Sustainable Footwear Market Size, Share Global Report, 2032

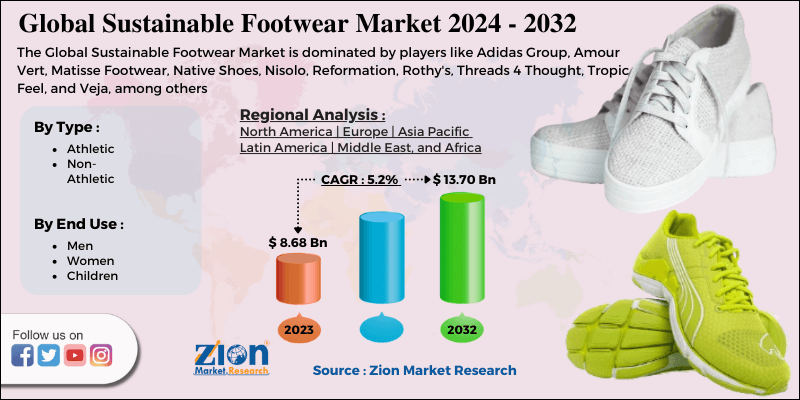

Global Sustainable Footwear Market By Type (Athletic and Non Athletic), By End User (Men, Women and Children), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

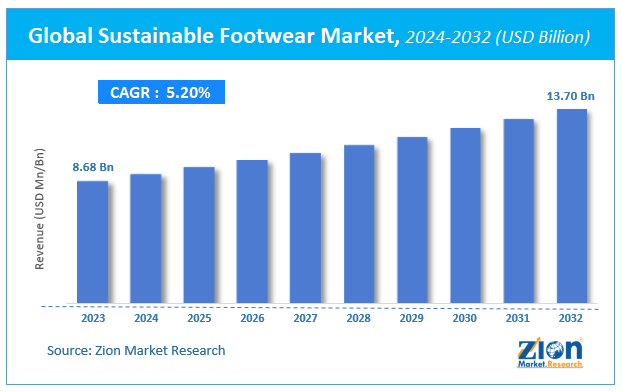

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.68 Billion | USD 13.70 Billion | 5.2% | 2023 |

Global Sustainable Footwear Market Insights

Zion Market Research has published a report on the global Global Sustainable Footwear Market, estimating its value at USD 8.68 Billion in 2023, with projections indicating that it will reach USD 13.70 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.2% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Global Sustainable Footwear Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Sustainable Footwear Industry: Overview

Sustainable footwear is footwear that is made from a fully sustainable value chain and has a long life cycle and is easy to dispose of, making it environmentally beneficial. It strives to include environmental considerations across the footwear value chain, from raw material selection to production, packaging, transportation, distribution, and maintenance.

Some of the value chain operations that differ from traditional footwear include the selection of raw materials such as organic and renewable sources, biodegradable materials, production with little waste and energy usage, recyclable packaging, and eco-friendly labeling.

COVID-19 Impact Analysis

The COVID-19 pandemic is expected to have a detrimental influence on the worldwide market for sustainable footwear. Due to total lockdown circumstances, which have resulted in the closure of hypermarkets/supermarkets, specialized stores, and other businesses, the market's development is slowing. Furthermore, all sustainable footwear production units were shut down, resulting in supply chain disruptions, order cancellations, export bans, product import bans from several countries, and raw material shortages.

In addition, to prevent the spread of the COVID-19 virus, many limits were imposed on the supply of non-essential items in particular locations and nations, resulting in a drop in market demand. People were unable to participate in outdoor activities such as basketball, soccer, and others due to lockdown conditions. In addition, gyms and fitness centers shuttered, lowering demand for athletic footwear.

Sustainable Footwear Market: Growth Factors

One of the major growth drivers for the Global Sustainable Footwear Market is the changing lifestyles. The growing desire for stylish and elegant footwear at an accessible price has resulted from changing lifestyle preferences. Over time, the footwear business has evolved and observed customer habits and behaviors. In this sense, millennials' on-the-go lifestyle has encouraged businesses to raise their manufacturing size. Consumers seek adaptability, comfort, functionality, sustainability, and performance in a variety of contexts, according to the NDP Group. As a result of this element, businesses have begun to include social and environmental concerns in their creative sustainable footwear production.

Another factor for the growth in this market is an increase in health awareness among people. The increased demand for sustainable sports footwear is due to people's rising health consciousness and desire to keep healthy and avoid chronic diseases. Obesity and a sedentary lifestyle have prompted individuals to exercise regularly and participate in a variety of indoor and outdoor sports such as basketball, soccer, badminton, jogging, and other activities. All of these activities have boosted the desire for footwear that is both comfortable and fashionable, as well as durable.

Global Sustainable Footwear Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Sustainable Footwear Market |

| Market Size in 2023 | USD 8.68 Billion |

| Market Forecast in 2032 | USD 13.70 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 210 |

| Key Companies Covered | Adidas Group, Amour Vert, Matisse Footwear, Native Shoes, Nisolo, Reformation, Rothy's, Threads 4 Thought, Tropic Feel, and Veja, among others. |

| Segments Covered | By Type, By End Use, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sustainable Footwear Market: Segmentation Analysis

Segment Analysis by Type

The sustainable footwear market is divided into two categories: athletic and non-athletic footwear. In the shoe sector, the sustainability trend is becoming an innovation. The notion of eco-consciousness is gaining popularity, as is the usage of conventional recycling and biodegradable procedures.

Sustainable practices are practiced by businesses such as New Balance, Adidas, Nike, and Puma in the sporting market. Puma, for example, has introduced the Puma InCycle shoe collection, which is made entirely of biodegradable materials.

Segment Analysis by End Use

The industry is divided into three divisions based on the end user: men, women, and children. With a market share of 55%, men dominate this segment. Men's desire for sustainable footwear is being driven by the growing popularity of sustainable athletic footwear appeal and accompanying technologies. Various product debuts in the sustainable footwear area have also contributed to the growth of the men's category. For example, New Balance has introduced bioLogic, a sustainable fabric material with ventilation panels to maintain various temperature ranges that are necessary and beneficial for athletes.

Sustainable Footwear Market: Regional Analysis

In 2023, Asia Pacific became the largest regional market for sustainable footwear. The market in Asia Pacific is being driven by rising disposable income, the growing influence of the newest fashion trends, and fast urbanization. Furthermore, the two most populous nations, China and India, provide a massive market for global firms to tap into.

Over the projection period, Europe is predicted to grow significantly. Changing lifestyles, more health consciousness, and the developing e-commerce industry are some of the primary drivers driving regional market expansion. The footwear business in the United Kingdom is growing rapidly, with an estimated 330 million pairs of shoes sold each year.

Sustainable Footwear Market: Competitive Analysis

Some of the key players in the Global Sustainable Footwear Market are

- Adidas Group

- Amour Vert

- Matisse Footwear

- Native Shoes

- Nisolo

- Reformation

- Rothy's

- Threads 4 Thought

- Tropic Feel

- Veja.

While established sustainable footwear producers have been concentrating on sustainability from the beginning and have made it a cornerstone of their company, newcomers are catching up to the sustainable footwear trend.

Adidas is working on designing and testing footwear made entirely of recyclable materials. Furthermore, by 2024, the business has officially committed to using only environmentally friendly components in its goods. Reebok has unveiled a running shoe made entirely of plant-based components rather than petroleum-based components.

The Global Sustainable Footwear Market is segmented as follows:

By Type

- Athletic

- Non-Athletic

By End Use

- Men

- Women

- Children

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Sustainable Footwear market size was worth around USD 8.68 billion in 2023 and is expected to reach USD 13.70 billion by 2032.

The global Sustainable Footwear market is expected to grow at a CAGR of 5.2% during the forecast period.

Some of the key factors driving the Global Sustainable Footwear Market growth are changing lifestyles and increase in health awareness among people.

Asia Pacific is expected to dominate the Sustainable Footwear market over the forecast period.

Some of the key players in the Global Sustainable Footwear Market are Adidas Group, Amour Vert, Matisse Footwear, Native Shoes, Nisolo, Reformation, Rothy's, Threads 4 Thought, Tropic Feel, and Veja.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed