Vyndaqel Market Size, Growth, Global Trends, Forecast 2034

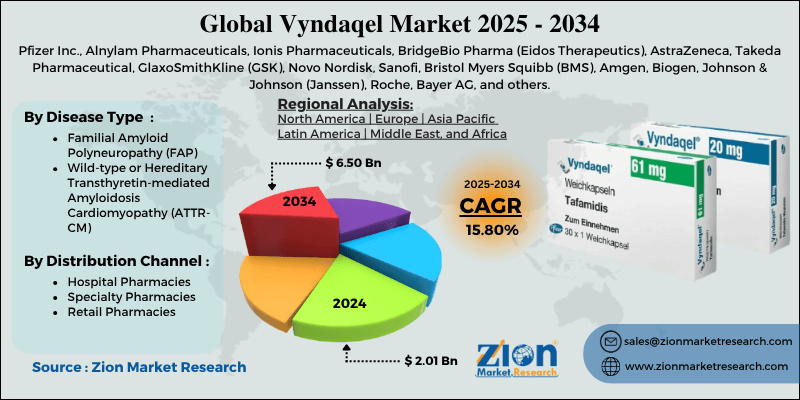

Vyndaqel Market By Disease Type (Familial Amyloid Polyneuropathy [FAP], Wild-type or Hereditary Transthyretin-mediated Amyloidosis Cardiomyopathy [ATTR-CM]), Distribution Channel (Hospital Pharmacies, Specialty Pharmacies, Retail Pharmacies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

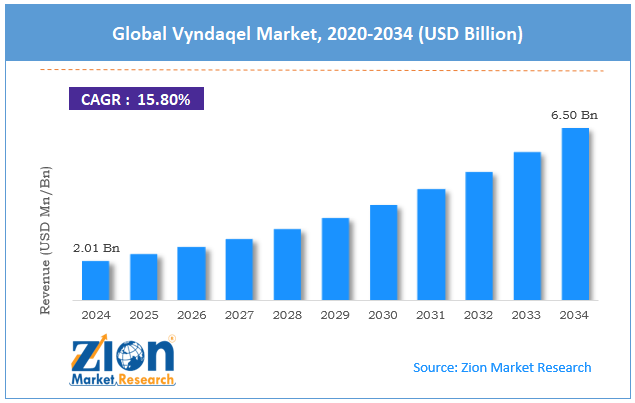

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.01 Billion | USD 6.50 Billion | 15.80% | 2024 |

Vyndaqel Industry Perspective:

The global Vyndaqel market size was worth around USD 2.01 billion in 2024 and is predicted to grow to around USD 6.50 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global Vyndaqel market is estimated to grow annually at a CAGR of around 15.80% over the forecast period (2025-2034)

- In terms of revenue, the global Vyndaqel market size was valued at around USD 2.01 billion in 2024 and is projected to reach USD 6.50 billion by 2034.

- The Vyndaqel market is projected to grow significantly owing to mounting diagnosis rates through advanced imaging and genetic tests, favorable regulatory approvals and orphan drug designations, and increasing awareness programs on ATTR diseases.

- Based on disease type, the Wild-type or Hereditary Transthyretin-mediated Amyloidosis Cardiomyopathy (ATTR-CM) segment is expected to lead the market. In contrast, the Familial Amyloid Polyneuropathy (FAP) segment is expected to grow considerably.

- Based on the distribution channel, the hospital pharmacies segment is expected to lead the market compared to the specialty pharmacies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Vyndaqel Market: Overview

Vyndaqel (tafamidis) is a medicinal drug that treats transthyretin amyloid cardiomyopathy (ATTR-CM), a progressive and rare disease in which abnormal protein deposits build up in the heart, resulting in failure. It works by stabilizing the transthyretin protein, slowing the creation of amyloid deposits, and helping preserve cardiac function. The global Vyndaqel market is projected to witness substantial growth driven by the growing cases of ATTR-CM, the first-in-class therapeutic advantage, and improved disease awareness and screening initiatives. Worldwide cases of both wild-type ATTR have surged due to better genetic screening and cardiology referral. Rising clinical recognition among elderly populations is growing the diagnostic patient pool. As patients are formally identified, the eligible population for Vyndaqel therapy continues to increase.

Moreover, Vyndaqel was the first FDA-accepted medication specifically targeting ATTR-CM, giving it early physician confidence and mover dominance. Being a pioneer therapy, it has transformed clinical guidelines and standard of care decisions. This exceptionality has ultimately fueled robust initial and sustained industry capture. Furthermore, cardiology congresses, academic outreach, and patient advocacy campaigns are increasing recognition of cardiac amyloidosis. Screening at heart failure clinics and the use of nuclear scintigraphy are elevating case detection rates. This awareness growth directly correlates with the surging treatable patient base.

Although drivers exist, the global market is challenged by factors like extremely high treatment costs and limited diagnostic rates in the developing nations. The annual cost of Vyndaqel therapy is more than $ 200,000, making it one of the most high-priced rare-disease medications. Without reimbursement support, affordability becomes a key access hindrance for a majority of patients. This high pricing limits penetration in price-sensitive regions. Likewise, several middle and low-income healthcare systems lack specialized cardiology diagnostics like biopsy infrastructure and nuclear scintigraphy. Underrecognition leads to untreated or misdiagnosed cases even when symptoms are present. Poor penetration caps the eligible industry pool.

Even so, the global Vyndaqel industry is well-positioned due to the expansion into early-stage patient cohorts, label expansion, and combination therapy development. Detecting and initiating treatment in pre-symptomatic or early progression patients may extend therapy duration per patient. Earlier intervention may offer superior results, enhancing payer willingness. This moves revenue from short-cycle to long-cycle therapy horizons. Studies assessing tafamidis with CRISPR edits, RNS silencers, or new cardiac protectants may widen indications. Combination strategies may drive additive patient capture beyond the current scope.

Vyndaqel Market Dynamics

Growth Drivers

How is the Vyndaqel market fueled by the aging population and increased incidence of heart failure?

ATTR-CM predominantly is seen in adults over 60, supporting the steadily growing demand for Vyndaqel with worldwide demographic trends. The United Nations 2025 World Population Prospects report projects that the population aged 60+ will reach nearly 1.1 billion by 2030, driving elevated cases of age-related ATTR-CM. Heart failure with preserved ejection fraction (HFpEF), usually associated with ATTR-CM, is growing every year by 3-4% in North America and Europe. This demographic move increases the patient base eligible for tafamidis, mainly in the developed regions. Health systems are increasingly prioritizing therapies that enhance long-term survival and decrease hospitalization in the elderly population.

How substantial a survival benefit and real-world evidence reinforcing use drive the Vyndaqel market?

Clinical evidence continues to demonstrate tafamidis' efficiency, aiding its industry adoption. The pivotal ATTR-ACT study recently showed a 30% reduction in all-cause mortality for tafamidis-treated patients v/s placebo. Real-world registry data from the GET-ATTR study (N=1,200 in European centers, 2024) confirmed continuous decreases in mortality and hospitalization. The United States Medicare claims analysis in 2024 stated a 29% lower heart-failure hospitalization cost among tafamidis users in 18 months. Endorsements from ESC and ACC guidelines as first-line therapy augments physician confidence, amplifying broader prescription uptake, impacting the Vyndaqel market.

Restraints

Competition from alternative therapies and generics negatively impacts market progress

While tafamidis is presently he standard, progressing therapies and generics may hamper its industry prominence. Novel RNA-silencing therapies like vutrisiran and patisiran have shown efficiency in ATTR-CM and are gaining physician preference in a few regions. Pfizer experiences competition from upcoming generic tafamidis formulations projected in 2026-27, which may reduce revenue. In 2024, early clinical trial data for next-generation small molecules signified potential efficiency in stabilizing TTR, raising questions regarding cost-efficiency comparisons. Industry entrants offering low-cost alternatives may hamper Vyndaqel uptake.

Opportunities

How does increasing diagnosis through advanced screening tools create promising avenues for the Vyndaqel industry growth?

Broader adoption of cardiac MRI, genetic testing, and scintigraphy (99mTc-PYP) is fueling early identification of ATTR-CM. In 2024, studies reported that early detection elevated treatment initiation by 25-30% in North America and Europe. Hospitals are establishing amyloidosis centers, aiding targeted therapy and referrals. As screening programs expand, more patients become eligible for Vyndaqel. This creates sustained demand growth in the emerging and developed regions, fueling the Vyndaqel industry.

Challenges

Limited awareness and misdiagnosis restrict the market growth

ATTR-CM is often misdiagnosed as standard heart failure, delaying treatment initiation. Studies suggest that nearly 50% of cases remain misdiagnosed or undiagnosed in routine cardiology. A European registry in 2023 reported a 2-3 year lag from symptom onset to accurate diagnostics. Physicians' hesitation to prescribe tafamidis without a confirmed diagnosis restricts uptake. Education programs and awareness campaigns are ongoing, but progress is still steady.

Vyndaqel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vyndaqel Market |

| Market Size in 2024 | USD 2.01 Billion |

| Market Forecast in 2034 | USD 6.50 Billion |

| Growth Rate | CAGR of 15.80% |

| Number of Pages | 216 |

| Key Companies Covered | Pfizer Inc., Alnylam Pharmaceuticals, Ionis Pharmaceuticals, BridgeBio Pharma (Eidos Therapeutics), AstraZeneca, Takeda Pharmaceutical, GlaxoSmithKline (GSK), Novo Nordisk, Sanofi, Bristol Myers Squibb (BMS), Amgen, Biogen, Johnson & Johnson (Janssen), Roche, Bayer AG, and others. |

| Segments Covered | By Disease Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vyndaqel Market: Segmentation

The global Vyndaqel market is segmented based on disease type, distribution channel, and region.

Based on disease type, the global Vyndaqel industry is divided into Familial Amyloid Polyneuropathy (FAP) and Wild-type or Hereditary Transthyretin-mediated Amyloidosis Cardiomyopathy (ATTR-CM). The Wild-type or Hereditary Transthyretin-mediated Amyloidosis Cardiomyopathy (ATTR-CM) segment is the most common form of transthyretin amyloidosis, mainly impacting elderly patients, primarily affecting senior patients, essentially men over 60 years. Its slow, progressive nature usually results in late diagnosis, raising the number of eligible patients for therapy. Vyndaqel has offered significant clinical benefit in slowing disease progression and decreasing hospitalization in this domain. The large patient pool and established clinical adoption surge the segmental dominance in the global market.

Conversely, the hereditary ATTR-CM, aka Familial Amyloid Polyneuropathy (FAP), is a rare genetic disorder caused by transthyretin mutations. Though less prevalent than wild-type, genetic screening and early diagnosis programs are growing in patient identification. Vyndaqel efficiently stabilizes transthyretin protein, slowing cardiac and neuropathic disease progression in these patients. This segment represents the second rank, fueled by specialized care centers and rising awareness in high-risk families.

Based on distribution channel, the global Vyndaqel market is segmented into hospital pharmacies, specialty pharmacies, and retail pharmacies. The hospital pharmacies segment registered a notable share of the market since most patients with ATTR-CM are diagnosed and treated in amyloidosis or specialized cardiology centers. These settings assure proper patient monitoring, access to supportive care during therapy, and better adherence. Hospitals also manage the reimbursement process for high-cost orphan drugs, streamlining patient access. The integration of prescription, diagnosis, and dispensing raises the segment's dominance.

On the other hand, specialty pharmacies hold a second-leading position, emphasizing high-cost and complex rare-disease therapies like Vyndaqel. They offer patient support programs, counseling, and shipment of drugs directly to patients' homes. Specialty pharmacies are essential in regions where hospital access is restricted or for ongoing outpatient management. Their increasing network improves adherence and convenience, backing steady industry growth in the segment.

Vyndaqel Market: Regional Analysis

What enables North America's strong foothold in the global Vyndaqel Market?

North America is likely to sustain its leadership in the vyndaqel market due to high prevalence and diagnosis of ATTR-CM, early regulatory and first-mover benefit, and substantial reimbursement and insurance coverage. North America holds a leading population of elderly patients, especially men over 60, who are vulnerable to wild-type ATTR-CM. Advanced diagnostic tools like nuclear scintigraphy and cardiac MRI, and enhanced awareness, have elevated confirmed cases. Studies suggest that more than 50,000 patients in the United States alone are eligible for tafamidis therapy, fueling the industry volume. The FDA approved Vyndaqel (tafamidis) for ATTR-CM in 2019, offering North America early access to this first-in-class therapy.

Speedy regulatory clearance allowed broader adoption in hospitals and specialized cardiology centers, and early industry entry strengthened clinical guidelines and prescription habits, boosting industry dominance. Medicaid, Medicare, and private insurance plans in North America usually cover orphan drugs like Vyndaqel, despite high yearly costs surpassing 200,000. Coverage reduces out-of-pocket expenses, enhancing patient adherence and access. Reimbursement support augments uptake and industry revenue.

Europe continues to secure the second-highest share in the Vyndaqel industry owing to earlier regulatory approval versus most regions, high treatment adoption and reimbursement penetration, and premium pricing sustains revenue weight. The EMA approved Vyndaqel for ATTR-PN in 2011 and for ATTR-CM in 2018, years before many Latin America and APAC regions. This longer availability window enables deeper physician familiarity and eaely adoption curves. Early entry also allowed clinical guideline integration and reimbursement negotiations ahead of competing regions.

Moreover, in Western Europe, nearly 35-40% of eligible diagnosed ATTR-CM patients are on tafamidis therapy, versus <20% in several worldwide regions. Broad public insurance and orphan drug reimbursement accelerate real uptake despite substantial annual therapy costs (~€200,000 per patient). Structured HTA pathways in the UK, Germany, and Italy allow predictable coverage, aiding persistent industry value.

Furthermore, unlike emerging industries that experience price caps or delayed access, Europe maintains premium orphan pricing bands than the United States in specific markets. Stable pricing under national reimbursement preserves revenue density even at modest patient volumes. This high patient revenue keeps Europe the second ranked region by value, and not just by volume.

Vyndaqel Market: Competitive Analysis

The leading players in the global Vyndaqel market are:

- Pfizer Inc.

- Alnylam Pharmaceuticals

- Ionis Pharmaceuticals

- BridgeBio Pharma (Eidos Therapeutics)

- AstraZeneca

- Takeda Pharmaceutical

- GlaxoSmithKline (GSK)

- Novo Nordisk

- Sanofi

- Bristol Myers Squibb (BMS)

- Amgen

- Biogen

- Johnson & Johnson (Janssen)

- Roche

- Bayer AG

Vyndaqel Market: Key Market Trends

Growth of real-world evidence and patient registries:

Post-marketing registries and real-world data collection are becoming crucial to demonstrate long-term safety and efficacy. These studies support payer negotiations and strengthen physician confidence. Expanding evidence generation also helps in reimbursement approvals and label expansion.

Increased adoption of companion diagnostics:

Advanced diagnostic techniques, comprising cardiac MRI, genetic testing, and scintigraphy, are integrated into routine patient pathways. Early and accurate detection promises timely intimation of Vyndaqel therapy. Diagnostics-led adoption is a central propeller of the industry expansion, especially in the developing regions.

Expansion into early diagnosis and pre-symptomatic treatment:

Pharma companies and clinicians are increasingly focusing on detecting ATTR-CM at earlier stages. Early intervention with Vyndaqel may slow disease progression and enhance long-term outcomes. This trend is fueling longer therapy duration and higher lifetime revenue per patient.

The global Vyndaqel market is segmented as follows:

By Disease Type

- Familial Amyloid Polyneuropathy (FAP)

- Wild-type or Hereditary Transthyretin-mediated Amyloidosis Cardiomyopathy (ATTR-CM)

By Distribution Channel

- Hospital Pharmacies

- Specialty Pharmacies

- Retail Pharmacies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Vyndaqel (tafamidis) is a medicinal drug that treats transthyretin amyloid cardiomyopathy (ATTR-CM), a progressive and rare disease in which abnormal protein deposits build up in the heart, resulting in failure. It works by stabilizing the transthyretin protein, slowing the creation of amyloid deposits, and helping preserve cardiac function.

The global Vyndaqel market is projected to grow due to the rising prevalence of transthyretin amyloidosis (ATTR), expanding healthcare expenditure globally, and robust clinical evidence supporting Vyndaqel efficacy.

According to study, the global Vyndaqel market size was worth around USD 2.01 billion in 2024 and is predicted to grow to around USD 6.50 billion by 2034.

The CAGR value of the Vyndaqel market is expected to be around 15.80% during 2025-2034.

Market trends and consumer preferences are evolving toward personalized therapy, earlier diagnosis, and enhanced access to high-cost orphan drugs like Vyndaqel.

North America is expected to lead the global Vyndaqel market during the forecast period.

The U.S. leads the Vyndaqel market due to early FDA approval, high ATTR-CM prevalence, broad insurance coverage, and strong healthcare infrastructure.

The key players profiled in the global Vyndaqel market include Pfizer Inc., Alnylam Pharmaceuticals, Ionis Pharmaceuticals, BridgeBio Pharma (Eidos Therapeutics), AstraZeneca, Takeda Pharmaceutical, GlaxoSmithKline (GSK), Novo Nordisk, Sanofi, Bristol Myers Squibb (BMS), Amgen, Biogen, Johnson & Johnson (Janssen), Roche, and Bayer AG.

Stakeholders should focus on geographic expansion, early diagnosis programs, real-world evidence generation, and patient support services to stay competitive in the Vyndaqel market.

The report examines key aspects of the Vyndaqel market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed