North American Airflow Visualization Testing And Certification Services Market Size 2034

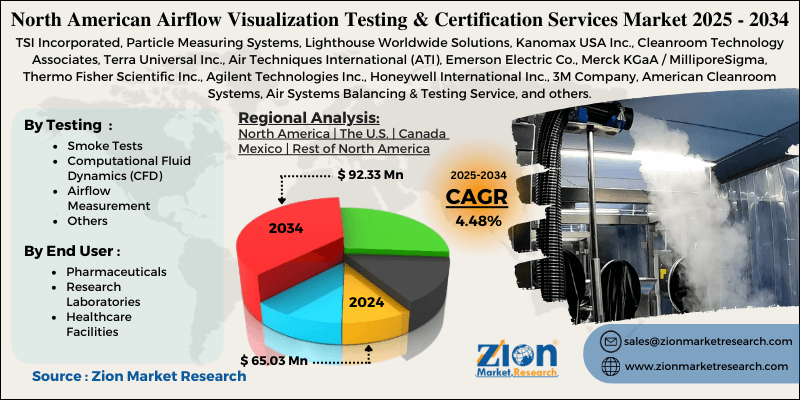

North American Airflow Visualization Testing And Certification Services Market By Testing (Smoke Tests, Computational Fluid Dynamics [CFD], Airflow Measurement, Others), By End-User (Pharmaceuticals, Research Laboratories, Healthcare Facilities), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

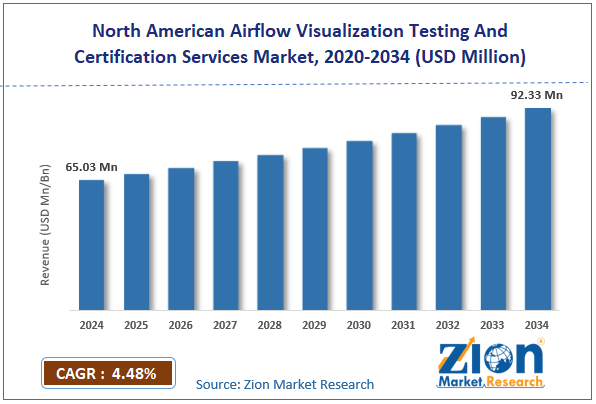

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 65.03 Million | USD 92.33 Million | 4.48% | 2024 |

North American Airflow Visualization Testing And Certification Services Industry Perspective:

The North American airflow visualization testing and certification services market size was approximately USD 65.03 million in 2024 and is projected to reach USD 92.33 million by 2034, with a compound annual growth rate (CAGR) of approximately 4.48% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the North American airflow visualization testing and certification services market is estimated to grow annually at a CAGR of around 4.48% over the forecast period (2025-2034)

- In terms of revenue, the North American airflow visualization testing and certification services market size was valued at around USD 65.03 million in 2024 and is projected to reach USD 92.33 million by 2034.

- The North American airflow visualization testing and certification services market is projected to grow significantly, driven by rising awareness of indoor air quality, surging demand for contamination control, and the construction and renovation of controlled facilities.

- Based on testing, the smoke tests segment is expected to lead the market, while the Computational Fluid Dynamics (CFD) segment is expected to grow considerably.

- Based on end-user, the pharmaceuticals segment is expected to lead the market, followed by healthcare facilities

- By country, the United States is projected to dominate the market during the forecast period, followed by Canada.

North American Airflow Visualization Testing And Certification Services Market: Overview

North American airflow visualization testing and certification services emphasize the evaluation of air movement within dedicated environments to ensure compliance, safety, and performance. These services include airflow mapping, smoke pattern testing, and verification of containment systems and ventilation to meet industry standards such as ANSI, ISO, and ASHRAE. The North American airflow-visualization testing and certification services market is poised for notable growth, driven by stringent regulatory compliance, the development of the biotech and pharmaceutical industries, and the growing demand for cleanrooms. Industries such as healthcare, pharmaceuticals, and semiconductor manufacturing face stringent regulations for containment and cleanroom environments. Airflow testing promises compliance with FDA and ISO standards. This fuel constant demand for certification services.

Moreover, the rapid growth of the pharmaceutical and biotech sectors in North America requires a highly controlled environment. Maintaining ideal airflow and contamination control is vital for production quality. This fuels investments in airflow testing services. Furthermore, the increasing adoption of cleanrooms in hospitals, research, and electronics manufacturing necessitates regular airflow verification. Proper airflow visualization is essential for preventing contamination. This augments growth in the testing and certification services industry.

Nevertheless, the global market faces limitations due to factors such as the complexity of testing procedures and a limited skilled workforce. Airflow visualization and certification need precision and technical knowledge. The complexity may create hesitation among the less specialized or smaller facilities, thus slowing industry penetration. Likewise, there is a lack of certified airflow testing professionals in North America. This creates barriers for service providers. Workflow restrictions may hamper the market expansion.

Still, the North American airflow visualization testing and certification services industry benefits from several favorable factors, such as the integration of automation and IoT, growth in healthcare facilities, and a focus on sustainability and energy efficiency. IoT-enabled airflow monitoring systems can provide real-time data to support compliance and enhancement. Services that integrate these solutions can offer greater value. Surgical centers, new hospitals, and isolation units need certified airflow systems. Increasing healthcare infrastructure growth fuels new service opportunities. Additionally, optimizing airflow can reduce energy consumption in controlled environments. Services that integrate airflow testing with energy-efficiency solutions are gaining prominence.

North American Airflow Visualization Testing And Certification Services Market Dynamics

Growth Drivers

How are advances in testing technology & methodologies propelling the North American airflow visualization testing and certification services market?

Recent innovations, including smoke visualization, real-time particle monitoring, CFD-based airflow modeling, and automated airflow mapping, have made airflow testing more efficient, accurate, and comprehensive. These improvements reduce testing time, broaden applicability, and enhance accuracy across diverse types of ventilation and cleanroom systems. Hence, businesses place greater value on obtaining professional certification. The complexity and low cost of modern methods make testing more accessible, prompting broader adoption, even by small facilities. This technological evolution widens the industry and deepens penetration.

How is the North American airflow visualization testing and certification services market driven by the growing trend of outsourcing testing to specialist providers?

Several businesses, mainly mid- and small-sized businesses, prefer outsourcing airflow testing rather than investing in dedicated equipment, personnel, and training. Using independent 3rd-party service providers promises expert-level results and compliance while avoiding capital expenditure. This outsourcing trend simplifies internal resource management and regulatory adherence for companies that lack in-house capabilities. As more companies adopt this model, the demand for 3rd-party testing services expands. The shift toward outsourcing reinforces the growth potential of the North American airflow visualization testing and certification services market.

Restraints

Shortage of skilled professionals and expertise significantly hampers the market progress

Accurate airflow visualization and certification depend on qualified technicians with a deep understanding of HVAC dynamics, testing protocols, and cleanroom standards. There is a remarkable scarcity of these experts, which means service providers often struggle to meet demand or must rely on overworked or understaffed personnel. This talent gap hampers service delivery, reduces scalability and quality for small companies, and increases labor costs. Hence, many potential customers may avoid testing due to long wait times or poor local service.

Opportunities

How do advancements in testing methods & use of digital simulation tools present favorable prospects for the growth of the North American airflow visualization testing and certification services market?

Progress in testing methods – comprising digital twin modeling, computational fluid dynamics (CFD), advanced sensor-based airflow mapping, and real-time particle monitoring- enhances the efficiency, accuracy, and reliability of airflow visualization services. As these methods become more standardized and accessible, more clients find airflow certification worthwhile. Faster turnaround times, greater confidence in results, and minimal operational disruption make services more appealing. This technological progress enables providers to offer premium-level validation services, thereby elevating perceived value and justifying higher service fees. These improvements ultimately fuel the North American airflow visualization testing and certification services industry.

Challenges

Retrofitting challenges and operational disruptions for existing facilities restrict the market growth

Several legacy facilities, or older buildings, were not designed with modern cleanroom or airflow-optimized HVAC systems. Retrofitting these facilities to meet airflow certification standards can be costly, operationally disturbing, and time-consuming. The need to modify HVAC ducting, balance airflow, or temporarily shut down sections for testing may hamper facility owners. Hence, only extensively renovated facilities or new buildings may choose to undergo airflow testing, thus limiting the addressable industry within the current infrastructure.

North American Airflow Visualization Testing And Certification Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | North American Airflow Visualization Testing And Certification Services Market |

| Market Size in 2024 | 65.03 Mn |

| Market Forecast in 2034 | 92.33 Mn |

| Growth Rate | CAGR of 4.48% |

| Number of Pages | 216 |

| Key Companies Covered | TSI Incorporated, Particle Measuring Systems, Lighthouse Worldwide Solutions, Kanomax USA Inc., Cleanroom Technology Associates, Terra Universal Inc., Air Techniques International (ATI), Emerson Electric Co., Merck KGaA / MilliporeSigma, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Honeywell International Inc., 3M Company, American Cleanroom Systems, Air Systems Balancing & Testing Service, and others. |

| Segments Covered | By Testing, By End User, and By Region |

| Regions Covered in North America | The U.S., Canada, Mexico, and Rest of North America |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North American Airflow Visualization Testing And Certification Services Market: Segmentation

The North American airflow visualization testing and certification services market is segmented based on testing, end-user, and region.

Based on testing, the North American airflow visualization testing and certification services industry is divided into smoke testing, Computational Fluid Dynamics (CFD), airflow measurement, and other categories. The smoke test segment held a dominant market share because it provides rapid, visible verification of airflow patterns, including directional flow, dead zones, and turbulence, which is vital for certifying controlled and cleanroom environments. They are easy to implement and interpret, increasing their demand among facilities that need documented, regulatory-compliant airflow verification. Their reliability and simplicity make them an on-the-go solution for industries that require consistent certification.

On the other hand, the Computational Fluid Dynamics (CFD) segment ranked second in the market. This modeling provides a simulation-based, detailed analysis of airflow under varying conditions, offering predictive insight rather than just a snapshot. This makes it valuable during the design or redesign of controlled-environment facilities, or when complex airflow patterns should be optimized and studied. As businesses progressively demand repeatability, precision, and scenario-based validation, CFD's adoption continues to increase.

Based on end-user, the North American airflow visualization testing and certification services market is segmented into pharmaceuticals, research laboratories, and healthcare facilities. The pharmaceutical segment leads the market, as cleanroom-based production facilities and drug manufacturers require rigorous contamination control and regulatory compliance. Their dependency on controlled environments for sterile manufacturing, biologics, and vaccines makes airflow testing indispensable. Therefore, pharmaceuticals hold the largest market share and drive steady demand.

Conversely, the healthcare facilities segment holds a second-leading share of the market. It comprises surgical centers, hospitals, and sterile processing units. Growing awareness of infection control, the need for validated ventilation in clinical settings, and concerns about indoor-air quality are driving demand. Subsequently, healthcare is the next leading segment after pharmaceuticals.

North American Airflow Visualization Testing And Certification Services Market: Regional Analysis

What gives the United States a competitive edge in the North American Airflow Visualization Testing and Certification Services Market?

The United States is projected to maintain its dominant position in the North American airflow visualization testing and certification services market, driven by extensive regulatory and compliance requirements, the need to validate cleanroom infrastructure frequently, and significant investments in research, healthcare, and manufacturing. United States facilities should comply with stringent regulatory standards for controlled and cleanroom environments. Regular airflow testing ensures compliance with these safety and quality requirements. This creates stable, recurring demand for certification services. The country also has a large installed base of cleanrooms due to its long history in biotech, pharma, and semiconductors.

Ongoing expansions, recertifications, and upgrades need repeated airflow testing. This promises constant market demand. Furthermore, high investments in laboratories, manufacturing plants, and hospitals fuel the construction of new controlled-environment facilities. These require airflow testing for both compliance and commissioning. Continuous expansion strengthens the country's dominance in the market.

Canada maintains its position as the second-largest region in the North American airflow-visualization testing and certification services industry, driven by expanding cleanroom and controlled-environment infrastructure and rising investment in biotech, healthcare, and life sciences R&D. Canada is home to numerous life sciences, biotech, and pharmaceutical facilities that require cleanrooms. The growth of these controlled environments has surged demand for certified airflow testing. This expanding infrastructure reinforces the country's market standing.

Moreover, growing investment in biotechnology, pharmaceuticals, and research laboratories augments the need for contamination-controlled spaces. Certification services and airflow visualization are vital for quality assurance and compliance. This investment trend fuels steady industry growth. Additionally, Canadian facilities should adhere to stringent cleanroom standards and environmental regulations. Regular airflow testing promises operational safety and compliance. This regulatory focus ensures consistent demand for certification services.

North American Airflow Visualization Testing And Certification Services Market: Competitive Analysis

The leading players in the North American airflow visualization testing and certification services market are:

- TSI Incorporated

- Particle Measuring Systems

- Lighthouse Worldwide Solutions

- Kanomax USA Inc.

- Cleanroom Technology Associates

- Terra Universal Inc.

- Air Techniques International (ATI)

- Emerson Electric Co.

- Merck KGaA / MilliporeSigma

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Honeywell International Inc.

- 3M Company

- American Cleanroom Systems

- Air Systems Balancing & Testing Service

North American Airflow Visualization Testing And Certification Services Market: Key Market Trends

Integration of digital & simulation‑based techniques:

The market is increasingly adopting advanced methods, such as digital airflow modeling and Computational Fluid Dynamics (CFD). These techniques enable detailed analysis of airflow patterns under multiple conditions, reducing reliance merely on conventional smoke or tracer tests and allowing predictive assessments during re-validation or design stages.

Real‑time monitoring & smart cleanroom systems:

Facilities are moving towards continuous environmental monitoring using automated systems and IoT sensors. Real-time tracking of airflow, particulate concentration, humidity, temperature, and pressure enables immediate detection of deviations and sustained compliance, rather than relying on periodic snapshot tests.

The North American airflow visualization testing and certification services market is segmented as follows:

By Testing

- Smoke Tests

- Computational Fluid Dynamics (CFD)

- Airflow Measurement

- Others

By End User

- Pharmaceuticals

- Research Laboratories

- Healthcare Facilities

By Region

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Certification Services Industry Perspective:Key Insights: Certification Services Overview Certification Services Market Dynamics Certification Services Report Scope Certification Services Segmentation Certification Services Regional Analysis Certification Services Competitive Analysis Certification Services Key Market TrendsThe North American airflow visualization testing and certification services market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed