Baby Diapers Market Size & Share Report, Growth, Trends, 2032

Baby Diapers Market, By Type (Biodegradable Diapers, Training Nappy, Cloth Diapers, Swim Pants, Disposable Diaper): Global Industry Perspective, Comprehensive Analysis and Forecast,2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

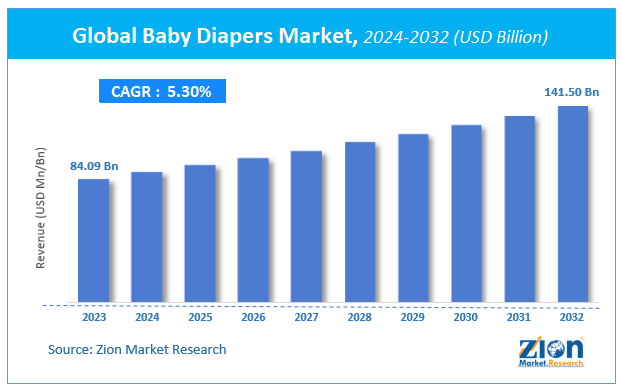

| USD 84.09 Billion | USD 141.50 Billion | 5.3% | 2023 |

Global Baby Diapers Market Insights

Zion Market Research has published a report on the global Baby Diapers Market, estimating its value at USD 84.09 Billion in 2023, with projections indicating that it will reach USD 141.50 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.3% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Baby Diapers Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Baby Diapers Market Size Overview

The demand for Baby Diapers is expected to rise at a significant rate during the forecast period owing to rising women population globally. Working mothers prefer easy to use and disposable cleaning products for their babies. For instance, the women employment rate in the Europe accounted for 64% in 2023. Further, rising health awareness among customer supports the growth of the market. Growing demand for natural and hygienic products is motivating the manufacturers to launch bio-based launched a new diaper in the market.

The new diaper is bio-based and softest diaper, it also offers great Growing demand for natural and hygienic products is forcing manufacturers to develop bio-based disposable diapers, which is also projected to propel market demand. Additionally, in November 2020, H.B. Fuller launched a new natural-based hygiene diapers.

Moreover, smart diaper is the newest trends in the overall diaper market. Manufactures nowadays are developing new and innovative baby diaper in the market which is expected to increasing the competition among existing player and is also increasing the demand for baby diapers over the forecast period. For instance, May 2023, Huggies launched a new smart diaper in the Korean market. The new smart diaper is equipped with a Bluetooth sensor and aims to provide text notification to the parents about bowel movements of the babies. In addition, in July 2023, Pampers, launched first ever smart diaper in the market. The new smart diaper “Lumi” offers traction of babies with the help of attached sensors.

Enzymes that are used in baby diapers are toxic to a baby's skin, as a result, companies are launching diapers with a multiple layer that allows faeces to reach the heart rather than on the surface. Thinner and lighter diapers are also being produced on a large scale that is skin-friendly as well as eco-friendly.

Growth Factors

The innovation in disposable diapers technology such as introduction of smart diapers is expected to drive the overall growth of the market over the forecast period. The smart diapers are capable to react in a prescribed manner when they come in contact with certain bacteria, or proteins. Thereby, provide signal to parents when the diaper needs to be changed.

The main factors driving the growth of the market are rising disposable income, favourable demographics, and increased concern for hygiene along with the increasing participation of women in the workforce in the developing nations such as India, China, and Indonesia is expected to boost the growth of Baby Diapers Market during the forecast period.

Baby Diapers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Baby Diapers Market |

| Market Size in 2023 | USD 84.09 Billion |

| Market Forecast in 2032 | USD 141.50 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 140 |

| Key Companies Covered | SCA Hygiene, Unicharm, Bumkins, Procter & Gamble, Kimberly-Clark, KAO Corporation, Diapees and Wipees, and Hengan amongst others |

| Segments Covered | By Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Request Free Sample

Request Free Sample

Product Segment Analysis Preview

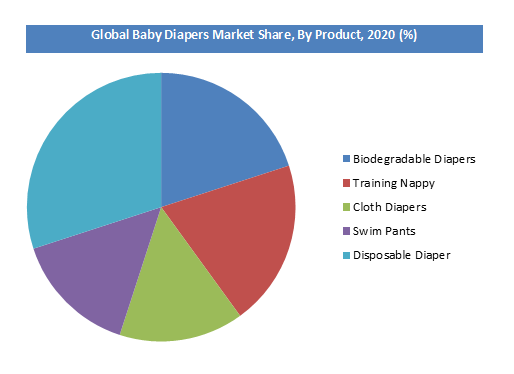

Based on product, the global baby diapers market is segmented into disposable diapers, training pants, biodegradable diapers, cloth diapers and swim pants.

The disposable diapers segment dominated the overall baby diaper market owing to continuous product advancements by manufacturers and ease of use. Moreover, Due to changing consumer preferences and the environmental issues, biodegradable baby diapers are likely to become the most eye-catching sector in the near future. On the other hand, raising awareness about the negative effects of chemicals used is important.

Disposable diapers account for the majority of the baby diapers market; however, the cloth diapers segment is expected to rise at the fastest CAGR during the forecast period. The presence of a massive infant population, as well as an increase in disposable income in Asia, Latin America, the Middle East, and Africa, contribute significantly to the growth of disposable diapers.

Regional Analysis Preview

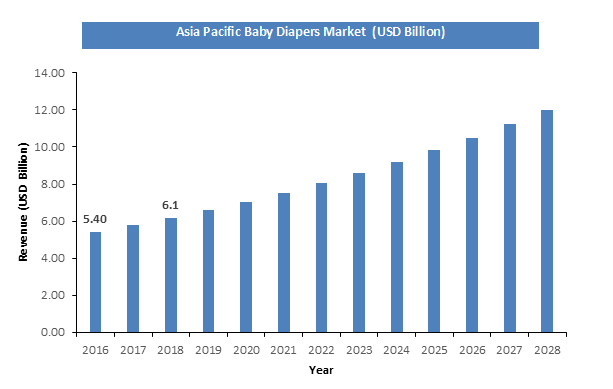

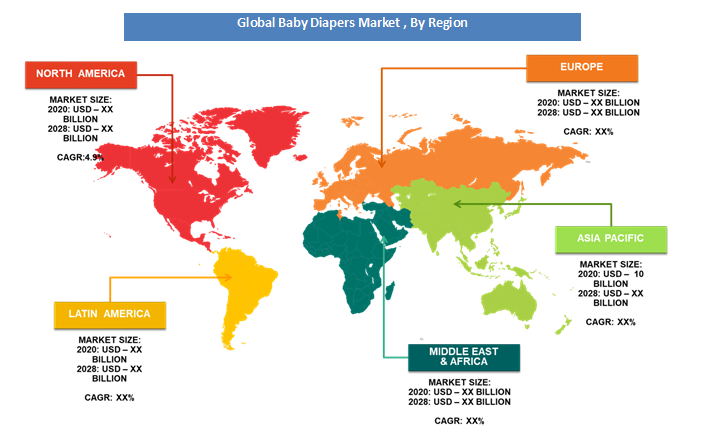

Asia Pacific held a share of around 30% in 2022 and is anticipated to be the fastest growing segment during the forecast period, owing to comfort convenience, along with competitive prices offered by major manufactures in the market. Moreover, the presence of major players in the region such as Proctor & Gamble, Kimberly Clarke-Lever and Unicharm’s Mamy Poko Pants among others also supports the growth of the market in the region. Moreover, reports by the Economic times in 2018 suggested that Proctor & Gamble accounted for 42% of the total market share in the Indian diapers market. Additionally, rising birth rates in the region also supports the market growth. For instance, 25 million babies are born every year in India and 15 million babies in China.

North America dominated the baby diapers industry in 2021, with the largest share, followed by Europe. In the coming years, the growth of the baby diapers market will likely be fuelled by rising literacy rates, rapid product innovation, and vast opportunities in emerging economies.

Key Market Players & Competitive Landscape

Some of key players in Baby Diapers Market are-

- SCA Hygiene,

- Unicharm

- Bumkins, Procter & Gamble

- Kimberly-Clark

- KAO Corporation

- Diapees and Wipees

- Hengan amongst others

The global Baby Diapers Market is segmented as follows:

By Type

- Biodegradable Diapers

- Training Nappy

- Cloth Diapers

- Swim Pants

- Disposable Diaper

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Baby Diapers Market was valued at USD 84.09 Billion in 2023.

The global Baby Diapers Market is expected to reach USD 141.50 Billion by 2032, growing at a CAGR of 5.3% between 2024 to 2032.

Some of the key factors driving growth of the global Baby Diapers Market are rising birth rates

Asia Pacific region held a substantial share of the Baby Diapers Market in 2020. This is attributable to the increased per capita income of people.

Some of the major companies operating in Baby Diapers Market are SCA Hygiene, Unicharm, Bumkins, Procter & Gamble, Kimberly-Clark, KAO Corporation, Diapees and Wipees, and Hengan amongst others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed