Fashion Accessories Market Size, Growth, Global Trends, Forecast 2034

Fashion Accessories Market By Product (Jewelry, Watches, Handbags & Purses, Belts & Wallets, Sunglasses, and Others), By End-User (Men, Women, Children), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

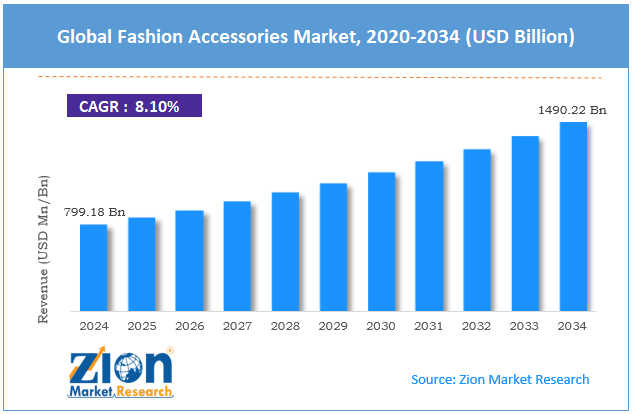

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 799.18 Billion | USD 1490.22 Billion | 8.10% | 2024 |

Fashion Accessories Industry Perspective:

What will be the size of the global fashion accessories market during the forecast period?

The global fashion accessories market size was around USD 799.18 billion in 2024 and is projected to reach USD 1490.22 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fashion accessories market is estimated to grow annually at a CAGR of around 8.10% over the forecast period (2025-2034)

- In terms of revenue, the global fashion accessories market was valued at approximately USD 799.18 billion in 2024 and is projected to reach USD 1,490.22 billion by 2034.

- The fashion accessories market is projected to grow significantly, driven by changing fashion trends, celebrity endorsements, and urbanization.

- Based on product, the jewelry segment is expected to lead the market, while the handbags & purses segment is expected to grow considerably.

- Based on end-user, the women segment is the dominating segment, while the men segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the online segment is expected to lead the market, followed by specialty stores.

- By region, Europe is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Fashion Accessories Market: Overview

Fashion accessories are styling items that complement and enhance apparel, adding style, functionality, and personality. They include watches, jewelry, scarves, hats, belts, sunglasses, and handbags. Beyond their aesthetic appeal, fashion accessories can reflect cultural influences, personal taste, and current trends, changing even a simple outfit into a gorgeous statement look. The global fashion accessories market is likely to expand rapidly, driven by the influence of fashion influencers and social media, e-commerce expansion, changing fashion trends, and the fast-fashion culture. Platforms like TikTok and Instagram amplify trends speedily. Influencers showcasing accessories shape consumer preferences. This leads to higher sales and faster adoption.

Moreover, online marketplaces make accessories more easily accessible worldwide. Consumers can explore multiple products and brands from home. This convenience augments overall industry growth. Furthermore, speedy trend cycles encourage frequent accessory purchases. Consumers update their style without replacing complete wardrobes. Brands respond by introducing seasonal collections quickly.

Despite growth, the global market is constrained by factors such as high competition and industry saturation, economic uncertainty and inflation, and supply chain disruptions. The accessories segment has lower entry barriers, making it appealing to numerous brands. High competition reduces profit margins. Smaller brands struggle to differentiate themselves. During economic downturns, discretionary spending drops. Accessories are usually considered non-essential items. This restricts industry growth in challenging times. Similarly, worldwide logistics and raw-material shortages increase costs. Delays affect timely product availability, and brands struggle to meet consumer demand.

Nonetheless, the global fashion accessories industry stands to gain from several key opportunities, including sustainability and eco-friendly product lines, tech-integrated wearables, and direct-to-consumer brand growth. Consumers steadily prefer eco-friendly, responsible products. Brands producing ethical or recycled accessories gain loyalty. Sustainability offers fresh market ranking prospects. Smart accessories blend functionality and fashion. Wearables like smartwatches appeal to tech-savvy consumers. This creates a high-growth and niche market segment. Digital platforms and social media allow small brands to connect directly with buyers. D2C models reduce dependency on retailers. This ultimately fosters strong consumer engagement and loyalty.

Fashion Accessories Market: Dynamics

Growth Drivers

How is the growth of e-commerce and omnichannel retailing positively influencing the fashion accessories market development?

E-commerce has made fashion accessories more accessible by offering convenient shopping experiences and a wide selection. Omnichannel tactics integrate offline and online retail, allowing users to browse, try on, and purchase smoothly. Social commerce and mobile shopping have further accelerated growth, especially among younger and digitally native buyers. Leading brands can now reach global markets, expanding their customer base beyond physical shops. This move has ranked hybrid and online channels as leading propellers of accessory sales and ultimately impacted the growth of the fashion accessories market.

How is the fashion accessories market augmented by innovation and technology integration?

Technology has changed fashion accessories into multifunctional products, blending style with utility. Wearable tech, smartwatches, and AR try-on tools create interactive and engaging experiences for consumers. Design innovations and design improve durability, versatility, and comfort. Digital trends like virtual accessories and NFTs expand the concept of ownership into online spaces. This tech-based evolution appeals to young and digitally savvy users while keeping established brands competitive.

Restraints

Counterfeit products and brand imitations negatively impact the market progress

The proliferation of imitation and counterfeit accessories highlights brand sales and equity for legitimate manufacturers. Consumers may choose low-priced replicas, impacting revenue for original brands. Legal enforcement against counterfeits may be slow and high-priced. Online marketplaces have further facilitated the circulation of forged products worldwide. Trust issues grow if consumers inadvertently buy low-class imitations. Counterfeiting limits the industry's growth potential, especially in premium and luxury segments.

Opportunities

How do customization and personalization offer advantages for the development of the fashion accessories market?

Personalized accessories cater to consumers who seek individuality and uniqueness. Bespoke designs, monograms, and AI-based customization improve perceived value. Personalized experiences strengthen emotional connection with the brand. Premium pricing and repeat purchases are common with custom products. Digital tools streamline configuration and production at scale. Rising consumer demand for unique fashion creates a major opportunity for brands in the fashion accessories industry to innovate.

Challenges

Economic fluctuations and inflation restrict the market growth

Inflation or economic downturns lower disposable income, making non-essential items like fashion accessories less affordable. Price-sensitive consumers may shift to cheaper substitutes or delay purchases. Currency variations impact export/import costs for global brands. Premium and luxury segments are especially sensitive to economic instability. Budget planning and pricing strategies are growing more complex for manufacturers. Economic uncertainty slows industry expansion and impacts long-term predictions.

Fashion Accessories Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fashion Accessories Market |

| Market Size in 2024 | USD 799.18 Billion |

| Market Forecast in 2034 | USD 1490.22 Billion |

| Growth Rate | CAGR of 8.10% |

| Number of Pages | 213 |

| Key Companies Covered | Louis Vuitton, Chanel, Gucci, Hermès, Prada, Saint Laurent, Cartier, Tiffany & Co., Ray Ban, Coach, Michael Kors, Kate Spade, Fossil Group, Titan Company, Radley London, and others. |

| Segments Covered | By Product, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, the Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fashion Accessories Market: Segmentation

The global fashion accessories market is segmented based on product, end-user, distribution channel, and region.

Based on product type, the global fashion accessories industry is divided into jewelry, watches, handbags & purses, belts & wallets, sunglasses, and other categories. The jewelry segment registers nearly 40% of the total market. It comprises necklaces, earrings, bracelets, and finger rings, appealing to mass-market and luxury consumers. Its strong gifting demand, fashion relevance, and collectability relevance sustain consistent growth.

On the other hand, the handbags & purses segment ranks second with 25% market share. They blend utility and style, with frequent seasonal trends and brand-driven demand. Premium and designer handbags are major drivers of global revenue growth.

Based on end-user, the global fashion accessories market is segmented into men, women, and children. The women segment dominates the market with 60% share. They fuel demand in handbags, jewelry, scarves, and other fashion stuff. Strong fashion consciousness and a higher inclination toward style variety sustain this dominance.

Conversely, the men segment captures a remarkable share 35%. Demand is backed by wallets, belts, watches, and tech-integrated accessories. Surging interest in lifestyle fashion and personal grooming is expanding men’s accessory consumption.

Based on distribution channel, the global market is segmented into hypermarkets & supermarkets, specialty stores, online, and others. The online sales segment registers nearly 45% of the worldwide market. E-commerce platforms and brand websites offer variety, convenience, and competitive pricing. Rising smartphone penetration and social media influence fuel online adoption.

However, the specialty stores segment holds second position, registering for 35% of the total market. They comprise dedicated accessory shops and brand boutiques that offer curated collections and personalized service. Consumers prefer them for in-store experiences and premium products.

Fashion Accessories Market: Regional Analysis

What gives Europe a competitive edge in the global Fashion Accessories Market?

Europe is anticipated to retain its leading role with a 6-7% CAGR in the global fashion accessories market, driven by strong brand presence and luxury fashion heritage, a large market size and steady growth, and high consumer spending and fashion consciousness. Europe is home to several leading fashion brands, primarily in Italy, France, and the UK. These brands lead worldwide accessory sales and trends with high-class jewelry, watches, and handbags. The long-standing tradition of craftsmanship and luxury appeals to both international and local consumers.

Moreover, the regional market is among the largest worldwide, indicating sustained demand and high-value consumption. Strong retail infrastructure and urban population density support ongoing industry expansion. This augments the region’s leading position in worldwide revenue. Furthermore, European consumers are highly fashion-conscious and willing to invest in accessories to express style. Gen Z and millennials fuel trends, especially in handbags, jewelry, and watches. Their strong buying power sustains elevated levels of market activity throughout the year.

Asia Pacific ranks as the second-largest region, with an 8-9% CAGR in the global fashion accessories industry, driven by rapid economic growth and rising incomes, a young and large consumer base, and mobile-first and digital shopping growth. Asia Pacific has experienced remarkable economic growth across key markets, including India, Southeast Asia, and China. Growing disposable incomes allow more individuals to spend on fashion accessories and lifestyle. This growing spending power expands both premium segments and mass markets.

Moreover, the region has the world’s largest population, with a major share of Gen Z and Millennials. Young consumers prioritize self-expression and trends through accessories like sunglasses, bags, and jewelry. Their fashion engagement drives frequent, high-value purchases.

Additionally, mobile shopping and e-commerce adoption in APAC are outstandingly strong, with social commerce propelling fast purchase cycles. Consumers seamlessly explore and buy accessories online, impacted by influencers and digital trends. This digital momentum augments industry growth.

Fashion Accessories Market: Competitive Analysis

The leading players in the global fashion accessories market are:

- Louis Vuitton

- Chanel

- Gucci

- Hermès

- Prada

- Saint Laurent

- Cartier

- Tiffany & Co.

- Ray Ban

- Coach

- Michael Kors

- Kate Spade

- Fossil Group

- Titan Company

- Radley London

What are the key trends in the global Fashion Accessories Market?

Smart and tech‑integrated accessories:

Wearable tech like connected bracelets, smartwatches, and jewelry with notification features or health-monitoring is blending fashion with functionality. Beyond style, these products attract consumers who seek lifestyle integration and convenience, such as notifications, fitness tracking, and mobile payments. This segment is growing rapidly, mainly among Gen Z and Millennials, who value tech-savvy, multifunctional items.

Personalized and custom accessories:

Customization has become a key propeller of accessory purchases, with consumers seeking engraved jewelry, tailor-made belts, and monogrammed handbags. Personalized products offer a sense of emotional connection and individuality that standard items cannot. Several brands are increasingly offering online tools for real-time customization, turning the shopping experience into a premium-focused and interactive journey.

Eco‑friendly and sustainable accessories:

Consumers are increasingly demanding products that reduce environmental impact, such as jewelry made from recycled metals, sunglasses made with bio-based plastics, or handbags made from vegan leather. Brands are highlighting transparency in ethical and sourcing manufacturing to appeal to conscious shoppers. This trend not only supports global sustainability goals but also builds brand loyalty among young consumers who prefer eco-friendly purchases.

The global fashion accessories market is segmented as follows:

By Product

- Jewelry

- Watches

- Handbags & Purses

- Belts & Wallets

- Sunglasses

- Others

By End-User

- Men

- Women

- Children

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed