Biodegradable Polymers Market Size, Share, Analysis, Trends, Growth Report, 2032

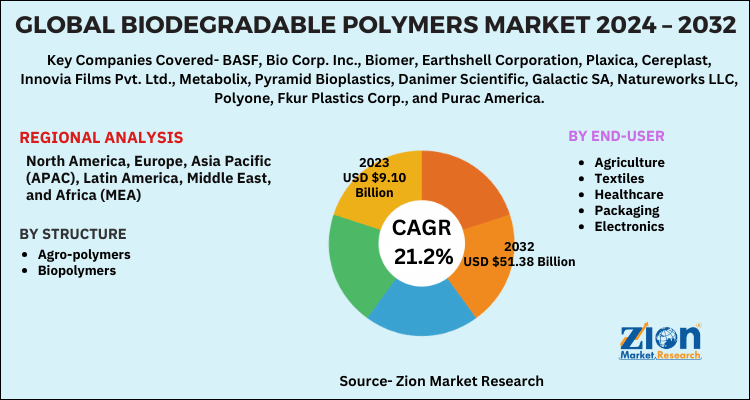

Biodegradable Polymers Market By Structure (Agro-polymers and Biopolymers), By End-User (Agriculture, Textiles, Healthcare, Packaging, Electronics, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

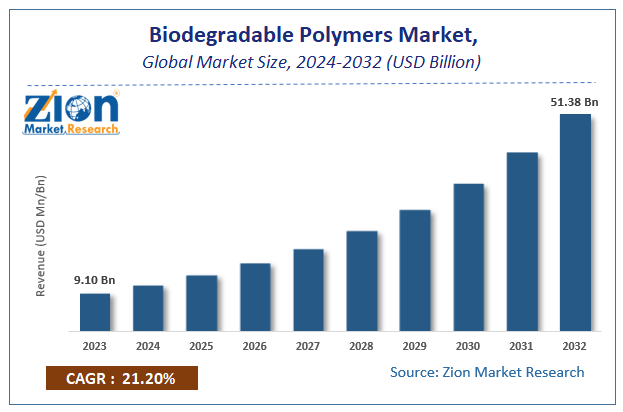

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.10 Billion | USD 51.38 Billion | 21.2% | 2023 |

Biodegradable Polymers Market Insights

Zion Market Research has published a report on the global Biodegradable Polymers Market, estimating its value at USD 9.10 Billion in 2023, with projections indicating that it will reach USD 51.38 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 21.2% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Biodegradable Polymers Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Biodegradable Polymers Market: Overview

A polymer that undergoes a big change within the chemical structure under specific environmental conditions is known as a biodegradable polymer. Features of the biodegradable polymers market like permeability, non-toxicity, mechanical strength, high tensile, and controlled rate of degradation make them highly effective in performance and a reliable source. The degradation process of the biodegradable polymer includes various ecological or chemical processes like hydrolysis combination, enzymatic degradation, and surface erosion.

Growing standardization and industrialization of packaging procedures and high implementation of biodegradable polymers are boosting the market. The inclination toward eco-friendly materials in packaging industries as well as textiles is the fueling factor of the biodegradable polymers market. Sustainable, recyclable, and nontoxic are the key elements for driving the buyer preference toward biopolymer materials, thus boosting the expansion of the biodegradable polymers market.

Moreover, increasing urbanization & lifestyle, health & environmental awareness, and consumer preferences towards fresh & prepared meals alongside convenient packaging styles are the vital factors impacting the expansion of the worldwide market positively. Increasing investment in this packaging revolution is leading to the demand for biodegradable polymers. High demand for biodegradable products within the agriculture sector for films, containers, plant pots, and storage bags for fertilizers and chemicals is additionally a crucial end-user segment liable for raising the demand for biodegradable polymers.

High demand for biodegradable compounds in cosmetics, food & beverages as well as continuous efforts of the manufacturer to expand the range of quality products and technologies are the biggest drivers of the biodegradable polymers market. Wide applications of biodegradable polymers in biomedical sectors such as blood bags, catheters, syringes, and artificial organs also are fostering the demand for biodegradable polymers.

COVID-19 Impact Analysis

At the start of 2021, COVID-19 disease began to spread around the world, many people worldwide were infected with COVID-19 disease, and major countries around the world have implemented foot prohibitions, strikes, and lockdown orders. Apart from the medical supplies and life support products industries, most industries are greatly impacted, and the Biodegradable Polymers industries are greatly affected. Considering the food supply chain, one of the foremost important sectors of the economy, it's been seen that COVID-19 has an impression on the entire process from the sector to the buyer. In light of recent challenges in the food supply chain, there's now considerable concern about food production, processing, distribution, and demand.

Biodegradable Polymers Market: Growth Factors

Governments barring the use of single-use plastic tied with raising awareness among the public regarding the ill effects of plastic waste are among the key trends stimulating the market growth. Additionally, increasing the use of biodegradable plastics in agriculture & packaging is expected to increase market growth.

Moreover, rising urbanization and lifestyle, health and environment awareness, and consumer preferences towards fresh and prepared meals in removing packaging with convenient packaging style are the vital factors impacting the expansion of the Biodegradable Polymers market positively.

Biodegradable Polymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biodegradable Polymers Market |

| Market Size in 2023 | USD 9.10 Billion |

| Market Forecast in 2032 | USD 51.38 Billion |

| Growth Rate | CAGR of 21.2% |

| Number of Pages | 190 |

| Key Companies Covered | BASF, Bio Corp. Inc., Biomer, Earthshell Corporation, Plaxica, Cereplast, Innovia Films Pvt. Ltd., Metabolix, Pyramid Bioplastics, Danimer Scientific, Galactic SA, Natureworks LLC, Polyone, Fkur Plastics Corp., and Purac America |

| Segments Covered | By Structure, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biodegradable Polymers Market: Segmentation Analysis

Biodegradable polymers are segmented based on their structure, end-user, and by Region.

Based on the structure, the global biodegradable polymers market is classified as agro-polymers and biopolymers. Further, the agro-polymers segment is divided into polysaccharides, protein, collagen, gelatin, and gluten. The biopolymer segment is classified as polyhydroxy butyrate and polylactic acid, which are obtained by microbial and conventional synthesis.

The end-users of the biodegradable polymer products are agriculture, textiles, packaging, healthcare, and electronics sectors. The growing rigid and flexible packaging in the food & beverages, pharmaceutical & healthcare industries is expected to accelerate the market’s growth during the coming years.

Biodegradable Polymers Market: Regional Analysis

Geographically, Europe is leading the worldwide biodegradable polymers market thanks to high demand from the packaging industry and various establishments of varied manufacturing units. Further, North America stands second within the market rankings thanks to the significant growth of the polymer industries within the region. The Asia Pacific may boost the expansion of the market due to the rising economy and rapid urbanization.

Biodegradable Polymers Market: Competitive Analysis

Some of the major players in the global Biodegradable Polymers market include:

- BASF

- Bio Corp. Inc.

- Biomer

- Earthshell Corporation

- Plaxica

- Cereplast

- Innovia Films Pvt. Ltd.

- Metabolix

- Pyramid Bioplastics

- Danimer Scientific

- Galactic SA

- Natureworks LLC

- Polyone

- Fkur Plastics Corp.

- Purac America

The global Biodegradable Polymers Market is segmented as follows:

By Structure

- Agro-polymers

- Biopolymers

By End-User

- Agriculture

- Textiles

- Healthcare

- Packaging

- Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Biodegradable Polymers market size was worth around USD 9.10 billion in 2023 and is expected to reach USD 51.38 billion by 2032.

The global Biodegradable Polymers market is expected to grow at a CAGR of 21.2% during the forecast period.

Some of the key factors driving the global Biodegradable Polymers Market growth are environmentally friendly properties, high consumer acceptance, favorable government policy, and renewable raw material sources.

Europe is expected to dominate the Biodegradable Polymers market over the forecast period.

Some of the major players dominating the global biodegradable polymers market are BASF, Bio Corp. Inc., Biomer, Earthshell Corporation, Plaxica, Cereplast, Innovia Films Pvt. Ltd., Metabolix, Pyramid Bioplastics, Danimer Scientific, Galactic SA, Natureworks LLC, Polyone, Fkur Plastics Corp., and Purac America.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed