Retail Media Networks Market Size, Share, Trends, Growth & Forecast 2034

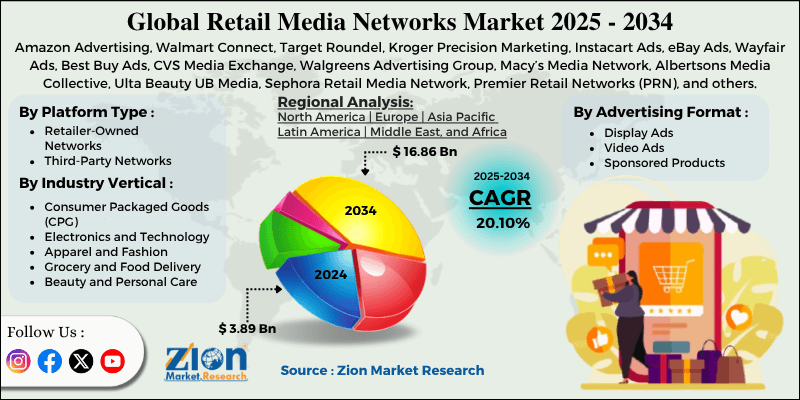

Retail Media Networks Market By Platform Type (Retailer-Owned Networks, and Third-Party Networks), By Advertising Format (Display Ads, Video Ads, Sponsored Products, and Others), By Industry Vertical (Consumer Packaged Goods [CPG], Electronics and Technology, Apparel and Fashion, Grocery and Food Delivery, Beauty and Personal Care, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

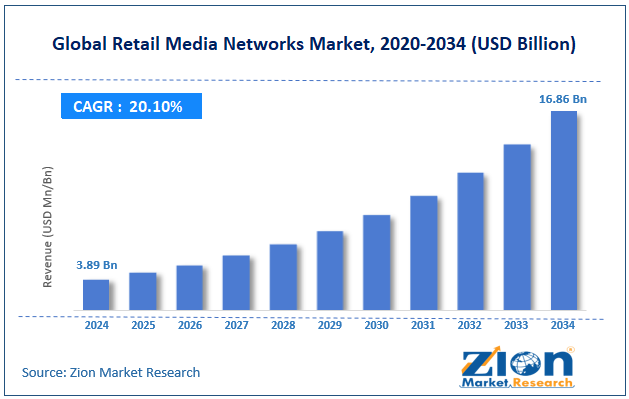

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.89 Billion | USD 16.86 Billion | 20.10% | 2024 |

Retail Media Networks Industry Perspective:

The global retail media networks market size was approximately USD 3.89 billion in 2024 and is projected to reach around USD 16.86 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global retail media networks market is estimated to grow annually at a CAGR of around 20.10% over the forecast period (2025-2034)

- In terms of revenue, the global retail media networks market size was valued at around USD 3.89 billion in 2024 and is projected to reach USD 16.86 billion by 2034.

- The retail media networks market is projected to grow significantly due to the shift of advertising and trade-promotion budgets toward digital and in-store media, the digitization of retail operations enabling media network opportunities, and the decline of third-party cookies, as well as the growing prevalence of privacy regulations.

- Based on platform type, the retailer-owned networks segment is expected to lead the market, while the third-party networks segment is anticipated to experience significant growth.

- Based on advertising format, the display ads segment is the dominant segment, while the sponsored products segment is projected to witness sizable revenue growth over the forecast period.

- Based on industry vertical, the Consumer Packaged Goods (CPG) segment is expected to lead the market, followed by the electronics and technology segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Retail Media Networks Market: Overview

Retail media networks are advertising platforms run by retailers that enable brands to reach shoppers directly on the retailer's digital properties, such as apps and websites, using the retailer's first-party data. These networks leverage rich shopper insights to deliver measurable and targeted ads at or near the point of purchase, fueling sales and brand awareness. The global retail media networks market is poised for notable growth, driven by the monetization of first-party data, the shift to e-commerce and digital development, and revenue diversification for retailers. Retailers are actively capitalizing on the vast amounts of first-party data collected from shopper interactions. By leveraging buying histories and browsing patterns, they create highly personalized and targeted advertising campaigns. This not just enhances ad performance but also transforms data into a profitable new revenue stream.

Moreover, the continuous growth of online shopping has led to an increase in digital advertising and online purchases within retail networks. As consumers spend more time browsing and buying stuff online, retailers gain more digital touchpoints to engage them. This rise in e-commerce activity propels the speedy growth of retail media networks.

Furthermore, as traditional retail margins become increasingly challenging, retailers are shifting to media sales as a new source of revenue. Retail media offers high-margin returns with comparatively low incremental costs, making it a strategic business growth. This diversification boosts financial stability and improves overall competitiveness.

Nevertheless, the global market faces limitations due to factors such as high setup and technology costs, as well as the complexity of measurement and attribution. Establishing a retail media network needs significant investment in technology and infrastructure. Data integration, ad management systems, and analytics platforms add to operational costs. Smaller retailers usually find these financial obstacles complex to overcome. Similarly, collecting ad exposures that lead to actual sales in both offline and online environments remains challenging. The lack of attribution models and standardized metrics creates variations in performance analysis. This uncertainty restricts advertiser confidence and investment in RMNs.

Still, the global retail media networks industry benefits from several favorable factors, including the expansion of omnichannel retail media and the integration of advanced technologies. Assimilating in-store and digital advertising helps reduce the gap between offline and online purchases. Retailers can engage shoppers through synchronized campaigns across various locations and devices. This integrated approach improves conversion and visibility potential. Additionally, advancements such as AR, AI, and machine learning are reshaping the outlook for retail advertising. These solutions allow more interactive, personalized, and dynamic ad experiences. Hence, RMNs can deliver measurable and engaging outcomes.

Retail Media Networks Market Dynamics

Growth Drivers

How is the retail media networks market boosted by retailers seeking new revenue streams?

For retailers with significant online traffic, physical stores, and loyalty programs, establishing a media arm offers a valuable and fresh stream. By becoming a 'media owner', they can monetize visits, in-store traffic, app sessions, and loyalty interactions as ad inventory. With retail margins under pressure, this alternative model offers a strategic boost to profitability. Subsequently, retailers are progressively investing in their RMN capabilities, treating it as a core business line instead of a secondary activity.

How does the evolution of Ad formats & integration across channels fuel the retail media networks market?

Retail media networks are expanding beyond product listing ads to include in-store digital screens, such as connected TV, off-site displays, and audio formats tied to retail data. In Europe, 70% of retailers now offer in-store digital screens, with 54% of buyers actively investing in them. These evolving formats make retail media networks increasingly attractive for brands seeking full-funnel engagement – from awareness to conversion – within a retailer's network. The more integrated and richer formats, the greater the value for both advertisers and retailers. This evolution marks the development of the retail media networks market.

Restraints

The high cost of setup, integration & talent shortage adversely impact the industry's progress.

Launching or expanding a retail media network needs significant investment in analytics, data infrastructure, technology, and specialized media-commerce talent. Nearly 65% of worldwide B2C marketing leaders report difficulties in testing or building RMN efficiency because of low data-team capacity, while 51% mention budget restrictions. Furthermore, a scarcity of media-commerce talent slows execution and restricts the competitiveness of newer and smaller networks. These resource and cost pressures create barriers for retailers, limiting entry and slowing the total growth of the market.

Opportunities

How does expansion into new touchpoints & formats open lucrative opportunities for the retail media networks market development?

Retail media networks have expanded beyond on-site sponsored products, now encompassing CTV, out-of-home digital signage, audio, and in-store access. Nearly 41% of networks now offer shoppable video sports in e-commerce apps and in-store kiosks, enabling advertisers to reach high-intent shoppers in multiple channels. This diversification allows retailers to monetize both physical assets, such as checkout lanes, and digital ones equally. Hence, brands can engage consumers throughout the whole funnel – from awareness to conversion – within the retailer's network. These efforts notably impact the growth of the retail media networks industry.

Challenges

Integration and organizational complexity restrict the market growth

Running an RMN goes beyond selling ad space, as it requires integrating data across commerce, media, marketing, analytics, and IT. Retailers often struggle to overcome organizational silos, outdated technology, and media-commerce talent shortages. Several brands feel pressured to buy from RMNs without complete transparency, which may hamper trust. Incorporating RMN campaigns with broader marketing strategies, such as social, search, and programmatic, is also challenging. Without strong cross-team alignment, RMNs risk low growth potential and inefficient spending.

Retail Media Networks Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Retail Media Networks Market |

| Market Size in 2024 | USD 3.89 Billion |

| Market Forecast in 2034 | USD 16.86 Billion |

| Growth Rate | CAGR of 20.10% |

| Number of Pages | 213 |

| Key Companies Covered | Amazon Advertising, Walmart Connect, Target Roundel, Kroger Precision Marketing, Instacart Ads, eBay Ads, Wayfair Ads, Best Buy Ads, CVS Media Exchange, Walgreens Advertising Group, Macy’s Media Network, Albertsons Media Collective, Ulta Beauty UB Media, Sephora Retail Media Network, Premier Retail Networks (PRN), and others. |

| Segments Covered | By Platform Type, By Advertising Format, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Retail Media Networks Market: Segmentation

The global retail media networks market is segmented based on platform type, advertising format, industry vertical, and region.

Based on platform type, the global retail media networks industry is divided into retailer-owned networks and third-party networks. The retailer-owned networks segment holds a leadership position in the market, as it offers brands direct access to first-party shopper data. These networks allow for precise targeting, surge conversion rates, and a more measurable ROI than third-party platforms. By leveraging their own physical and digital channels, retailers can effectively monetize traffic while maintaining control over ad placement and quality.

Based on advertising format, the global retail media networks market is segmented into display ads, video ads, sponsored products, and others. The display ads segment holds a dominant share, offering a broad visual reach across retailer apps, websites, and partner networks. They are preferred for consideration and awareness, as brands can showcase rich creatives at scale in retail contexts. Their strong presence reflects their established flexibility and ability to integrate first-party shopper data for targeting.

Based on industry vertical, the global market is segmented into Consumer Packaged Goods (CPG), electronics and technology, apparel and fashion, grocery and food delivery, beauty and personal care, and others. The Consumer Packaged Goods (CPG) segment holds a leading share, reflecting its extensive range of everyday products and high repeat purchase rates. Brands in this category utilize retail media to enhance visibility, introduce new SKUs, and influence shoppers at the point of purchase. Their dependency on first-party retail data and high-volume advertising activity makes CPG the leading segment in the domain.

Retail Media Networks Market: Regional Analysis

Why does North America hold a dominant position in the global Retail Media Networks Market?

North America is projected to maintain its dominant position in the global retail media networks market due to its sophisticated e-commerce ecosystem, the presence of major retailers with proprietary media networks, and advanced digital advertising infrastructure & first-party data capabilities. North America boasts a well-established e-commerce infrastructure, with consumers regularly shopping online through mobile devices. This developed market offers a large base of digital purchase data and repeat shopper behavior that feeds retailer-media systems. Subsequently, retailers in the region hold a strong foundation for deploying retail media networks and monetizing ad inventory.

Retail giants like Target Corporation, Walmart, and Amazon operate their own media networks and leverage vast first-party shopper data to attract brands. Their brand and scale relationships enhance ad spend in regional retail media channels. Advertisers in the region have access to developed ad tech, rich first-party data, and programmatic tools, allowing for highly targeted campaigns with measurable ROI. Retailers in the region heavily invest in AI, analytics, and omnichannel integration, thereby improving the effectiveness of ad placements.

Europe maintains its position as the second-largest region in the global retail media networks industry, driven by a strong market size and revenue base, a high growth rate and upside potential, and a mature e-commerce & multi-channel infrastructure. Europe's retail media industry generated nearly $7.7 billion in 2024, accounting for around 24% of the worldwide market. Its primary revenue base appeals to global and regional brand ad spend.

Moreover, the European retail media network sector is expected to grow at a 11.8% CAGR, reaching nearly $14.2 billion by 2030. Speedy adoption by brands and retailers drives this expansion. String growth potential assures regional dominance worldwide. Furthermore, European retailers operate integrated offline and online channels, which improves their first-party data connection and ad inventory. Nearly 40% of retailers maintain a physical and marketplace store presence; this multi-channel structure supports targeted and effective retail media campaigns.

Retail Media Networks Market: Competitive Analysis

The leading players in the global retail media networks market are:

- Amazon Advertising

- Walmart Connect

- Target Roundel

- Kroger Precision Marketing

- Instacart Ads

- eBay Ads

- Wayfair Ads

- Best Buy Ads

- CVS Media Exchange

- Walgreens Advertising Group

- Macy’s Media Network

- Albertsons Media Collective

- Ulta Beauty UB Media

- Sephora Retail Media Network

- Premier Retail Networks (PRN)

Retail Media Networks Market: Key Market Trends

Rise of programmatic and automated buying:

Programmatic ad buying enables the real-time purchase and optimization of retail media inventory. Automation enhances targeting precision, efficiency, and scalability for brands of all sizes. Self-service platforms enable even smaller advertisers to easily access RMNs.

Expansion of richer Ad formats and immersive experiences

Retail media networks are actively adopting video, shoppable ads, AR/VR experiences, and interactive content to engage consumers more deeply. Richer formats help brands to gain traction and differentiate themselves in competitive retail environments. This trend improves engagement and fuels higher conversion rates.

The global retail media networks market is segmented as follows:

By Platform Type

- Retailer-Owned Networks

- Third-Party Networks

By Advertising Format

- Display Ads

- Video Ads

- Sponsored Products

- Others

By Industry Vertical

- Consumer Packaged Goods (CPG)

- Electronics and Technology

- Apparel and Fashion

- Grocery and Food Delivery

- Beauty and Personal Care

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Retail media networks are advertising platforms run by retailers that enable brands to reach shoppers directly on the retailer's digital properties, such as apps, websites, or in-store screens, as well as across external channels using the retailer's first-party data.

The global retail media networks market is projected to grow due to increased use of first-party data by retailers and brands, rising demand for personalized and targeted advertising, and expansion of in-store digital advertising and retail technology.

According to study, the global retail media networks market size was worth around USD 3.89 billion in 2024 and is predicted to grow to around USD 16.86 billion by 2034.

The CAGR value of the retail media networks market is expected to be approximately 20.10% from 2025 to 2034.

Stricter data privacy regulations, such as CCPA and GDPR, along with a growing emphasis on responsible and sustainable advertising, are shaping the growth of retail media networks.

Macroeconomic factors, such as shifts in consumer spending, inflation, and adjustments to advertising budgets, will influence the growth and investment priorities of retail media networks in the near future.

North America is expected to lead the global retail media networks market during the forecast period.

The key players profiled in the global retail media networks market include Amazon Advertising, Walmart Connect, Target Roundel, Kroger Precision Marketing, Instacart Ads, eBay Ads, Wayfair Ads, Best Buy Ads, CVS Media Exchange, Walgreens Advertising Group, Macy’s Media Network, Albertsons Media Collective, Ulta Beauty UB Media, Sephora Retail Media Network, and Premier Retail Networks (PRN).

Stakeholders should adopt omnichannel integration, data-driven targeting, programmatic automation, and innovative ad formats to enhance ROI and remain competitive in the retail media networks market.

The report examines key aspects of the retail media networks market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed