Ammonium Sulphate Market Size, Share, Value & Forecast 2034

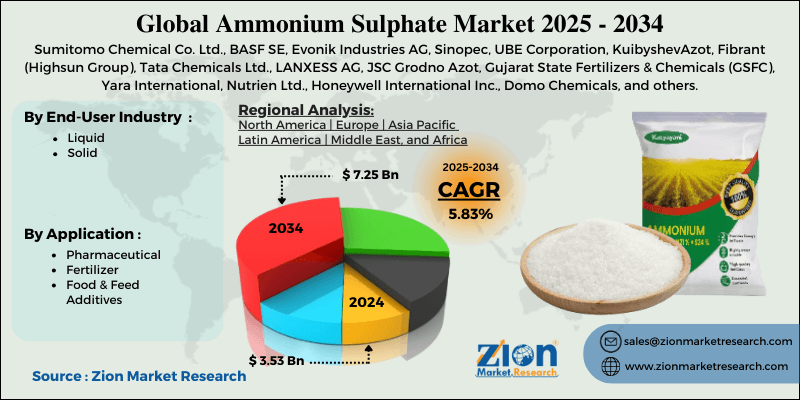

Ammonium Sulphate Market By End-User Industry (Liquid and Solid), By Application (Pharmaceutical, Fertilizer, and Food & Feed Additives), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

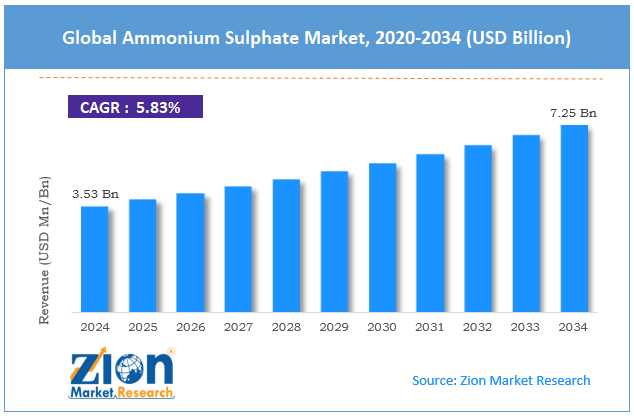

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.53 Billion | USD 7.25 Billion | 5.83% | 2024 |

Ammonium Sulphate Industry Perspective:

What will be the size of the global ammonium sulphate market during the projected period?

The global ammonium sulphate market size was worth around USD 3.53 billion in 2024 and is predicted to grow to around USD 7.25 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.83% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global ammonium sulphate market is estimated to grow annually at a CAGR of around 5.83% over the forecast period (2025-2034)

- In terms of revenue, the global ammonium sulphate market size was valued at around USD 3.53 billion in 2024 and is projected to reach USD 7.25 billion by 2034.

- The ammonium sulphate market is projected to grow at a significant rate due to the rising demand for fertilizers across the globe.

- Based on the end-user industry, the solid segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on the application, the fertilizer segment is anticipated to command the largest market share

- Based on region, the Asia-Pacific is projected to dominate the global market during the forecast period

Ammonium Sulphate Market: Overview

Ammonium sulfate is an inorganic compound with wide applications in the agriculture sector. It is used as a sulfur and nitrogen fertilizer in crop production. According to industry analysis, ammonium sulfate delivers several farming and industrial applications due to its consistent performance and high solubility. Ammonium sulfate appears as a white crystalline compound, and its pH ranges between 5 and 6. Ammonium sulfate is preferred in lawn and crop applications that require sulfur and nitrogen fertilizers. Non-agricultural applications of ammonium sulfate include use as a dough conditioner and as an essential component of fire extinguishers.

Furthermore, it is also applied in the growing textile industry. During the forecast period, demand for ammonium sulfate is expected to continue growing, driven by multiple factors. For instance, increased expansion of the agricultural sector, along with growing use in the pharmaceutical industry, will facilitate improved revenue for industry players. On the other hand, competition from alternative nitrogen-based fertilizers and price volatility of raw materials may impact business decisions in the long run.

Ammonium Sulphate Market: Dynamics

Growth Drivers

How will the surge in fertilizer demand influence ammonium sulfate market growth?

The global ammonium sulphate market is expected to be driven by rising demand for fertilizers across the globe. Ammonium sulphate has a high pH and is therefore used extensively to reduce soil alkalinity. Ammonium sulphate provides access to nitrogenous and sulfur components, making it highly suitable to enhance crop yield and overall quality. Furthermore, it can be used easily in combination with nitrogen fertilizers, further improving product end applications. The growing global food demand and increasing efforts to reduce crop damage will facilitate improved revenue for players providing ammonium sulphate.

According to industry research, arable land is rapidly decreasing, which is facilitating the development of more effective fertilizers. Industry research suggests that the US uses more than 19 million metric tons of fertilizers every year. Similar trends are observed worldwide, and recent signs indicate scope for amplified fertilizer demand in the coming years.

Industrial applications of ammonium sulphate will facilitate higher revenue for the industry players

Ammonium sulphate has witnessed higher applications across major industries over the last few years. For instance, it is one of the most widely used dough conditioners during bread preparation. In addition, ammonium sulphate is also applied as a critical component of modern fire extinguishing powders and flameproofing agents. The rapid expansion of the food & beverages industry and thriving coffee culture worldwide will create demand for food-grade ammonium sulphate during the forecast period. Food globalization is expected to shape the end-use applications of ammonium sulphate compounds in the coming years.

Additionally, rising consumer awareness about the importance of fire extinguishers and government-led safety standards mandating the use of fire extinguishing agents across residential & commercial properties will work in favor of the global ammonium sulphate market during the forecast period.

Restraints

What impact will competition from alternative solutions have on ammonium sulphate market expansion?

The global ammonium sulphate industry is expected to be constrained by rising competition from other, more effective solutions. Some of the most popular nitrogen fertilizers include ammonium nitrate and urea. These alternatives are more efficient in delivering nitrogen content to plants and crops. They are extensively preferred in the agriculture industry worldwide. Additionally, a lack of awareness among end users and an existing market base for substitutes can impede market expansion in the long run.

Opportunities

Technological advancements in ammonium sulphate manufacturing processes generate growth opportunities

The global ammonium sulphate market is expected to offer growth opportunities driven by advancements in production processes. In July 2025, Casale, a Swiss-based chemical engineering and technology company, announced that it had signed a strategic deal with Daewoo Engineering & Construction Co. The latter is the world’s leading Engineering, Procurement, and Construction (EPC) contractor.

The agreement will allow Casale to deliver the Process Design Package (PDP) of a new ammonium sulphate (AS) granulation plant along with a novel granular Single Superphosphate (SSP) production facility. Once the infrastructure is ready, the plant is expected to produce 100,000 tons/year of Ammonium Sulphate (AS), which has extensive agronomic use. The rising focus of industry players toward producing highly pure ammonium sulphate using modern techniques, such as vacuum thermal stripping, will further help the industry thrive.

Challenges

Which challenges will supply chain issues and raw material price volatility create for the ammonium sulphate market?

The global ammonium sulphate industry is expected to be significantly challenged by the supply chain issues reported in the market. The evolving geopolitical partnerships, along with changes in production and availability of natural gas, and other external factors, can create supply chain disruptions. Furthermore, raw material prices are subject to changes, which can create additional growth barriers for the industry players. Another major challenge for the market may emerge in the form of seasonal demand for ammonium sulphate, leading to inconsistent sales and revenue throughout the year.

Ammonium Sulphate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ammonium Sulphate Market |

| Market Size in 2024 | USD 3.53 Billion |

| Market Forecast in 2034 | USD 7.25 Billion |

| Growth Rate | CAGR of 5.83% |

| Number of Pages | 216 |

| Key Companies Covered | Sumitomo Chemical Co. Ltd., BASF SE, Evonik Industries AG, Sinopec, UBE Corporation, KuibyshevAzot, Fibrant (Highsun Group), Tata Chemicals Ltd., LANXESS AG, JSC Grodno Azot, Gujarat State Fertilizers & Chemicals (GSFC), Yara International, Nutrien Ltd., Honeywell International Inc., Domo Chemicals, and others. |

| Segments Covered | By End-User Industry, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ammonium Sulphate Market: Segmentation

The global ammonium sulphate market is segmented based on end-user industry, application, and region.

Based on end-user industry, the global market is divided into liquid and solid. In 2024, the industry generated the highest revenue in the solid segment. During the projection period, similar trends are expected to emerge in the market, driven by the ability of solid-state ammonium sulphate to quickly dissolve in water. The liquid segment is projected to generate considerable revenue during the projection period.

Based on application, the global market segments are pharmaceutical, fertilizer, and food& feed additives. In 2024, the highest market share was held by the fertilizer segment. The growing use of nitrogen fertilizers across the global agricultural landscape will promote higher segmental revenue in the coming years. The pharmaceutical segment is expected to deliver improved CAGR during the forecast period due to the rising use of the compound in drug discovery and development.

Ammonium Sulphate Market: Regional Analysis

Which factors will contribute to the dominance of Asia-Pacific in the ammonium sulphate market?

The global ammonium sulphate market is expected to be led by Asia-Pacific during the forecast period, delivering a CAGR of more than 5.35%. Growth in Asia-Pacific will be driven by a robust, thriving chemical & materials manufacturing industry across India and China. In January 2024, Gujarat State Fertilizers & Chemicals Ltd. announced that the company had commissioned an ammonium sulphate production facility in India’s Gujarat state. The facility can produce up to 1,32,000 MT of Ammonium Sulphate. Furthermore, major Asian countries have extensive agricultural land, necessitating the use of effective fertilizers. The growing regional food demand and rising crop exports will further help the Asia-Pacific deliver significant revenue in the coming years.

North America is projected to emerge as the second-highest revenue generator in the ammonium sulphate industry in the coming years. It is projected to register a CAGR of over 5% during the projection period. The US is anticipated to emerge as the dominant leader in the North American market. The regional prominence will result from the increasing demand for agricultural fertilizers across North America.

Additionally, growing use of ammonium sulphate in the region’s pharmaceutical industry and surging demand in the food & beverages sector will propel regional expansion in the coming years. Moreover, the presence of several favorable government policies will prove beneficial for the industry leaders.

Ammonium Sulphate Market: Competitive Analysis

The global ammonium sulphate market is led by players like:

- Sumitomo Chemical Co. Ltd.

- BASF SE

- Evonik Industries AG

- Sinopec

- UBE Corporation

- KuibyshevAzot

- Fibrant (Highsun Group)

- Tata Chemicals Ltd.

- LANXESS AG

- JSC Grodno Azot

- Gujarat State Fertilizers & Chemicals (GSFC)

- Yara International

- Nutrien Ltd.

- Honeywell International Inc.

- Domo Chemicals

Ammonium Sulphate Market: Key Market Trends

Sustainable agricultural trends

An emerging trend in the ammonium sulphate industry is the rising focus on sustainable agriculture. This includes the use of environmentally-friendly fertilizers. Additionally, the growing integration of precision farming in agriculture will promote increased demand for ammonium sulphate.

Applications in water treatment

Ammonium sulphate has found growing applications in water treatment facilities. The addition of ammonium sulphate to chlorine results in the formation of chloramines, as it adds stability to the mixture. Ammonium sulphate is considered ideal for use in large-scale municipal water treatment facilities.

The global ammonium sulphate market is segmented as follows:

By End-User Industry

- Liquid

- Solid

By Application

- Pharmaceutical

- Fertilizer

- Food & Feed Additives

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Which application areas will offer significant growth opportunities in the ammonium sulphate market?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed