Nanocoatings Market Size, Share, Trends, Growth & Forecast 2034

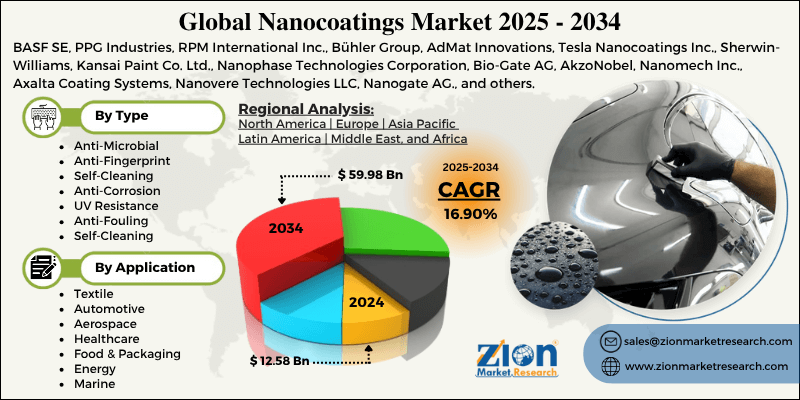

Nanocoatings Market By Type (Anti-Microbial, Anti-Fingerprint, Self-Cleaning, Anti-Corrosion, UV Resistance, Anti-Fouling, Self-Cleaning, Thermal Barrier & Flame Retardant, Conductive, Anti-Icing, Abrasion & Wear Resistant), By Application (Textile, Automotive, Aerospace, Healthcare, Food & Packaging, Energy, Marine, Building & Construction, Electronics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

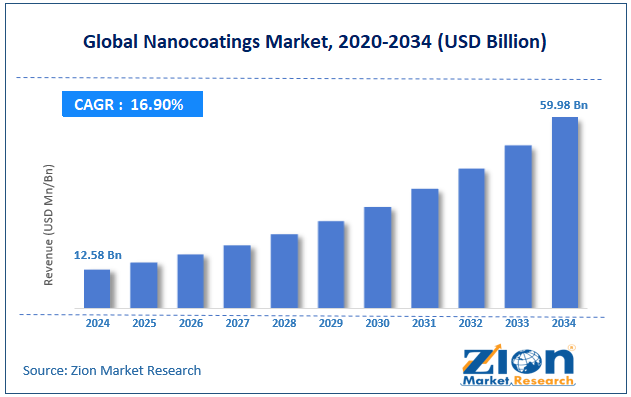

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.58 Billion | USD 59.98 Billion | 16.90% | 2024 |

Nanocoatings Industry Perspective:

The global nanocoatings market size was worth around USD 12.58 billion in 2024 and is predicted to grow to around USD 59.98 billion by 2034, with a compound annual growth rate (CAGR) of roughly 16.90% between 2025 and 2034.

Nanocoatings Market: Overview

Nanocoatings are extremely thin layers of specialized material or chemicals that are coated over surfaces using a wide range of techniques. Certain nanocoatings are polymers that undergo polymerization either prior to application or in situ. Nanocoatings are measured on a nanoscale, with thickness ranging between 1 and 100 nanometers. Concepts of quantum physics are applied when designing and applying nanocoatings over a surface. The main goal of nanocoating applications is to impact certain physical or chemical properties of the surface. For instance, certain nanoscale coatings may impart oleophobic or hydrophobic properties to a platform, improving corrosion resistance. Furthermore, demand for self-cleaning nanocoating solutions has increased in the last few years.

According to industry research, nanocoatings are also more environmentally friendly, as they release limited volatile organic compounds (VOCs) compared to traditional coatings. During the forecast period, demand for nanocoatings is expected to grow at a steady pace driven by increasing applications across major end-user industries. The textile segment is likely to emerge as a leading growth contributor to the market. Moreover, growing innovation and technical advancements in nanocoating technology will further aid market expansion in the coming years. A Major drawback for the market is the high cost of investment associated with the market.

Key Insights:

- As per the analysis shared by our research analyst, the global nanocoatings market is estimated to grow annually at a CAGR of around 16.90% over the forecast period (2025-2034)

- In terms of revenue, the global nanocoatings market size was valued at around USD 12.58 billion in 2024 and is projected to reach USD 59.98 billion by 2034.

- The nanocoatings market is projected to grow at a significant rate due to the increasing use in the automotive industry.

- Based on the type, the self-cleaning segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the electronics segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Nanocoatings Market: Growth Drivers

Increasing use in the automotive industry to fuel market expansion in the coming years

The global nanocoatings market is expected to be driven by the rising use of special materials in the automotive industry. The emergence and rapid expansion of modern automotive technologies, including self-driving cars and electric vehicles (EVs) with sophisticated features, have helped the nanocoating industry thrive. For instance, graphene-based nanocoatings are becoming extremely popular among automotive manufacturers. They offer higher resistance to scratch and superior durability as compared to other coating materials. According to market research, the application of nanocoating to automotive parts helps prevent rust formation.

One of the prominent features of nanocoating solutions designed for the automotive industry includes self-cleaning properties. Most nanocoatings deliver hydrophobic properties to vehicle parts, thus allowing them to repel water or other liquids. Furthermore, the introduction of solutions offering protection against ultraviolet (UV) rays can further enhance the overall lifecycle of a modern vehicle. The growing number of vehicle users worldwide will create expansion possibilities for nanocoating developers across the globe.

Will environmental benefits of nanocoating encourage higher adoption of the nanocoating market during the forecast period?

Market analysis suggests that a leading reason for the increased use of nanocoatings across industries is the environmental benefits associated with the solutions. Traditional polymer-based coatings are known to have a serious environmental impact as they emit high volumes of VOCs. Most nanocoats are based on water, thus replacing conventional solvents used by coating producers. Furthermore, the production of nanocoatings requires less solvent, thus offering excellent reactivity. The global nanocoatings market is expected to benefit from the increasing efforts worldwide to reduce harmful emissions from the coating & paint industry across the globe.

Nanocoatings Market: Restraints

High cost of production and application to limit market revenue in the long run

The global nanocoatings industry is expected to be restricted due to the high cost of production associated with novel materials. Nanocoating solutions leverage the properties of highly exclusive and rare raw materials such as graphene, silver, or titanium dioxide. Additionally, the manufacturing process of nanocoatings requires the use of specialized equipment and techniques, which further contributes to the higher cost of developing the overall solution. The limited infrastructure supporting large-scale production of nanocoatings may further affect the final revenue generated by the market.

Nanocoatings Market: Opportunities

Increasing advancements to create growth opportunities for industry players

The global nanocoatings market is expected to generate growth opportunities due to the rising technological advancements in the industry. In March 2025, Pellucare Technologies, a leading glass coatings provider, announced the launch of its first production facility in the Indian market. The move marks India’s first dedicated nanocoating facility for producing anti-soiling and anti-reflective coatings for automotive and architectural glass sectors. The new facility is expected to produce 8,500 metric tons of nanocoatings annually.

In January 2025, Naco Technologies, an emerging company developing nanocoating as a replacement for expensive metals in hydrogen production, raised nearly USD 1.5 million in pre-Series A funding. The company leverages sophisticated magnetron sputtering technology to replace expensive metals in hydrogen production, thereby reducing costs and improving efficiency.

Furthermore, technological advancements are evident in nanocoatings, offering tailored solutions for specific end-user industries. For instance, the development of safer medical devices equipped with protective nanoparticle coating has gained significant traction in the medical care industry in the last few years. Moreover, advancements in nanocoatings specifically targeting the textile industry may open new avenues for extended growth in the industry.

Nanocoatings Market: Challenges

How do competition from alternative solutions and supply chain disruptions challenge the nanocoatings market expansion?

The global nanocoatings industry is expected to be challenged by the high competition the industry faces from alternative solutions. For instance, traditionally used polymer-based coatings continue to remain a popular choice among end-users. Moreover, growing vulnerability of the industry to changing geopolitical relations that can potentially harm the supply chain of nanoparticles may further impede a steady growth rate in the industry.

Nanocoatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nanocoatings Market |

| Market Size in 2024 | USD 12.58 Billion |

| Market Forecast in 2034 | USD 59.98 Billion |

| Growth Rate | CAGR of 16.90% |

| Number of Pages | 213 |

| Key Companies Covered | BASF SE, PPG Industries, RPM International Inc., Bühler Group, AdMat Innovations, Tesla Nanocoatings Inc., Sherwin-Williams, Kansai Paint Co. Ltd., Nanophase Technologies Corporation, Bio-Gate AG, AkzoNobel, Nanomech Inc., Axalta Coating Systems, Nanovere Technologies LLC, Nanogate AG., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nanocoatings Market: Segmentation

The global nanocoatings market is segmented based on type, application, and region.

Based on the type, the global market segments are anti-microbial, anti-fingerprint, self-cleaning, anti-corrosion, UV resistance, anti-fouling, thermal barrier & flame retardant, conductive, anti-icing, abrasion & wear resistant. In 2024, the highest growth was listed in the self-cleaning segment, which dominated a significant part of the market share. Moreover, the antimicrobial segment is expected to deliver the highest CAGR during the forecast period, as end-user demand continues to witness higher growth. The average lifespan of a nanocoated glass surface is between 2 and 5 years, according to research.

Based on the application, which segment among textile, automotive, aerospace, healthcare, food & packaging, energy, marine, building & construction, electronics, and others will dominate the nanocoatings industry?

In 2024, the highest revenue was listed by the electronics segment, dominating nearly 27.05% of the total revenue. The increasing demand for modern consumer electronics with advanced features, such as anti-corrosion and anti-fingerprint properties, will fuel segmental demand in the future.

Nanocoatings Market: Regional Analysis

North America to continue dominating the market during the forecast period

The global nanocoatings market will be led by North America during the forecast period. In 2024, the region held prominence over 35.05% of the global revenue, with the US leading the regional market share. In February 2025, NanoTech Materials, Inc., a US-based leading company in the market, announced the launch of Wildfire Shield as wildfires in the country become more intense and destructive.

The new launch is a non-toxic, high-temperature-resistant thermal coating. It can withstand a temperature of up to 1,800°C, preventing essential wooden infrastructure from damage in case of fire. In September 2024, Aculon, Inc., from California, USA, launched AcuFlow® 7. The company is a leading provider of surface modification technologies. AcuFlow® 7 offers the most superior repellent nanocoating technology as compared to its contemporaries.

Where Europe stands in the global nanocoatings industry?

Europe is the second-leading region in the market. In 2024, it contributed to 30.1% of the global revenue. The increasing focus on developing sustainable and environmentally friendly alternatives to other harmful chemicals & materials is propelling the regional demand. Additionally, the growing use of nanocoatings in the regional textile, aerospace, and automotive industries is further contributing to the region's thriving economy.

For instance, German company Onyx is the first company in the world to produce a combined 10H and N1 nanocoating. The solution offered by Onyx is widely popular among automotive companies globally. Moreover, Europe is also witnessing higher use of nanocoating in food & beverages to improve the shelf life of the items, further helping the regional market thrive.

Nanocoatings Market: Competitive Analysis

The global nanocoatings market is led by players like:

- BASF SE

- PPG Industries

- RPM International Inc.

- Bühler Group

- AdMat Innovations

- Tesla Nanocoatings Inc.

- Sherwin-Williams

- Kansai Paint Co. Ltd.

- Nanophase Technologies Corporation

- Bio-Gate AG

- AkzoNobel

- Nanomech Inc.

- Axalta Coating Systems

- Nanovere Technologies LLC

- Nanogate AG.

The global nanocoatings market is segmented as follows:

By Type

- Anti-Microbial

- Anti-Fingerprint

- Self-Cleaning

- Anti-Corrosion

- UV Resistance

- Anti-Fouling

- Self-Cleaning

- Thermal Barrier & Flame Retardant

- Conductive

- Anti-Icing

- Abrasion & Wear Resistant

By Application

- Textile

- Automotive

- Aerospace

- Healthcare

- Food & Packaging

- Energy

- Marine

- Building & Construction

- Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Nanocoatings are extremely thin layers of special material or chemicals that are coated over surfaces using a wide range of techniques.

The global nanocoatings market is expected to be driven by the rising use of special materials in the automotive industry.

According to study, the global nanocoatings market size was worth around USD 12.58 billion in 2024 and is predicted to grow to around USD 59.98 billion by 2034.

The CAGR value of nanocoatings market is expected to be around 16.90% during 2025-2034.

The global nanocoatings market will be led by North America during the forecast period.

The global nanocoatings market is led by players like BASF SE, PPG Industries, RPM International Inc., Bühler Group, AdMat Innovations, Tesla Nanocoatings Inc., Sherwin-Williams, Kansai Paint Co., Ltd., Nanophase Technologies Corporation, Bio-Gate AG, AkzoNobel, Nanomech Inc., Axalta Coating Systems, Nanovere Technologies LLC, and Nanogate AG.

The report explores crucial aspects of the nanocoatings market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed