Global HVAC Systems Market Size, Share, Growth Analysis Report - Forecast 2034

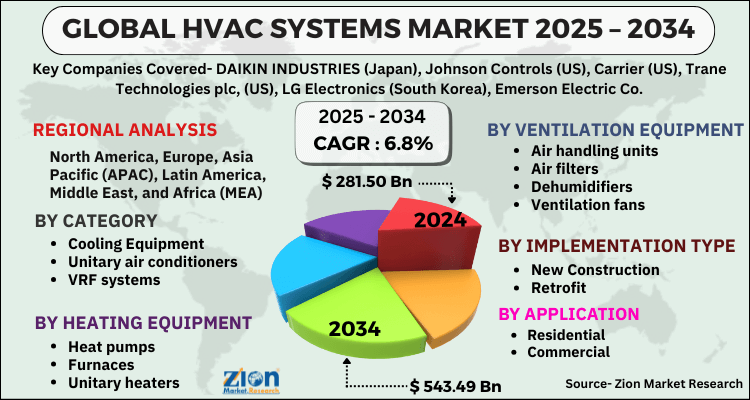

HVAC Systems Market By Category (Cooling Equipment, Unitary air conditioners, VRF systems, Chillers Room air conditioners, Coolers, Cooling towers), By Heating Equipment (Heat pumps, Furnaces, Unitary heaters, Boilers), Ventilation Equipment (Air handling units, Air filters, Dehumidifiers, Ventilation fans, Humidifiers, Air purifiers), Implementation Type (New Construction, Retrofit), Application (Residential, Commercial, Industrial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

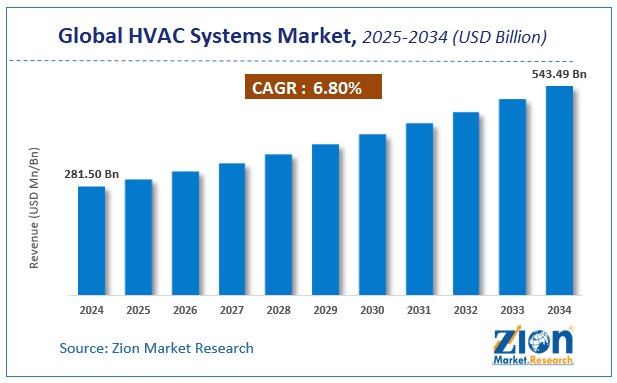

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 281.50 Billion | USD 543.49 Billion | 6.8% | 2024 |

HVAC Systems Market: Industry Perspective

The global HVAC systems market size was worth around USD 281.50 Billion in 2024 and is predicted to grow to around USD 543.49 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.8% between 2025 and 2034.

The report analyzes the global HVAC systems market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the HVAC systems industry.

HVAC Systems Market: Overview

HVAC (heating, ventilation, and air conditioning) equipment is a type of indoor and vehicular comfort technology that helps to provide thermal comfort and good indoor air quality. It is a vital component in single-family homes, apartment buildings, hotels, and senior living facilities, as well as medium to large industrial and office buildings, such as skyscrapers and hospitals, vehicles, such as cars, trains, airplanes, ships, and submarines, and marine environments, where safe and healthy building conditions, such as temperature and humidity, are regulated using fresh air from the outside

A rise in multi-family and single-family homes is paving the way for future development. The HVAC sector is steadily putting a greater emphasis on energy efficiency. Several OEMs are focusing on green efforts, with the goal of saving money while lowering greenhouse gas emissions. As a result, there has been a shift in recent years toward environmentally friendly HVAC devices. This includes goods that use less energy and are powered by renewable energy sources, lowering energy expenses. As a result, the usage of geothermal cooling and heating equipment has increased in recent years, reducing reliance on fuel-based equipment. The desire for comfort among customers is paving the way for expansion.

Heating, ventilation, and air conditioning (HVAC) systems provide heating and cooling services. These systems control the indoor air quality, humidity, and temperature of buildings and vehicles. HVAC systems are used in commercial, residential, and industrial buildings.

Key Insights

- As per the analysis shared by our research analyst, the global HVAC systems market is estimated to grow annually at a CAGR of around 6.8% over the forecast period (2025-2034).

- Regarding revenue, the global HVAC systems market size was valued at around USD 281.50 Billion in 2024 and is projected to reach USD 543.49 Billion by 2034.

- The HVAC systems market is projected to grow at a significant rate due to urbanization and sustainability initiatives.

- Based on Category, the Cooling Equipment segment is expected to lead the global market.

- On the basis of Heating Equipment, the Heat pumps segment is growing at a high rate and will continue to dominate the global market.

- Based on the Ventilation Equipment, the Air handling units segment is projected to swipe the largest market share.

- By Implementation Type, the New Construction segment is expected to dominate the global market.

- In terms of Application, the Residential segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

HVAC Systems Market: Growth Drivers

Increasing government regulatory policies and incentives to ensure energy saving and conservation of natural resources to drive global market growth

Various governments are enacting strict regulatory standards for vendors when constructing and retrofitting energy-efficient HVAC systems. For example, starting in January 2015, the European Union's Ozone Depleting Substances (ODS) legislation prohibited the use of the R-22 refrigerant in all EU member states. Currently, R-22 is used in a huge number of HVAC systems; however, R-22 will grow more expensive over time, and there will be a scarcity. As a result, consumers will need to replace their existing HVAC systems, which will boost demand for contemporary, energy-efficient HVAC systems with programmable thermostats for temperature management throughout the day..

The HVAC systems market is driven by the rising demand for air conditioning systems. In 2017, the global demand for air condition systems was about 110.56 million units, a rise of about 8% from 2016. Major countries contributing to this growth were the U.S. and China. In 2016, the U.S and China contributed to almost 60% of the total global air conditioning systems stock. The annual AC sales in the U.S. were about 24 million units during the same year. Furthermore, in 2016, it was estimated that the residential air conditioning systems sales in China alone were about 40 million units. Thus, it is expected that the rising demand for air conditioning systems will fuel the HVAC systems market during the forecast period.

HVAC Systems Market: Restraints

Shortage of skilled labor in HVAC Systems to hamper the market growth

The HVAC business is expected to grow at a steady pace. For optimal operation and to avoid failure, HVAC systems require fine-tuning and specific manufacture of parts during installation. As a result, professionals are required to install HVAC systems properly. If the installation is not done properly, the end user may have to pay extra for repairs in the future, or the HVAC systems may not function properly. The user is likely to pay greater costs as a result of the need for skilled workers. As a result, it may stymie the HVAC system market's implementation.

HVAC Systems Market: Opportunities

The rapid transformation of IoT within the HVAC industry to bring growth opportunities for the global market

The Internet of Things (IoT) is a situation in which HVAC systems are connected to the internet and data is shared. It manages HVAC systems, collects data, and stores it in the cloud; it enhances HVAC operations for increased efficiency, and it maintains a maintenance schedule that is predictive. It also monitors, regulates, and diagnoses units in a cost-effective manner over the internet. In addition, IoT allows for reduced HVAC system maintenance and repair expenses in the long run. IoT-enabled buildings, for example, can provide facility managers with early alerts of any operational irregularities and enable remote diagnostics and adjustment of units, thereby saving money by reducing system failures.

HVAC Systems Market: Challenges

Lack of awareness about the benefits of HVAC systems in developing countries may give rise to challenges for its growth

With the rapid advancement of technology, it is important to educate end customers about the advantages of new technology. In the case of HVAC systems, consumer understanding of cost and environmental benefits is minimal; they are typically seen as expensive, which makes market penetration in developing economies difficult. There is also a paucity of knowledge about energy-efficient HVAC systems. Despite various innovations, such as the development of low GWP refrigerants for HVAC, HVAC system adoption is not commensurate with the benefits they provide. Furthermore, there is a lack of awareness of HVAC system standards among HVAC system contractors. Higher SEER criteria, such as 21 SEER units, have just been introduced, which home HVAC building firms are ignorant of, causing their business to suffer.

HVAC Systems Market: Segmentation Analysis

The global HVAC systems market is segmented based on Category, Heating Equipment, Ventilation Equipment, Implementation Type, Application, and region.

Based on Category, the global HVAC systems market is divided into Cooling Equipment, Unitary air conditioners, VRF systems, Chillers Room air conditioners, Coolers, Cooling towers.

On the basis of Heating Equipment, the global HVAC systems market is bifurcated into Heat pumps, Furnaces, Unitary heaters, Boilers.

By Ventilation Equipment, the global HVAC systems market is split into Air handling units, Air filters, Dehumidifiers, Ventilation fans, Humidifiers, Air purifiers.

In terms of Implementation Type, the global HVAC systems market is categorized into New Construction, Retrofit.

By Application, the global HVAC Systems market is divided into Residential, Commercial, Industrial.

HVAC Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | HVAC Systems Market |

| Market Size in 2021 | USD 281.50 Billion |

| Market Forecast in 2028 | USD 543.49 Billion |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 182 |

| Key Companies Covered | DAIKIN INDUSTRIES (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea), Emerson Electric Co. (US), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Nortek Air Management (US), Samsung Electronics (South Korea. (US), |

| Segments Covered | By Cooling Equipment, By Heating Equipment, By Ventilation Equipment, By Implementation Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- September 2021 - Johnson Controls has announced that it will combine its industry-leading OpenBlue Healthy Buildings portfolio with the new UL-SafeTraces cooperation. K-12 administrators can verify that schools fulfill indoor air quality regulations, limit infection risks, and provide a healthy environment for students, teachers, and staff by using science-based performance data backed by cutting-edge technology.

- September 2021 - Johnson Controls and Apollo Worldwide Management, Inc., a major global alternative asset management, have established a strategic agreement to provide sustainability and energy efficiency services to assist their customers in achieving their decarbonization and operational cost goals for their buildings. The alliance creates a new strategic alternative for tackling the USD 240 billion worldwide markets for decarbonization retrofit and services over the next decade in North America.

HVAC Systems Market: Regional Landscape

During the projected period, the HVAC systems market in APAC is expected to have the biggest market share. China, Japan, and India are just a few of the prominent players in the APAC HVAC system industry. Growing development activity and a growing population are two main reasons driving the region's HVAC system industry forward. In countries like Japan, South Korea, and China, there is a high demand for smart houses. The need for HVAC systems in the region is expanding as a result of rapid urbanization and industry. Furthermore, regulatory programs such as the Commercial Building Disclosure (CBD) Program in Australia, the launch of Energy Conservation Building Codes in India, the launch of the LEED-India project, and the formation of the Indian Society of Heating, Refrigeration, and Air-Conditioning Engineers (ISHRAE) all help to promote HVAC system adoption in the region.

HVAC Systems Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the HVAC systems market on a global and regional basis.

The global HVAC systems market is dominated by players like:

- DAIKIN INDUSTRIES (Japan)

- Johnson Controls (US)

- Carrier (US)

- Trane Technologies plc

- (US)

- LG Electronics (South Korea)

- Emerson Electric Co. (US)

- Honeywell International Inc. (US)

- Mitsubishi Electric Corporation (Japan)

- Nortek Air Management (US)

- Samsung Electronics (South Korea. (US)

The global HVAC systems market is segmented as follows;

By Category

- Cooling Equipment

- Unitary air conditioners

- VRF systems

- Chillers Room air conditioners

- Coolers

- Cooling towers

By Heating Equipment

- Heat pumps

- Furnaces

- Unitary heaters

- Boilers

By Ventilation Equipment

- Air handling units

- Air filters

- Dehumidifiers

- Ventilation fans

- Humidifiers

- Air purifiers

By Implementation Type

- New Construction

- Retrofit

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global HVAC systems market is expected to grow due to rising urbanization, increasing demand for energy-efficient climate control solutions, and technological advancements in smart hvac systems.

According to a study, the global HVAC systems market size was worth around USD 281.50 Billion in 2024 and is expected to reach USD 543.49 Billion by 2034.

The global HVAC systems market is expected to grow at a CAGR of 6.8% during the forecast period.

Asia-Pacific is expected to dominate the HVAC systems market over the forecast period.

Leading players in the global HVAC systems market include DAIKIN INDUSTRIES (Japan), Johnson Controls (US), Carrier (US), Trane Technologies plc, (US), LG Electronics (South Korea), Emerson Electric Co. (US), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Nortek Air Management (US), Samsung Electronics (South Korea. (US), among others.

The report explores crucial aspects of the HVAC systems market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed