Wearable Healthcare Devices Market Size, Share, Trends, Growth and Forecast 2034

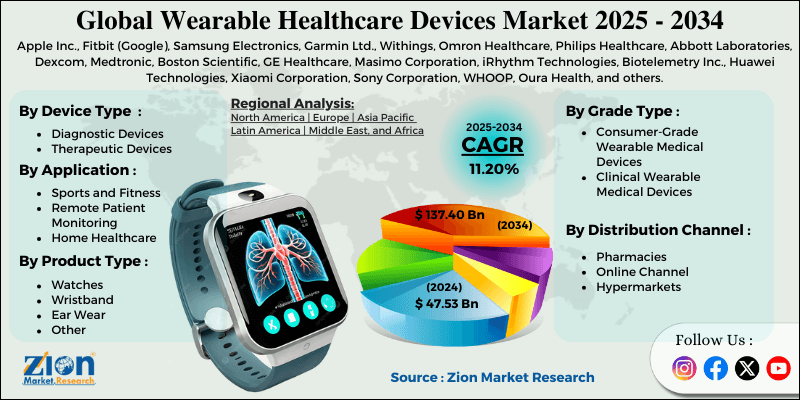

Wearable Healthcare Devices Market By Device Type (Diagnostic Devices, Therapeutic Devices), By Application (Sports and Fitness, Remote Patient Monitoring, Home Healthcare), By Product Type (Watches, Wristband, Ear Wear, Other), By Grade Type (Consumer-Grade, Clinical), By Distribution Channel (Pharmacies, Online Channel, Hypermarkets), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

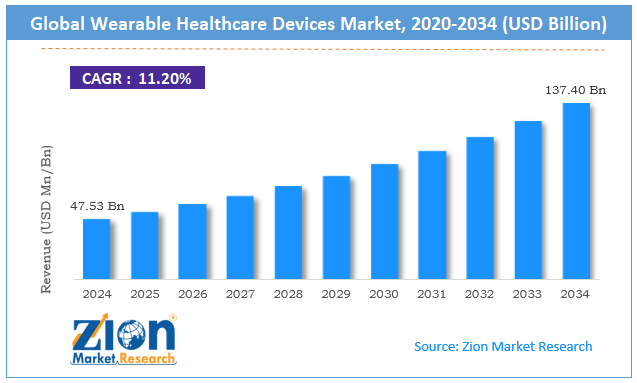

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.53 Billion | USD 137.40 Billion | 11.20% | 2024 |

Wearable Healthcare Devices Industry Perspective:

The global wearable healthcare devices market was valued at approximately USD 47.53 billion in 2024 and is expected to reach around USD 137.40 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 11.20% between 2025 and 2034.

Wearable Healthcare Devices Market: Overview

Wearable healthcare devices are electronic devices worn on the body that monitor, track, and transmit health and fitness data to the user and healthcare provider, combining sensor technology, data analytics, and user-friendly interfaces to deliver health insights. These devices have advanced biosensors, wireless connectivity, long-lasting batteries, and sophisticated algorithms to detect and analyze various health parameters in real-time.

From consumer-focused fitness bands to medical-grade continuous glucose monitors, products vary in data collection, analysis, and presentation depending on use case and target audience.

The increasing prevalence of chronic diseases, growing health consciousness among consumers, and technological advancements in sensor miniaturization and battery efficiency are expected to drive substantial growth in the global wearable healthcare devices industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global wearable healthcare devices market is estimated to grow annually at a CAGR of around 11.20% over the forecast period (2025-2034)

- In terms of revenue, the global wearable healthcare devices market size was valued at around USD 47.53 billion in 2024 and is projected to reach USD 137.40 billion by 2034.

- The wearable healthcare devices market is projected to grow significantly due to the integration of artificial intelligence capabilities, increasing adoption of remote patient monitoring systems, and supportive reimbursement policies.

- Based on device type, diagnostic devices lead the segment and will continue to lead the global market.

- Based on the application, remote patient monitoring leads the market with the largest revenue share.

- Based on product type, watches represent the predominant market segment during the forecast period.

- Based on grade type, consumer-grade wearable medical devices account for the largest market share.

- Based on the distribution channel, online channels are anticipated to command the largest market share.

- Based on region, North America is projected to lead the global market during the forecast period.

Wearable Healthcare Devices Market: Growth Drivers

Digital health ecosystem expansion and preventive care evolution

The wearable healthcare devices market is growing due to connected health platforms and a shift in approach to preventive medicine. Digital health ecosystems now connect to wearable devices in developed markets, shifting from simply tracking to health management. Mobile health applications have transformed user engagement as continuous monitoring becomes frequent rather than periodic measurement.

Healthcare providers are adopting wearables for older adults and chronic disease patients. Preventive health monitoring has moved beyond fitness enthusiasts to personalized risk assessment, increasing demand across all demographics.

Integration capabilities and clinical validation enhancement

Innovation in the wearable healthcare devices industry has transformed functionality and medical relevance throughout the industry. Multi-parameter monitoring has increased, giving healthcare systems health insights and operational efficiency. AI with predictive analytics has reduced false alarms and improved early intervention in high-risk patients.

Clinical validation through controlled studies allows symptom correlation, condition-specific monitoring, and treatment response tracking to add medical credibility beyond wellness use cases.

Battery and power management improvements, including energy harvesting and optimized sensors, have increased device run time by 3-5 days to address the consumer pain point of having to charge daily.

Wearable Healthcare Devices Market: Restraints

Data security concerns and regulatory compliance complexity

Despite growing demand, the wearable healthcare devices market faces significant challenges related to data protection vulnerabilities and evolving regulatory requirements. Health data is sensitive, which creates privacy risks, resulting in consumer hesitation and preventing the adoption by potential users.

The industry is under increasing regulatory scrutiny, regional compliance variations, and certification requirements that can impact product development timelines and market entry in a matter of months.

Wearable Healthcare Devices Market: Opportunities

Specialized condition monitoring and healthcare provider integration

The wearable healthcare devices industry has substantial opportunities through condition-specific monitoring solutions and deeper clinical workflow integration models. Chronic disease management with specialized sensors for diabetes, cardiovascular disease, and respiratory conditions has shown better outcomes and appeals to the growing population with these conditions.

The remote patient monitoring reimbursement models have created new business models where providers can get paid for virtual care delivered through wearables. Advanced materials that offer better comfort, durability, and biocompatibility align with user expectations and create brand differentiation in medical-grade wearables.

Wearable Healthcare Devices Market: Challenges

Accuracy limitations and user abandonment concerns

The wearable healthcare devices market has challenges in maintaining clinical accuracy as consumers want more health insights. Human physiology is variable, and measurement across different body types, skin tones, and activity levels is challenging when moving beyond basic metrics.

Consumer electronics companies have created new competition with lower prices without the traditional overhead of medical device validation. Users are high on initial enthusiasm but low on long-term engagement, making it challenging for companies to balance initial adoption with sustainable usage patterns.

Wearable Healthcare Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wearable Healthcare Devices Market |

| Market Size in 2024 | USD 47.53 Billion |

| Market Forecast in 2034 | USD 137.40 Billion |

| Growth Rate | CAGR of 11.20% |

| Number of Pages | 215 |

| Key Companies Covered | Apple Inc., Fitbit (Google), Samsung Electronics, Garmin Ltd., Withings, Omron Healthcare, Philips Healthcare, Abbott Laboratories, Dexcom, Medtronic, Boston Scientific, GE Healthcare, Masimo Corporation, iRhythm Technologies, Biotelemetry Inc., Huawei Technologies, Xiaomi Corporation, Sony Corporation, WHOOP, Oura Health, and others. |

| Segments Covered | By Device Type, By Application, By Product Type, By Grade Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wearable Healthcare Devices Market: Segmentation

The global wearable healthcare devices market is segmented into device type, application, product type, grade type, distribution channel, and region.

Based on device type, the market is segregated into diagnostic devices (vital sign monitoring devices, sleep monitoring devices, electrocardiographs, fetal and obstetric devices, neuromonitoring devices) and therapeutic devices (pain management devices, rehabilitation devices, respiratory therapy devices, other therapeutic devices).

Diagnostic devices lead the market due to their versatility in health monitoring capabilities, increasing functional sophistication, expanding app ecosystems, and the ability to serve both consumer wellness and clinical monitoring needs.

Based on the application, the wearable healthcare devices industry is classified into sports and fitness, remote patient monitoring, and home healthcare. Remote patient monitoring holds the largest market share due to growing telehealth adoption, increasing chronic disease prevalence, demonstrated cost savings for healthcare systems, and supportive reimbursement policies across diverse healthcare settings.

Based on the product type, the wearable healthcare devices market is divided into watches, wristbands, ear wears, and others. The watch segment is expected to lead the market during the forecast period due to its versatility, comprehensive functionality, and consumer preference for all-in-one devices that combine health monitoring with everyday utility.

Based on grade type, the market is categorized into consumer-grade wearable medical devices and clinical wearable medical devices. Consumer-grade devices lead the market due to wider accessibility, lower prices, and growing health consciousness among general consumers.

Based on the distribution channel, the wearable healthcare devices industry is divided into pharmacies, online channels, and hypermarkets. The online channel segment is expected to lead the market due to extensive product selection, detailed specification information, consumer review availability, and convenience across diverse geographic regions.

Wearable Healthcare Devices Market: Regional Analysis

North America to lead the market

North America leads the global wearable healthcare devices market due to high technology adoption rates, healthcare expenditure, and digital health infrastructure. The region accounts for approximately 42% of the global market share, with the U.S. being the world's largest adopter of health wearables per capita.

Consumer studies show North American users replace their health wearables every 18-24 months across various price points and functionality levels. The region has advanced healthcare integration frameworks enabling seamless data sharing between devices and electronic health records in many health systems.

High technology literacy and comfort with health tracking create an environment for advanced wearable healthcare devices. The insurance sector in the region generates consistent demand for preventive monitoring through wellness programs and incentive structures throughout the year. Strong consumer interest in personalized health insights creates predictable upgrade cycles and feature expansion opportunities for manufacturers.

Europe is to maintain a substantial market share.

Europe represents a growing wearable healthcare devices market characterized by strong public healthcare systems, privacy-conscious consumers, and developing regulatory frameworks. Countries like Germany, the UK, France, and the Nordic nations have high adoption and strong clinical integration models. The region's focus on evidence-based medicine and clinical validation creates market entry requirements that differ from those of other global regions.

National health systems and private providers influence adoption more than direct-to-consumer models in other developed markets. European users prioritize data ownership and privacy protection, which creates requirements with less willingness to share health data than in North America.

The growing aging population has accelerated the adoption of remote monitoring technologies for chronic conditions, creating opportunities for medically oriented wearable services. A strong emphasis on scientific validation supports higher price points for clinically proven devices in most European markets than global averages.

Recent Market Developments:

- In March 2025, the Mayo Clinic published results from a study involving over 10,000 patients demonstrating that wearable ECG monitoring detected 35% more cases of atrial fibrillation than traditional screening methods.

Wearable Healthcare Devices Market: Competitive Analysis

The global wearable healthcare devices market is led by players like:

- Apple Inc.

- Fitbit (Google)

- Samsung Electronics

- Garmin Ltd.

- Withings

- Omron Healthcare

- Philips Healthcare

- Abbott Laboratories

- Dexcom

- Medtronic

- Boston Scientific

- GE Healthcare

- Masimo Corporation

- iRhythm Technologies

- Biotelemetry Inc.

- Huawei Technologies

- Xiaomi Corporation

- Sony Corporation

- WHOOP

- Oura Health

The global wearable healthcare devices market is segmented as follows:

By Device Type

- Diagnostic Devices

- Vital Sign Monitoring Devices

- Sleep Monitoring Devices

- Electrocardiographs, Fetal and Obstetric Devices

- Neuromonitoring Devices

- Therapeutic Devices

- Pain Management Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

- Other Therapeutic Devices

By Application

- Sports and Fitness

- Remote Patient Monitoring

- Home Healthcare

By Product Type

- Watches

- Wristband

- Ear Wear

- Other

By Grade Type

- Consumer-Grade Wearable Medical Devices

- Clinical Wearable Medical Devices

By Distribution Channel

- Pharmacies

- Online Channel

- Hypermarkets

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wearable healthcare devices are electronic products worn on or close to the body that collect, analyze, and transmit health-related data, combining sensor technology, connectivity features, and analytical capabilities to provide users and healthcare providers with actionable health insights.

The wearable healthcare devices market is expected to be driven by increasing chronic disease prevalence, growing focus on preventive healthcare, technological advancements in sensors and batteries, expanding telehealth services, favorable reimbursement policies, and rising health consciousness among consumers.

According to our study, the global wearable healthcare devices market was worth around USD 47.53 billion in 2024 and is predicted to grow to around USD 137.40 billion by 2034.

The CAGR value of the wearable healthcare devices market is expected to be around 11.20% during 2025-2034.

The global wearable healthcare devices market will register the highest growth in North America during the forecast period.

Key players in the wearable healthcare devices market include Apple Inc., Fitbit (Google), Samsung Electronics, Garmin Ltd., Withings, Omron Healthcare, Philips Healthcare, Abbott Laboratories, Dexcom, Medtronic, Boston Scientific, GE Healthcare, Masimo Corporation, iRhythm Technologies, Biotelemetry Inc., Huawei Technologies, Xiaomi Corporation, Sony Corporation, WHOOP, and Oura Health.

The report comprehensively analyzes the wearable healthcare devices market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, business model evolution, and the changing healthcare provider and consumer preferences shaping the wearable healthcare devices industry ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed