Global Clinical Trials Market Size, Share, Growth Analysis Report - Forecast 2034

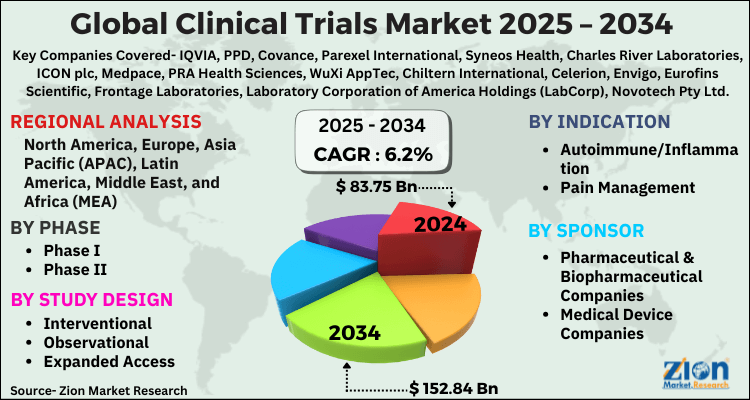

Clinical Trials Market By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional, Observational, Expanded Access), By Indication (Autoimmune/Inflammation, Pain Management, Oncology, CNS Condition, Diabetes, Obesity, Cardiovascular, Others), By Sponsor (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Others), By Service Type (Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing Services, Clinical Trial Data Management Services, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

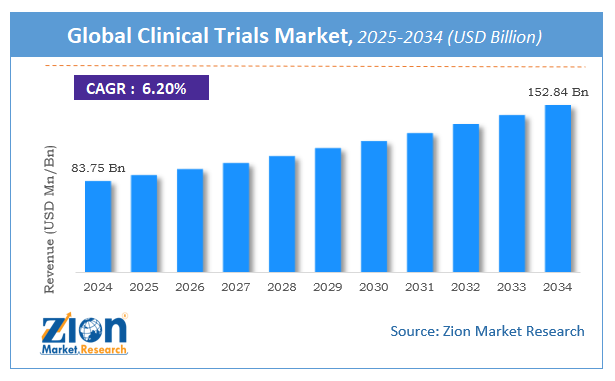

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 83.75 Billion | USD 152.84 Billion | 6.2% | 2024 |

Global Clinical Trials Market: Industry Perspective

The global clinical trials market size was worth around USD 83.75 Billion in 2024 and is predicted to grow to around USD 152.84 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.2% between 2025 and 2034. The report analyzes the global clinical trials market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the clinical trials industry.

Global Clinical Trials Market: Overview

Clinical trials are research experiments carried out in individuals aimed at testing a medical, behavioral, or surgical intervention. They are the key platform for researchers to find out if a new medication is safe and successful in humans, such as a new medicine, medical device, or diet. A clinical study is also used to assess whether new treatments are more successful and/or have fewer adverse side effects than traditional therapies.

Other clinical trials are exploring ways of detecting disease early, even before symptoms appear. It also researches ways to stop a health condition. A clinical study can also look at how people coping with a life-threatening illness or a chronic health condition can make life easier. Often, clinical trials research the involvement of caregivers or support groups.

Before the United States Food and Drug Administration (FDA) approves the launch of a clinical trial, in which scientists conduct experimental tests and animal trials to assess the safety and effectiveness of possible treatment. The FDA gives permission for the intervention to be studied in humans if these studies produce favorable results.

Global Clinical Trials Market: Growth Factors

Increase in the prevalence of chronic diseases and surge in demand for personalized medicine drive the market growth

The global clinical trials market is experiencing significant growth due to the increasing prevalence of chronic and infectious diseases, demand for personalized medicine, and advancements in technology. The market is further driven by the rising investment by pharmaceutical and biotechnology companies and favorable government initiatives to support clinical research and development. Moreover, the increasing adoption of virtual and decentralized clinical trials is fueling market growth, as they enable faster recruitment, reduce trial costs, and offer improved patient experiences. Additionally, the emergence of contract research organizations (CROs) is contributing to market expansion, as they provide cost-effective solutions to drug developers.

Furthermore, the use of artificial intelligence, machine learning, and big data analytics is expected to transform the clinical trials landscape by improving trial efficiency and accuracy. Thus, the clinical trials market is expected to grow significantly in the coming years.

Restraints

Extortionate cost of conducting trials to hamper the growth of the industry

The clinical trials industry also faces several restraints, including the high cost associated with conducting trials and complex regulatory requirements. Additionally, the COVID-19 pandemic has disrupted clinical trials, leading to delays, cancellations, and reduced enrollment. Moreover, the lack of patient diversity in clinical trials is a significant challenge, as it limits the generalizability of trial results to broader populations. Furthermore, ethical concerns and the need for informed consent from participants pose additional challenges to the market. Finally, there is a need for increased collaboration between stakeholders, including sponsors, CROs, regulators, and patients, to overcome these challenges and ensure the success of clinical trials.

Opportunities

Increase in the development of new technologies create ample opportunities for the industry

Despite the challenges, the global clinical trials market presents several opportunities for growth. One of the significant opportunities is the increasing focus on precision medicine, which requires personalized and targeted therapies based on patient-specific characteristics. This approach necessitates the development of more sophisticated and specialized clinical trials, providing opportunities for CROs and other service providers.

Moreover, the growing interest in rare diseases and orphan drugs presents significant opportunities for clinical trials, as these areas require specialized expertise and resources. Furthermore, the emergence of real-world evidence (RWE) and patient-generated health data (PGHD) offers new avenues for clinical research, improving trial design and outcomes.

The adoption of new technologies, such as telemedicine and wearables, is also expected to expand the reach of clinical trials and increase patient participation. Furthermore, collaborations and partnerships between pharmaceutical companies, CROs, and academic institutions can help drive innovation and improve the efficiency of clinical trials.

Challenges

Shortage of skilled professionals to act as a challenge for the industry

The clinical trials industry faces several challenges, including complex regulatory requirements, the shortage of skilled professionals, disruptions caused by the COVID-19 pandemic, and a lack of patient diversity. Additionally, ethical concerns and the need for informed consent from participants pose significant challenges to the market. Overcoming these challenges requires increased collaboration between stakeholders, the adoption of new technologies, and innovative trial designs that promote patient participation and diversity.

Recent Developments

- In October 2024, Novartis announced the completion of its Phase III clinical trial for a new sickle cell disease treatment. The trial showed a significant reduction in the rate of sickle cell-related pain crises compared to the placebo, and the company plans to submit the drug for regulatory approval in 2024.

- In June 2024, AstraZeneca announced positive results from its Phase III clinical trial for a new lung cancer treatment. The trial showed a significant improvement in progression-free survival compared to the placebo, and the company plans to submit the drug for regulatory approval.

- In September 2024, Pfizer and BioNTech announced the completion of a Phase II/III trial for their COVID-19 vaccine in children aged 5 to 11. The trial showed a favorable safety profile and robust antibody responses, and the companies plan to seek regulatory authorization for the vaccine in this age group.

Global Clinical Trials Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clinical Trials Market |

| Market Size in 2024 | USD 83.75 Billion |

| Market Forecast in 2034 | USD 152.84 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 215 |

| Key Companies Covered | IQVIA, PPD, Covance, Parexel International, Syneos Health, Charles River Laboratories, ICON plc, Medpace, PRA Health Sciences, WuXi AppTec, Chiltern International, Celerion, Envigo, Eurofins Scientific, Frontage Laboratories, Laboratory Corporation of America Holdings (LabCorp), Novotech Pty Ltd., Pharmaron, Pharmaceutical Product Development, LLC (PPD), and QuintilesIMS (now IQVIA) among others., and others. |

| Segments Covered | By Phase, By Study Design, By Indication, By Sponsor, By Service Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Clinical Trials Market: Segmentation

The global clinical trials market is segmented based on phase, study design, indication, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on phase, the market bifurcated into Phase I, Phase II, Phase III, and Phase IV. The Phase III segment held the largest market share in 2022 and is further predicted to grow rapidly at a notable CAGR during the forecast period. The main reason for the growth of this segment is its critical role in drug development. Phase III trials are designed to compare the safety and efficacy of new treatments to existing therapies, providing important data for regulatory approval and market access.

The increasing prevalence of chronic and infectious diseases and demand for personalized medicine is driving the need for new and innovative treatments, leading to a surge in Phase III trials. Moreover, the emergence of real-world evidence and patient-generated health data is expected to transform the Phase III landscape, enabling more efficient and effective trials.

Based on study design, the clinical trials industry is bifurcated into observational, interventional, and expanded access. The interventional design segment held the dominating market share in 2022 and is further projected to grow rapidly at a significant CAGR during the forecast period.

The interventional design segment of the clinical trials market is expected to experience significant growth due to the increasing demand for innovative and effective treatments. Interventional trials involve the use of a new treatment or drug and are designed to evaluate its safety, efficacy, and side effects. These trials play a crucial role in the development of new therapies and are essential for gaining regulatory approval and market access. The rising prevalence of chronic & infectious diseases and demand for personalized medicine is driving the need for new & innovative treatments, leading to a surge in interventional trials. Moreover, advancements in technology and data analytics are expected to transform interventional trial design, making them more efficient and effective.

Based on indication, the market is segmented into gastrointestinal, cardiovascular, autoimmune/inflammation, pain management, CNS condition, cancer, mental disorders, oncology, diabetes, obesity, and others. The oncology segment held the dominating market share in 2024 and is projected to cite a remarkable CAGR during the forecast period.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Clinical Trials Market: Regional Analysis

North America region to dominate the global market during the forecast period

The North American region held the dominating clinical trials market share in 2024 and is further predicted to grow at an exponential CAGR during the forecast period. North America is a major player in the clinical trials market, with the United States accounting for the majority of the region's market share. The growth of the market in North America is driven by several factors, including the increasing prevalence of chronic & infectious diseases, the demand for personalized medicine, and the presence of a well-established pharmaceutical industry.

Global Clinical Trials Market: Competitive Players

The major players in the global clinical trials market include:

- IQVIA

- PPD

- Covance

- Parexel International

- Syneos Health

- Charles River Laboratories

- ICON plc

- Medpace

- PRA Health Sciences

- WuXi AppTec

- Chiltern International

- Celerion

- Envigo

- Eurofins Scientific

- Frontage Laboratories

- Laboratory Corporation of America Holdings (LabCorp)

- Novotech Pty Ltd.

- Pharmaron

- Pharmaceutical Product Development LLC (PPD)

- QuintilesIMS (now IQVIA)

- Among Others.

Global Clinical Trials Market: Segmentation Analysis

The report segment of the global clinical trials market is as follows:

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Observational

- Interventional

- Expanded Access

By Indication

- Gastrointestinal

- Cardiovascular

- Autoimmune/Inflammation

- Pain management

- CNS condition

- Cancer

- Mental disorders

- Oncology

- Diabetes

- Obesity

- Others

Global Clinical Trials Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Clinical trials are research experiments carried out in individuals aimed at testing a medical, behavioral, or surgical intervention. They are the key platform for researchers to find out if a new medication is safe and successful in humans, such as a new medicine, medical device, or diet. A clinical study is also used to assess whether new treatments are more successful and/or have fewer adverse side effects than traditional therapies.

The global clinical trials market is expected to grow due to increasing R&D investments, rising chronic disease prevalence, and adoption of decentralized trial models.

According to a study, the global clinical trials market size was worth around USD 83.75 Billion in 2024 and is expected to reach USD 152.84 Billion by 2034.

The global clinical trials market is expected to grow at a CAGR of 6.2% during the forecast period.

North America is expected to dominate the clinical trials market over the forecast period.

Leading players in the global clinical trials market include IQVIA, PPD, Covance, Parexel International, Syneos Health, Charles River Laboratories, ICON plc, Medpace, PRA Health Sciences, WuXi AppTec, Chiltern International, Celerion, Envigo, Eurofins Scientific, Frontage Laboratories, Laboratory Corporation of America Holdings (LabCorp), Novotech Pty Ltd., Pharmaron, Pharmaceutical Product Development, LLC (PPD), and QuintilesIMS (now IQVIA) among others., among others.

The report explores crucial aspects of the clinical trials market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed