Dog DNA Test Market Size Report, Industry Share, Analysis, Forecast 2034

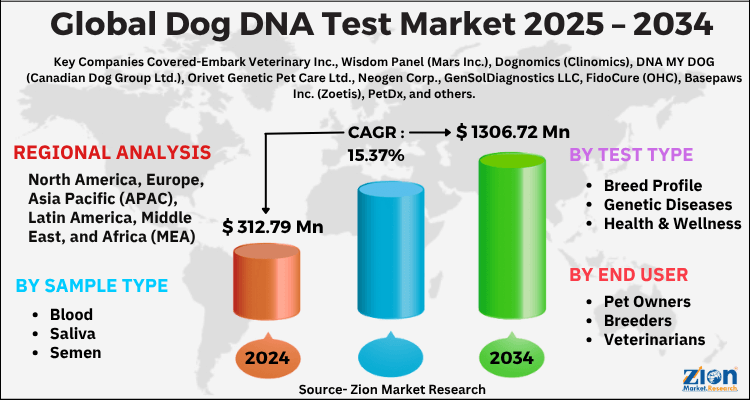

Dog DNA Test Market By Sample Type (Blood, Saliva, Semen, Others), By Test Type (Breed Profile, Genetic Diseases, Health & Wellness), By End User (Pet Owners, Breeders, Veterinarians), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 312.79 Million | USD 1306.72 Million | 15.37% | 2024 |

Dog DNA Test Market: Industry Perspective

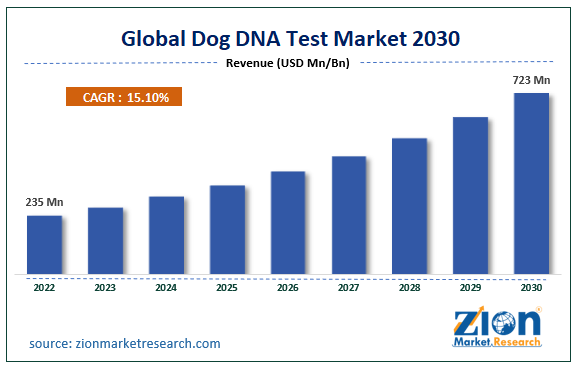

The global dog DNA test market size was worth around USD 312.79 Million in 2024 and is predicted to grow to around USD 1306.72 Million by 2034 with a compound annual growth rate (CAGR) of roughly 15.37% between 2025 and 2034. The report analyzes the global dog DNA test market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the dog DNA test industry.

The report analyzes the global Dog DNA Test market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Dog DNA Test industry.

DOG DNA TEST Market: Overview

A dog's biology is examined using a dog DNA test, a scientific technique that reveals details about a dog's origin, genetic health indicators, and probable propensity for specific diseases. A tiny sample of the dog's cells is normally obtained for this non-invasive test using a cheek swab or blood sample. The DNA sequence of the dog is then decoded using cutting-edge methods in a laboratory using the genetic material that was collected from the sample. The main objective of a dog DNA test includes breed identification, ancestry tracing, health screening, traits & behavior prediction, and others.

Key Insights

- As per the analysis shared by our research analyst, the global dog DNA test market is estimated to grow annually at a CAGR of around 15.37% over the forecast period (2025-2034).

- Regarding revenue, the global dog DNA test market size was valued at around USD 312.79 Million in 2024 and is projected to reach USD 1306.72 Million by 2034.

- The dog DNA test market is projected to grow at a significant rate due to increasing pet adoption, rising consumer interest in personalized pet healthcare, advancements in genetic testing technologies, and growing awareness among pet owners about the benefits of genetic testing.

- Based on Sample Type, the Blood segment is expected to lead the global market.

- On the basis of Test Type, the Breed Profile segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Pet Owners segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Dog DNA Test Market: Growth Drivers

Increasing pet adoption along with a growing curiosity for breed identification drives the market

The increasing pet adoption along with a growing curiosity for breed identification is expected to propel the global dog DNA test market expansion over the analysis period. For instance, according to RAINWALK PET Insurance, in America, 4.1 million animals are adopted annually, with 2 million dogs and 2.1 million cats. In addition, particularly for mixed-breed dogs or rescues with unknown origins, many dog owners are interested in understanding the breeds of their pets. Finding out a dog's genetic ancestry and the many breeds included in its pedigree may be both entertaining and educational due to dog DNA tests. DNA testing has become increasingly popular as a result of people's desire to learn more about a dog's heritage and characteristics. For instance, mixed-breed dogs are the most widely adopted canine breed, according to HumanePro adoption data. In 2021, 54% of all dogs that are owned will be classified as mixed-breed or mongrel dogs. Thus, these facts support the growth of the market during the forecast period.

Dog DNA Test Market: Restraints

High cost and lack of standardization limit the market growth

The high cost of doing pet DNA testing is one of the main factors that can serve as a constraint on worldwide dog DNA test market sales value. Financially strapped pet owners should take note of this in particular. With additional fees for disease detection, the starting price for canine DNA testing is about USD 100. Additionally, the pet DNA testing sector is still mostly unregulated, and there is a severe lack of standardization, which results in inconsistent and inaccurate test findings. Thus, the high cost and lack of standardization might be hampering the growth of the market over the forecast period.

Dog DNA Test Market: Opportunities

Growing collaboration offers a significant opportunity

Increasing collaboration in the dog DNA test industry is expected to offer an attractive opportunity for market growth over the forecast period. For instance, in January 2023, one of the largest open-access cat and dog genome databases was made possible due to a collaboration between Mars Petcare and the Broad Institute of MIT and Harvard, a global leader in the genetic and molecular research of diseases. Over the next ten years, the MARS PETCARE BIOBANKTM effort will sequence the genomes of 10,000 dogs and 10,000 cats. Future generations of dogs and cats may benefit from more tailored pet health care due to insights from the open-access database. The National Center for Biotechnology Information (NCBI) Sequence Read Archive will make the 20,000 pets' complete genome sequences and variant data available to the public. This will allow for scientific research into a variety of topics, including the detailed ancestry of dog and cat breeds, novel genetic mutations specific to the particular dog and cat breeds and how they relate to diseases, and the aging process of pets. Thus, this is expected to drive the market growth.

Dog DNA Test Market: Challenges

Privacy concern poses a major challenge to the market growth

Despite the numerous precautions implemented by experts in the pet DNA testing sector, pet owners continue to have serious concerns about the possibility of genetic data on pets being leaked. The sharing of a pet's DNA information with other people might not be acceptable to certain people. Professionals must guarantee that the data is safe and does not violate privacy in any manner to prevent such problems. Although a positive quality, the increased competition has left many players behind since they failed to take timely distinguishing actions.

Dog DNA Test Market: Segmentation

The global Dog DNA Test industry is segmented based on sample type, test type, end-user, and region.

Based on the sample type, the global market is bifurcated into blood, saliva, semen, and others. The saliva segment is expected to dominate the market over the forecast period. In comparison to other methods of sample collection, taking a saliva sample from a dog's jowl is far more convenient. Dog saliva must be specially prepared before being sent to the lab since it includes a lot of pathogenic agents. For instance, some DNA test kits advise mixing the animal's saliva with water to lower the possibility of sample contamination. On the other hand, the blood segment is expected to capture a significant market share over the forecast period. Blood samples are used in pet DNA testing, which is a painless and easy technique to detect genetic or hereditary disorders in animals. Typically, these tests include taking blood from an animal's vein and safely transferring it to the designated laboratory. Leading companies in the sector, including NeoGen Corp., provide canine SNP (Single Nucleotide Polymorphisms) & STR (Short Tandem Repeats) Parentage semen sample DNA test kits. Compared to traditional STR tests, which only detect STRs, this DNA test is more efficient in differentiating between closely related sires. Thereby, driving the segment growth.

Based on the test type, the global Dog DNA Test industry is divided into breed profile, genetic diseases, and health & wellness. The health & wellness segment is expected to grow at the highest CAGR over the forecast period. Some pet breeds have shorter life expectancy rates and are far more susceptible to inheritable diseases. To assess the acceptable risk of genetic diseases in purebred, mixed-breed, and hybrid pets, a thorough genetic attribute profile must be completed. Individual genetic DNA testing can be carried out to determine the specific medical condition in question when the breed mix of a particular pet is already known to be associated with a specific disease risk. Thus, this is expected to drive segment growth over the analysis period.

Based on end-user, the dog DNA test market is segmented into pet owners, breeders, and veterinarians. Breeders segment is expected to dominate the market over the forecast period. Breeders all across the world are working to create better dogs with desirable characteristics to meet the needs of future owners. Owners are increasingly seeking animals with superior health and abilities in certain duties, in addition to physical characteristics such as beautiful fur color, eye color, height, weight, and other attributes. Due to these reasons, breeders are currently educating themselves about various breed combinations and potential mating to meet consumer preferences. Thereby, propelling the segment growth.

Dog DNA Test Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dog DNA Test Market |

| Market Size in 2024 | USD 312.79 Million |

| Market Forecast in 2034 | USD 1306.72 Million |

| Growth Rate | CAGR of 15.37% |

| Number of Pages | 229 |

| Key Companies Covered | Embark Veterinary Inc., Wisdom Panel (Mars Inc.), Dognomics (Clinomics), DNA MY DOG (Canadian Dog Group Ltd.), Orivet Genetic Pet Care Ltd., Neogen Corp., GenSolDiagnostics LLC, FidoCure (OHC), Basepaws Inc. (Zoetis), PetDx, and others. |

| Segments Covered | By Sample Type, By Test Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dog DNA Test Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to dominate the global dog DNA test market over the forecast period. Dogs are among the most common companion animals in North America, where a sizeable percentage of people keep pets. Dog owners' intense attachment to their canines has encouraged interest in the genetic makeup and general health of their canines. For instance, according to the data given by the ASPCA, every year, some 6.3 million companion animals are brought into animal shelters in the United States. There are about 3.1 million dogs among them. Moreover, in North America, veterinarians are extremely important in helping clients understand the advantages of DNA testing. To help in breed identification, determine health concerns, and create individualized care plans, several veterinarians suggest DNA testing to dog owners. Thus, this is expected to drive the market growth in the region.

Dog DNA Test Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the dog DNA test market on a global and regional basis.

The global Dog DNA Test market is dominated by players like:

- Embark Veterinary Inc.

- Wisdom Panel (Mars Inc.)

- Dognomics (Clinomics)

- DNA MY DOG (Canadian Dog Group Ltd.)

- Orivet Genetic Pet Care Ltd.

- Neogen Corp.

- GenSolDiagnostics LLC

- FidoCure (OHC)

- Basepaws Inc. (Zoetis)

- PetDx

The global Dog DNA Test market is segmented as follows:

By Sample Type

- Blood

- Saliva

- Semen

- Others

By Test Type

- Breed Profile

- Genetic Diseases

- Health & Wellness

By End User

- Pet Owners

- Breeders

- Veterinarians

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A dog's biology is examined using a dog DNA test, a scientific technique that reveals details about a dog's origin, genetic health indicators, and probable propensity for specific diseases. A tiny sample of the dog's cells is normally obtained for this non-invasive test using a cheek swab or blood sample.

The global dog DNA test market is expected to grow due to rising pet ownership, increasing awareness of breed-specific health risks, growing demand for personalized pet care, and expanding advancements in genetic testing technology.

According to a study, the global dog DNA test market size was worth around USD 312.79 Million in 2024 and is expected to reach USD 1306.72 Million by 2034.

The global dog DNA test market is expected to grow at a CAGR of 15.37% during the forecast period.

North America is expected to dominate the dog DNA test market over the forecast period.

The global Dog DNA Test market is dominated by players like Embark Veterinary, Inc., Wisdom Panel (Mars, Inc.), Dognomics (Clinomics), DNA MY DOG (Canadian Dog Group Ltd.), Orivet Genetic Pet Care Ltd., Neogen Corp., GenSolDiagnostics, LLC, FidoCure (OHC), Basepaws, Inc. (Zoetis) and PetDx among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed