Meat Processing Equipment Market Size, Share, Trends, Growth and Forecast 2034

Meat Processing Equipment Market By Type (Cutting Equipment, Blending Equipment, Tenderizing Equipment, Filling Equipment, Dicing Equipment, Grinding Equipment, Smoking Equipment, Massaging Equipment, Others), By Meat Type (Processed Beef, Processed Pork, Processed Mutton, Others), By Product Type (Fresh Processed Meat, Raw Cooked Meat, Precooked Meat, Raw Fermented Sausages, Cured Meat, Dried Meat, Others), By Application (Slicing, Dicing, Grinding, Smoking, Massaging, Filling, Others), By Distribution Channel (Direct Sales, Indirect Sales), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

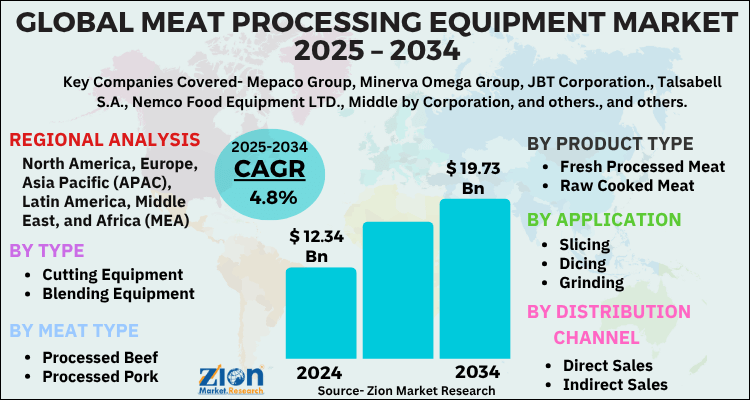

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.34 Billion | USD 19.73 Billion | 4.8% | 2024 |

Meat Processing Equipment Market: Industry Perspective

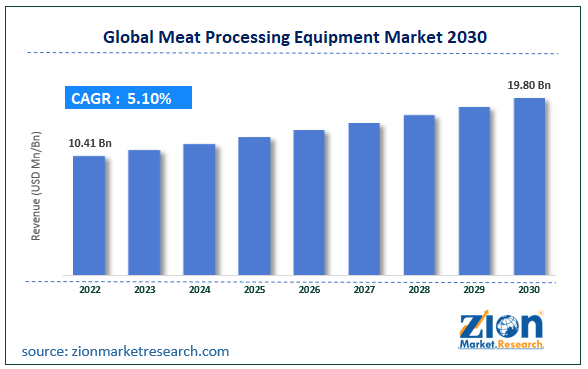

The global meat processing equipment market size was worth around USD 12.34 Billion in 2024 and is predicted to grow to around USD 19.73 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034. The report analyzes the global meat processing equipment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the meat processing equipment industry.

Meat Processing Equipment Market: Overview

Meat Processing Equipment is widely used to perform various operations such as tumbling, mixing, comminuting, chopping, salting curing, etc. This machine is useful to reduce the number of harmful bacteria and prepare meat for human consumption. Growing investments in meat processing machinery along with the advancement in technologies are supporting the meat processing equipment industry’s growth to a great extent. Furthermore, strict government regulations regarding trading, selling, and transporting meat to avoid spoilage of nutrient values are anticipated to boost the demand for meat processing equipment during the study period. On the flip side, the negative effect of the COVID outbreak coupled with low product awareness will hamper the market growth in the future.

Key Insights

- As per the analysis shared by our research analyst, the global meat processing equipment market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global meat processing equipment market size was valued at around USD 12.34 Billion in 2024 and is projected to reach USD 19.73 Billion by 2034.

- The meat processing equipment market is projected to grow at a significant rate due to increasing global meat consumption, technological advancements in automation, and demand for processed meat products.

- Based on Type, the Cutting Equipment segment is expected to lead the global market.

- On the basis of Meat Type, the Processed Beef segment is growing at a high rate and will continue to dominate the global market.

- Based on the Product Type, the Fresh Processed Meat segment is projected to swipe the largest market share.

- By Application, the Slicing segment is expected to dominate the global market.

- In terms of Distribution Channel, the Direct Sales segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Meat Processing Equipment Market: Growth Drivers

Adoption of fully automated technologies will drive market growth

The worldwide meat processing equipment market is majorly driven by the strong expansion of the food processing industry in recent years and is expected to witness the same trend in the future. Meat processing industry is augmenting owing to the rising adoption of advanced & automated technologies and inbuilt sensor systems in process equipment. Furthermore, the rising efficiency of processing machines, growing equipment speed, and rising adoption of automated processing systems are projected to support the overall industry growth positively during the forecast period.

In addition to this, growing lifestyle changes and rising inclination in preferences of consumers for meat products will spur market growth. Increasing demand for packaged foods & processed meat products coupled with the rising demand for food safety will further drive the overall industry development during the study period.

Meat Processing Equipment Market: Restraints

High cost of machinery likely to restrict industry expansion

The average product pricing of meat processing equipment in the developed countries would range from USD 2,500 – USD 3,500. Whereas, the cost of this product in developing regions range from USD 2,000 – USD 2,200. In addition, the research and development cost of this product is considered to be on a higher side. Such high cost of this product restricts small-scale players from entering this market. This would, in turn, hampers the global meat processing equipment market growth to some extent.

Meat Processing Equipment Market: Opportunities

Rising in the trade flow of meat to spur growth avenues for the market

Rapid increases in meat trade generate complex global networks across regions/countries. Increase in the trade flow of meat has boosted the demand for processed meat with shelf life and high durability, which is fueling the meat processing equipment industry growth. In addition, the steep dietary transition toward high meat consumption accelerates countries’ dependence on meat trade to fulfill increased domestic demands which would, in turn, support the product demand globally.

Meat Processing Equipment Market: Segmentation

The global Meat Processing Equipment market is segmented based on type, product, technology, and region

Based on the type, the global market is bifurcated into Beef and Mutton. Among which, Beef accounted for the significant revenue share. Growing demand for low-fat meats, such as rabbit and guinea pigs, is high, thus driving the demand for meat processing equipment. Continuous dominance of meat-based culture in many regions is further augmenting the product demand.

Depending upon product, the global Meat Processing Equipment industry is categorized into Fresh Processed, Raw Cooked, and Precooked. Of these, the processed meat accounted for a significant revenue share. Processed meat is considered the ideal option for the fast-food category and is gaining much popularity among working class societies. This would, in turn, support the overall segmental growth to a great extent during the study period.

In terms of technology, the overall market is divided into Grinding, Dicing, Blending, Smoking, Massaging & Marinating, and Others. The blending segment has captured a notable revenue share. Whereas the smoking segment is projected to grow at the fastest growth rate over the study period.

Recent Developments:

- In July 2022, JBT Corporation announced its strategic acquisition of Alco-food-machines GmbH & Co. KG. This acquisition is aimed to expand company’s product offering in processing category.

- BAADER announced the introduction of the BAADER 608 machine in April 2021. This machine is considered to be the most powerful and biggest member of the BAADERING technology.

Meat Processing Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Meat Processing Equipment Market |

| Market Size in 2024 | USD 12.34 Billion |

| Market Forecast in 2034 | USD 19.73 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 223 |

| Key Companies Covered | Mepaco Group, Minerva Omega Group, JBT Corporation., Talsabell S.A., Nemco Food Equipment LTD., Middle by Corporation, and others., and others. |

| Segments Covered | By Type, By Meat Type, By Product Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Meat Processing Equipment Market: Regional Analysis

North America is expected to dominate the market during the forecast period

The global Meat Processing Equipment market share is dominated by developed regions such as North America and Europe. North America accounted for the notable revenue share. Continuous growth in food & beverages industry coupled with strategic investment by key players in these markets has supported the regional growth. On the flip side, the Asia Pacific region is anticipated to grow at a promising CAGR during the study period. Increasing product demand will support regional growth.

Meat Processing Equipment Market: Competitive Analysis

The global Meat Processing Equipment market is dominated by players like:

- Mepaco Group

- Minerva Omega Group

- JBT Corporation.

- Talsabell S.A.

- Nemco Food Equipment LTD.

- Middle by Corporation

Other players such as

- Talsabell S.A.

- Nemco Food Equipment, LTD.

Middle by Corporation accounted for the notable revenue share. Industry players are actively engaged in strategic collaboration to enhance their market share.

The global Meat Processing Equipment market is segmented as follows:

By Type

- Beef

- Mutton

- Others

By Product

- Fresh Processed

- Raw Cooked

- Precooked

By Technology

- Blending

- Dicing

- Grinding

- Smoking

- Massaging & Marinating

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Meat Processing Equipment is widely used to perform various operations such as tumbling, mixing, comminuting, chopping, salting curing, etc. This machine is useful to reduce the number of harmful bacteria and prepare meat for human consumption.

The global meat processing equipment market is expected to grow due to increasing global meat consumption, technological advancements in automation, and demand for processed meat products.

According to a study, the global meat processing equipment market size was worth around USD 12.34 Billion in 2024 and is expected to reach USD 19.73 Billion by 2034.

The global meat processing equipment market is expected to grow at a CAGR of 4.8% during the forecast period.

The global Meat Processing Equipment market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market owing to the increasing product demand.

The global Meat Processing Equipment market is dominated by players like Mepaco Group, Minerva Omega Group, and JBT Corporation. Other players such as Talsabell S.A., Nemco Food Equipment, LTD., and Middleby Corporation.

The report analyzes the global Meat Processing Equipment market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Meat Processing Equipment market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed