Security as a Service Market Size, Share, And Growth Report 2032

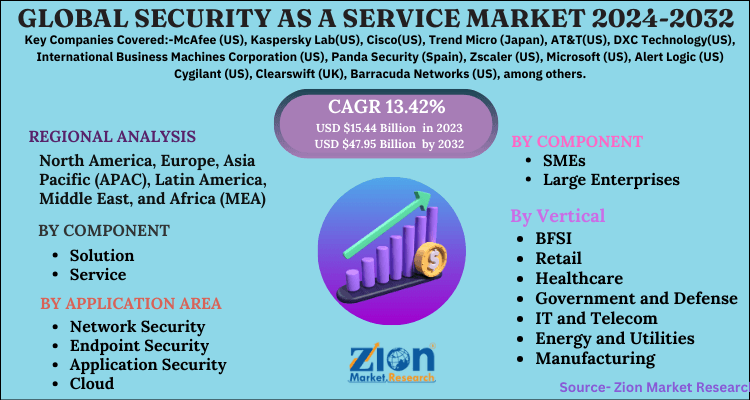

Security as a Service Market by Component (Solution and Service), by Application Area (Network Security, Endpoint Security, Application Security, and Cloud), by Organization Size (SMEs and Large Enterprises), by Vertical (BFSI, Retail, Healthcare, Government and Defense, IT and Telecom, Energy and Utilities, Manufacturing and others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

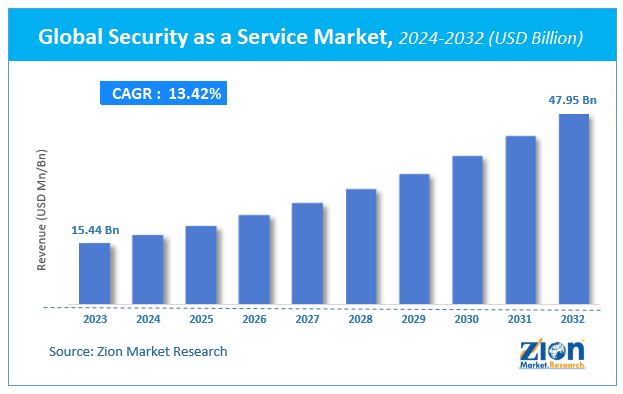

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.44 Billion | USD 47.95 Billion | 13.42% | 2023 |

Security as a Service Market Size

Zion Market Research has published a report on the global Security as a Service Market, estimating its value at USD 15.44 Billion in 2023, with projections indicating that it will reach USD 47.95 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 13.42% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Security as a Service Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Security as a Service Market: Overview

Security as a Service has become one of the most concerning and mandate things in this century. Data is increasing exponentially in the era and with the increased usage of the internet, it has become really cumbersome to save our data from the hackers across the world. One mistake is all they need and everything will be cleared from the systems. With the growth of business in terms of scale and structure, as well as the use of social media, cloud services, big data, and multiple computing devices, the role of information security is becoming more complex. The growing number of security attacks and malicious activities perpetrated by organized cybercriminal groups has raised concerns among businesses. In addition, network infrastructure has become more complex. Furthermore, increased network infrastructure complexity is proving to be a significant impediment to data protection management. In this situation, outsourcing security tasks to controlled security service providers have proven to be a profitable choice for businesses.

COVID-19 Impact Analysis

Various governments and regulatory agencies have mandated both public and private organizations to adopt new practices for operating remotely and preserving social distance in the wake of the COVID-19 pandemic. Since then, digital best practices have become the latest Business Continuity Plan (BCP) for a variety of businesses. The COVID-19 crisis has changed the mindset of a company's management and board of directors when it comes to cybersecurity. But for the technology giants, SMBs, startups, and large corporations saw cybersecurity budgets as an inevitable Capital Expenditure (CAPEX) due to regulatory and enforcement requirements. A cybersecurity policy is yet to be implemented by a number of digital organizations. This crisis has exposed businesses to situations in which their IP addresses are at the mercy of their employees' behavior while operating remotely on office laptops with no firewall security or personal laptops with/without free antivirus software.

Security as a Service Market: Growth Factors

Over time, organizations and governments have been massively hit by numerous cyber attacks which hold a substantial impact on the economy of the nation. Data security directives are critical in resolving growing questions about the privacy of an organization's data. The constantly evolving threat environment has resulted in a slew of government legislation that must be strictly followed by businesses all over the world. Also, these stringent regulations and increased adoption of cloud technology such as cloud computing, SaaS, and many more are major growth drivers. Enterprises are expected to follow mandatory security requirements or face hefty fines from governments if they do not. Enterprise data breaches or data leaks result in significant data loss and damage to a company's brand image. Various regulatory authorities include Federal Trade Commission (FTC), Payment Card Industry Data Security Standard (PCI DSS), FISMA, HIPAA, EU Agency for Network and Information Security (ENISA), GDPR, Gramm-Leach-Bliley Act (GLBA), and Homeland Security Act.

Security as a Service Market: Segmentation

Component Type Segment Analysis Preview

The security as a service market by solution includes continuous monitoring, business continuity, and disaster recovery, encryption, Data Loss Prevention (DLP), intrusion management, Identity and Access Management (IAM), vulnerability scanning, Security Information and Event Management (SIEM), and others. During the forecast period, the SIEM segment of the protection as a service solution market is projected to have the largest market size. Individuals, Small and Medium-sized Enterprises (SMEs), and large enterprises are all worried about gaining connectivity to their network, endpoints, cloud, and apps, which is driving the demand for services. Due to the need to resolve any technical issues and prevent downtime, the support and repair services segment is projected to have the largest market share.

Application Area Segment Analysis Preview

During the forecast period, the network security segment is expected to have the largest market size. Network Security is a dynamic approach for protecting a network from advanced threats that involve gathering and analyzing various forms of network security event data. With the growing threat landscape, cloud-based security solutions for network security are becoming more common, as they secure the network by limiting system management access to terminals, approved services, management ports, and protocols. To avoid unauthorized access and abuse of networking infrastructure, businesses implement a set of policies and cybersecurity cloud services. , Endpoint Security, Application Security, and Cloud form the Application Area segment.

Organization Size Segment Analysis Preview

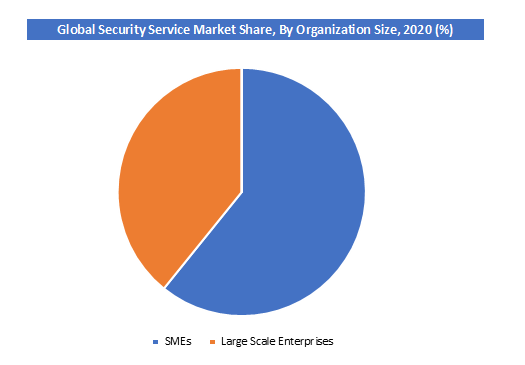

The SME segment is expected to grow at the highest CAGR during the forecast period. This is attributable to the fact of increased cyber-attacks across the globe. SMEs are limited in scale but serve a wide number of customers around the world. Because of their financial limitations, SMEs do not incorporate robust and detailed security solutions. However, Large Enterprise holds the highest share of the security as a service market in 2020.

Vertical Segment Analysis Preview

The retail vertical is expected to grow at the highest CAGR of 27.4% during the forecast period. BFSI vertical is estimated to have the largest market size in 2020. Healthcare, Government and Defense, IT and Telecom, Energy and Utilities, Manufacturing, and others form the Vertical segment.

Security as a Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Security as a Service Market |

| Market Size in 2023 | USD 15.44 Billion |

| Market Forecast in 2032 | USD 47.95 Billion |

| Growth Rate | CAGR of 13.42% |

| Number of Pages | 130 |

| Key Companies Covered | McAfee (US), Kaspersky Lab(US), Cisco(US), Trend Micro (Japan), AT&T(US), DXC Technology(US), International Business Machines Corporation (US), Panda Security (Spain), Zscaler (US), Microsoft (US), Alert Logic (US) Cygilant (US), Clearswift (UK), Barracuda Networks (US), among others |

| Segments Covered | By Component, By Application Area, By Component, By Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Security as a Service Market: Regional Analysis Preview

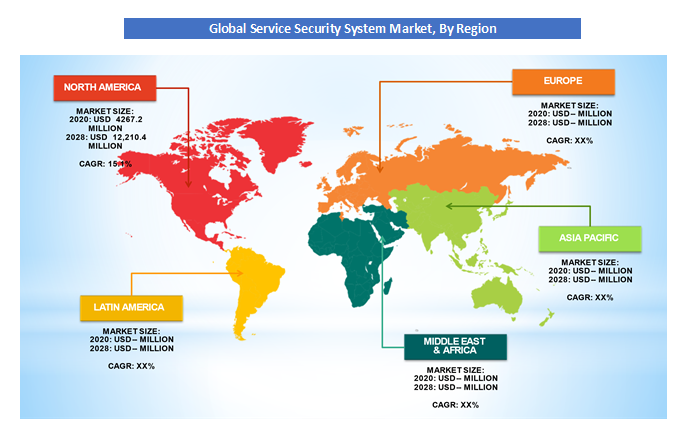

The North American region held a share of 37.56% in 2020. This is attributable to the factors such as escalated usage of the Internet of Things (IoT), Bring Your Own Device (BYOD), and industrial could adoption. Due to the cumbersome cyber-attacks, European countries are investing heavily in cyber security. In order to fight cyber-crime they have set up special courts which is initiated by International Engineering Task Force (IETF) which handles only the cases related to cyberspace.

The Asia Pacific region is projected to grow at a CAGR of 17.9% over the forecast period. This is due to the surge in the demand for cloud-based solutions for business purposes among SMEs. Countries such as China, India, and Japan are heavily spending money in order to be safe from internal and external cyber-attacks. Also, the increased cloud based security solutions adoption among various sectors such as BSFI, Healthcare, Retail, and Defense will make the phenomenal growth during the forecast period.

Security as a Service Market: Key Players & Competitive Landscape

Some of the key players in the service security market include:

- McAfee (US)

- Kaspersky Lab(US)

- Cisco(US)

- Trend Micro (Japan)

- AT&T(US)

- DXC Technology(US)

- International Business Machines Corporation (US)

- Panda Security (Spain)

- Zscaler (US)

- Microsoft (US)

- Alert Logic (US) Cygilant (US)

- Clearswift (UK)

- Barracuda Networks (US)

- Among others

McAfee is one of the leading players in the world's largest competitive defense as a service industry, helping to protect its vast customer base from APTs and vulnerabilities. s main market strategy is to create business-specific solutions and services that are tailored to the current state of evolving vulnerabilities. As part of its long-term approach, it intends to create innovative business models and incorporate multi-application technologies.

A recent advancement was seen when McAfee and Atlassian partnered in May 2020 to provide advanced data security and threat protection to customers adopting cloud systems. Atlassian will be given access to the MVISION cloud, which will provide visibility and control for SaaS, PaaS, and IaaS environments via a secure platform.

The global security service market is segmented as follows:

By Component

- Solution

- Service

By Application Area

- Network Security

- Endpoint Security

- Application Security

- Cloud

By Component

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Retail

- Healthcare

- Government and Defense,

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Security as a Service (SECaaS) is a cloud-based model that provides cybersecurity solutions on a subscription basis. It includes services like threat detection, data protection, identity management, and compliance monitoring, enabling businesses to secure their systems without investing in extensive in-house infrastructure.

According to study, the Security as a Service Market size was worth around USD 15.44 billion in 2023 and is predicted to grow to around USD 47.95 billion by 2032.

The CAGR value of Security as a Service Market is expected to be around 13.42% during 2024-2032.

North America has been leading the Security as a Service Market and is anticipated to continue on the dominant position in the years to come.

The Security as a Service Market is led by players like McAfee (US), Kaspersky Lab(US), Cisco(US), Trend Micro (Japan), AT&T(US), DXC Technology(US), International Business Machines Corporation (US), Panda Security (Spain), Zscaler (US), Microsoft (US), Alert Logic (US) Cygilant (US), Clearswift (UK), Barracuda Networks (US), among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed