Ammonium Nitrate Market Size, Share, Trends, Growth 2034

Ammonium Nitrate Market By Application (Fertilizers, Explosives, Others (Cold Packs, Gas Generators, Pyrotechnics, Rocket Propulsion, Industrial Processes)), By End-Use Industry (Agriculture, Mining, Defense, Others (Automotive, Food, Chemical, Oil and Gas, Medical, Construction)), Grade (Agriculture Grade, Industrial Grade), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

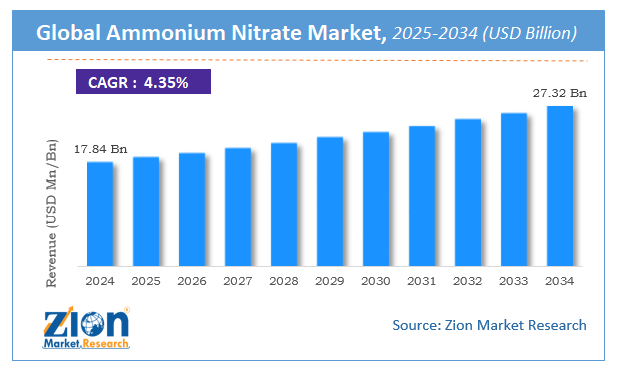

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.84 Billion | USD 27.32 Billion | 4.35% | 2024 |

Ammonium Nitrate Industry Perspective:

The global ammonium nitrate market size was worth around USD 17.84 Billion in 2024 and is predicted to grow to around USD 27.32 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.35% between 2025 and 2034. The report analyzes the global ammonium nitrate market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ammonium nitrate industry.

The report analyzes the ammonium nitrate market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ammonium nitrate market.

Ammonium Nitrate Market: Overview

Ammonium nitrate is a white crystalline solid chemical compound made of ions of ammonium and nitrate. It is highly water-soluble while also displaying properties of retaining water from the environment either through absorption or adsorption, however, the compound does not hydrate. Since ammonium nitrate is an extremely volatile substance, there are numerous guidelines and safety measures mentioned on the safety data sheets provided by the manufacturers and by different governments.

Pure ammonium nitrate is not inflammable but is a strong oxidizer and supports the combustion of organic & some inorganic material, however, storing it near combustible items should be avoided. Ammonium nitrate is stable at normal temperature pressure but a strong initiation charge may cause it to detonate and its storage near blasting agents or explosives is prohibited.

The global ammonium nitrate market is one of the highly observed markets because of the extremely disastrous application of the compound under improper care along with a few small and large-scale incidents in the past.

Key Insights

- As per the analysis shared by our research analyst, the global ammonium nitrate market is estimated to grow annually at a CAGR of around 4.35% over the forecast period (2025-2034).

- Regarding revenue, the global ammonium nitrate market size was valued at around USD 17.84 Billion in 2024 and is projected to reach USD 27.32 Billion by 2034.

- The ammonium nitrate market is projected to grow at a significant rate due to rising use in fertilizers and mining explosives, increasing agricultural productivity needs, and expanding construction and quarrying activities.

- Based on Application, the Fertilizers segment is expected to lead the global market.

- On the basis of End-Use Industry, the Agriculture segment is growing at a high rate and will continue to dominate the global market.

- Based on the Grade, the Agriculture Grade segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Ammonium Nitrate Market: Growth Drivers

Rising demand in agriculture, defense, and mining sectors to aid market growth

Ammonium nitrate is used extensively as a fertilizer with an NPK rating of 34-0-0. It is preferred over urea owing to its higher stability and lesser dispersion of nitrogen to the atmosphere making it more acceptable in the field of agriculture since crops consume nitrogen in the form of nitrate. The agriculture sector has been growing exponentially because of the rising population and subsequent food demand. Agriculture is one of the most essential as well as key driving sectors for many economies which is aided by the adoption of technology and extensive R&D in food cultivation. The differential rise in the agricultural products and the food sector is anticipated to propel the global ammonium nitrate market growth.

Ammonium nitrate is capable of creating explosive mixtures of different properties when combined with other products or fuels. Hence, the military and defense segments of many economies use the product for creating explosives. However, a key point to note is that the use in the military is for defense purposes only and the mixtures are created as per military-dictated guidelines and under extreme supervision. The global market is projected to grow in the coming years because of rising demand in mining and construction as well.

Ammonium Nitrate Market: Restraints

Safety issues related to the use of ammonium nitrate to restrain the market growth

Since ammonium nitrate is used for creating explosives, the product has already been used in terrorist activities multiple times raising safety-related concerns. Because of the rising misuse of ammonium nitrate in anti-national activities, many governments have established stringent rules for the manufacturing of the chemical compound. These rules apply to all sectors where ammonium nitrate is used thus making it difficult for regular manufacturers as well to create the compound easily or hassle-free.

The global ammonium nitrate market growth may also be restricted because of other harmful effects of the compound like health issues as prolonged exposure to nitrate can lead to eye irritation and other uncomfortable physical reactions.

Ammonium Nitrate Market: Opportunities

Growing demand in the mining and construction industry to provide ample market growth opportunities

With the expanding population, there is a rise in the demand for necessities which in turn has propelled the growth of consumer products. When coupled with the higher demands for products like vehicles, buildings, or other such products, leads to the increased need for coal which acts as a first source of energy generator to manufacture these products. The subsequent rise in mining activities is expected to provide for multiple growth opportunities in the global market, especially in developing nations that have recently expanded the consumer product database owing to urbanization and high income amongst the general population.

The growth in construction of newer sites as well as restoration of older buildings may also provide expansion opportunities in the global market.

Ammonium Nitrate Market: Challenges

Presence of substitutes along with the prevention of hazardous incidents to pose challenges to market expansion

Owing to the misuse of ammonium nitrate in unacceptable and unpleasant activities, there are ongoing research activities conducted worldwide for the substitute of ammonium nitrate, for example, a mixture of urea and ammonium sulfate which is expected to deliver the same results as ammonium nitrate minus the harmful properties. This poses a major challenge in the global market growth along with detailed protocols to be followed while handling ammonium nitrate to prevent any hazardous event. Many economies are now phasing out the use of the chemical compound because of many fatal explosions that have occurred in the past.

Ammonium Nitrate Market: Segmentation

The global ammonium market is segmented based on application, end-user, and region.

Based on application, the global market is segmented as explosives, fertilizers, and others. The segment is expected to be dominated by its application in manufacturing fertilizers owing to the abundant presence of nitrate in the chemical compound which is used extensively by crops during their growth phase.

Based on end-user, the global market segments are mining, defense, agriculture, and others where the agricultural sector is expected to dominate the segment. In 2020, because of the high use of ammonium nitrate in agriculture, it alone accounted for 74% of the global market share and is anticipated to showcase the same effect in the coming years.

Recent Developments:

- In December 2021, Deepak Fertilisers and Petrochemicals Corporation Limited, a leading giant of agricultural chemicals, crop nutrients, and fertilizers in India, announced the launch of a Rs 2200 Cr technical ammonium nitrate plant in Odisha state. The installation of the plant will make the corporation a key supplier of ammonium nitrate in the entire eastern region of India.

- In August 2020, after the fatal explosion of ammonium nitrate containers at Beirut port, the country’s government changed rules and regulations related to the storage of the chemical compound by introducing fire-fighting provisions along with better handling and storage procedures to be followed.

Ammonium Nitrate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ammonium Nitrate Market |

| Market Size in 2024 | USD 17.84 Billion |

| Market Forecast in 2034 | USD 27.32 Billion |

| Growth Rate | CAGR of 4.35% |

| Number of Pages | 220 |

| Key Companies Covered | Orica Limited, Austin Powder Company, Enaex S.A., San Corporation, OSTCHEM Holding Company, Incitec Pivot Limited, EuroChem Group AG, CF Industries Holdings Inc., Yara International ASA, URALCHEM JSC, and others. |

| Segments Covered | By Application, By End-Use Industry, By Grade, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ammonium Nitrate Market: Regional Landscape

Asia Pacific to dominate the global market in the coming period

The global ammonium nitrate market is expected to be dominated by Asia-Pacific owing to increased food safety regulations in countries like India, China, Japan, and South Korea with higher revenues both in terms of consumption and production. This is also propelled by the exponential rise of population in these regions aiding the demand for food products along with the availability of large land segments, growing interest in organic farming, and adoption of technologically advanced equipment in farming.

North America is expected to generate high revenue because of rising demand in the mining and defense sector for infrastructure maintenance and further development mainly in regions like the USA and Canada where the economic stability and government spending are high.

This is followed by Europe owing to the growing civil explosives and construction market and the keen interest of the government to expand their agricultural sector

Ammonium Nitrate Market: Competitive Landscape

The key players in the global ammonium nitrate market are

- Abu Qir Fertilizers Co

- Fertiberia SA

- Enaex S.A

- Austin Powder International

- Borealis

- OSTCHEM Holding Company

- CF Industries Holdings

- Orica Ltd.

- Yara International, Inc

- EuroChem Group AG

- CSBP Limited

- San Corporation

- URALCHEM Holding P.L.C

- Neochim Ad

- DFPCL

- Incitec Pivot Limited

Global Ammonium Nitrate Market is segmented as below:

By Application

- Explosives

- Fertilizers

- Other

By End-User

- Mining

- Defense

- Agriculture

- Others

By region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global ammonium nitrate market is expected to grow due to its use in fertilizers and explosives, especially in agriculture and mining sectors.

According to a study, the global ammonium nitrate market size was worth around USD 17.84 Billion in 2024 and is expected to reach USD 27.32 Billion by 2034.

The global ammonium nitrate market is expected to grow at a CAGR of 4.35% during the forecast period.

Asia-Pacific is expected to dominate the ammonium nitrate market over the forecast period.

Leading players in the global ammonium nitrate market include Orica Limited, Austin Powder Company, Enaex S.A., San Corporation, OSTCHEM Holding Company, Incitec Pivot Limited, EuroChem Group AG, CF Industries Holdings Inc., Yara International ASA, URALCHEM JSC, among others.

The report explores crucial aspects of the ammonium nitrate market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed