U.S. Steel Wire Market Size, Share, Growth, and Industry Analysis 2032

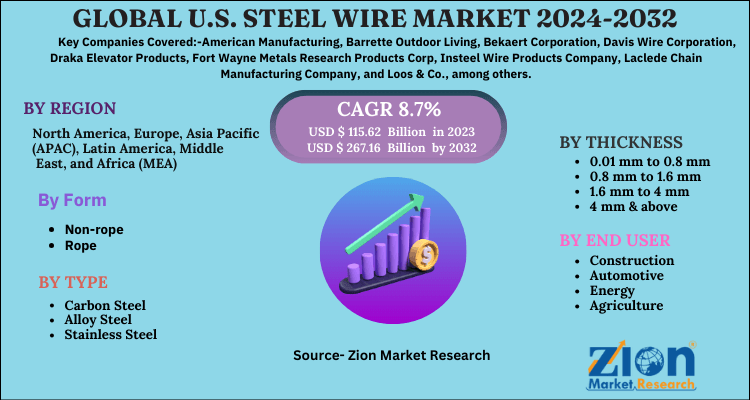

U.S. Steel Wire Market By Form (Non-rope and Rope), by Type (Carbon Steel, Alloy Steel, and Stainless Steel), by Thickness (0.01 mm to 0.8 mm, 0.8 mm to 1.6 mm, 1.6 mm to 4 mm, and 4 mm & above), by End User (Construction, Automotive, Energy, Agriculture, and Others): U.S. Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

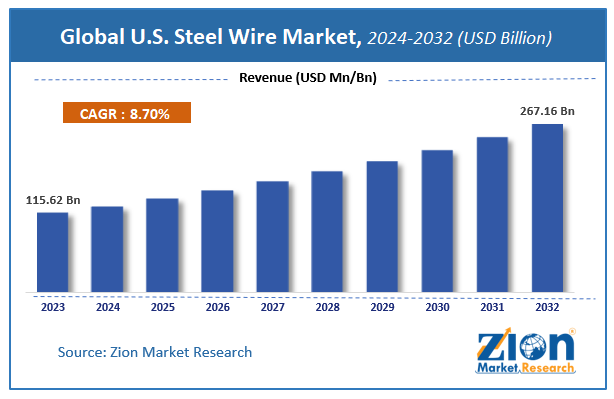

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 115.62 Billion | USD 267.16 Billion | 8.7% | 2023 |

U.S. Steel Wire Market Insights

According to a report from Zion Market Research, the global U.S. Steel Wire Market was valued at USD 115.62 Billion in 2023 and is projected to hit USD 267.16 Billion by 2032, with a compound annual growth rate (CAGR) of 8.7% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the U.S. Steel Wire Market industry over the next decade.

U.S. Steel Wire Market: Overview

Steel is an inorganic type of material. The steel wire is made with a cold drawing process in which a steel ingot or a thick rod is drawn through a circular-shaped die of a high-hardness mold that is thinner than the ingot.295 The steel deforms to a smaller diameter under the pressure from the mold. By multiple steps of such cold drawing, the diameter of the wire is gradually reduced to desired level. The major factor that is primarily driving the growth of the market is the rising investments by the government authorities in the development of infrastructure in emerging economies.

This, in turn, has hampered the growth of all the associated industries. Several ongoing projects were either halted or delayed. During this period, the price of numerous construction materials including steel has gone up. For instance, steel prices saw an upsurge of more than 50% as compared to the prices of early 2020, which is projected to slow down the rate of construction activities in the coming years.

The Automotive and energy sectors witnessed the slowest demand for steel wire as the market was completely shut for more than six months. Production of automotive was halted due to lockdown and shortage of labor among others. The industry has to face a prominent loss in revenue during this period. This impact and recovery is likely to take 2-3 years to restore to the previous growth rate. Since, most of the industries were either partially operational or closed that reduced the consumption of energy. This resulted into lower production of electricity. The lower production discouraged the operators to undertake any development activities that would utilize steel wire.

However, the market has started regaining at an unpreceded rate on account of the introduction of the Covid-19 vaccine, the uplift of lockdown, ease of regulations. The beginning of 2021 witnessed slow growth as expected but then it went up. As per our analysis, the market will take around 2-3 years to come back to normal.

U.S. Steel Wire Market: Growth Factors

The construction industry is the largest application industry in the steel wire market in terms of volume. Steel wires are heavily used in a range of applications in the construction industry in road, atomic reactor domes, river & railway bridges and flyovers, slabs, hangers, silos, aqueducts, viaducts, high-rise buildings, and railway sleeper construction. In addition to this, the market has started witnessing a significant boost after 2020 in the residential and construction activities in the U.S. Moreover, the U.S. federal government is planning to invest USD 500 billion over 10 years (2017–2028). The demand for steel is likely to go up until 2024 as most of the delayed and halted construction projects are expected to go online until the year. The residential construction segment is projected add fuel to the overall market growth as the number of individual home buyers has gone up since the mortgage has reduced to a record low. This will further encourage the homebuyers.

The demand for steel wire is projected to continue growing in the coming years as the market does not have any other substitute which can reduce its overall application and end use. This can mainly be attributed to the lightweight, high tensile and mechanical strength, ability to work under high pressure and temperature, and anti-corrosion properties. Moreover, steel wires offer these properties at significantly low prices, which further encourages the demand for the product. As per applications, these properties can be enhanced by offering plastic or nylon coating and anti-corrosion can be taken to the next level by galvanizing the wire. In addition to this, the U.S. government has been paying more attention to the safety of passengers and is directing the automotive producer to make better safest possible vehicles, which can be achieved by high grade steel wire. The emergence of EVs has further added fuel to the overall demand.

U.S. Steel Wire Market: Segment Analysis

On the basis of type the market is segmented into Carbon Steel and Alloy Steel. Carbon Steel holds the major share in the market whereas, Alloy Steel segment will surpass the Carbon Steel segment in near future owing to the huge application. Carbon steel is projected to dominate the market on account of a wide range of end-use applications and growing demand from the construction and automotive industries.

By end use, the market is segmented into construction, automotive, energy, agriculture, and others. Wherein, the construction industry is projected to lead the market. It is expected to hold a major share and is likely to continue dominating the market during the forecast. The construction industry has started showing slow growth as expected in the year 2021, the demand and growth has started returning to normal at a very high rate. In addition to this, the residential construction activities have started booming again and most of the projects that were halted have become operational.

U.S. Steel Wire Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Steel Wire Market |

| Market Size in 2023 | USD 115.62 Billion |

| Market Forecast in 2032 | USD 267.16 Billion |

| Growth Rate | CAGR of 8.7% |

| Number of Pages | 199 |

| Key Companies Covered | American Manufacturing, Barrette Outdoor Living, Bekaert Corporation, Davis Wire Corporation, Draka Elevator Products, Fort Wayne Metals Research Products Corp, Insteel Wire Products Company, Laclede Chain Manufacturing Company, and Loos & Co., among others. |

| Segments Covered | By Form, By Type, By Thickness, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

U.S. Steel Wire Market: Regional Analysis Preview

The market is likely to remain stable in the coming years on account of strong demand from the construction, automotive, and energy sectors. However, the market has seen a significant increase in steel prices on account of reduced production and increased demand and supply gap. The prices are likely to come back to normal by 2024 as the production restores and tension between the U.S. and China.

Key Market Players & Competitive Landscape

Some of key players in U.S. steel wire market are

- American Manufacturing

- Barrette Outdoor Living

- Bekaert Corporation

- Davis Wire Corporation

- Draka Elevator Products

- Fort Wayne Metals Research Products Corp

- Insteel Wire Products Company

- Laclede Chain Manufacturing Company

- and Loos & Co

- among others.

The U.S. steel wire market is segmented as follows:

By Form

- Non-rope

- Rope

By Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

By Thickness

- 0.01 mm to 0.8 mm

- 0.8 mm to 1.6 mm

- 1.6 mm to 4 mm

- 4 mm & above

By End User

- Construction

- Automotive

- Energy

- Agriculture

- Others

By Region

- U.S.

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global U.S. Steel Wire Market was valued at USD 115.62 Billion in 2023 and is projected to hit USD 267.16 Billion by 2032.

According to a report from Zion Market Research, the global U.S. Steel Wire Market a compound annual growth rate (CAGR) of 8.7% during the forecast period 2024-2032.

Some of the key factors driving the U.S. steel wire market growth are increasing demand from the construction industry and lack of prominent substitute, among others.

Some of the major companies operating in the U.S. steel wire market are American Manufacturing, Barrette Outdoor Living, Bekaert Corporation, Davis Wire Corporation, Draka Elevator Products, Fort Wayne Metals Research Products Corp, Insteel Wire Products Company, Laclede Chain Manufacturing Company, and Loos & Co., among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed