Colon Cancer Diagnostic Market Size, Share, Trends, Growth 2034

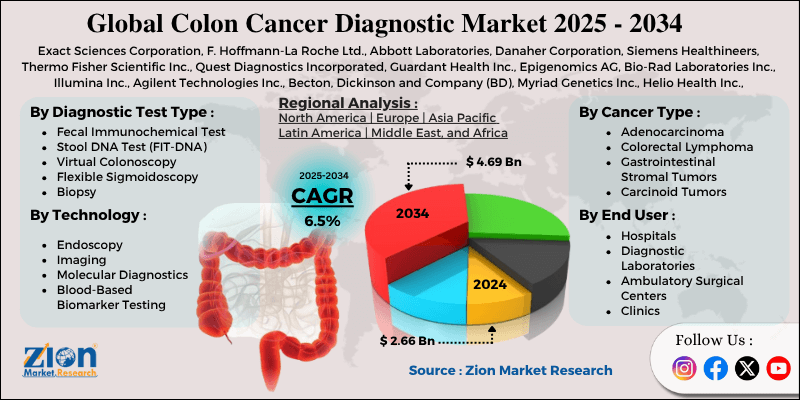

Colon Cancer Diagnostic Market By Diagnostic Test Type (Colonoscopy, Fecal Occult Blood Test [FOBT], Fecal Immunochemical Test [FIT], Stool DNA Test [FIT-DNA], Virtual Colonoscopy, Flexible Sigmoidoscopy, Biopsy), By Technology (Endoscopy, Imaging, Molecular Diagnostics, Blood-Based Biomarker Testing, Immunohistochemistry), By Cancer Type (Adenocarcinoma, Colorectal Lymphoma, Gastrointestinal Stromal Tumors, Carcinoid Tumors, and Others), By End-User (Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Clinics), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

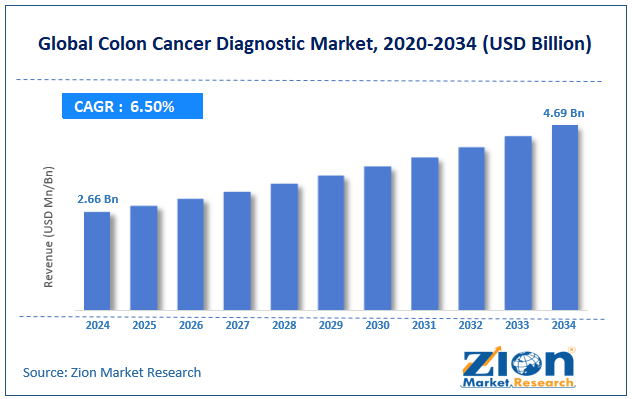

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.66 Billion | USD 4.69 Billion | 6.5% | 2024 |

Colon Cancer Diagnostic Industry Perspective:

The global colon cancer diagnostic market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 4.69 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034.

Colon Cancer Diagnostic Market: Overview

Colon cancer diagnostics comprise a range of medical procedures and tests used to detect colorectal cancer at an early stage, thereby increasing survival rates and enhancing patient outcomes. Standard diagnostic techniques comprise fecal occult blood tests, colonoscopy, stool DNA tests, biomarker-based blood tests, and CT colonography. The global colon cancer diagnostic market is poised for notable growth, owing to government reimbursement support and screening programs, improvements in diagnostic tools, and rising adoption of non-invasive tests. Governments are increasingly backing colorectal cancer testing via reimbursement policies and funded programs.

In the United States, the CDC's CRCCP has increased access for underserved populations. These programs promote early diagnosis and a surge in the adoption of these tests. Advancements such as digital pathology, CT colonography, and AO-based colonoscopy improve diagnostic efficiency and accuracy. These tools offer enhanced detection of precancerous tumors and polyps. Their integration in routine testing is changing the way diagnostics are performed.

Moreover, non-invasive screening tools, such as stool DNA tests and fecal immunochemical tests (FIT), are gaining traction. These tools enhance compliance and reduce patient discomfort, particularly among reluctant and elderly populations. Their convenience fuels growth in the number of diagnostic tests.

Nevertheless, the global market faces limitations due to factors such as the high cost of advanced diagnostic procedures, and the invasive nature of colonoscopy dampens screenings. Advanced tools like molecular diagnostics and CT colonography are expensive, usually restricting their accessibility. Patients in uninsured regions and budget-conscious groups experience affordability obstacles. These costs may hamper industry penetration and broader adoption.

Also, colonoscopy is invasive and uncomfortable for several patients. Anxiety, procedural risks, and bowel prep often prevent individuals from undergoing timely screening. This adversely impacts the diagnostic adoption rate. Still, the global colon cancer diagnostic industry benefits from several favorable factors, including growth in digital diagnostics and improvements in genomics and liquid biopsy. At-home screenings and post-pandemic solutions have gained tremendous traction for their convenience and privacy.

Companies offering main-in diagnostic kits are experiencing higher adoption. This trend supports the decentralization of screening for the said cancer. Liquid biopsy methods allow early and non-invasive detection of diseases through blood samples. These tests are refined to detect colon cancer with high sensitivity. Further, genomic screening enables early intervention and personalized risk assessment.

Key Insights:

- As per the analysis shared by our research analyst, the global colon cancer diagnostic market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034)

- In terms of revenue, the global colon cancer diagnostic market size was valued at around USD 2.66 billion in 2024 and is projected to reach USD 4.69 billion by 2034.

- The colon cancer diagnostic market is projected to grow significantly owing to rising cases of colorectal cancer, increasing global healthcare expenditure, and improvements in diagnostic technologies.

- Based on diagnostic test type, the Colonoscopy, Fecal Occult Blood Test (FOBT) segment is expected to lead the market. In contrast, the Fecal Immunochemical Test (FIT) segment is expected to grow considerably.

- Based on technology, the endoscopy is the dominating segment, while the molecular diagnostics segment is projected to witness sizeable revenue over the forecast period.

- Based on cancer type, the adenocarcinoma segment dominates the market, while the carcinoid tumors segment is projected to flourish considerably.

- Based on end user, the hospitals segment is expected to lead the market compared to the diagnostic laboratories segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Colon Cancer Diagnostic Market: Growth Drivers

Growing patient engagement and rising awareness via digital platforms propel the market growth

Consumer awareness of colon cancer symptoms, the significance of early diagnosis, and risk factors is surging globally. Campaigns like Colorectal Cancer Awareness Month (March) and encouragement by organizations like Flight CRC have positively impacted screening rates, mainly among the at-risk population. This awareness and programs worldwide have remarkably progressed the colon cancer diagnostic market.

Additionally, the adoption of digital health applications, telehealth platforms, and wearable health trackers has aided proactive health monitoring and enhanced patient compliance with screening schedules.

Technological improvements in diagnostic tools notably fuel the industry growth

The advancement of modern diagnostic methods, including next-generation sequencing, AI-based colonoscopy systems, molecular biomarkers, and liquid biopsies, is significantly enhancing the efficiency and accuracy of colon cancer detection. Technologies like Exact Sciences' Cologuard and Guardant Health’s Guardant360 are highly preferred due to their high specificity and non-invasive nature.

Colon Cancer Diagnostic Market: Restraints

Missed diagnoses and the risk of false negatives hinder the market's progress

Although advancements have enhanced diagnostic accuracy, missed lesions and false negatives still occur, which can lower patient and clinicians' confidence. For example, studies published in 2024 by JAMA Oncology revealed that conventional colonoscopy may miss nearly 27% of sessile or flat serrated adenomas, which are more prone to becoming cancerous. Likewise, painless stool-based tests, although appropriate, may not detect all high-risk polyps.

Colon Cancer Diagnostic Market: Opportunities

Rising investments in digital pathology and AI contribute to the market growth

Artificial intelligence is highly preferred for the diagnosis of colon cancer for polyp detection, image analysis, pathology automation, and risk stratification. Systems like Iterative Scopes' SKOUT and Medtronic's GI Genius use artificial intelligence to improve the accuracy of colonoscopies by highlighting doubtful lesions in real-time, thereby contributing to the colon cancer diagnostic industry.

The FDA authorized many AI-based platforms, including an AI-based colon polyp classifier launched by DeepMed IO, presenting opportunities for worldwide commercial rollouts.

Colon Cancer Diagnostic Market: Challenges

Diagnostic variability and inaccuracy in test performance limit the industry's growth

Despite technological advancements, no single diagnostic test provides 100% precision. For instance, while colonoscopy is regarded as the gold standard, it misses early 25% of small or flat adenomas, as per JAMA Oncology, 2024. Likewise, stool DNA and FIT tests have less sensitivity for detecting precancerous lesions or advanced adenomas.

Moreover, test performance usually depends on population genetics, operator expertise, and lab quality. In low-tier and rural facilities, technician error or poor equipment may give false negatives, delaying further treatment.

Colon Cancer Diagnostic Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Colon Cancer Diagnostic Market |

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2034 | USD 4.69 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 214 |

| Key Companies Covered | Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Danaher Corporation, Siemens Healthineers, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Guardant Health Inc., Epigenomics AG, Bio-Rad Laboratories Inc., Illumina Inc., Agilent Technologies Inc., Becton, Dickinson and Company (BD), Myriad Genetics Inc., Helio Health Inc., and others. |

| Segments Covered | Diagnostic Test Type, By Technology, By Cancer Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Colon Cancer Diagnostic Market: Segmentation

The global colon cancer diagnostic market is segmented based on diagnostic test type, technology, cancer type, end user, and region.

Based on diagnostic test type, the global colon cancer diagnostic industry is divided into colonoscopy, fecal occult blood test (FOBT), fecal immunochemical test (FIT), stool DNA test (FIT-DNA), virtual colonoscopy, flexible sigmoidoscopy, and biopsy. The colonoscopy and fecal occult blood test (FOBT) segment fuels the market owing to its ability to detect and eradicate polyps, as well as its high accuracy in a single process.

Conversely, the fecal immunochemical test (FIT) segment has made considerable progress, primarily due to its painless nature, rising adoption in national screening programs, and ease of use, particularly in the UK, the U.S., and Japan.

Based on technology, the global market is segmented into endoscopy, imaging, molecular diagnostics, blood-based biomarker testing, and immunohistochemistry. The endoscopy segment registers a notable market share, owing to its dual role in treatment and diagnosis, along with direct visualization potential.

On the other hand, the molecular diagnostics segment holds a second-leading position, fueled by improvements in stool DNA tests, genetic testing, and liquid biopsies.

Based on cancer type, the global colon cancer diagnostic market is segmented as adenocarcinoma, colorectal lymphoma, gastrointestinal stromal tumors, carcinoid tumors, and others. The adenocarcinoma segment leads the global market due to its high cases requiring significant volumes of diagnostic procedures.

Nonetheless, the carcinoid tumors segment ranks second in the global market, although they account for a smaller share of colorectal cancers. This is attributed to enhancements in imaging and biopsy techniques and rising awareness, which strengthens their relevance in the industry.

Based on end-user, the global market is segmented into hospitals, diagnostic laboratories, ambulatory surgical centers, and clinics. The hospitals segment captured the majority market share due to their comprehensive diagnostic infrastructure, including endoscopy units, pathology labs, and advanced imaging capabilities.

However, the diagnostic laboratories segment holds a secondary position in the global market, as they play a vital role in processing blood-based biomarkers, stool tests, and molecular diagnostics.

Colon Cancer Diagnostic Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is projected to maintain its dominant position in the global colon cancer diagnostic market owing to high incidences of colon cancer, well-established screening initiatives, and an advanced healthcare ecosystem. North America, mainly the United States, holds a leading number of colon cancer cases. More than 1,50,000 fresh colon cancer cases were diagnosed in the United States in 2023, according to the American Cancer Society. This high prevalence fuels considerable demand for advanced and early diagnostic services. The region also has a strong and structured colon cancer screening initiative.

The United States PSTF commends routine screening starting at age 45, backed by private insurers and Medicare. High screening coverage contributes to early intervention and strong industry demand. Furthermore, the region benefits from mature diagnostic infrastructure, including AI-based endoscopy, molecular labs, and virtual colonoscopy. These tools are broadly available in specialty centers and hospitals.

Europe maintains its position as the second-leading region in the global colon cancer diagnostic industry due to strong public healthcare systems, robust ecosystem for diagnostic techniques, and surging adoption of home-based testing. Europe's general healthcare architecture promises better accessibility of colon cancer diagnostics, which are often available at low or no cost to the public. This boosts compliance with routine screening and follow-ups. Nations like Sweden and the Netherlands have high screening participation because of strong healthcare access.

Moreover, European healthcare systems are well-equipped with advanced technologies comprising AI-based imaging, virtual colonoscopy, and molecular diagnostics. Institutions like INSERM in France or the NHS in the UK support superior diagnostic reach. This technological availability boosts the region's diagnostic capabilities. Europe is also experiencing a rise in demand for painless tests, such as FIT-DNA or FIT, especially following the pandemic. For instance, Belgium and Spain report an increase in the use of home-based kits for colorectal screening. This shift boosts diagnostic test numbers and enhances participation.

Colon Cancer Diagnostic Market: Competitive Analysis

The key operating players in the global colon cancer diagnostic market are:

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Danaher Corporation

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated

- Guardant Health Inc.

- Epigenomics AG

- Bio-Rad Laboratories Inc.

- Illumina Inc.

- Agilent Technologies Inc.

- Becton

- Dickinson and Company (BD)

- Myriad Genetics Inc.

- Helio Health Inc.

Colon Cancer Diagnostic Market: Key Market Trends

Improvements in molecular diagnostics and liquid biopsy:

Liquid biopsy solutions are gaining prominence for the early detection of colon cancer, utilizing blood samples to detect gene mutations or circulating tumor DNA (ctDNA). Molecular diagnostics enable targeted screening and personalized risk profiling. These advancements are enabling non-invasive, earlier, and more precise detection methods.

Growth of screening rules to younger populations:

Following growing incidences in young adults, many health agencies, such as the USPSTF, have reduced the screening age to 45 from 50. This expands the target demographic for diagnostics, fueling high test volumes. The trend reflects a proactive move in early intervention policies globally.

The global colon cancer diagnostic market is segmented as follows:

By Diagnostic Test Type

- Colonoscopy, Fecal Occult Blood Test (FOBT)

- Fecal Immunochemical Test (FIT)

- Stool DNA Test (FIT-DNA)

- Virtual Colonoscopy

- Flexible Sigmoidoscopy

- Biopsy

By Technology

- Endoscopy

- Imaging

- Molecular Diagnostics

- Blood-Based Biomarker Testing

- Immunohistochemistry

By Cancer Type

- Adenocarcinoma

- Colorectal Lymphoma

- Gastrointestinal Stromal Tumors

- Carcinoid Tumors

- Others

By End User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Clinics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Colon cancer diagnostics comprise a range of medical procedures and tests used to detect colorectal cancer at a primary stage, increasing survival rates and enhancing patient outcomes. Standard diagnostic techniques comprise fecal occult blood tests, colonoscopy, stool DNA tests, biomarker-based blood tests, and CT colonography.

The global colon cancer diagnostic market is projected to grow due to rising awareness of early cancer detection, expansion of screening programs, and surging demand for personalized medicine.

According to study, the global colon cancer diagnostic market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 4.69 billion by 2034.

The CAGR value of the colon cancer diagnostic market is expected to be around 6.5% during 2025-2034.

North America is expected to lead the global colon cancer diagnostic market during the forecast period.

The key players profiled in the global colon cancer diagnostic market include Exact Sciences Corporation, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Danaher Corporation, Siemens Healthineers, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Guardant Health, Inc., Epigenomics AG, Bio-Rad Laboratories, Inc., Illumina, Inc., Agilent Technologies, Inc., Becton, Dickinson and Company (BD), Myriad Genetics, Inc., and Helio Health, Inc.

The report examines key aspects of the colon cancer diagnostic market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed