CNC Machine Tools Market Size, Share, Trends, Growth & Forecast 2034

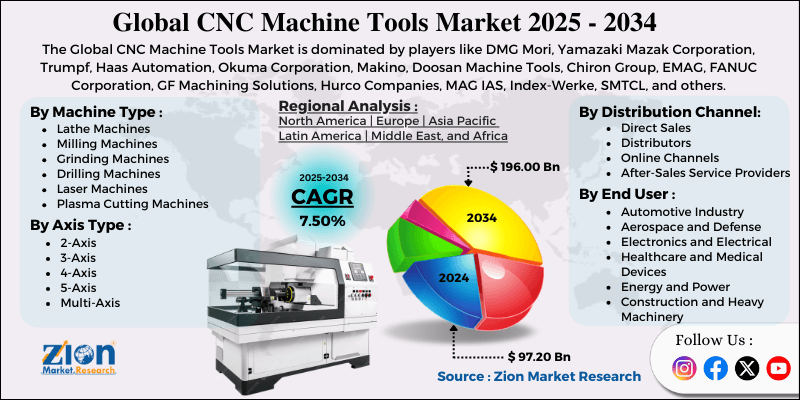

CNC Machine Tools Market By Machine Type (Lathe Machines, Milling Machines, Grinding Machines, Drilling Machines, Laser Machines, Plasma Cutting Machines, Electrical Discharge Machines), By Axis Type (2-Axis, 3-Axis, 4-Axis, 5-Axis, Multi-Axis), By Distribution Channel (Direct Sales, Distributors, Online Channels, After-Sales Service Providers), By End-User (Automotive Industry, Aerospace and Defense, Electronics and Electrical, Healthcare and Medical Devices, Energy and Power, Construction and Heavy Machinery), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

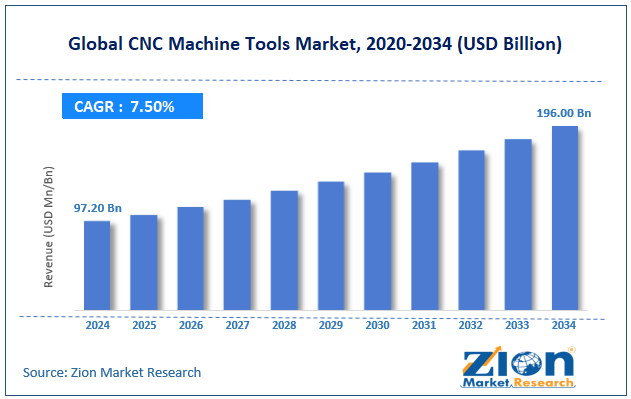

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 97.20 Billion | USD 196.00 Billion | 7.50% | 2024 |

CNC Machine Tools Industry Perspective:

The global CNC machine tools market size was worth approximately USD 97.20 billion in 2024 and is projected to grow to around USD 196.00 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global CNC machine tools market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2025-2034).

- In terms of revenue, the global CNC machine tools market size was valued at approximately USD 97.20 billion in 2024 and is projected to reach USD 196.00 billion by 2034.

- The CNC machine tools market is projected to grow significantly due to the increasing adoption of automation in manufacturing, rising demand for precision components, and growing emphasis on productivity improvement and operational efficiency.

- Based on machine type, the milling machines segment is expected to lead the CNC machine tools market, while the laser machines segment is anticipated to experience significant growth.

- Based on axis type, the 5-axis segment is expected to lead the CNC machine tools market, while the multi-axis segment is anticipated to witness notable growth.

- Based on the distribution channel, the direct sales segment is the dominating segment, while the online channels segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the automotive industry segment is expected to lead the market compared to the aerospace and defense segment.

- Based on region, Asia Pacific is projected to dominate the global CNC machine tools market during the estimated period, followed by Europe.

CNC Machine Tools Market: Overview

Computer Numerical Control (CNC) machine tools are automated manufacturing systems that use programmed computer instructions to control machining operations instead of relying on manual handling. These machines perform cutting, drilling, milling, turning, and grinding tasks with a level of precision and consistency that human operators cannot achieve. Modern CNC equipment uses advanced software, servo motors, and precision guiding systems to produce highly accurate components used across many industries. Manufacturing plants depend on CNC machines to create both basic parts and complex components with tight tolerances. The automotive sector uses CNC machining for engine blocks, transmission parts, and other critical elements that require uniform quality. Aerospace companies rely on multi-axis CNC systems to shape turbine blades, structural parts, and landing gear from challenging materials. Medical and electronics manufacturers use CNC precision to produce implants, instruments, device housings, and connectors. Integration with CAD and CAM software reduces setup time and improves accuracy, while Industry 4.0 technologies enable connected, smarter, and more efficient production.

The increasing demand for precision components across industries and the ongoing automation of manufacturing processes are expected to drive growth in the CNC machine tools market throughout the forecast period.

CNC Machine Tools Market Dynamics

Growth Drivers

How are Industry 4.0 and smart manufacturing driving the CNC machine tools market growth?

The CNC machine tools market is growing quickly as industries adopt smart factory ideas under Industry 4.0 principles to improve overall productivity and quality. Digital transformation efforts encourage companies to invest in connected equipment that communicates with systems across the factory to enable smoother, faster operations. Modern CNC machines use sensors to collect real-time information on tool wear, vibration, temperature, and performance, enabling predictive maintenance and better workflow planning. Artificial intelligence systems study production data to improve efficiency, lower scrap rates, and adjust machining parameters without manual involvement.

Cloud-based software connects with CNC machines to provide live production updates, supporting accurate scheduling and quick decision-making. Digital twin models recreate machines and processes virtually, helping engineers test programs safely before real machining begins. Remote monitoring tools allow support teams to diagnose issues and offer guidance from distant locations. Energy-tracking systems measure power use in CNC equipment, supporting efficient operation and sustainability goals.

Rising demand for precision components across industries

The global CNC machine tools market is expanding as industries require precise components with complex geometries, produced through advanced, accurate machining processes. The aerospace sector relies on CNC machining for parts made from strong alloys, supporting precise dimensions, dependable operation, and safe performance in applications. Electric vehicle production depends on CNC machining for motor housings, battery cases, and components with precision to ensure assembly and reliable operation. Medical implants require CNC machining to achieve fine tolerances, supporting performance, safe placement within the body, and dependable function over extended use. Semiconductor production relies on CNC machining for components made with micron-level accuracy, enabling stable chip fabrication and reliable operation of high-precision manufacturing equipment.

Renewable energy systems use CNC machining for turbine gearboxes and power components with accurate dimensions, supporting durability, efficiency, and reliable performance. Robotics, optical devices, scientific instruments, and consumer electronics depend on CNC machining for precise components that support stable alignment and consistent function in applications.

Restraints

High initial investment costs and total ownership expenses

A major challenge for the CNC machine tools market is the high cost of purchasing equipment, along with the ongoing operational expenses. Entry-level machines require large investments, while advanced multi-axis models can reach extremely high prices, creating financial pressure on smaller companies. Building preparation requires foundation work, electrical upgrades, and climate control, which increases the overall cost before installation begins. Operator training requires time and money because CNC programming and machine handling demand skills beyond basic machining experience. Software licenses for programming and simulation create recurring expenses for every company using modern CNC systems.

Precision tooling and fixtures require steady investment, especially when production involves many different components and setups. Regular maintenance includes spindle service, ball screw replacement, and motor repairs, leading to predictable but significant costs. Large CNC machines consume high levels of energy during demanding processes, contributing to increased operational expenses. Floor space needs, coolant management, calibration tools, insurance coverage, and financing issues add further pressure on overall ownership costs.

Opportunities

How is the aerospace industry creating new opportunities for the CNC machine tools market?

The CNC machine tools industry is growing rapidly as aerospace companies increase production and launch new aircraft programs that require advanced, precise machining. Commercial aviation continues to expand as global travel rises, creating ongoing demand for new aircraft with reliable and accurate components. Next-generation aircraft use composite materials, but still depend on precision-machined metal parts for engines, landing gear, and major structural assemblies. Engine manufacturers develop fuel-efficient designs with complex cooling paths and aerodynamic shapes, requiring powerful 5-axis machines for dependable production. Space exploration projects from government agencies and private firms create demand for accurate machining of rocket sections, propulsion components, and satellite hardware.

Military modernization programs support demand for precise machining used in new fighter aircraft, helicopters, and unmanned aerial systems. Maintenance and repair facilities require CNC machines to produce replacement parts for aging aircraft fleets across global markets. Hybrid aerospace production uses 3D-printed parts combined with CNC finish machining for final accuracy and dependable performance.

Challenges

How are skilled labor shortages and training requirements creating challenges for the CNC machine tools market?

The CNC machine tools industry faces major challenges due to a shortage of skilled workers and the difficulty involved in training new operators and programmers effectively. Manufacturing companies worldwide struggle to find machinists with strong technical knowledge and hands-on experience needed for high-quality production work. Many experienced workers are retiring, creating large skill gaps and removing valuable knowledge from global manufacturing environments. Young workers often choose careers outside factories, reducing the number of people entering machining and related technical fields. Educational programs in machining have declined, limiting opportunities for students to learn essential skills used in modern CNC environments. CNC operation requires both machining ability and computer understanding, creating additional barriers for many new workers entering industry roles.

Programming advanced machines demands knowledge of geometry, tool paths, and machine movements far beyond basic programming levels. Each machine brand has unique controls and programming styles, requiring training specific to individual systems. Rapid technological changes require continuous learning, increasing costs and pressure on companies. Mistakes during training can damage equipment or waste material, adding additional difficulty during early learning stages.

CNC Machine Tools Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | CNC Machine Tools Market |

| Market Size in 2024 | USD 97.20 Billion |

| Market Forecast in 2034 | USD 196.00 Billion |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 215 |

| Key Companies Covered | DMG Mori, Yamazaki Mazak Corporation, Trumpf, Haas Automation, Okuma Corporation, Makino, Doosan Machine Tools, Chiron Group, EMAG, FANUC Corporation, GF Machining Solutions, Hurco Companies, MAG IAS, Index-Werke, SMTCL, and others. |

| Segments Covered | By Machine Type, By Axis Type, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

CNC Machine Tools Market: Segmentation

The global CNC machine tools market is segmented based on machine type, axis type, distribution channel, end-user, and region.

Based on machine type, the global CNC machine tools industry is segregated into lathe machines, milling machines, grinding machines, drilling machines, laser machines, plasma cutting machines, and electrical discharge machines. Milling machines lead the market due to their versatile applications across multiple industries, widespread use in job shops and production facilities, and suitability for both roughing and finishing operations on various materials.

Based on axis type, the industry is segmented into 2-axis, 3-axis, 4-axis, 5-axis, and multi-axis. The 5-axis segment leads the market due to its capability to machine complex geometries in a single setup, the elimination of multiple fixtures and part handling, and its essential role in aerospace and medical device manufacturing applications.

Based on distribution channel, the global CNC machine tools market is classified into direct sales, distributors, online channels, and after-sales service providers. Direct sales are expected to lead the market during the forecast period due to the high-value nature of CNC equipment purchases, the need for technical consultation and customization, and the preference for direct manufacturer engagement for major capital investments.

Based on end-user, the global market is divided into automotive, aerospace and defense, electronics and electrical, healthcare and medical devices, energy and power, and construction and heavy machinery. The automotive industry holds the largest market share due to enormous production volumes that require extensive machining capacity and ongoing shifts toward electric vehicles, which create new machining demands.

CNC Machine Tools Market: Regional Analysis

What factors are contributing to the Asia Pacific's dominance in the global CNC machine tools market?

Asia Pacific is the leading region in the CNC machine tools market because it has the world’s largest and most diverse manufacturing base, supported by rapid industrial growth and strong government involvement in industrial development. The region produces a wide range of goods, including automobiles, electronics, industrial machinery, aerospace parts, consumer products, and precision components, creating massive and continuous demand for CNC machines. China plays the biggest role, with huge production volumes across automotive, electronics, and general engineering sectors, making it the largest machine tool consumer globally. Japan remains a global leader in CNC technology, with companies such as Mazak, Okuma, and DMG Mori known for innovation, precision, and reliability. South Korea has strong capabilities in automotive, semiconductor, shipbuilding, and electronics manufacturing, all of which require advanced CNC machining systems. India is rapidly expanding its manufacturing sector through the Make in India initiative, increasing demand for modern, automated machine tools. Asia Pacific benefits from cost-effective manufacturing, availability of skilled labor, strong supplier ecosystems, and the ability to scale production quickly.

Governments across the region are actively supporting industrial modernization, technology adoption, smart factories, and digital manufacturing programs, thereby boosting CNC investment. Large automotive clusters in China, Japan, South Korea, Thailand, and India generate significant CNC machine demand. Electronics manufacturing hubs in China, Vietnam, Malaysia, and Taiwan require precision machining for enclosures, connectors, molds, and tooling. Growing infrastructure development and heavy machinery production further strengthen the region’s leadership. Overall, Asia Pacific’s combination of industrial scale, technological capability, strong domestic demand, and global export strength ensures its dominant position in the CNC machine tools market.

Europe is experiencing significant growth.

Europe is the second leading region in the CNC machine tools market because it has a long-established industrial base, strong engineering capabilities, and advanced manufacturing systems built around high precision and quality standards. Germany plays the most influential role, as it is a major global producer of premium CNC machines and home to well-known companies that focus on precision, reliability, and advanced automation. Countries such as Italy, Switzerland, Austria, and the Czech Republic also contribute significantly due to their strong machine tool industries and expertise in producing specialized equipment for automotive, aerospace, and industrial manufacturing. Europe has a highly skilled workforce and strong technical education systems, supporting innovation in machine design, automation, robotics, and digital manufacturing.

The region benefits from strong demand in automotive production, especially in Germany, France, Italy, and Spain, where CNC machines are widely used for engines, powertrain components, structural parts, and tooling. Aerospace manufacturing in France, Germany, and the United Kingdom creates additional demand for 5-axis machines used to produce high-precision components from lightweight alloys and composite materials. Europe is also advancing smart factory adoption, Industry 4.0 technologies, and digital twin systems, which increases the need for modern CNC machines integrated with sensors and automation.

The region’s strong focus on sustainability is also driving investments in energy-efficient CNC systems and advanced machining processes. Europe’s leadership in high-precision engineering, combined with modern manufacturing capabilities and export strength, ensures its continued position as a key global market for CNC machine tools.

Recent Market Developments:

- In November 2025, Jyoti CNC Automation Ltd inaugurated a major expansion of its production facilities at its subsidiary Huron Graffenstaden in Strasbourg, France, doubling its capacity as part of its global growth strategy in machine tool manufacturing.

CNC Machine Tools Market: Competitive Analysis

The leading players in the global CNC machine tools market are:

- DMG Mori

- Yamazaki Mazak Corporation

- Trumpf

- Haas Automation

- Okuma Corporation

- Makino

- Doosan Machine Tools

- Chiron Group

- EMAG

- FANUC Corporation

- GF Machining Solutions

- Hurco Companies

- MAG IAS

- Index-Werke

- SMTCL

The global CNC machine tools market is segmented as follows:

By Machine Type

- Lathe Machines

- Milling Machines

- Grinding Machines

- Drilling Machines

- Laser Machines

- Plasma Cutting Machines

- Electrical Discharge Machines

By Axis Type

- 2-Axis

- 3-Axis

- 4-Axis

- 5-Axis

- Multi-Axis

By Distribution Channel

- Direct Sales

- Distributors

- Online Channels

- After-Sales Service Providers

By End User

- Automotive Industry

- Aerospace and Defense

- Electronics and Electrical

- Healthcare and Medical Devices

- Energy and Power

- Construction and Heavy Machinery

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed