Point of Care Diagnostics Market Size, Growth Drivers & Opportunities 2034

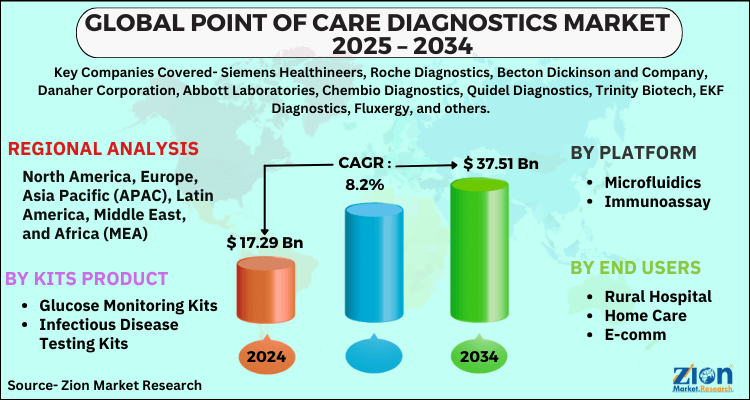

Point of Care Diagnostics Market - By Kits Product (Glucose Monitoring Kits, Infectious Disease Testing Kits, Pregnancy and Fertility Testing Kits, Hematology Testing Kits, Cardiometabolic Monitoring Kits, Urinalysis Testing Kits, Coagulation Monitoring Kits, Tumor Markers Testing Kits, Cholesterol Test Strips, Drugs of Abuse Testing Kits, Fecal Occult Testing Kits, and Others), By Platform (Microfluidics and Immunoassay), By End-user (Rural Hospital, Home Care, and E-comm) and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

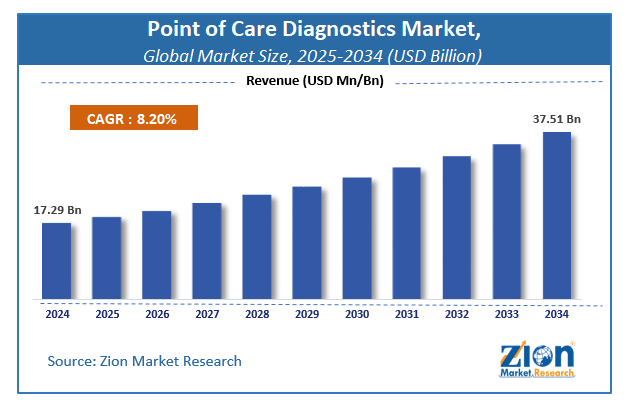

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.29 Billion | USD 37.51 Billion | 8.2% | 2024 |

Point of Care Diagnostics Market: Industry Perspective

The global point of care diagnostics market size was worth around USD 17.29 Billion in 2024 and is predicted to grow to around USD 37.51 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.2% between 2025 and 2034

The report analyzes the global point of care diagnostics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the point of care diagnostics industry.

Point of Care Diagnostics Market: Overview

Point-of-care diagnostics (POCD) is critical for detecting analytes close to the patient, allowing for improved illness monitoring, diagnosis, and management. It allows for rapid medical choices since illnesses can be detected at an early stage, resulting in better health outcomes for patients by allowing for the early initiation of therapy. The point of Care diagnostics is medical testing performed at a clinical laboratory close to where the patient is receiving care. POCT is usually performed by non-laboratory persons and the results are used for clinical decision making. Point-of-care technologies may enhance the management of different diseases and conditions.

Point-of-care diagnostics is of great importance in developing countries. Unfortunately, a major aspect in developing countries is that they often lack modern laboratories, and fully automated instruments that provide highly reproducible, quantitative, and hence sensitive and accurate diagnostic results. To circumvent these issues, the emergence of rapid and easy-to-use point-of-care (POC) tests can dramatically enhance a physician’s ability to diagnose patients’ diseases rapidly and accurately.

Key Insights

- As per the analysis shared by our research analyst, the global point of care diagnostics market is estimated to grow annually at a CAGR of around 8.2% over the forecast period (2025-2034).

- Regarding revenue, the global point of care diagnostics market size was valued at around USD 17.29 Billion in 2024 and is projected to reach USD 37.51 Billion by 2034.

- The point of care diagnostics market is projected to grow at a significant rate due to increasing demand for rapid and convenient diagnostic solutions, the rising prevalence of chronic diseases, and advancements in portable and user-friendly diagnostic technologies.

- Based on Kits Product, the Glucose Monitoring Kits segment is expected to lead the global market.

- On the basis of Platform, the Microfluidics segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Rural Hospital segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Point of Care Diagnostics Market: Growth Drivers

Rise in the prevalence of infectious and chronic diseases is fostering market growth

Globally, the burden of infectious and chronic diseases is on the rise. Lack of exercise, changes in lifestyle, and unhealthy habits are also some of the factors that are leading to an increase in chronic diseases like diabetes, chronic respiratory diseases, and cardiovascular diseases. According to WHO, cardiovascular disease constitutes the majority of non-communicable disease mortality (17.9 million per year), followed by cancer (9.3 million), respiratory infections (4.1 million), and diabetes (1.5 million). Additionally, two-thirds of all tuberculosis cases worldwide were traced to just eight countries: South Africa, Bangladesh, Nigeria, Pakistan, the Philippines, China, Indonesia, and India. POC diagnostics can considerably enhance the treatment of infectious illnesses, particularly in underdeveloped nations where prompt medical care is difficult to come by and healthcare infrastructure is limited.

Furthermore, government incentives and grants for the introduction of new products are driving the use of modern technology for infectious disease diagnostics. These efforts have made it simpler for people in undeveloped and impoverished nations to afford these tests. Moreover, factors such as the increasing number of clinics implementing POC diagnostics for the quick identification of infectious diseases are likely to fuel the growth of the global point of care diagnostics market.

Point of Care Diagnostics Market: Restraints

Lack of trained professionals in the diagnostic field hamper market growth

According to WHO research, a worldwide health concern is a shortage of healthcare workers, which affects access to healthcare services. Low- and middle-income countries are further hampered by a shortage of trained health professionals, and new innovations, such as the adoption of POC diagnostics in medical care, are posing challenges to POCT delivery due to the increasing workload and dearth of skilled health workers.

Point of Care Diagnostics Market: Opportunities

Smart devices equipped with mobile healthcare (mH) to pave the way for market expansion

The current POCD trend is firmly leaning toward smart devices integrated with mobile healthcare, which have the potential to genuinely transform customized healthcare monitoring and management, opening the way for next-generation point-of-care diagnostics. Smartphone POC technologies for the interpretation of colorimetric, chemiluminescent, fluorescence, electrochemical, label-free, and lateral flow assays detection of cells, nanoparticles, biomolecules, and microbes; and other diagnostic applications have previously been developed.

The number of cellphone users has now surpassed 7.4 billion, with 70 percent of them living in poor nations with a severe need for POCD. Numerous smartphone gadgets and smart applications for managing and monitoring fundamental health metrics such as blood pressure, blood glucose, pulse rate, body analysis, physical activity, weight, and electrocardiogram have been commercialized. All these factors ensure the healthy growth of the global point of care diagnostics market during the forecast period.

Point of Care Diagnostics Market: Challenges

The market is likely to face challenges due to high test costs compared to laboratory tests

One of the major challenges for the global point of care diagnostics market is its high cost as compared to laboratory tests. Rural areas and underdeveloped nations still prefer laboratory testing over POC diagnostics which in turn is limiting the market growth. Also, unfavorable reimbursement policies for POC diagnostics have led to low penetration of the market in emerging countries.

Point of Care Diagnostics Market: Segmentation

The global point of care diagnostics market is segmented based on kits product, platform, end-user, and region.

Based on kits product, the market can be segmented into glucose monitoring kits, infectious disease testing kits, pregnancy and fertility testing kits, hematology testing kits, cardiometabolic monitoring kits, urinalysis testing kits, coagulation monitoring kits, tumor markers testing kits, cholesterol test strips, drugs of abuse testing kits, fecal occult testing kits, and others. Glucose testing held a 40% share of the overall market in terms of revenue in 2016. The increasing prevalence of diabetes across the globe is expected to boost the demand for glucose testing in the years to come. The infectious disease testing kits are expected to grow at the highest CAGR during the forecast period on account of the rise in the number of HIV-infected individuals.

On the basis of platform, the global point of care diagnostics market is bifurcated into microfluidics and immunoassay.

Based on the end-user, the market can be segmented into rural hospitals, home care, and e-comm. The hospitals segment was the leading segment and it accounted for a large chunk of the market share in 2016. Increasing adoption of these tests in the clinics for diagnosis of several infections and monitoring of disease progression by assessment of symptoms and other parameters is expected to boost the demand for POCT in this segment. Home health care is another important segment of this segment.

Point of Care Diagnostics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Point of Care Diagnostics Market |

| Market Size in 2024 | USD 17.29 Billion |

| Market Forecast in 2034 | USD 37.51 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 187 |

| Key Companies Covered | Siemens Healthineers, Roche Diagnostics, Becton Dickinson and Company, Danaher Corporation, Abbott Laboratories, Chembio Diagnostics, Quidel Diagnostics, Trinity Biotech, EKF Diagnostics, Fluxergy, and others. |

| Segments Covered | By Kits Product, By Platform, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Point of Care Diagnostics Market: Regional Landscape

North America is expected to remain the largest market for point of care diagnostics during the forecast period. Key factors propelling the growth of the market in the region include an increase in the upper-class population, increasing cases of chronic disorders due to changes in food habitats & lifestyle, and growing demand for effective and efficient diagnostics. Further, healthcare infrastructure in major countries in the region such as the US and Canada is well developed and supports advanced treatment & diagnostics systems.

Moreover, high spending power on medical treatments is well supported by increasing initiatives by private and public hospitals in the region. Asia Pacific is projected to provide plenty of opportunities for the expansion of the point of care diagnostics market. Large middle-class populations with frequent health problems are triggering the need for efficient diagnostic systems. Besides, increasing awareness regarding POC diagnostics in emerging countries such as India and China is expected to fuel the market growth over the forecast period.

Recent Developments

- On 23 September 2021, Celltrion, a specialist biologics firm, stated that the Department of Defense's Defense Logistics Agency (DLA) has granted Celltrion USA, Inc., a Celltrion affiliate, a purchase agreement for its DiaTrustTM COVID-19 Ag Rapid Test.

Point of Care Diagnostics Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the point of care diagnostics market on a global and regional basis.

Key players with a major share in the global point of care diagnostics market include;

- Siemens Healthineers

- Roche Diagnostics

- Becton, Dickinson and Company

- Danaher Corporation

- Abbott Laboratories

- Chembio Diagnostics

- Quidel Diagnostics

- Trinity Biotech

- EKF Diagnostics

- Fluxergy

The global point of care diagnostics market is segmented as follows;

By Kits Product

- Glucose Monitoring Kits

- Infectious Disease Testing Kits

- Pregnancy and Fertility Testing Kits

- Hematology Testing Kits

- Cardiometabolic Monitoring Kits

- Urinalysis Testing Kits

- Coagulation Monitoring Kits

- Tumor Markers Testing Kits

- Cholesterol Test Strips

- Drugs of Abuse Testing Kits

- Fecal Occult Testing Kits

- Others (Calcium Assay Kits and Immunochemistry Kits)

By Platform

- Microfluidics

- Immunoassay

By End Users

- Rural Hospital

- Home Care

- E-comm

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global point of care diagnostics market is expected to grow due to rising prevalence of chronic diseases, increasing demand for rapid and accurate diagnostic solutions, advancements in testing technologies, growing healthcare accessibility, and the shift towards personalized medicine.

According to a study, the global point of care diagnostics market size was worth around USD 17.29 Billion in 2024 and is expected to reach USD 37.51 Billion by 2034.

The global point of care diagnostics market is expected to grow at a CAGR of 8.2% during the forecast period.

North America is expected to dominate the point of care diagnostics market over the forecast period.

Leading players in the global point of care diagnostics market include Siemens Healthineers, Roche Diagnostics, Becton Dickinson and Company, Danaher Corporation, Abbott Laboratories, Chembio Diagnostics, Quidel Diagnostics, Trinity Biotech, EKF Diagnostics, Fluxergy, among others.

The report explores crucial aspects of the point of care diagnostics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed