DIY Home Improvement Market Size, Share, Growth & Forecast 2034

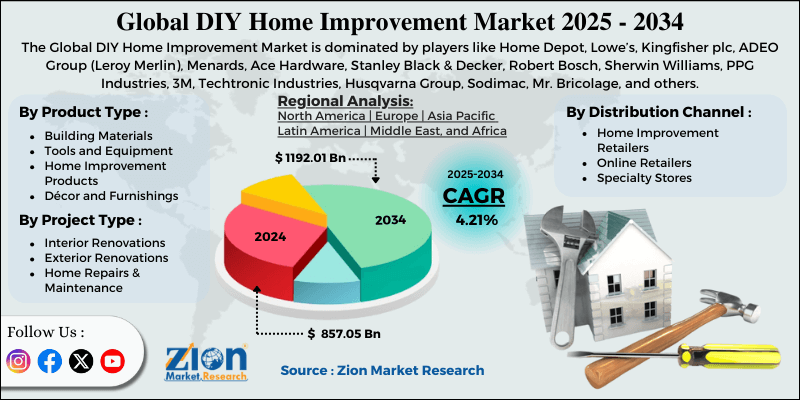

DIY Home Improvement Market By Product Type (Building Materials, Tools and Equipment, Home Improvement Products, and Decor and Furnishings), By Project Type (Interior Renovations, Exterior Renovations, and Home Repairs & Maintenance), By Distribution Channel (Home Improvement Retailers, Online Retailers, Specialty Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

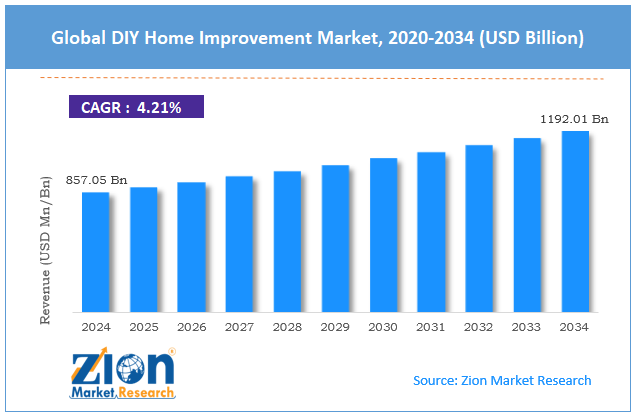

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 857.05 Billion | USD 1192.01 Billion | 4.21% | 2024 |

DIY Home Improvement Industry Perspective:

What will be the size of the global DIY home improvement market during the forecast period?

The global DIY home improvement market size was around USD 857.05 billion in 2024 and is projected to reach USD 1192.01 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.21% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global DIY home improvement market is estimated to grow annually at a CAGR of around 4.21% over the forecast period (2025-2034)

- In terms of revenue, the global DIY home improvement market size was valued at around USD 857.05 billion in 2024 and is projected to reach USD 1192.01 billion by 2034.

- The DIY home improvement market is projected to grow significantly, driven by rising renovation and remodeling activities, urbanization and housing expansion, and technological advancements in tools and materials.

- Based on product type, the tools and equipment segment is expected to lead the market, while the building materials segment is expected to grow considerably.

- Based on project type, the home repairs & maintenance segment is the largest, while the interior renovations segment is projected to record sizeable revenue over the forecast period.

- Based on distribution channel, the home improvement retailers segment is expected to lead the market compared to the ‘online retailers’ segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

DIY Home Improvement Market: Overview

DIY home improvement allows homeowners to improve their living spaces through hands-on projects, from painting walls and installing shelves to landscaping or updating fixtures. It includes cost savings, creativity, and personal satisfaction, allowing users to customize their rooms and other spaces to reflect their style while learning practical skills. The global DIY home improvement market is likely to expand rapidly, fueled by increasing homeownership, aging housing stock, economic incentives and cost savings, and the growth of digital platforms and e-commerce. As more individuals buy older properties and homes need upkeep, the demand for DIY projects increases. Homeowners steadily focus on enhancing functionality and aesthetics. Simple renovations and maintenance tasks are usually tackled without professional help. These trends augment steady growth in the worldwide market.

Moreover, DIY projects are usually more affordable than hiring specialists. Homeowners save costs while still improving their living spaces. This cost-consciousness approach is majorly attractive during economic uncertainty. It motivates experimentation and normal small-scale projects. Furthermore, online shopping makes materials, tools, and tutorials broadly accessible. The convenience of information and delivery reduces obstacles to entry. Consumers are therefore more confident about taking on new projects.

Despite growth, the global market is impeded by factors such as skill and confidence barriers and safety and liability concerns. Many consumers hesitate due to a lack of expertise. Fear of damage or mistakes restricts the project scope. Inexperienced DIYers may need extensive research or support. This may slow the adoption of complicated home improvements. Likewise, some tasks involve risks, such as structural or electrical work. Without proper knowledge, mishaps may occur. Code or legal issues may arise from improper installations. Safety concerns limit some DIY projects to professionals.

Nonetheless, the global DIY home improvement industry stands to gain from a few key opportunities, like educational and community platforms and connected and smart home solutions. Tutorials, workshops, and online courses empower consumers. Learning resources build skills and confidence. Communities encourage sharing tips and successes. Education propels more ambitious and frequent DIY projects. Additionally, user-friendly smart home devices offer fresh opportunities. Homeowners can implement technological upgrades without professional help. Connectivity and automation appeal to tech-savvy people. This trend expands the scope of DIY beyond traditional tasks.

DIY Home Improvement Market: Dynamics

Growth Drivers

How are affordability pressures & economic uncertainty fueling the DIY home improvement market?

Economic pressures like inflation, high interest rates, and stagnant property markets have prompted homeowners to enhance rather than move, leading to a rise in DIY renovations. With borrowing costs increased, spending on small-to-medium projects has become more appealing than large professional jobs. In regions where house price growtha has stalled, users are choosing budget-friendly DIY improvements over expensive relocations or significant remodeling. This affordability-driven mindset sustains steady DIY demand even in uncertain weather conditions. Cost savings remain a core motivator for DIY engagement in income brackets.

How is the DIY home improvement market driven by digital accessibility & online knowledge resources?

The proliferation of digital content, step-by-step guides, tutorials, and influencer project videos has remarkably reduced barriers to entry for DIY homeowners. Platforms like TikTok and YouTube serve as online workshops where millions of users learn skills like woodworking and tiling. Search interest in DIY home improvement projects continues to climb each year, signaling rising consumer confidence in tackling tasks independently, boosting sales, and fueling the DIY home improvement market. AR and mobile planning tools also help individuals visualize outcomes before buying products. This democratization of knowledge is driving greater participation in DIY activities worldwide.

Restraints

Upfront tool & material costs negatively impact the market progress

Although DIY saves money on labor, upfront purchases of quality materials and specialized tools could be challenging. For occasional DIYers, investing in tools used only once increases the effective cost of the project. This obstacle is particularly acute for low-income households or younger homeowners on tight budgets. Financing options for suppliers and tools are less prevalent than for professional services. Consequently, cost sensitivity hampers participation in more ambitious or larger DIY projects.

Opportunities

How do smart home integration & plug‑and‑play tech create promising avenues for the DIY home improvement industry growth?

The rise in consumer adoption of smart devices offers DIYers opportunities to gradually upgrade their living spaces. Easy-install smart thermostats, security systems, and lighting systems appeal to tech-oriented homeowners who prefer self-installation. Bundling smart kits with clear guidance lessens perceived complexity and increases the DIY product ecosystem. Associations between home improvement retailers and smart tech brands increase convenience and reach. This trend connects lifestyle enhancement with hands-on improvement efforts, positively impacting the DIY home improvement industry.

Challenges

Supply chain volatility & price fluctuations restrict the market growth

Varying prices for steel, lumber, and key building materials increase project uncertainty for consumers who budget tightly. Supply chain disruptions may lead to inventory shortages or delays, disrupting project schedules. Smaller DIY purchasers may last in line when demand increases, further inhibiting planning. Price volatility also complicates users' compare-and-shop decisions. These economic pressures may reduce consumer confidence and hinder project initiation.

DIY Home Improvement Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | DIY Home Improvement Market |

| Market Size in 2024 | USD 857.05 Billion |

| Market Forecast in 2034 | USD 1192.01 Billion |

| Growth Rate | CAGR of 4.21% |

| Number of Pages | 216 |

| Key Companies Covered | Home Depot, Lowe’s, Kingfisher plc, ADEO Group (Leroy Merlin), Menards, Ace Hardware, Stanley Black & Decker, Robert Bosch, Sherwin Williams, PPG Industries, 3M, Techtronic Industries, Husqvarna Group, Sodimac, Mr. Bricolage, and others. |

| Segments Covered | By Product Type, By Project Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

DIY Home Improvement Market: Segmentation

The global DIY home improvement market is segmented based on product type, project type, distribution channel, and region.

Based on product type, the global DIY home improvement industry is divided into building materials, tools and equipment, home improvement products, and décor and furnishings. The building materials segment captured 54% of the market share, as DIYers often need materials such as paint, wood, cement, and tiles for maintenance, structural, and renovation projects. These are high-volume purchases, but are much less recurring than tools.

On the other hand, the tools and equipment segment held nearly 40% of the market share, as these are essential for almost all DIY projects, from basic repairs to complex renovations. They are bought repeatedly and in multiple types, making them the fastest-growing revenue-generating category.

Based on project type, the global DIY home improvement market is segmented into interior renovations, exterior renovations, and home repairs & maintenance. The home repairs and maintenance segment holds nearly 44% of the market share. The segment comprises routine maintenance, such as electrical repairs, plumbing fixes, small-scale renovations, and painting, which homeowners frequently perform, making it the high-volume, most consistent category.

Conversely, the interior renovations segment is the fastest-growing, accounting for approximately 40% of the market. These comprise upgrading kitchens, flooring, bathrooms, décor, and more inside the home. While less frequent than repairs, interior projects usually require more materials and tools, which can drive significant market value.

Based on distribution channel, the global market is segmented into home improvement retailers, online retailers, and specialty stores. The home improvement retailers segment registered nearly 72% of the market. These large-format stores offer a broader range of materials, tools, and products under one roof, making them the convenient choice for DIY consumers.

However, the online retailers segment ranks second with 25% market share. E-commerce platforms have grown rapidly due to a wide selection, convenience, and home delivery, appealing to tech-savvy consumers, particularly for décor, small tools, and specialty items.

DIY Home Improvement Market: Regional Analysis

What gives North America a competitive edge in the global DIY Home Improvement Market?

North America is anticipated to retain its leading role in the global DIY home improvement market, with a 3.9% CAGR, driven by high market share, strong homeowner engagement, a high homeownership rate, and a well-developed retail and distribution infrastructure. North America accounts for nearly 44% of the global market, reflecting its leading role among regions. The US alone accounts for a leading share, with a large percentage of households engaging in at least one DIY project every year. This extensive participation fuels strong retail demand and frequent product turnover.

Moreover, the region holds a high homeownership rate and an aging housing base, fueling consistent renovation and maintenance activity. Older homes need regular repairs and updates, triggering homeowners to choose DIY over expensive professional services. This lifelong cycle of upkeep sustains a strong industry for tools, materials, and equipment. Furthermore, the region benefits from a deeply penetrated network of big-box home improvement retailers and specialty stores, making products broadly accessible. Chains with both online and physical presence simplify purchases of materials, tools, and décor for consumers. This infrastructure drives convenience and encourages repeat DIY purchases.

Europe ranks as the second-largest region, with a 3.4% CAGR in the global DIY home improvement industry, driven by substantial market share, a well-established consumer base, sustainability and energy efficiency, and strong retail networks and sophisticated distribution. Europe accounts for 25-30% of the global market, making it the second-largest region after North America. Strong participation from major nations such as France, Germany, and the UK fuels consistent demand. This wide regional footprint sustains high overall revenues.

Moreover, European homeowners increasingly choose energy-efficient, sustainability-oriented projects due to environmental regulations and priorities. This increases the demand for eco-friendly materials, insulation, and energy-efficient upgrades. Renovations that reduce energy usage are now a leading propeller of DIY spending. Additionally, Europe features a sophisticated retail landscape with big DIY chains and specialty stores offering broader assortments of materials, tools, and décor. These networks make products equally accessible in rural and urban areas. Retail infrastructure supports both in-store and online consumer engagement.

DIY Home Improvement Market: Competitive Analysis

The leading players in the global DIY home improvement market are:

- Home Depot

- Lowe’s

- Kingfisher plc

- ADEO Group (Leroy Merlin)

- Menards

- Ace Hardware

- Stanley Black & Decker

- Robert Bosch

- Sherwin Williams

- PPG Industries

- 3M

- Techtronic Industries

- Husqvarna Group

- Sodimac

- Mr. Bricolage

DIY Home Improvement Market: Key Market Trends

Hybrid & multifunctional living spaces:

As remote work and compact living become more prevalent, DIY projects focus on multifunctional, space-saving solutions such as foldaway furniture, built-in storage, and flexible room layouts. This trend focuses practically without sacrificing style. Consumers prioritize projects that maximize space utility and improve daily living.

Omnichannel shopping & digital engagement:

DIY buyers steadily blend in-store and online experiences, researching products online, using mobile applications in stores, and opting for click-and-collect options for better convenience. Retailers are rapidly adopting unified commerce models and modernized digital tools. This fluid channel behavior improves accessibility and supports informed DIY purchases.

The global DIY home improvement market is segmented as follows:

By Product Type

- Building Materials

- Tools and Equipment

- Home Improvement Products

- Décor and Furnishings

By Project Type

- Interior Renovations

- Exterior Renovations

- Home Repairs & Maintenance

By Distribution Channel

- Home Improvement Retailers

- Online Retailers

- Specialty Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed