Food Service Equipment Market Size, Share, Trends, And Forecast 2032

Food Service Equipment Market By Product (Kitchen Purposes, Refrigeration, Storage, Ware Washing, Food Holding And Serving, And Others) And By End-User (Full-Service Restaurants & Hotels, Quick-Service Restaurants & Pubs, Caterings, And Supermarkets & Chain Stores), And By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

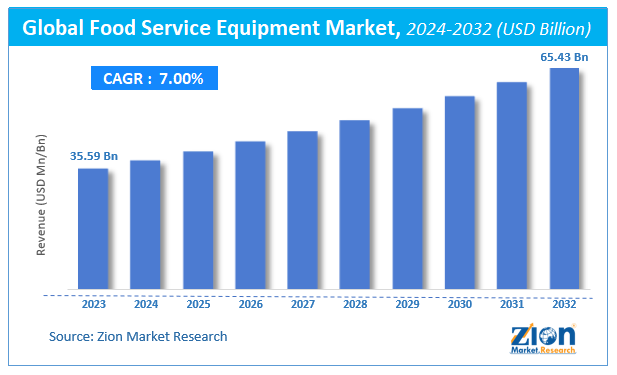

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35.59 Billion | USD 65.43 Billion | 7% | 2023 |

Food Service Equipment Market Size

The global food service equipment market size was worth around USD 35.59 billion in 2023 and is predicted to grow to around USD 65.43 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The report covers a forecast and an analysis of the Food Service Equipment market on a global and regional level.

Food Service Equipment Market Overview

Food service equipment is used for handling or processing food, right from cooling to roasting and from peeling to grinding, for different commercial purposes. The equipment is used majorly in the food service industry by restaurants, hotels, and other commercial kitchens. The Europe food service equipment market consists of a wide array of players including manufacturers, service providers, distributors, etc. The equipment manufacturers seek to maintain their products’ quality while keeping in mind the different products the equipment surface will be in contact with. Some key characteristics of food service equipment include good mechanical strength, easy assemblage, and corrosion-resistant. With digitalization, food service equipment has also evolved to include automated tools. Different equipment available in the market today has automated temperature controllers and remote access, which help the manufacturers diversify their offerings and cater to a wide range of requirements for specific end-users. These features additionally help in reducing the energy cost of the equipment in use.

The food service equipment market is likely to grow majorly over the estimated timeframe due to the development made in the hospitality industry resulting in the rising number of hotels and restaurants globally. Moreover, the increased demand for refrigerated food products, changing lifestyles of people, growing import-export of various foods and beverages, and altering food consumption trends are projected to contributing toward the food service equipment market growth over the forecast time period. However, high capital investments and growing need for a skilled workforce to operate the equipment may hamper the Europe food service equipment market in the upcoming years.

The study includes drivers and restraints of the food service equipment market along with their market impact over the forecast period. Additionally, the report includes the study of opportunities available in the food service equipment in Europe.

In order to give the users of this report a comprehensive view of the food service equipment in Europe, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, and country of major market participants involved in Europe. Moreover, the study covers price trend analysis and the product portfolio of various companies according to the country.

Food Service Equipment Market Segmentation

The study provides a decisive view of the food service equipment by segmenting the market based on product, end-user, and country. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

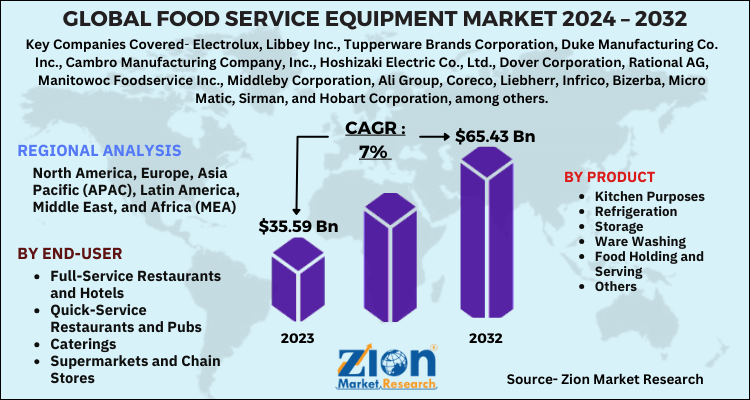

On the basis of product, the food service equipment market is segmented into refrigeration, kitchen purposes, storage, food holding and serving, ware washing, and others.

Based on end-user, the food service equipment market is segmented into quick-service restaurants and pubs, full-service restaurants and hotels, supermarkets and chain stores, and caterings.

Food Service Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Service Equipment Market |

| Market Size in 2023 | USD 35.59 Billion |

| Market Forecast in 2032 | USD 65.43 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 110 |

| Key Companies Covered | Electrolux, Libbey Inc., Tupperware Brands Corporation, Duke Manufacturing Co. Inc., Cambro Manufacturing Company, Inc., Hoshizaki Electric Co., Ltd., Dover Corporation, Rational AG, Manitowoc Foodservice Inc., Middleby Corporation, Ali Group, Coreco, Liebherr, Infrico, Bizerba, Micro Matic, Sirman, and Hobart Corporation, among others |

| Segments Covered | By product, By end-user and By region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Service Equipment Market Regional Analysis

The country-wise segment of this market includes for France, UK, Germany, Poland, Russia, Spain, Italy, and Rest of Europe. The Europe food service equipment market is majorly dominated by France. France held the major market share in 2023 and is expected to continue its dominance in the upcoming years as well. This growth can be attributed to the presence of a large number of fast food giants, such as Subway, McDonald's, Burger King, and KFC, among others, and various types of restaurants across the country.

Food Service Equipment Market Key Players Analysis

Some major players operating in the food service equipment market are

- Electrolux

- Libbey Inc.

- Tupperware Brands Corporation

- Duke Manufacturing Co. Inc.

- Cambro Manufacturing Company Inc.

- Hoshizaki Electric Co. Ltd.

- Dover Corporation

- Rational AG

- Manitowoc Foodservice Inc.

- Middleby Corporation

- Ali Group

- Coreco

- Liebherr

- Infrico

- Bizerba

- Micro Matic

- Sirman

- Hobart Corporation

This report segments the food service equipment market into:

Europe Food Service Equipment Market: Product Analysis

- Kitchen Purposes

- Refrigeration

- Storage

- Ware Washing

- Food Holding and Serving

- Others

Europe Food Service Equipment Market: End-User Analysis

- Full-Service Restaurants and Hotels

- Quick-Service Restaurants and Pubs

- Caterings

- Supermarkets and Chain Stores

Europe Food Service Equipment Market: Country-Wise Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Food service equipment is used for handling or processing food, right from cooling to roasting and from peeling to grinding, for different commercial purposes.

According to study, the Food Service Equipment Market size was worth around USD 35.59 billion in 2023 and is predicted to grow to around USD 65.43 billion by 2032.

The CAGR value of Food Service Equipment Market is expected to be around 7% during 2024-2032.

France has been leading the Food Service Equipment Market and is anticipated to continue on the dominant position in the years to come.

The Food Service Equipment Market is led by players like Electrolux, Libbey Inc., Tupperware Brands Corporation, Duke Manufacturing Co. Inc., Cambro Manufacturing Company, Inc., Hoshizaki Electric Co., Ltd., Dover Corporation, Rational AG, Manitowoc Foodservice Inc., Middleby Corporation, Ali Group, Coreco, Liebherr, Infrico, Bizerba, Micro Matic, Sirman, Hobart Corporation, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed