Workforce Management Market Size, Share Analysis, Trends, Growth 2032

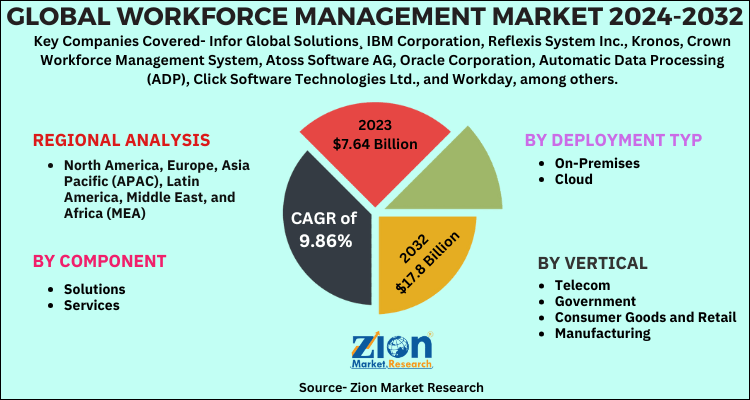

Workforce Management Market by Component (Solutions, Services) by Deployment Type (On-Premises, Cloud), by Vertical (Telecom, Government, Consumer Goods and Retail, Manufacturing and Others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

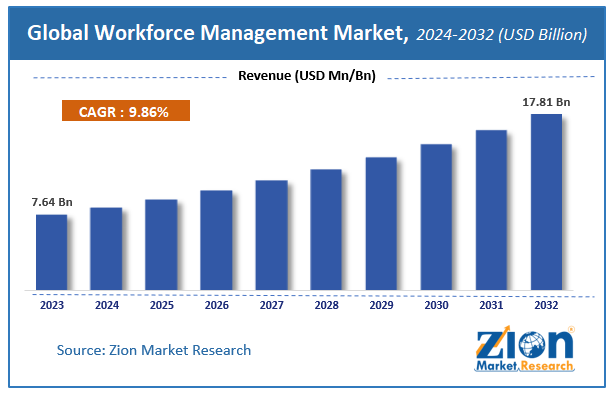

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.64 Billion | USD 17.81 Billion | 9.86% | 2023 |

Workforce Management Market Size

Zion Market Research has published a report on the global Workforce Management Market, estimating its value at USD 7.64 Billion in 2023, with projections indicating that it will reach USD 17.81 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.86% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Workforce Management Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Workforce Management Market: Overview

Workforce management manages and maintains all major workforce functions in the organization. This component of workforce management falls under the category of HR management. Human resource management enables organizations to address existing problems and ensure the efficient use of resources.

In addition, some businesses that can be medium or small enterprises, there are different methods like traditional methods and convenient methods that are used to track the actual employees and workforce. This is done to overcome the drawbacks that the traditional methods human resource management faces. Hence, reducing labor costs, improving productivity, and utilizing employees to improve business performance are done. Automatically processes such as remuneration of employees and their calculation time increase accuracy and eliminate calculation errors.

COVID-19 Impact Analysis

Due to COVID-19, there have been disruptions all over the world. The working of many industries has been disrupted and now people are adopting solutions that are software-based and this will help them in growing their business and help in management of the productivity of employees. With the use of these effective workforce management tools the business can strategically plan their business goals. Due to the pandemic, the demand for a good workforce has increased so that they can create a good balance between technological use and employee performance.

Workforce Management Market: Growth Factors

The major factors influencing the growth of workforce management are the rising demand for a mobile-based workforce and optimization of the workforce. Furthermore, people are now moving towards workforce management by adopting cloud-based management. This is helpful in the stabilization of the remote workforce and hence thereby helpful in the pandemic situation and this is boosting the global workforce management market.

In addition to this, the other factors that are responsible for growth in this market are that the dynamics of the workforce are continuously going through changes and the growing consumption of the workforce further adds up to the growth of the global workforce management market. Moreover, the use of mobile phones has drastically increased in the past few years and ease of software solutions availability. It has functions in different verticals like healthcare, retail, e-commerce, and government. Hence, all these factors contribute to the growth of the overall workforce management market.

Workforce Management Market: Segmentation

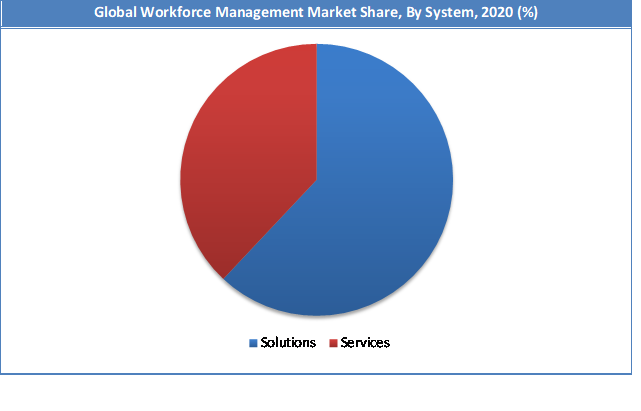

Component Segment Analysis Preview

The solutions segment held a share of above 52% in 2020. This is attributable to the fact that these workforce management solutions are changing rapidly due to the transformation of traditional solutions into technology solutions and IT. Furthermore, the management give time to the employees to focus on the most important business aspects and it offers a variety of solutions to simplify the work of employees in organizations.

In addition, the solutions offered by the market not only help the better organization of employees but also helps to simplify employee performance. By component, the market is divided into services and solutions. These management solutions include staff planning, time and attendance, workforce scheduling, employee analytics, leave and absence management, and more including management of tasks and fatigue management which helps maintain a variety of human resource operations and analysis of data of key business processes. Hence, this contributes to the growth of the solutions segment thereby growing the overall Workforce management market.

Verticals Segment Analysis Preview

The consumer goods and retail segment will grow at a CAGR of over 6.5% from 2021 to 2028. This is attributable to this emerging vertical and is expected to grow rapidly in terms of technological changes, customer needs, and employment. This vertical involves customer engagement and demands for employee productivity hence to achieve such competitive advantages workforce management is a must.

Furthermore, the Consumer goods and retail subsegment requires a lot of visibility and control of a variety of mixed and varied staff consisting of drivers, field service providers, and store staff, both internally and externally. These solutions solve these complexities with the efficient use of resources

The vertical segment includes many subsegments other than consumer goods and retail, some of the other subsegments include Government, Banking and Financial Services and Insurance (BFSI), Manufacturing, Healthcare, and Life Sciences, Energy and Utilities, Information Technology enabled Services, Transportation and Logistics Education, Travel and Hospitality, and Media and Entertainment and Telecom.

Workforce Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Workforce Management Market |

| Market Size in 2023 | USD 7.64 Billion |

| Market Forecast in 2032 | USD 17.81 Billion |

| Growth Rate | CAGR of 9.86% |

| Number of Pages | 150 |

| Key Companies Covered | Infor Global Solutions¸ IBM Corporation, Reflexis System Inc., Kronos, Crown Workforce Management System, Atoss Software AG, Oracle Corporation, Automatic Data Processing (ADP), Click Software Technologies Ltd., and Workday, among others. |

| Segments Covered | By Component, By Deployment Type, By Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Workforce Management Market: Regional Analysis

The Asia Pacific region held a share of 30% in 2020. This is attributable to These solutions for Workforce management helps to solve these complexities with the efficient use of resources and big data and provide mobile solutions for budgeting, forecasting, and human resource management. Moreover, the increasing demand for smart management solutions is expected to generate huge demand for the market in this region.

The North American region is projected to grow at a CAGR of over 6.5% over the forecast period and will be a leading region in adopting workforce or human resource management solutions and services. This surge is due to the increasing adoption of workforce management solutions in the region. Businesses in the region are the most progressive in terms of ML or Machine Learning, Artificial Intelligence (AI) adoption, and cloud adoption, thereby enhancing market growth.

Workforce Management Market: Key Players & Competitive Landscape

Some of the key players in the Workforce Management market are:

- Infor Global Solutions

- IBM Corporation

- Reflexis System Inc.

- Kronos

- Crown Workforce Management System

- Atoss Software AG

- Oracle Corporation

- Automatic Data Processing (ADP)

- Click Software Technologies Ltd.

- Workday

- Among Others

Customer engagement and increasing employee productivity are a must for human resource management hence in the different verticals like healthcare, retail, and e-commerce, the government there is a huge demand for workforce management. With difficulties in the business sector, it needs to focus on employee training, timing and availability, human analytics, forecasting, and performance planning.

The global Workforce Management market is segmented as follows:

By Component:

- Solutions

- Services

By Deployment Type:

- On-Premises

- Cloud

By Vertical:

- Telecom

- Government

- Consumer Goods and Retail

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Workforce management (WFM) is a set of processes and tools designed to optimize and oversee employee productivity and efficiency. It includes tasks like scheduling, time tracking, attendance management, and forecasting labor needs, helping organizations align workforce operations with business goals.

According to study, the Workforce Management Market size was worth around USD 7.64 billion in 2023 and is predicted to grow to around USD 17.81 billion by 2032.

The CAGR value of Workforce Management Market is expected to be around 9.86% during 2024-2032.

Asia Pacific has been leading the Workforce Management Market and is anticipated to continue on the dominant position in the years to come.

The Workforce Management Market is led by players like Infor Global Solutions¸ IBM Corporation, Reflexis System Inc., Kronos, Crown Workforce Management System, Atoss Software AG, Oracle Corporation, Automatic Data Processing (ADP), Click Software Technologies Ltd., and Workday, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed