U.S. Healthcare Transportation Services Market Size, Share, Forecast Report - 2034

U.S. Healthcare Transportation Services Market By Type (Medical Transportation, Incubator Transport, Mobile Treatment Facilities, Patient Transport, and Non-Medical Transportation), By End Use (Hospitals, Medical Centers, Nursing Care Facilities, and Airport Shuttle), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.75 Billion | USD 32.89 Billion | 7.64% | 2024 |

U.S. Healthcare Transportation Services Market Size

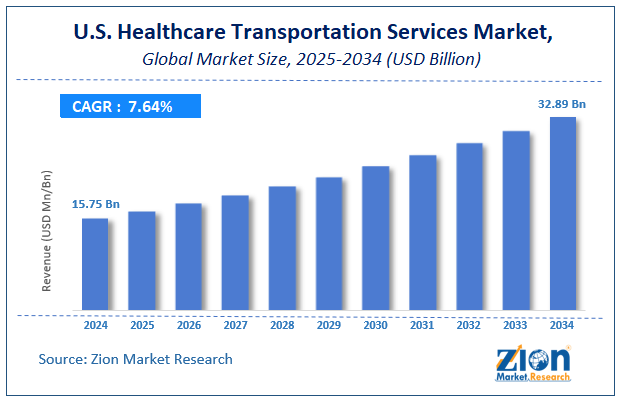

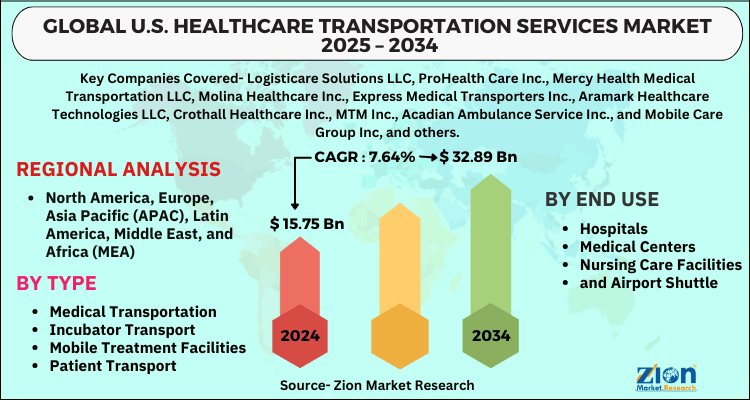

The global U.S. healthcare transportation services market size was worth around USD 15.75 Billion in 2024 and is predicted to grow to around USD 32.89 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.64% between 2025 and 2034.

The report analyzes the global U.S. healthcare transportation services market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the U.S. healthcare transportation services industry.

U.S. Healthcare Transportation Services Market Overview

Transportation is inextricably linked to the economic and social factor that favors mobility of people. The healthcare research team has opined that 20% of health can be attributed to medical care, while access to transportation, educational attainment, housing status, and healthy food accounted for 40%. Transportation barriers can be interrelated with social determinants of health, such as social isolation, poverty, racial discrimination, and access to education. It might result in increased health expenditures, overall poorer health outcomes, and delayed or missed healthcare appointments. The development of appropriate and affordable transportation options, bike lanes, walkable communities, and other healthy transit options can help improve health conditions.

Transportation Services in the healthcare industry help to assure the safe and timely transfer of patients, medications, medical equipment, and test specimens from one site to another. As a result, the healthcare sector's efficiency improves. Healthcare transportation is a new concept that can save both patients and healthcare practitioners a significant amount of time. The growing need for speedy mobility and an improving healthcare system are the primary drivers driving the market's growth.

The rising cases of SARS-CoV-2 infection, increasing pharmaceutical R&D activities, and novel medication pipelines are among the key drivers driving global pharma & healthcare company growth in recent years. Growing adoption of telehealth and telemedicine services, increased government funding for vaccine development, and the rising need for improved point-of-care diagnostics and home healthcare devices have all helped the industry's growth. Due to the expanding rates of infectious diseases, the global focus on healthcare is projected to serve additional growth prospects in the next years.

Key Insights

- As per the analysis shared by our research analyst, the global U.S. healthcare transportation services market is estimated to grow annually at a CAGR of around 7.64% over the forecast period (2025-2034).

- Regarding revenue, the global U.S. healthcare transportation services market size was valued at around USD 15.75 Billion in 2024 and is projected to reach USD 32.89 Billion by 2034.

- The U.S. healthcare transportation services market is projected to grow at a significant rate due to rising demand for non-emergency medical transport, an aging population, increasing chronic disease prevalence, and the need for cost-effective and reliable patient logistics solutions.

- Based on Type, the Medical Transportation segment is expected to lead the global market.

- On the basis of End Use, the Hospitals segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

U.S. Healthcare Transportation Services Market: Drivers

Improving healthcare systems and expanding healthcare facilities are some of the factors driving this segment's market growth. Additionally, healthcare providers are providing healthcare transportation services to patients who require non-emergency healthcare transportation to obtain various healthcare services, which is driving the growth of the U.S. Healthcare Transportation market. Growing demand for speedy transportation of samples and specimens for testing, as well as a greater emphasis on lowering logistical costs, are some of the factors driving market expansion. Furthermore, increased ride-sharing for healthcare transportation is helping to drive the expansion of the U.S. Healthcare Transportation Market.

The transportation system is considered an integral part of the entire healthcare market. Based on the instructions established by main healthcare bodies, the transport service providers have to comply with regulations like having sufficient field and clinical experience to deal with different types of health conditions. The rising geriatric population prone to cardiovascular diseases is one of the major driving forces of the U.S. healthcare transportation services market. Medical transportation has catered to a large number of patients in the past few years due to the aforementioned reason. Moreover, accelerating medical tourism, favorable reimbursement policies, and advancement in technology are some other factors fuelling the demand for healthcare transportation services in the U.S. However, the dearth of skilled healthcare professionals and expensive emergency care services can hamper the growth of the U.S. healthcare transportation services market.

U.S. Healthcare Transportation Services Market: Restraint

The lack of investment and high maintenance costs of transportation vehicles are impeding the growth of this sector. Additionally, a lack of investment from domestic companies is limiting its market expansion during the predicted period. A significant amount of money must be spent in order to provide and improve healthcare transportation services. When even local players are afraid to invest in this area, underdeveloped economies are unable to do so. As a result, the rate of market expansion will be slowed. Furthermore, offering high-quality healthcare transportation services is a commercial problem. The limited reach of key players has a negative impact on the rate of growth.

U.S. Healthcare Transportation Services Market: Segmentation

The U.S. Healthcare Transportation Services Market is segregated based on type, and end-use.

By Type, the market is classified into Medical Transportation, Incubator Transport, Mobile Treatment Facilities, Patient Transport, and Non-Medical Transportation. The medical transportation market is expected to be the fastest-growing segment, during the forecast period. Medical transportation services are required for those who are in a critical or life-threatening scenario. Medical transportation services are essential for adverse Medicaid recipients, such as the elderly, disabled, and financially disadvantaged persons who are unable to get healthcare transportation services, which contributes to the growth of this industry.

By End-Use, the market is classified into Hospitals, Medical Centers, Nursing Care Facilities, and Airport Shuttle. In the forecast period, hospitals were the major end-user, accounting for almost the largest share of worldwide healthcare transportation services revenue, and are expected to rise over the projection period. This area is expected to maintain its dominance in the coming years, owing to an increase in the number of hospitals, particularly in developed countries, as well as a greater need for cost reductions and increased reach.

U.S. Healthcare Transportation Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | U.S. Healthcare Transportation Services Market |

| Market Size in 2024 | USD 15.75 Billion |

| Market Forecast in 2034 | USD 32.89 Billion |

| Growth Rate | CAGR of 7.64% |

| Number of Pages | 180 |

| Key Companies Covered | Logisticare Solutions LLC, ProHealth Care Inc., Mercy Health Medical Transportation LLC, Molina Healthcare Inc., Express Medical Transporters Inc., Aramark Healthcare Technologies LLC, Crothall Healthcare Inc., MTM Inc., Acadian Ambulance Service Inc., and Mobile Care Group Inc, and others. |

| Segments Covered | By Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global U.S. Healthcare Transportation Services Market: Regional Landscape

The market for healthcare transportation services is dominated by North America. This is owing to an increasing population in need of medical assistance, as well as the availability of high-quality healthcare provisions. The existence of cutting-edge technology also helps to provide the best healthcare transportation services to the residents of this region. The top players in the US healthcare transportation services market are expected to keep their competitive advantage in the industry by increasing their product offerings and investing in mergers and acquisitions.

Due to the increase in government spending on healthcare facilities, Asia Pacific is predicted to be the fastest expanding market. This is a critical component fueling the region's demand for innovative healthcare transportation services. The growing government spending on healthcare transportation services, particularly in underdeveloped countries. This is an important factor in driving the region's desire for innovative healthcare transportation services.

U.S. Healthcare Transportation Services Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the U.S. healthcare transportation services market on a global and regional basis.

The global U.S. healthcare transportation services market is dominated by players like:

- Logisticare Solutions LLC

- ProHealth Care Inc.

- Mercy Health Medical Transportation LLC

- Molina Healthcare Inc.

- Express Medical Transporters Inc.

- Aramark Healthcare Technologies LLC

- Crothall Healthcare Inc.

- MTM Inc.

- Acadian Ambulance Service Inc.

- and Mobile Care Group Inc

The global U.S. healthcare transportation services market is segmented as follows;

By Type

- Medical Transportation

- Incubator Transport

- Mobile Treatment Facilities

- Patient Transport

- and Non-Medical Transportation

By End Use

- Hospitals

- Medical Centers

- Nursing Care Facilities

- and Airport Shuttle

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global U.S. healthcare transportation services market is expected to grow due to increasing demand for non-emergency medical transportation (NEMT), rising aging population, advancements in medical logistics, and growing focus on patient-centric healthcare solutions.

According to a study, the global U.S. healthcare transportation services market size was worth around USD 15.75 Billion in 2024 and is expected to reach USD 32.89 Billion by 2034.

The global U.S. healthcare transportation services market is expected to grow at a CAGR of 7.64% during the forecast period.

North America is expected to dominate the U.S. healthcare transportation services market over the forecast period.

Leading players in the global U.S. healthcare transportation services market include Logisticare Solutions LLC, ProHealth Care Inc., Mercy Health Medical Transportation LLC, Molina Healthcare Inc., Express Medical Transporters Inc., Aramark Healthcare Technologies LLC, Crothall Healthcare Inc., MTM Inc., Acadian Ambulance Service Inc., and Mobile Care Group Inc, among others.

The report explores crucial aspects of the U.S. healthcare transportation services market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed