Testing Inspection And Certification Market Size, Share, Trends, Growth 2034

Testing Inspection And Certification Market By Type (Testing, Inspection, and Certification), By Application (Government, Education, Consumer Goods & Retail, Environmental Services, Chemicals, Food, Agriculture, Energy & Power, Infrastructure, Mining, Healthcare, Oil, Gas, & Petroleum, and Others), Market and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

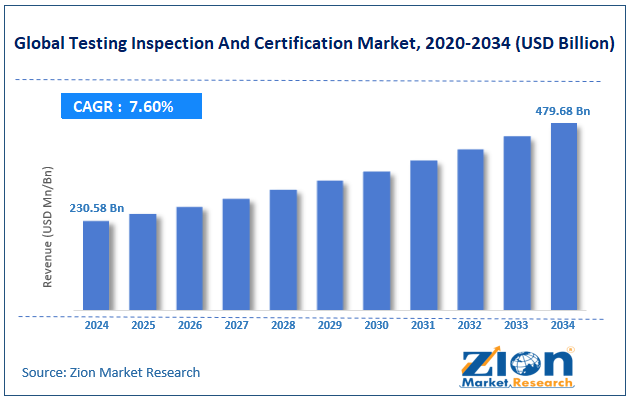

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 230.58 Billion | USD 479.68 Billion | 7.60% | 2024 |

Testing Inspection And Certification Industry Perspective

The global testing inspection and certification market size was worth around USD 230.58 billion in 2024 and is predicted to grow to around USD 479.68 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.60% between 2025 and 2034.

Testing Inspection And Certification Market: Overview

The testing, inspection, and certification (TIC) industry is a growing market providing conformity assessment services. It deals with delivering testing, validation, declaration of conformity, and other related solutions to a wide range of industries. TIC is conducted to either meet regulatory guidelines or ensure good business practices, thereby protecting the environment and people. Some of the most common testing, inspection, and certification services include industrial site inspections, supply chain certifications, periodic car inspections, management system auditing and certification, pre-shipment inspections, product testing, and consignment-based conformity assessments, among several others. Certain companies, especially larger corporations, tend to invest in in-house testing, inspection, and certification services, while smaller or mid-size firms may partner with third-party TIC services providers.

One of the primary reasons for the higher market demand for testing, inspection, and certification is the intensifying rate of government mandates that ensure business operations do not have a significant impact on the environment and consumers. On the other hand, the rising number of new technologies enabling error-free TIC may create more growth opportunities during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global testing inspection and certification market is estimated to grow annually at a CAGR of around 7.60% over the forecast period (2025-2034)

- In terms of revenue, the global testing inspection and certification market size was valued at around USD 230.58 billion in 2024 and is projected to reach USD 479.68 billion by 2034.

- The testing inspection and certification market is projected to grow at a significant rate due to the intensifying government mandates ensuring product quality and safety.

- Based on the type, the testing segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the oil, gas, & petroleum segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Testing Inspection And Certification Market: Growth Drivers

How will intensifying government mandates, ensuring product quality and safety, propel testing inspection and certification market expansion?

The global testing, inspection, and certification market is expected to be driven by the intensifying rate of government mandates and frameworks ensuring the quality and safety of products launched in the commercial market. For instance, the global food & beverages industry is one of the highly regulated industries. Production and supply of adulterated food is a major health concern across the globe. Similarly, the pharmaceutical and automotive industries are widely regulated by government guidelines. In December 2024, the European Union Joint Research Center (JRC) launched a new method for detecting adulteration in 6 spices and herbs. Additionally, the agency also launched new reference materials for identifying fraudulent fish products.

In October 2024, the European Union seized over EUR 91 million worth of fraudulent food across the region. Companies across industries are under heavy government scrutiny, encouraging them to develop more effective testing, inspection, and certification procedures. In April 2025, the Indian government announced its plan to establish 100 additional food testing laboratories across the country. Food quality is a major cause of concern in India, and 205 food labs will be built in the coming years at a budget of INR 503 crore.

Rising construction of new industrial units, including smart factories, to generate higher revenue

Demand for TIC services is expected to be influenced by the rising investments in the development of robust industrial units worldwide. The emergence and rapid expansion of smart factories and manufacturing facilities will encourage industry players to innovate their service offerings.

In March 2025, Nvidia, one of the world’s largest technology companies, announced a partnership with Cassava Technologies. The companies will collaborate to construct South Africa’s first Artificial Intelligence (AI) factory. Such advancements are expected to work in favor of the global testing, inspection, and certification market.

Testing Inspection And Certification Market: Restraints

High cost of services to affect market revenue during the long term

The global testing inspection and certification industry is expected to be restricted due to the high cost of services associated with TIC, especially on a large scale. For instance, the average cost of a full aircraft certification for a Boeing or Airbus can range between USD 50 and USD 150 million.

In addition, the process of testing, inspecting, and obtaining certification is a time-consuming process, taking up to or more than 5 years. These factors are likely to work against the TIC industry in the coming years.

Testing Inspection And Certification Market: Opportunities

Will integration of next-generation technologies in TIC procedures create growth opportunities for testing inspection and certification market?

The global testing, inspection, and certification market is expected to generate growth opportunities due to the rising integration of next-generation technologies in TIC procedures. In January 2025, Nvidia announced the launch of a new Artificial Intelligence-powered facility called the NVIDIA DRIVE AI Systems Inspection Lab. According to official sources, the unit is expected to help automotive companies navigate the evolving industry standards worldwide in terms of autonomous vehicle safety.

In April 2024, Waygate Technologies, a leading provider of non-destructive testing (NDT) solutions for industrial inspection, launched Krautkrämer CL Go+. It is a new ultrasonic precision thickness gauge and a highly efficient inspection tool for components used in the aerospace and automotive industries. Krautkrämer CL Go+ has proven effectiveness in measuring stamped and cast metal components made using copper, steel, bronze, and aluminum. In May 2025, Visometry launched version 2.4 of its mobile inspection solution called Twyn. It is an Augmented Reality (AR) tool designed for use on a tablet. Twyn 2.4 is expected to streamline on-site quality checks across the production environment.

Testing Inspection And Certification Market: Challenges

Extreme fragmentation in regulatory requirements poses major challenges for market players

The global testing inspection and certification industry is expected to be challenged by the presence of extreme fragmentation in the regulatory environment. Each country has specific TIC guidelines and companies are expected to comply 100% with the dynamic and ever evolving frameworks. It can be challenging for global companies to keep up with the rapid pace at which government regulations change globally.

Testing, Inspection And Certification Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Testing, Inspection And Certification Market |

| Market Size in 2024 | USD 230.58 Billion |

| Market Forecast in 2034 | USD 479.68 Billion |

| Growth Rate | CAGR of 7.60% |

| Number of Pages | 217 |

| Key Companies Covered | DEKRA SE, SGS SA, TÜV Rheinland, UL Solutions, Intertek Group plc, TÜV NORD Group, Element Materials Technology, Lloyd’s Register Group Services Limited, Eurofins Scientific, Bureau Veritas, DNV GL, MISTRAS Group, TÜV SÜD, ALS Limited, Applus+., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Testing Inspection And Certification Market: Segmentation

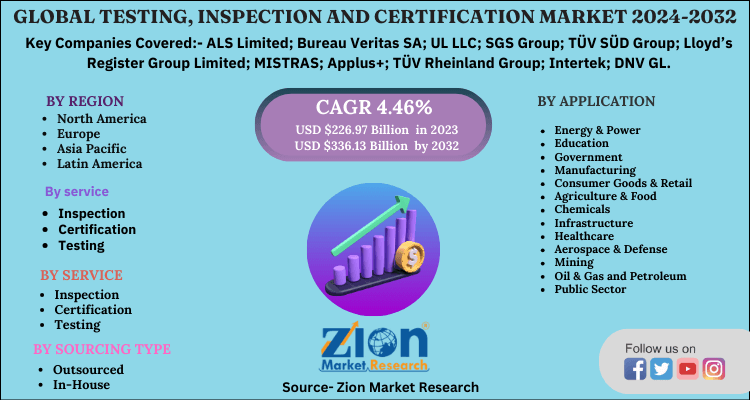

The global testing inspection and certification market is segmented based on type, application, and region.

Based on the type, the global market divisions are testing, inspection, and certification. In 2024, the highest growth was listed in the testing segment, which accounted for nearly 72.01% of the final revenue. The increasing use of advanced testing techniques across major industries such as automotive and aerospace will propel segmental revenue in the future. The certification segment is expected to deliver a higher CAGR as compared to the last few years during the forecast period.

Based on the application, the global market divisions are government, education, consumer goods & retail, environmental services, chemicals, food, agriculture, energy & power, infrastructure, mining, healthcare, oil, gas, & petroleum, and others. In 2024, the highest demand was listed in the oil, gas, & petroleum segment. The presence of strict safety regulations in the industry has helped the segment thrive in the last few years. The infrastructure segment accounted for nearly 19.01% of the total revenue in 2024 and is expected to continue generating significant revenue for industry players.

Testing Inspection And Certification Market: Regional Analysis

Will North America deliver the highest revenue in the testing inspection and certification market?

The global testing inspection and certification market will be led by North America during the forecast period. The region held over 25.05% of the total revenue in 2024, according to market research. The increasing use of sophisticated testing, inspection, and certification services in industrial facilities, the aerospace segment, and the automotive industry is propelling the regional expansion rate. The US is projected to emerge as the leading contributor to North America’s final revenue led by ongoing advancements in Artificial Intelligence, renewable energy systems, and Internet of Things (IoT) solutions.

Europe is projected to emerge as the second-highest revenue generator in the testing inspection and certification industry. The ongoing construction of smart factories across the European Union (EU) will promote higher industrial applications of TIC. On the other hand, major industries in the EU are highly regulated with frameworks monitored by agencies such as the European Commission, European Committee for Standardization (CEN), European Chemicals Agency (ECHA), and others.

The growing investments in infrastructure development across Europe may further facilitate regional growth during the projection period. According to recent trends, Europe is focusing heavily on improving sustainability across industries, creating growth scope for innovative TIC solutions.

Testing Inspection And Certification Market: Competitive Analysis

The global testing inspection and certification market is led by players like:

- DEKRA SE

- SGS SA

- TÜV Rheinland

- UL Solutions

- Intertek Group plc

- TÜV NORD Group

- Element Materials Technology

- Lloyd’s Register Group Services Limited

- Eurofins Scientific

- Bureau Veritas

- DNV GL

- MISTRAS Group

- TÜV SÜD

- ALS Limited

- Applus+

The global testing inspection and certification market is segmented as follows:

By Type

- Testing

- Inspection

- Certification

By Application

- Government

- Education

- Consumer Goods & Retail

- Environmental Services

- Chemicals

- Food

- Agriculture

- Energy & Power

- Infrastructure

- Mining

- Healthcare

- Oil

- Gas & Petroleum

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The testing, inspection, and certification (TIC) industry is a growing market providing conformity assessment services.

The global testing, inspection, and certification market is expected to be driven by the intensifying rate of government mandates and frameworks ensuring the quality and safety of products launched in the commercial market.

According to study, the global testing inspection and certification market size was worth around USD 230.58 billion in 2024 and is predicted to grow to around USD 479.68 billion by 2034.

The CAGR value of the testing inspection and certification market is expected to be around 7.60% during 2025-2034.

The global testing inspection and certification market will be led by North America during the forecast period.

The global testing inspection and certification market is led by players like DEKRA SE, SGS SA, TÜV Rheinland, UL Solutions, Intertek Group plc, TÜV NORD Group, Element Materials Technology, Lloyd’s Register Group Services Limited, Eurofins Scientific, Bureau Veritas, DNV GL, MISTRAS Group, TÜV SÜD, ALS Limited, and Applus+.

The report explores crucial aspects of the testing inspection and certification market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

List of Contents

Testing Inspection And CertificationIndustry PerspectiveOverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesTesting, Inspection And Certification Report ScopeSegmentationRegional AnalysisCompetitive AnalysisThe global testing inspection and certification market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed