AC-DC Converter Market Size, Share, Value and Trends 2034

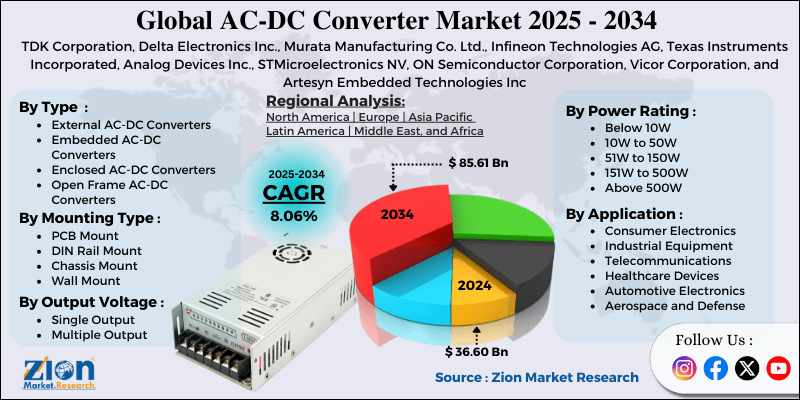

AC-DC Converter Market By Type (External AC-DC Converters, Embedded AC-DC Converters, Enclosed AC-DC Converters, Open Frame AC-DC Converters, and Others), By Power Rating (Below 10W, 10W to 50W, 51W to 150W, 151W to 500W, Above 500W), By Application (Consumer Electronics, Industrial Equipment, Telecommunications, Healthcare Devices, Automotive Electronics, Aerospace and Defense), By Output Voltage (Single Output, Multiple Output), By Mounting Type (PCB Mount, DIN Rail Mount, Chassis Mount, Wall Mount), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

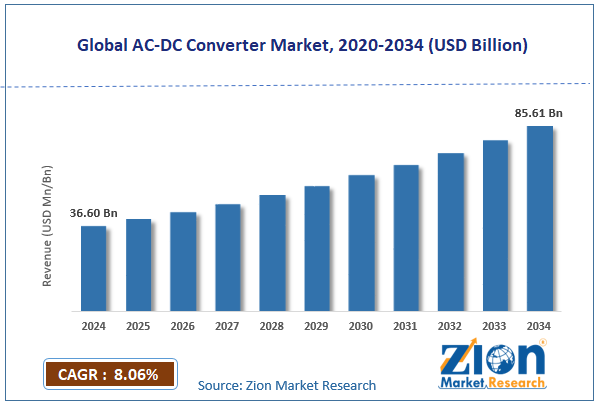

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.60 Billion | USD 85.61 Billion | 8.06% | 2024 |

AC-DC Converter Industry Perspective

The global AC-DC converter market size was worth approximately USD 36.60 billion in 2024 and is projected to grow to around USD 85.61 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.06% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global AC-DC converter market is estimated to grow annually at a CAGR of around 8.06% over the forecast period (2025-2034).

- In terms of revenue, the global AC-DC converter market size was valued at approximately USD 36.60 billion in 2024 and is projected to reach USD 85.61 billion by 2034.

- The AC-DC converter market is projected to grow significantly due to the rising demand for consumer electronics, increasing industrial automation, growing renewable energy installations, and expanding electric vehicle charging infrastructure.

- Based on type, the external AC-DC converters segment is expected to lead the AC-DC converter market. In contrast, the embedded AC-DC converters segment is anticipated to experience significant growth.

- Based on power rating, the 10W to 50W segment is expected to lead the AC-DC converter market, while the above 500W segment is anticipated to witness notable growth.

- Based on application, the consumer electronics segment is the dominating segment, while the automotive electronics segment is projected to witness sizeable revenue over the forecast period.

- Based on output voltage, the single-output segment is expected to lead the market compared to the multiple-output segment.

- Based on mounting type, the PCB mount segment is expected to have the largest market share during the forecast period.

- Based on region, Asia Pacific is projected to dominate the global AC-DC converter market during the estimated period, followed by North America.

AC-DC Converter Market: Overview

AC-DC converters are devices that change alternating current from power outlets into direct current used by electronic equipment, allowing devices to operate safely and reliably. They take input from household or industrial power sources and produce controlled DC voltages required for stable electronic performance. Modern designs use high-frequency switching methods to improve efficiency, reduce heat, and shrink overall size compared with earlier linear systems. The conversion process includes converting AC waveforms to pulsating DC, smoothing the output with filters, controlling voltage through feedback systems, and protecting circuits from excessive current, high voltage, or overheating.

External converters, often known as power adapters, plug into outlets and supply portable power to laptops, phones, and other small devices, while built-in converters operate inside equipment enclosures and meet strict interference limits. Industrial converters use strong housings for harsh environments, and open-frame versions offer compact, low-cost solutions. These converters support nearly every electronic system, and improvements in efficiency, power density, and digital control continue driving steady global demand. The increasing adoption of electronic devices and growing emphasis on energy efficiency are expected to drive growth in the AC-DC converter market throughout the forecast period.

AC-DC Converter Market Dynamics

Growth Drivers

How is the proliferation of electronic devices driving the AC-DC converter market growth?

The AC-DC converter market is growing rapidly as electronic devices proliferate across homes, workplaces, and industries, driving strong demand for reliable power conversion. Smartphone and tablet use continues to rise worldwide, and each device needs an adapter that converts AC power to safe DC for regular charging. Laptop computers sold in large numbers rely on external adapters offering easy, portable power without requiring repairs or device disassembly. Smart home products like thermostats, cameras, speakers, and lighting systems are spread across households, each using small adapters that supply low-voltage DC power for everyday operation. Wearable devices, including fitness trackers and smartwatches, require compact converters that support daily charging for active users.

Gaming consoles and accessories need steady power from external adapters and built-in supplies supporting modern graphics and system performance. Smart televisions, streaming devices, and set-top boxes include converters powering displays and processors for smooth entertainment. Desktop computers and workstations use internal supplies, creating multiple DC outputs for processors, storage, and memory components.

Industrial automation and renewable energy adoption

The global AC-DC converter market is growing steadily as industrial systems are increasing automation, and renewable energy projects are expanding across many regions, creating consistent demand for dependable power conversion. Factory automation relies on controllers, drives, sensors, and actuators, all powered by stable DC supplied by converters linked to industrial electrical services. Robotic equipment depends on accurate power delivery for control circuits, servo motors, and communication modules supporting efficient production in modern facilities. Process control instruments measuring temperature, pressure, and flow operate with a clean DC power supply provided by embedded converters, isolating sensitive circuits from electrical noise.

Machine tools, including mills, lathes, and routers, use DC-powered subsystems for positioning, spindle operation, and tool management supported through coordinated conversion systems. Building automation systems for heating, cooling, lighting, and access depend on distributed converters powering controllers and actuators across facilities. Solar power systems generate DC, requiring conversion to AC for grid use, while support electronics need regulated DC from incoming AC supplies. Wind turbines use converters to manage generator output, while control modules require a reliable DC supply provided by grid-connected conversion stages.

Restraints

Stringent efficiency regulations and compliance costs are affecting profitability

A major challenge for the AC-DC converter market is strict global energy-efficiency rules that demand higher performance while limiting design freedom and increasing development effort for manufacturers. Efficiency standards set by agencies in major regions establish minimum performance levels that converters must meet at several load points, removing older designs and driving steady technical progress in new products. Standby power limits restrict the energy converters that can be used when connected devices remain inactive, requiring advanced control systems that increase overall cost and design complexity in many applications. Harmonics rules reduce the distortion introduced into AC systems, requiring power factor correction stages, increasing component usage and physical size across many converter types. Electromagnetic interference limits prevent unwanted electrical noise, requiring filters and careful layout, increasing engineering time during development cycles. Safety approvals across different markets require testing and documentation, increasing compliance efforts for global manufacturers serving multiple regions. Environmental restrictions limit the materials used in construction, requiring substitutions and new processes that affect costs and production planning across manufacturing operations.

Opportunities

How is electric vehicle and charging infrastructure growth creating new opportunities for the AC-DC converter market?

The AC-DC converter industry is experiencing strong growth as electric vehicle adoption increases worldwide, creating steady demand for charging systems that require efficient, high-power conversion for rapid battery recharging. Public charging stations across highways, parking areas, and city locations require durable converters delivering high power while converting grid electricity into suitable DC for vehicle batteries. Home charging equipment allows vehicle owners to recharge overnight using residential electricity through converters designed for long life, safe operation, and simple daily use. Workplace charging supports employee convenience and corporate sustainability through installations requiring multiple moderate-power converters across parking areas. Fleet charging facilities serving delivery vans, trucks, and buses need highly reliable converters that operate continuously under demanding usage patterns. Ultra-fast charging stations delivering very high power require advanced cooling, efficient conversion stages, and precise control systems supporting rapid energy transfer.

Wireless charging systems for stationary or dynamic applications rely on efficient converters feeding resonant circuits, enabling cable-free charging for many vehicles. Bidirectional charging systems, which allow vehicles to support buildings or grids during peak periods, require converters supporting energy flow in both directions. Onboard vehicle chargers that convert AC from charging points to DC for battery storage require compact, lightweight, and efficient designs that meet automotive durability requirements.

Challenges

How is supply chain complexity and component shortages creating challenges for the AC-DC converter industry?

The AC-DC converter industry faces major challenges from supply chain disruptions, semiconductor shortages, and material availability issues, creating delays, higher costs, and pressure on manufacturers serving growing demand. Shortages of power semiconductors, including MOSFETs, IGBTs, and control ICs, create production limits when essential parts become scarce or lead times extend far beyond normal cycles. Passive components, including capacitors, inductors, and transformers, show fluctuating availability influenced by demand shifts and manufacturing capacity constraints, creating sourcing risks for many designs. Magnetics parts require skilled manual labor and depend on limited core material supplies, creating bottlenecks during periods of rapid demand growth. Price changes for copper wire, aluminum capacitors, and other materials add uncertainty, influencing quotations and reducing margins when long-term contracts restrict adjustments. Geopolitical tensions affecting trade routes create tariff changes, export barriers, and supply continuity risks for manufacturers operating across global networks. Supplier consolidation reduces sourcing options, leaving companies dependent on fewer suppliers for essential parts without easy alternatives during shortages.

AC-DC Converter Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | AC-DC Converter Market Research Report |

| Market Size in 2024 | USD 36.60 Billion |

| Market Forecast in 2034 | USD 85.61 Billion |

| Growth Rate | CAGR of 8.06% |

| Number of Pages | 220 |

| Key Companies Covered | TDK Corporation, Delta Electronics Inc., Murata Manufacturing Co. Ltd., Infineon Technologies AG, Texas Instruments Incorporated, Analog Devices Inc., STMicroelectronics NV, ON Semiconductor Corporation, Vicor Corporation, and Artesyn Embedded Technologies Inc |

| Segments Covered | By Type, By Power Rating, By Application, By Output Voltage, By Mounting Type And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

AC-DC Converter Market: Segmentation

The global AC-DC converter market is segmented based on type, power rating, application, output voltage, mounting type, and region.

Based on type, the global AC-DC converter industry is segregated into external AC-DC converters, embedded AC-DC converters, enclosed AC-DC converters, open frame AC-DC converters, and others. External AC-DC converters lead the market due to the widespread use in consumer electronics, including smartphones, laptops, and tablets, and the convenience of replaceable power adapters.

Based on power rating, the industry is segmented into below 10W, 10W to 50W, 51W to 150W, 151W to 500W, and above 500W. The 10W to 50W segment is expected to lead the market during the forecast period due to the balance between cost and performance, and the dominance of smartphones, tablets, and IoT devices in this power range.

Based on application, the global AC-DC converter market is classified into consumer electronics, industrial equipment, telecommunications, healthcare devices, automotive electronics, and aerospace and defense. Consumer electronics hold the largest market share due to the massive global volumes of smartphones, laptops, tablets, and other devices that require power conversion, and the diversity of products spanning multiple price points and performance levels.

Based on output voltage, the global market is divided into single-output and multiple-output. Single-output holds the largest market share due to its simplicity and lower cost for applications requiring only one DC voltage, its suitability for most consumer electronics and simple industrial equipment, and its reduced design, testing, and certification complexity.

Based on mounting type, the global market is categorized into PCB mount, DIN rail mount, chassis mount, and wall mount. PCB mount holds the largest market share due to the integration advantages within equipment enclosures, and the space efficiency achieved through direct board mounting.

AC-DC Converter Market: Regional Analysis

What factors are contributing to the Asia Pacific's dominance in the global AC-DC converter market?

Asia Pacific leads the AC-DC converter market because the region holds large electronics manufacturing hubs, a huge consumer base, strong technical capabilities, and cost-efficient production supporting both domestic and international demand. China dominates global electronics production by assembling smartphones, laptops, televisions, and many other devices, creating a very high demand for converters used inside products and sold as charging accessories worldwide. Major contract manufacturers, including Foxconn and Pegatron, operate enormous facilities that produce millions of devices for global brands and integrate large volumes of converters into finished goods shipped across international markets. Consumer markets in China and India, with very large populations buying personal electronics, generate strong internal demand alongside the region’s manufacturing output for foreign customers. Regional component ecosystems, including capacitor, transformer, and semiconductor suppliers, support efficient supply chains and fast development cycles, helping converter manufacturers reduce costs and improve production speed.

Cost advantages from labor rates, strong infrastructure, and large-scale operations allow Asian producers to offer competitive pricing in global consumer markets dominated by price sensitivity. Technology strengths, including engineering expertise and growing intellectual property, allow regional firms to move into premium converter segments serving advanced applications across industries. India shows rising potential with government programs supporting domestic electronics production, along with expanding consumer device demand and growing export activity. Electric vehicle manufacturing is growing across China, producing major demand for onboard chargers and charging systems requiring high-power AC-DC conversion. Renewable energy expansion, including large solar and wind installations, increases demand for conversion systems, with Asian suppliers gaining a rising market share across global energy projects.

North America maintains a substantial market presence

North America maintains a strong position in the AC-DC converter market because the region supports advanced technology development, high industrial demand, expanding electric vehicle infrastructure, and steady consumer use of electronic devices, creating continuous market activity. The United States hosts major technology companies producing computers, consumer electronics, and networking equipment, which require sophisticated power conversion solutions for products sold across international markets. Industrial automation growth increases demand for reliable converters serving factory machinery, process control equipment, and building systems where durable performance supports higher pricing. Healthcare equipment, including imaging machines, diagnostic instruments, monitoring systems, and surgical tools, relies on medical-grade converters meeting strict safety and electromagnetic compatibility standards across all clinical environments.

Aerospace and defense sectors require specialized converters built for harsh conditions, long lifetimes, and precise performance supporting mission-critical systems. Telecommunications networks supporting mobile services, internet platforms, and data centers rely on stable conversion supplying power for servers, routers, switches, and communication links. Electric vehicle adoption increases demand for home chargers, workplace charging stations, and public infrastructure that require high-quality AC-DC conversion capable of serving multiple charging levels. Data center expansion supporting cloud services and enterprise computing needs large power systems that convert utility AC into multiple DC outputs for servers and storage equipment. Consumer device use produces a steady demand for replacement adapters and aftermarket supplies when original equipment becomes misplaced or damaged across households and workplaces. Canada presents similar trends with strong industrial sectors, rising electric vehicle adoption, and high technology engagement supporting regional converter demand across many applications.

Recent Developments

- In March 2025, ARCH Electronics Corp. introduced the ATCW40 40 W OVC IV AC/DC power module, offering high protection levels and suited for global input-voltage conditions.

- In October 2025, Ador Powertron launched a 30 kW AC-DC converter module under its Yonder brand, designed to power electric-vehicle fast chargers for public charging infrastructure.

AC-DC Converter Market: Competitive Analysis

The leading players in the global AC-DC converter market are

- TDK Corporation

- Delta Electronics Inc

- Murata Manufacturing Co Ltd

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc

- STMicroelectronics NV

- ON Semiconductor Corporation

- Vicor Corporation

- Artesyn Embedded Technologies Inc

The global AC-DC converter market is segmented as follows:

By Type

- External AC-DC Converters

- Embedded AC-DC Converters

- Enclosed AC-DC Converters

- Open Frame AC-DC Converters

- Others

By Power Rating

- Below 10W

- 10W to 50W

- 51W to 150W

- 151W to 500W

- Above 500W

By Application

- Consumer Electronics

- Industrial Equipment

- Telecommunications

- Healthcare Devices

- Automotive Electronics

- Aerospace and Defense

By Output Voltage

- Single Output

- Multiple Output

By Mounting Type

- PCB Mount

- DIN Rail Mount

- Chassis Mount

- Wall Mount

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed