Frozen Chicken Market Size, Share, Trends, Growth & Forecast 2034

Frozen Chicken Market By Type (Chicken Breast, Chicken Thigh, Chicken Drumstick, Chicken Wings, and Others), By Product (Chicken Nuggets, Chicken Popcorn, Chicken Fingers, Chicken Patty, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

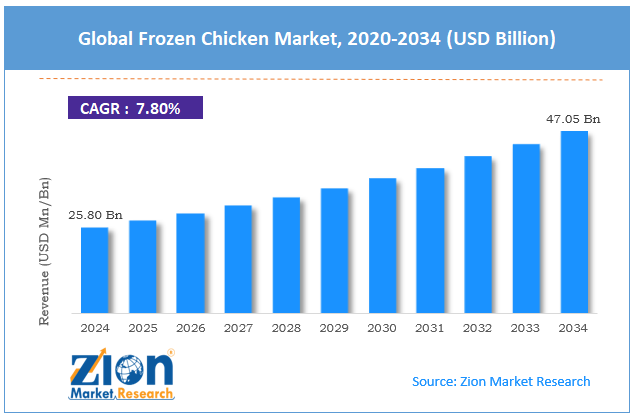

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.80 Billion | USD 47.05 Billion | 7.80% | 2024 |

Frozen Chicken Industry Perspective:

What will be the size of the global frozen chicken market during the forecast period?

The global frozen chicken market size was around USD 25.80 billion in 2024 and is projected to reach USD 47.05 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global frozen chicken market is estimated to grow annually at a CAGR of around 7.80% over the forecast period (2025-2034)

- In terms of revenue, the global frozen chicken market size was valued at around USD 25.80 billion in 2024 and is projected to reach USD 47.05 billion by 2034.

- The frozen chicken market is projected to grow significantly owing to rising demand from quick‑service restaurants and foodservice, the growth of frozen convenience food trends, and urbanization and changing lifestyles.

- Based on type, the chicken breast segment is expected to lead the market, while the chicken wings segment is expected to grow considerably.

- Based on product, the chicken nuggets segment is the largest, while the chicken popcorn segment is projected to record sizeable revenue over the forecast period.

- Based on the distribution channel, the supermarkets/hypermarkets segment is expected to lead the market, followed by the convenience stores segment.

- By region, Asia Pacific is projected to dominate the global market during the forecast period, followed by North America.

Frozen Chicken Market: Overview

Frozen chicken is raw chicken that has been rapidly chilled to sub-zero temperatures to preserve its texture, freshness, and nutritional value for extended periods. It is widely used for long-term storage and convenience, enabling the food industry and households to keep poultry on hand without incurring immediate spoilage. Frozen chicken is a versatile ingredient for cooking, grilling, roasting, and other methods, including stewing and frying. The global frozen chicken market is projected to experience substantial growth, driven by rising demand for convenience foods, expanding urbanization and population, and the development of cold-chain infrastructure. Busy lifestyles are driving demand for easy-to-store, ready-to-cook frozen chicken products. Consumers prefer frozen chicken for its convenience and extended shelf life. This convenience drives higher adoption in the foodservice and household sectors.

Moreover, urban populations are expanding, leading to greater consumption of protein-rich foods such as chicken. Frozen chicken offers an accessible protein source for densely populated regions. This demographic trend drives steady industry growth. Furthermore, improved cold storage and transportation facilities increase product availability and reduce spoilage. Improved logistics enable frozen chicken to reach distant markets efficiently. This infrastructure investment boosts industry penetration.

Although drivers exist, the global market is challenged by factors like high energy costs for storage and consumer preference for fresh meat. Maintaining frozen chicken requires continuous refrigeration, increasing operational costs. Growing energy prices can affect suppliers' profitability. This limits industry growth, mainly in the developing markets. Similarly, some consumers perceive fresh chicken as tastier and healthier than frozen substitutes. This preference lowers demand for frozen products in some markets. Regional and cultural biases impact purchasing behavior.

Even so, the global frozen chicken industry is well-positioned due to product innovation and value-added offerings, as well as the growth of e-commerce and online grocery. Seasoned, pre-marinated, or ready-to-cook frozen chicken appeals to convenience-seeking consumers. Innovation improves differentiation in a competitive market. Value-added products can dominate premium segments. Online grocery platforms facilitate the sale of frozen chicken for home delivery. Consumers increasingly prefer digital channels for convenience. E-commerce offers fresh distribution avenues.

Frozen Chicken Market: Dynamics

Growth Drivers

How are technological & cold chain advancements driving the worldwide frozen chicken market?

Advancements in packaging and freezing methods, such as cryogenic freezing, blast freezing, and IQF (Individual Quick Freezing), are enhancing product quality, shelf life, and texture. These technological enhancements reduce ice crystal formation and help preserve nutrients, increasing consumer trust and confidence in frozen food products.

Meanwhile, investments in temperature-controlled storage and cold chain logistics are expanding distribution reach, mainly in the emerging regions. Infrastructure and enhanced tracking systems are promising for product safety and reducing spoilage. Altogether, these supply chain and technological enhancements have led to increased growth of the frozen chicken market and export potential.

How do health, clean‑label & product innovation trends augment the global frozen chicken market growth?

Consumers are favoring frozen chicken with clean-label claims such as preservative-free and antibiotic-free, reflecting safety and health preferences. Brands are increasingly responding with value-added and premium products, such as flavored and marinated versions of ethnic cuisines, or products inspired by them, to meet growing taste trends. These advancements increase demand, support higher market valuations, and differentiate products.

Restraints

Environmental & sustainability concerns create a negative impact on the market progress

Frozen chicken production and poultry farming add to energy consumption, water use, and greenhouse gas emissions. Growing consumer and regulatory focus on sustainable practices exerts pressure on companies. Brands that don't adopt eco-friendly practices risk losing market share. Sustainability-driven reforms, such as renewable energy for cold storage, require significant upfront investment. These environmental considerations act as a limitation for large-scale growth.

Opportunities

How does the expansion of foodservice & institutional demand create lucrative opportunities for the development of the frozen chicken market?

The worldwide casual dining, QSR, and catering sectors continue to grow, especially in the Middle East and Asia Pacific. Frozen chicken simplifies operations and reduces waste for foodservice operators. Value-added products such as strips, wings, and breaded cuts are in high demand. Associating with restaurant chains offers predictable revenue and a stable bulk contract. Institutional demand offers a high-volume growth avenue for producers, thus impacting the growth of the frozen chicken industry.

Challenges

Competition from alternative proteins limits the market growth

Plant-based meats, seafood alternatives, and lab-grown proteins are gaining huge prominence among environmentally conscious and health-conscious consumers. These substitutes are increasingly seen as convenient, sustainable, and nutritious. Growing consumer adoption of alternative proteins may constrain the growth of the frozen chicken market. Brands should innovate to differentiate their products to retail industry. Competitive pressure challenges the growth of conventional frozen poultry.

Frozen Chicken Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Frozen Chicken Market |

| Market Size in 2024 | USD 25.80 Billion |

| Market Forecast in 2034 | USD 47.05 Billion |

| Growth Rate | CAGR of 7.80% |

| Number of Pages | 217 |

| Key Companies Covered | Tyson Foods Inc., JBS S.A., Perdue Farms Inc., Cargill, Incorporated, Inghams Group Limited, Hormel Foods Corporation, Pilgrim’s Pride Corporation, Sanderson Farms Inc., Foster Farms, Venkateshwara Hatcheries, LDC Group, Koch Foods Inc., 2 Sisters Food Group, Shanthi Feeds, K&N’s, and others. |

| Segments Covered | By Type, By Product, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Frozen Chicken Market: Segmentation

The global frozen chicken market is segmented based on type, product, distribution channel, and region.

Why is the Chicken Breast segment projected to dominate the frozen chicken market?

Based on type, the global frozen chicken industry is divided into chicken breast, chicken thigh, chicken drumstick, chicken wings, and others. The chicken breast segment holds a dominant 40% share of the market due to its high-protein content, suitability for health-focused diets, and broad appeal as a lean, versatile cooking option. Its strong presence in food service and retail channels enhances its global leadership. Consumers usually choose it for its versatility in meal preparation and convenience.

Conversely, the chicken wings segment ranks second, accounting for 25% of the total market. Their prominence drives it in snacks, casual dining, and quick-serve menus. This cut’s versatility and surging appeal across global cuisines support steady demand. Although smaller than the breast segment, wings are a key growth driver in frozen poultry.

What factors help the Chicken Nuggets segment lead the frozen chicken market?

Based on product, the global frozen chicken market is segmented into chicken nuggets, chicken popcorn, chicken fingers, chicken patty, and others. The chicken nuggets segment holds a leading 35% market share, owing to their strong appeal as a ready-to-cook, convenient option for foodservice providers and families. Their bite-size and versatile nature makes them popular among people of all ages across the globe. Chicken nuggets’ broad acceptance and convenience help drive their dominance in the industry.

Nonetheless, the chicken popcorn segment holds the second-largest market share at 20%. The segment is fueled by increasing demand for snack-style and easy-prepare frozen foods. Its bite-sized, small-format attracts younger consumers and households seeking quick meal components. While trailing nuggets, chicken popcorn is a key segment in the processed chicken category.

What are the key reasons for the leadership of the Supermarkets/Hypermarkets segment in the frozen chicken market?

Based on distribution channel, the global market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, and online retail. The supermarkets/hypermarkets segment accounts for 60% of the market, offering a broad product range, convenient access, and competitive pricing for consumers. Their urban presence and large freezer capacity make them the most preferred channel worldwide.

However, the convenience stores segment ranks second with nearly 20% market share. It offers quick access to frozen chicken for urban people. Their proximity and extended hours make them a leading choice for small-quantity and immediate purchases.

Frozen Chicken Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Frozen Chicken Market?

Asia Pacific is likely to sustain its leadership in the frozen chicken market, with a 7.9% CAGR, driven by growing urbanization and incomes, surging demand for protein-rich diets, and the expansion of the cold chain and infrastructure. Rapid urbanization in the Asia-Pacific region is fueling demand for ready-to-cook and convenient foods such as frozen chicken, as urban residents seek quick meal options. Growing disposable incomes and a growing middle class raise spending on frozen and processed foods. These socio-economic changes have sustained industry growth in the region.

Moreover, consumers in APAC are inclining to protein-rich diets, with poultry viewed as a healthy and affordable protein source. This dietary evolution has led to the consumption of frozen chicken as part of daily meals. These trends are particularly pronounced in populous economies such as India and China.

Furthermore, investments in cold chain logistics and storage facilities have increased significantly in APAC, enabling wider distribution of frozen chicken products beyond key cities. Better infrastructure enhances product quality assurance and reduces spoilage. These improvements make frozen chicken more accessible in peri-urban and urban markets.

What factors make North America rank second in the global Frozen Chicken Market?

North America continues to hold the second-highest share, with a 7% CAGR in the frozen chicken industry, owing to high consumer acceptance, advanced cold-chain and distribution infrastructure, and mature retail foodservice channels. Consumers in Canada and the U.S. broadly embrace frozen chicken for convenience, nutrition, and meal planning, with poultry a staple in several households. Retailers offer wider frozen product collections, backing strong year-round sales. This entrenched preference fuels a consistent regional demand over other regions. Moreover, North America benefits from one of the strongest cold chain networks, allowing for reliable logistics that reduce spoilage and ensure quality retention from processing to retail. This infrastructure backs nationwide penetration and industry stability.

Additionally, well-established hypermarkets, supermarkets, and convenience stores lead in frozen chicken distribution, supported by growth in online grocery. The food service industry, comprising casual dining and quick-service chains, also primarily uses frozen chicken to control costs and maintain consistency. This diversity of channels improves industry reach and sales volume.

Frozen Chicken Market: Competitive Analysis

The leading players in the global frozen chicken market are:

- Tyson Foods Inc.

- JBS S.A.

- Perdue Farms Inc.

- Cargill

- Incorporated

- Inghams Group Limited

- Hormel Foods Corporation

- Pilgrim’s Pride Corporation

- Sanderson Farms Inc.

- Foster Farms

- Venkateshwara Hatcheries

- LDC Group

- Koch Foods Inc.

- 2 Sisters Food Group

- Shanthi Feeds

- K&N’s

What are the key trends in the global Frozen Chicken Market?

Growth of value‑added & ready‑to‑cook offerings:

There is a growing demand for value-added frozen chicken products, including marinated, pre-cooked, ready-to-eat, and pre-seasoned formats. These products cater to busy lifestyles by simplifying meal prep and adding variety to flavors. Their prominence helps differentiate offerings and increase consumption.

Technological advances in packaging & freezing:

Enhancements such as modified-atmosphere packaging and individually quick freezing (IQF) are improving shelf life, quality, and food safety. These solutions maintain texture and taste while reducing spoilage, thereby augmenting consumer confidence. Better packaging also supports sustainability goals.

The global frozen chicken market is segmented as follows:

By Type

- Chicken Breast

- Chicken Thigh

- Chicken Drumstick

- Chicken Wings

- Others

By Product

- Chicken Nuggets

- Chicken Popcorn

- Chicken Fingers

- Chicken Patty

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed