Super Absorbent Polymers Market Size, Share, Analysis, Trends, Growth 2032

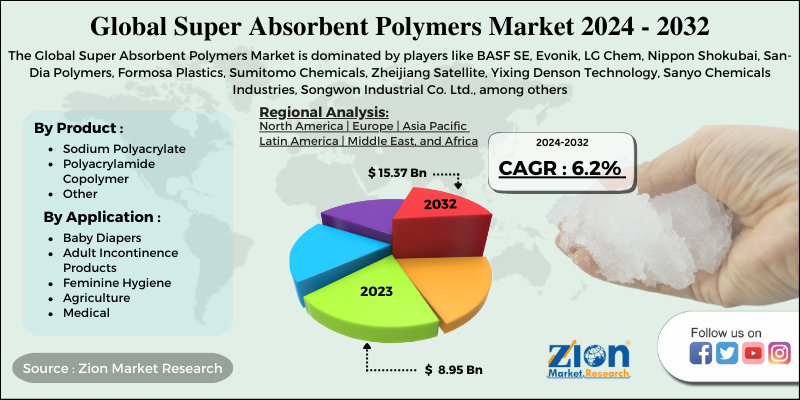

Super Absorbent Polymers Market By Product Type (Sodium Polyacrylate, Polyacrylamide Copolymer And Other Super Absorbent Polymers), By Application (baby diapers, adult incontinence products, feminine hygiene, agriculture, medical and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

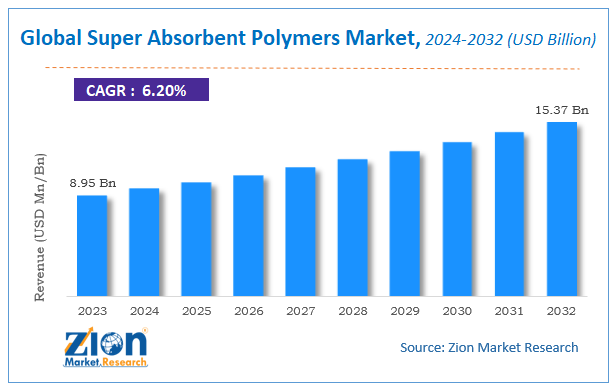

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.95 Billion | USD 15.37 Billion | 6.2% | 2023 |

Super Absorbent Polymers Market Insights

According to a report from Zion Market Research, the global Super Absorbent Polymers Market was valued at USD 8.95 Billion in 2023 and is projected to hit USD 15.37 Billion by 2032, with a compound annual growth rate (CAGR) of 6.2% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Super Absorbent Polymers industry over the next decade.

Global Super Absorbent Polymers Market: Overview

Superabsorbent polymer (SAP) is a substance with a high potential for absorbing liquids. It is a cross-linked polymer structure that prevents dissolution. This types of polymers can absorb up to 100 times the weight of their own liquid. It is therefore used in products where high absorption properties are necessary, such as infant diapers/nappies, incontinence objects, and others.

Global Super Absorbent Polymers Market: Growth Factors

The demand for adult incontinence and female grooming products, which in turn drives market development, is fueled by high customer knowledge of grooming. The growth of the U.S. market is also positively influenced by rising disposable income, along with increasing understanding of sanitization in the region. In addition, rising birth rates, combined with the growing geriatric population, are expected to boost demand for baby and adult diapers, which in turn would provide the superabsorbent polymer industry with a fillip. To help the industry gain considerable traction in the coming years, the concentration of end-use industries on product innovation is also projected.

Global Super Absorbent Polymers Market: Segmentation

The Super Absorbent Polymers market is fragmented based on product, and application.

By product, the market is divided into sodium polyacrylate, polyacrylamide copolymer and other super absorbent polymers. In 2019, sodium acrylate generated considerable sales and covers more than three-fifth of the global industry. Sodium acrylate is commonly used in infant diapers and adult incontinence products due to its ability to absorb up to 500 times the water mass. In addition , the rising demand for polyacrylamide will fuel the superabsorbent polymer market due to its increasing usage in water treatment, paper-making processes, and widespread use in the manufacture of infant and adult diapers.

On the basis of application, the Super Absorbent Polymers market includes baby diapers, adult incontinence products, feminine hygiene, agriculture, medical and others. The application market for adult incontinence would expand at a pace of over 6.5 percent globally. For aged and elderly persons, the incidence of urinary incontinence and overactive bladder increases. In developing countries , due to hygiene knowledge among people, these items have enormous reach.

Super Absorbent Polymers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Super Absorbent Polymers Market |

| Market Size in 2023 | USD 8.95 Billion |

| Market Forecast in 2032 | USD 15.37 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 110 |

| Key Companies Covered | BASF SE, Evonik, LG Chem, Nippon Shokubai, San-Dia Polymers, Formosa Plastics, Sumitomo Chemicals, Zheijiang Satellite, Yixing Denson Technology, Sanyo Chemicals Industries, Songwon Industrial Co. Ltd., among others |

| Segments Covered | By Product, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Super Absorbent Polymers Market: Regional Analysis

With a significant share, Europe was the world's top revenue contributor to the super-absorbent polymer industry in 2019. It is projected that it will hold its position until 2025. Thanks to its high water absorption and retention power, the market is driven by rising demand from baby diaper manufacturers. Any of the key factors leading to regional demand development include evolving habits and booming e-commerce.

Global Super Absorbent Polymers Market: Competitive Players

Some main participants of the Super Absorbent Polymers market are

- BASF SE

- Evonik

- LG Chem

- Nippon Shokubai

- San-Dia Polymers

- Formosa Plastics

- Sumitomo Chemicals

- Zheijiang Satellite

- Yixing Denson Technology

- Sanyo Chemicals Industries

- Songwon Industrial Co. Ltd

The global super absorbent polymers market is segmented as follows:

By Product Type

- Sodium Polyacrylate

- Polyacrylamide Copolymer

- Other Super Absorbent Polymers

By Application

- Baby Diapers

- Adult Incontinence Products

- Feminine Hygiene

- Agriculture

- Medical

- Others

Super Absorbent Polymers Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed