Water Testing and Analysis Market Size, Share, Price & Growth 2034

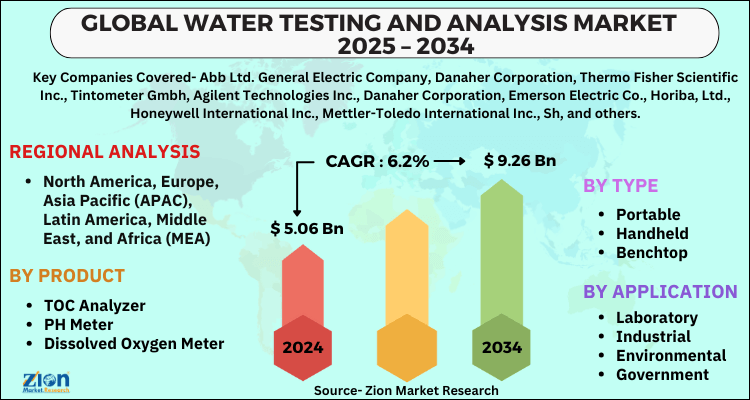

Water Testing and Analysis Market - By Product (TOC Analyzer, PH Meter, Dissolved Oxygen Meter, Conductivity Sensor, Turbidity Meter, and Others), By Type (Portable, Handheld, Benchtop, and Others), By Application (Laboratory, Industrial, Environmental, Government, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

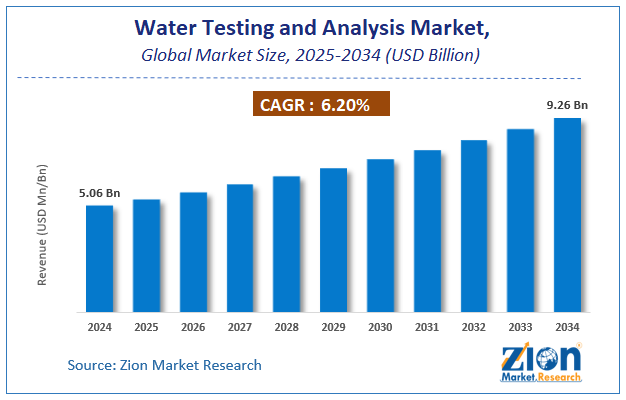

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.06 Billion | USD 9.26 Billion | 6.2% | 2024 |

Water Testing and Analysis Market: Industry Perspective

The global water testing and analysis market size was worth around USD 5.06 Billion in 2024 and is predicted to grow to around USD 9.26 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.2% between 2025 and 2034. The report analyzes the global water testing and analysis market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the water testing and analysis industry.

The report analyzes the Water Testing and Analysis market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Water Testing and Analysis market.

Water Testing and Analysis Market: Overview

Water Testing and Analysis are crucial to determine the quality of water that can be used for multiple purposes such as drinking, use in industries, and day-to-day life activities. As the population increases the demand for potable water will also increase and substantially bolster the need for Water Testing and Analysis services on a global scale and this is expected to majorly influence Water Testing and Analysis market potential through the forecast period.

Water testing provides insights on qualities such as alkalinity, acidity, turbidity, water conductivity, and radioactivity which helps in deciding the use of water and avoids waste of water in multiple industries. Water analysis systems are deployed in multiple industries to check the quality of water to decide its appropriate use and application, these systems are highly popular in mining, pharmaceuticals, food and beverages, aquaculture, etc.

However, the lack of efficient water infrastructure and high costs of Water Testing and Analysis equipment will act as a restraining factor for the Water Testing and Analysis market over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global water testing and analysis market is estimated to grow annually at a CAGR of around 6.2% over the forecast period (2025-2034).

- Regarding revenue, the global water testing and analysis market size was valued at around USD 5.06 Billion in 2024 and is projected to reach USD 9.26 Billion by 2034.

- The water testing and analysis market is projected to grow at a significant rate due to growing concerns over water quality, stringent environmental regulations, rising demand for safe drinking water, advancements in testing technologies, and increasing industrial and municipal water treatment requirements.

- Based on Product, the TOC Analyzer segment is expected to lead the global market.

- On the basis of Type, the Portable segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Laboratory segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Water Testing and Analysis Market: Growth Drivers

Stringent Water Treatment Regulations to Boost Water Testing and Analysis Services Demand

Wastewater contains multiple harmful elements and toxic chemicals that are harmful to the environment and human health and has a major negative impact on the global population to avoid these complications governments across the world are implementing new regulations to ensure proper treatment of water before disposal or use. This will majorly increase the demand for Water Testing and Analysis solutions and services and hence drive the Water Testing and Analysis market growth through 2028.

Increasing demand for water in different application industries is expected to drive the global water testing and analysis market growth over the forecast period. Industries such as healthcare, food, and beverages, and pharmaceuticals require good quality water, which is anticipated to further drive the industry growth in the future years. It is mandatory for some industries to adhere to some strict rules and regulations to maintain water quality. Increase in the cases of water contamination and water poisoning that affect humans, animals, and the environment has made it mandatory for water testing and analysis. Rapid change in the technology that provides new and improved methods to study the parameter of water-quality is expected to further drive the industry growth.

The growing awareness levels regarding the measurement of water quality due to rising water pollution and increased government funding for monitoring and controlling pollution are the major driving factors for water testing and analysis market growth over the forecast period. However, technical limitations with the water monitoring products and the high cost associated with environmental monitoring solutions may restrain industry growth in the future years. Moreover, increasing regulatory support for high-standard maintenance is anticipated to further boost the water testing and analysis market. As per the Ministry of Water Resources India, the demand for water across industries in the country is expected to increase from 41.4 billion cubic meters in 2010 to 80 billion cubic meters by 2025, which includes industries such as energy.

Water Testing and Analysis Market: Restraints

High Cost of Equipment and Less Developed Water Infrastructure to Restrain Market Growth

Water Testing and analysis market will see steady growth through 2028 but the high cost of equipment will have a major restraining effect on the global Water Testing and Analysis market potential. This will be a major obstacle for Water Testing and Analysis market growth in economies with low spending potential and hence constrain global Water Testing and Analysis market potential. The lack of developed water infrastructure will also have an adverse impact on the Water Testing and Analysis market growth through 2028.

Global Water Testing and Analysis Market: Segmentation

The global Water Testing and Analysis market is segregated based on product, type, application, and region.

Based on product, the water testing and analysis market is segmented into TOC analyzer, pH meter, dissolved oxygen meter, conductivity sensor, and turbidity meter. The TOC Analyzer segment dominates the water testing and analysis market due to its essential role in detecting organic contamination and ensuring regulatory compliance. However, pH Meters, Dissolved Oxygen Meters, Conductivity Sensors, and Turbidity Meters also hold significant importance, catering to diverse applications in industrial, environmental, and municipal water management. The growing emphasis on water quality and stricter environmental regulations continue to drive market expansion across all segments.

In terms of type, the global the water testing and analysis market is divided into portable, handheld, benchtop, and others.

By Application, the water testing and analysis market is segmented into laboratory, industrial, environmental, government, and others (agricultural, household and general applications). The rising industrialization on a global scale will propel the demand from the industrial segment and is expected to be a major segment in the global Water Testing and Analysis market landscape.

Water Testing and Analysis Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Testing and Analysis Market |

| Market Size in 2024 | USD 5.06 Billion |

| Market Forecast in 2034 | USD 9.26 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 185 |

| Key Companies Covered | Abb Ltd. General Electric Company, Danaher Corporation, Thermo Fisher Scientific Inc., Tintometer Gmbh, Agilent Technologies Inc., Danaher Corporation, Emerson Electric Co., Horiba, Ltd., Honeywell International Inc., Mettler-Toledo International Inc., Sh, and others. |

| Segments Covered | By Product, By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Water Testing and Analysis Market: Regional Analysis

The market for Water Testing and Analysis in North America will hold a dominant stance over the forecast period. This can be attributed to the presence of a developed water analysis and testing infrastructure and rapid technology adoption to boost water quality in multiple applications through the forecast period. The United States is expected to be the most prominent market in this region owing to the rising demand for water testing in the nation due to stringent government regulations and the presence of key manufacturing companies in the nation.

Asia Pacific region will see a swift increase in demand owing to rising demand for water from a growing population, rapid industrialization, and strict government laws to ensure water quality before use or disposal. The Europe Water Testing and Analysis market is also anticipated to hold a prominent market share in the global Water Testing and Analysis industry over the forecast period.

Recent Developments

- In 2021 – Irish Water appointed Intertek to create a new water quality model in collaboration with Nicholas O’Dwyer Ltd. This partnership will be tasked to deliver a Strategic Modelling Study of Cork Harbour and help analyze the impact of water activities in Cork Harbour.

Water Testing and Analysis Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the water testing and analysis market on a global and regional basis.

Some of the main competitors dominating the global Water Testing and Analysis market include -

- Abb Ltd. General Electric Company

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- Tintometer Gmbh

- Agilent Technologies Inc.

- Danaher Corporation

- Emerson Electric Co.

- Horiba, Ltd.

- Honeywell International Inc.

- Mettler-Toledo International Inc.

- Shimadzu Corporation.

Global Water Testing and Analysis market is segmented as follows:

By Product

- TOC Analyzer

- PH Meter

- Dissolved Oxygen Meter

- Conductivity Sensor

- Turbidity Meter

- Others (conductivity meters, colorimeters, spectrophotometers, refractometers, ion analyzers, temperature sensors, and radioactivity analyzers)

By Type

- Portable

- Handheld

- Benchtop

- Others (continuous, in-line, and multi-functional meters)

By Application

- Laboratory

- Industrial

- Environmental

- Government

- Others (agricultural, household and general applications)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Water testing and analysis is the scientific process of evaluating water quality by measuring physical, chemical, biological, and radiological characteristics. It ensures water is safe for consumption, industrial use, environmental protection, and regulatory compliance.

The Global water testing and analysis market is expected to grow due to increasing concerns over water safety, stringent government regulations, and the rising prevalence of waterborne diseases.

According to a study, the Global water testing and analysis market size was worth around USD 5.06 Billion in 2024 and is expected to reach USD 9.26 Billion by 2034.

The Global water testing and analysis market is expected to grow at a CAGR of 6.2% during the forecast period.

North America is expected to dominate the water testing and analysis market over the forecast period.

Leading players in the Global water testing and analysis market include Abb Ltd. General Electric Company, Danaher Corporation, Thermo Fisher Scientific Inc., Tintometer Gmbh, Agilent Technologies Inc., Danaher Corporation, Emerson Electric Co., Horiba, Ltd., Honeywell International Inc., Mettler-Toledo International Inc., Sh, among others.

The report explores crucial aspects of the water testing and analysis market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed