Pharmaceutical Lipids Market Size, Share, Trends, Growth and Forecast 2032

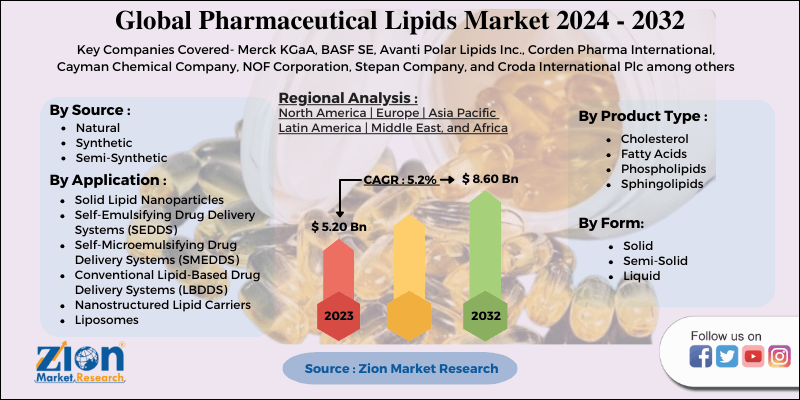

Pharmaceutical Lipids Market by Product Type (Cholesterol, Fatty Acids, Triglycerides, Phospholipids, Sphingolipids, Others) by Form (Solid, Semi-Solid, Liquid) by Source (Natural, Synthetic, Semi-Synthetic) by Application (Solid Lipid Nanoparticles, Self-Emulsifying Drug Delivery Systems (SEDDS), Self-Microemulsifying Drug Delivery Systems (SMEDDS), Conventional Lipid-Based Drug Delivery Systems (LBDDS), Nanostructured Lipid Carriers, Liposomes, Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

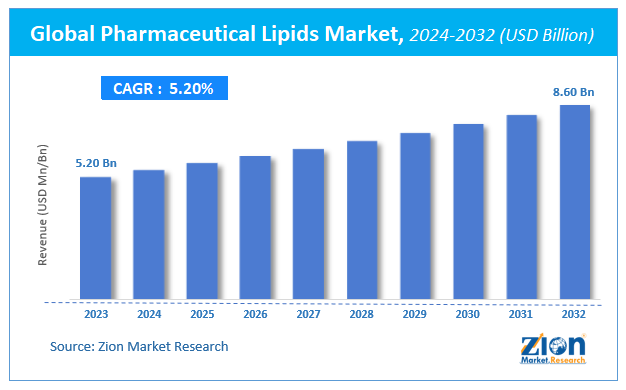

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.20 Billion | USD 8.60 Billion | 5.2% | 2023 |

Pharmaceutical Lipids Market Insights

According to a report from Zion Market Research, the global Pharmaceutical Lipids Market was valued at USD 5.20 Billion in 2023 and is projected to hit USD 8.60 Billion by 2032, with a compound annual growth rate (CAGR) of 5.2% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Pharmaceutical Lipids Market industry over the next decade.

Global Pharmaceutical Lipids Market: Overview

Lipids perform essential roles in a number of contexts. They are vital for all living things because they perform important plastic, energy, and metabolic functions. They also have various uses in nutrition and dietetics, food science, cosmetics, pharmaceuticals, varnishes, detergents, paints and so on. According to the Food and Agriculture Organization of the United Nations (FAO) and the World Health Organization, the five major functions of dietary fats are as follows: for cell structure and membrane functions, as a source of energy obtaining mainly water and carbon dioxide in their final conversion, as a source of essential fatty acids for prostaglandin synthesis and cell structures, as a medium for oil-soluble vitamins such as vitamin A, vitamin D, vitamin E, and vitamin K, and for blood lipid regulation.

Fats have a long and contentious history in relation to cholesterol metabolism and cardiovascular disease (coronary thrombosis, atherosclerosis, and cerebral haemorrhage). Many concerns regarding the roles of fats in these phenomena in relation to the structures of dietary fatty acids remain unanswered. Many recent advances have been made in complexes where lipids and proteins are held together by van der Waal forces, like in lipoproteins. Now it appears that there is a close association between the occurrence of blood levels of High-Density Lipoproteins (HDL) and cardiovascular disease, or the ratio of high to low density lipoproteins.

Global Pharmaceutical Lipids Market: Growth Factors

The global healthcare industry has undergone significant changes in recent years. The advancement of drug delivery technology, as well as the implementation of drug formularies, is driving the growth of the pharmaceutical lipids market. One of the main factors driving the growth of the global pharmaceutical lipids market is the rapid onset of chronic health problems and the subsequent drug delivery to patients.

According to the American Association of Pharmaceutical Scientists (AAPS), approximately 90% of pipeline drugs and 40% of marketed drugs have low water solubility. Based on this assumption, lipid-based formulations are becoming more common in nutraceuticals, vaccines, diagnostics, and pharmaceuticals. This is projected to be a significant growth driver for the market.

Moreover, lipid-based formulations protect active compounds from degradation, or biological transformation, thereby increasing drug production and shelf life. Furthermore, lipid-based particulate drug delivery system changes biodistribution and, as a result, decreases the level of toxicity in a number of medications. This raises the safety index, accelerating market growth.

Because of the increased demand for lipid nanocarriers due to their improved biocompatibility, market participants are moving away from polymeric nanoparticles towards the former. This is expected to generate lucrative business opportunities in the coming years.

The outbreak of Covid-19 has increased competition for pharmaceutical lipids along with other medications. This is because healthcare workers and researchers around the world are looking for ways to tackle Covid-19. For instance, in May 2020, Moderna Inc. announced its agreement with CordenPharma to secure large quantities of lipids used in the production of its experimental Covid-19 vaccine. Moderna also announced that if the vaccine is effective, it plans to supply one million doses per month in 2020 and 10 million doses per month in 2021. According to researchers at Hebrew University (Israel), fenofibrate, an existing cholesterol medication, is capable of reducing the danger posed by Covid-19 to common cold.

Global Pharmaceutical Lipids Market: Segmentation

Lipids are vital biomolecules. For instance, cholesterol is a critical component of the human cell membrane as well as a precursor of bile acids and steroid hormones. Moreover, Triglycerides also play a critical role in the transfer of energy from food to body cells. However, any biomolecule in abundance is detrimental to human health. Similarly, an increase in various types of lipids in the bloodstream, known as hyperlipidemia, is a constant health problem. Since lipids are held in the bloodstream, hyperlipidemia is often a danger to coronary arteries and the most significant risk factor for coronary heart disease.

However, in order to combat these issues, a number of medications known as lipid-lowering drugs are developed. Statins are a class of drugs that lower cholesterol by interacting with the cholesterol biosynthetic pathway. Fibrates, on the other hand, lower fatty acid and triglyceride levels by activating the peroxisomal β-oxidation pathway.

Pharmaceutical Lipids Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Lipids Market |

| Market Size in 2023 | USD 5.20 Billion |

| Market Forecast in 2032 | USD 8.60 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 110 |

| Key Companies Covered | Merck KGaA, BASF SE, Avanti Polar Lipids Inc., Corden Pharma International, Cayman Chemical Company, NOF Corporation, Stepan Company, and Croda International Plc among others |

| Segments Covered | By Product Type, By Form, By Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Pharmaceutical Lipids Market: Regional Analysis

By Geography, the pharmaceutical lipids market is segmented into North America, Europe, Latin America, Asia Pacific, and Middle East and Africa.

Asia Pacific is the most lucrative market for pharmaceutical lipids due of the high rate of adoption of proprietary drugs. Increased acceptance of generic drugs and branded generic in Asia-Pacific will drive the lipids active pharmaceutical ingredients market to exponential growth in the near future. However, the FDA's stringent regulatory environment for the approval of drugs containing lipid active pharmaceutical ingredients would restrict the market's growth. The pharmaceutical lipids market in Asia-Pacific is dominated by India, Japan, and China. South Asia is a promising market due to growth in in-house production.

North America is also seeing an increase in the market for long-acting formulations. Increased cases of various deadly diseases are expected to fuel the demand during the forecast era. The market for lipophilic drugs in Europe, on the other hand, is driven by better bioavailability. An increasing number of healthcare centers and growing demand for medical formulations are expected to drive the market in Europe.

Global Pharmaceutical Lipids Market: Competitive Players

The major players in the global pharmaceutical lipids market include:

- Merck KGaA

- BASF SE

- Avanti Polar Lipids Inc.

- Corden Pharma International

- Cayman Chemical Company

- NOF Corporation

- Stepan Company

- Croda International Plc among others.

The report segment of global pharmaceutical lipids market are as follows:

Global Pharmaceutical Lipids Market: Product Type Segment Analysis

- Cholesterol

- Fatty Acids

- Phospholipids

- Sphingolipids

- Others

Global Pharmaceutical Lipids Market: Form Segment Analysis

- Solid

- Semi-Solid

- Liquid

Global Pharmaceutical Lipids Market: Source Segment Analysis

- Natural

- Synthetic

- Semi-Synthetic

Global Pharmaceutical Lipids Market: Application Segment Analysis

- Solid Lipid Nanoparticles

- Self-Emulsifying Drug Delivery Systems (SEDDS)

- Self-Microemulsifying Drug Delivery Systems (SMEDDS)

- Conventional Lipid-Based Drug Delivery Systems (LBDDS)

- Nanostructured Lipid Carriers

- Liposomes

- Others

Global Pharmaceutical Lipids Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed