Reprocessed Medical Devices Market Size, Share, Growth and Forecast 2034

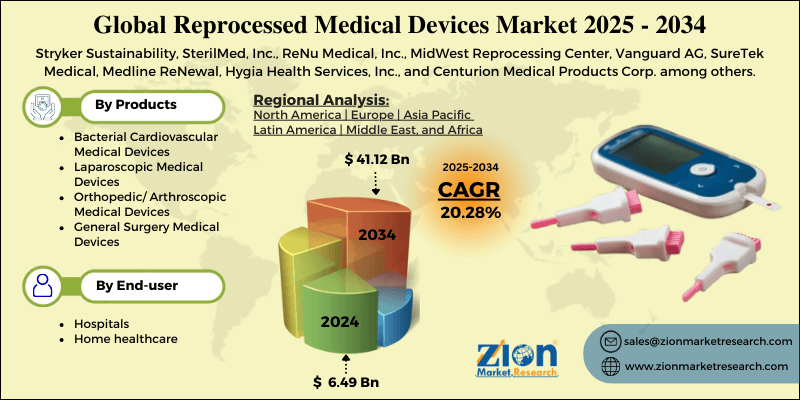

Reprocessed Medical Devices Market Analysis by Product (Bacterial Cardiovascular Medical Devices, Laparoscopic Medical Devices, Orthopedic/ Arthroscopic Medical Devices, and General Surgery Medical Devices), By End-user (Hospitals and Home healthcare): Global Industry Perspective, Comprehensive Analysis and Forecast, 2025-2034

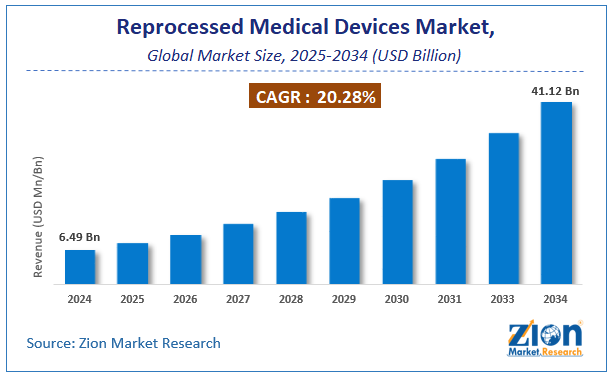

| Market Size in 2024 | Market Forecast in 2024 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.49 Billion | USD 41.12 Billion | 20.28% | 2024 |

Reprocessed Medical Devices Market Overview

The global Reprocessed Medical Devices market accounted for USD 6.49 Billion in 2024 and is expected to reach USD 41.12 Billion by 2034, growing at a CAGR of around 20.28% between 2025 and 2034.

Reprocessed Medical Devices Market: Overview

Reusable medical devices can be reused by healthcare services providers to diagnose as well as to treat multiple patients. Such medical devices include surgical forceps, stethoscopes, and endoscopes. Reprocessing of such devices removes tissue, blood, and other biological debris and inactivates infectious microbes so that devices are safe for the patient. Reprocessed medical devices are devices that can be reprocessed and reused on multiple patients. Reprocessing of the medical devices is the process of disinfection, cleaning, remanufacturing, testing, packaging & labeling, and sterilization of medical equipment. The reprocessing of medical devices has taken the health care sector by storm in recent years.

Reprocessed Medical Devices Market: Growth Dynamics

Global reprocessed medical devices market is expected to exhibit strong growth in the near future on account of increasing significance and need for medical waste disposal. Moreover, a presence of favorable government regulations is expected to boost the market growth in the near future. Increasing investment of industry players in the form of manufacturing facility set up in Asia Pacific is further expected to present with a higher degree of growth in the years to come. However, reluctance in adopting reprocessed medical devices may pose a threat to the market growth in the years to come. Nonetheless, reduced product pricing of reprocessed devices is anticipated to open up new growth opportunities in the near future.

Growing requirement for medical waste disposal and favorable government policies are expected to boost the development of reprocessed medical devices market. Apart from this, mounting concerns pertaining to high volume of landfills & wastes produced across the globe is projected to favorably influence the global demand for reprocessed medical devices. High product demand from hospitals as well as home healthcare sector is likely to expand the business sphere over the next few years.

Reluctance in accepting the reprocessed products, however, can obstruct the industry growth over the ensuing years. Nevertheless, low costs of reprocessed equipment are forecast to open new vistas for reprocessed medical devices market over the coming years, normalizing the impact of hindrances on the reprocessed medical devices market.

The key players in reprocessed medical devices market are focusing aggressively on innovation, as well as on including advanced technologies in their existing products. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development, states the reprocessed medical devices market study.

In a major breakthrough witnessed across reprocessed medical devices industry, in August 2018, Cantel Medical made public that it acquired Stericycle Inc.'s controlled environment solutions business for USD 17 million. Reports state that the strategic decision was based on the firm’s objective of expanding its life sciences portfolio.

Reprocessed Medical Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Reprocessed Medical Devices Market Size Report |

| Market Size in 2024 | USD 6.49 Billion |

| Market Forecast in 2034 | USD 41.12 Billion |

| Growth Rate | CAGR of 20.28% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Stryker Sustainability, SterilMed, Inc., ReNu Medical, Inc., MidWest Reprocessing Center, Vanguard AG, SureTek Medical, Medline ReNewal, Hygia Health Services, Inc., and Centurion Medical Products Corp. among others. |

| Segments Covered | By Type, By Application, By Process, and By Region |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reprocessed Medical Devices Market Segment Analysis Preview

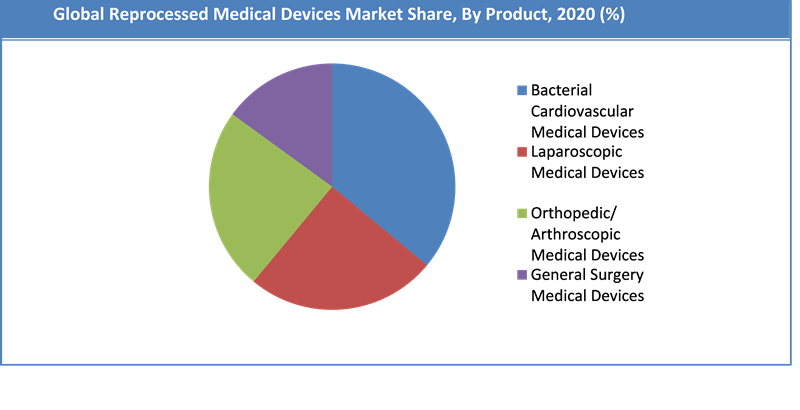

The reprocessed medical device market is segmented on the basis of different types such as cardiovascular medical devices, laparoscopic medical devices, orthopedic/ arthroscopic medical devices, gastroenterology medical devices and general surgery medical devices. Among them, the demand for cardiovascular medical devices is relatively higher and the trend is anticipated to remain so over the next few years. This is due to rising number of cardiovascular surgeries & treatments that are bolstering the need for cost-efficient alternatives. In addition to this, the advent of low-cost and single-use cardiovascular reprocessed devices resulted in upsurge in adoption; hence, contributing to the overall segment growth. Laparoscopy was another leading segment on account of the increasing demand for minimally invasive techniques.

On the basis of end-use, reprocessed medical devices market can be segmented into the hospital and home healthcare. The hospital was the leading segment reprocessed medical devices market in 2015 and is expected to continue its dominance in the coming years. This growth is mainly attributed to increasing outsourcing activities for reprocessing to third-party vendors. For instance, according to the study published in PubMed, in the year 2007, the National Institutes of Health, more than 42% of hospitals in the U.S. outsourced reprocessing to third-party reprocessing organizations. Home healthcare is expected to experience significant growth within the forecast period.

Regional Analysis Preview

Regionally, North America has been leading the worldwide reprocessed medical devices market and is anticipated to continue on the dominant position in the years to come, states the reprocessed medical devices market study. High product acceptance rate and favorable government initiatives supporting the production of reprocessed medical devices is the main factor behind the dominance of the North America reprocessed medical devices market. The high number of market players being headquartered in North America is another yet significant factor that is supporting this regional reprocessed medical devices market.

Key Market Players & Competitive Landscape

Some of the major players of the global Reprocessed Medical Devices market include

- Stryker Sustainability

- SterilMed, Inc.

- ReNu Medical, Inc.

- MidWest Reprocessing Center

- Vanguard AG

- SureTek Medical

- Medline ReNewal

- Hygia Health Services, Inc.

- and Centurion Medical Products Corp. among others.

The global Reprocessed Medical Devices Market is segmented as follows:

By Products

- Bacterial Cardiovascular Medical Devices

- Blood Pressure Cuffs/Tourniquet Cuffs

- Cardiac Stabilization And Positioning Devices

- Compression Sleeves (DVT)

- Diagnostic Electrophysiology Catheters

- Electrophysiology Cables

- Laparoscopic Medical Devices

- Endoscopic Trocars And Components

- Harmonic Scalpels

- Orthopedic/ Arthroscopic Medical Devices

- External Fixation Devices

- Gastroenterology Medical Devices

- Biopsy Forceps

- General Surgery Medical Devices

- Balloon Inflation Devices

By End-user

- Hospitals

- Home healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Reprocessed Medical Devices Market was valued at USD 6.49 Billion in 2024.

The global Reprocessed Medical Devices Market is expected to reach USD 41.12 Billion by 2034, growing at a CAGR of 20.28% between 2025 to 2034.

Some of the key factors driving the global Reprocessed Medical Devices Market growth are growing requirement for medical waste disposal and favorable government policies.

North America is expected to remain the dominant region over the forecast period. North America followed by Asia-Pacific and Europe in terms of demand for Reprocessed Medical Devices.

Some of the major players of global Reprocessed Medical Devices market Stryker Sustainability, SterilMed, Inc., ReNu Medical, Inc., MidWest Reprocessing Center, Vanguard AG, SureTek Medical, Medline ReNewal, Hygia Health Services, Inc., and Centurion Medical Products Corp. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed