Test Automation Market Size, Share, Analysis, Trends, Growth, 2032

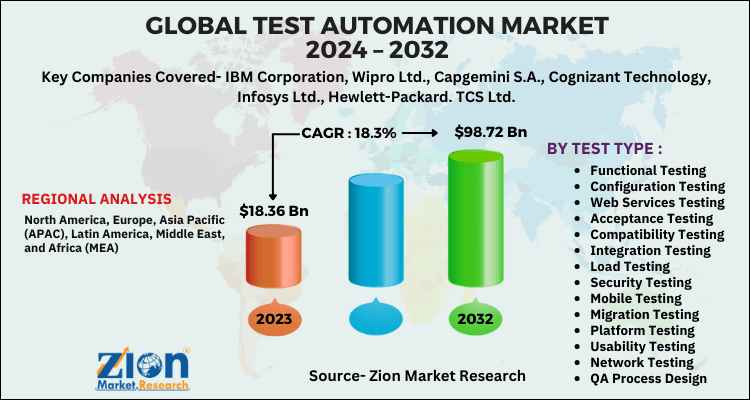

Test Automation Market By Test Type (Functional Testing, Configuration Testing, Web Services Testing, Acceptance Testing, Compatibility Testing, Integration Testing, Load Testing, Security Testing, Mobile Testing, Migration Testing, Platform Testing, Usability Testing, Network Testing And QA Process Design): Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024-2032

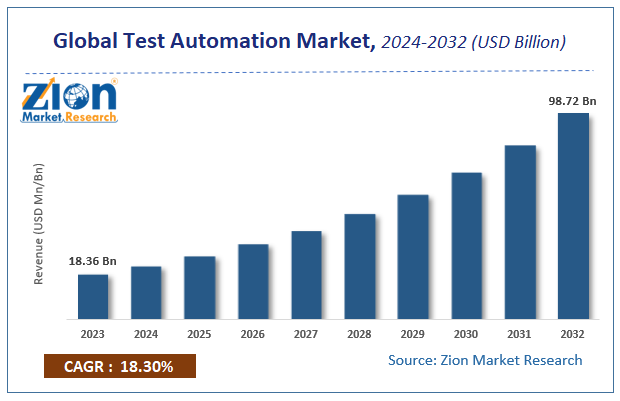

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.36 Billion | USD 98.72 Billion | 18.3% | 2023 |

Test Automation Market Insights

According to a report from Zion Market Research, the global Test Automation Market was valued at USD 18.36 Billion in 2023 and is projected to hit USD 98.72 Billion by 2032, with a compound annual growth rate (CAGR) of 18.3% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Test Automation Market industry over the next decade.

Test Automation Market: Overview

The test automation market is probably going to witness noteworthy development due to the rising trend of digital transformation everywhere on the planet. Rising investment in the IT sector elevates the expansion of the test automation market. The main towering factor for the test automation market is that the advantages provided by these tools like easy to check for multilingual websites, cost & time saving, enhancing the test speed, and no need for human intervention, which elevates the event of test automation market. Moreover, test automation enhances the event procedure of a software item that elevates the acceptance of testing tools in the IT sector and power the event of the test automation market.

Acceptance of cloud platform solutions from firms is anticipated to unlock new growth opportunists for the test automation market within the near future. Additionally, various mergers & acquisitions by market players also are set to boost the test automation market. For instance, in March 2017, Amplicon was hired by Virginia Panel Corporation as its partner for the UK. This endeavor will offer both the firms new business avenues and additionally assist in intensifying the test automation market.

Test Automation Market: Growth Factors

With the increased usage of AI within the development of test tools, the tools can self-heal at runtime. Self-healing automation testing is anticipated to be one of the most important automation testing trends over the forecast period, owing to these, the market is witnessing new launches. The new solution is expected to leverage machine learning to optimize testing and quality delivery, help quality engineers be more efficient, reduce the necessity for specific tests, remove bottlenecks, and enhance risk-based testing protocols. Consistent with Qualitest, companies using Qualisense have seen a quite sixfold increase in release velocity.

Test Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Test Automation Market |

| Market Size in 2023 | USD 18.36 Billion |

| Market Forecast in 2032 | USD 98.72 Billion |

| Growth Rate | CAGR of 18.3% |

| Number of Pages | 150 |

| Key Companies Covered | IBM Corporation, Wipro Ltd., Capgemini S.A., Cognizant Technology, Infosys Ltd., Hewlett-Packard. TCS Ltd. |

| Segments Covered | By Test Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Test Automation Market: Segmentation

Based on test types, global test automation market is segmented into configuration testing, functional testing, acceptance testing, web services testing, integration testing, compatibility testing, security testing, load testing, migration testing, mobile testing, usability testing, platform testing, QA process design, and network testing.

Regional Segment Analysis Preview

Globally, North America is probably going to remain the leader in the test automation market within the near future. The fast deployment of SaaS (Software as a Service) and mobile applications on the cloud is one of the main factors for the event of North America test automation market. The rapidly developing IT sector in emerging nations of Australia, China, Japan, Singapore, and India is probably going to spice up the Asia Pacific test automation market. The region is witnessing rapidly increasing connectivity and accelerating growth of digital transformation. Factors contributing to the high rate of growth is that of the presence of multinational companies based in North America and Europe. In recent years, the APAC region has undergone tremendous economic processes, political transformations, and social changes.

Test Automation Market: Competitive Landscape

The key companies operating in the Test Automation Market include

- IBM Corporation

- Wipro Ltd.

- Capgemini S.A.

- Cognizant Technology

- Infosys Ltd.

- Hewlett-Packard.

- TCS Ltd.

The detailed description of players includes parameters such as company overview, financial overview, business and recent developments of the company.

The global Test Automation Market is segmented as follows:

By Test Type

- Functional Testing

- Configuration Testing

- Web Services Testing

- Acceptance Testing

- Compatibility Testing

- Integration Testing

- Load Testing

- Security Testing

- Mobile Testing

- Migration Testing

- Platform Testing

- Usability Testing

- Network Testing

- QA Process Design

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Test Automation Market was valued at USD 18.36 Billion in 2023.

The global Test Automation Market is expected to reach USD 98.72 Billion by 2032, growing at a CAGR of 18.3% between 2024 to 2032.

Rapid urbanization, the popularity of automation testing services among large and small scale enterprises due to less turnaround time, and enhanced efficiency of testing services in the software is driving test automation market growth.

North America region held a substantial share of the Test Automation Market in 2023.

The key companies operating in the Test Automation Market include IBM Corporation, Wipro Ltd., Capgemini S.A., Cognizant Technology, Infosys Ltd., Hewlett-Packard. TCS Ltd. The detailed description of players includes parameters such as company overview, financial overview, business and recent developments of the company.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed