.30% during the forecast period.

North America is expected to dominate the polyethylene market over the forecast period.

Leading players in the global polyethylene market include Dow Du Pont Inc., Exxon Mobil Corp., SABIC., Borealis AG., INEOS., Lyondell Basell Industries Holdings., SINOPEC., Sumitomo Chemical Co Ltd., China Petrochemical Ltd., NOVA Chemical Corp., Reliance Petrochemicals Ltd., Formosa Plastics Corp., China National Chemical Corp., Arkema SA., Chevron Phillips Chemical Company LIC., among others.

The polyethylene market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed