Global Remittance Market Size, Share Report, Analysis, Trends, Growth, 2032

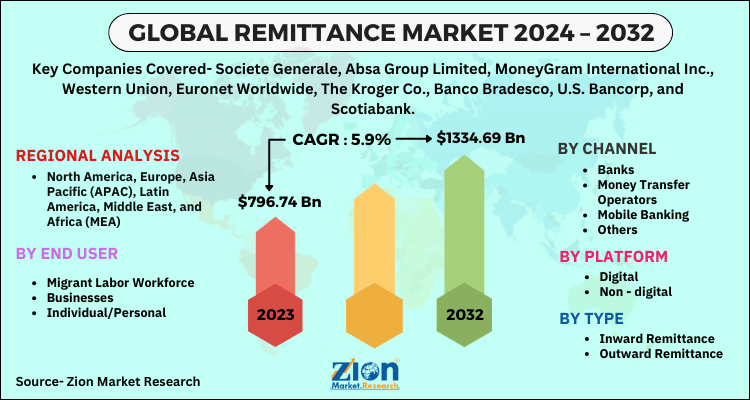

Remittance Market - by Type (Inward Remittance and Outward Remittance), by Platform (Digital and Non-Digital), by Channel (Banks, Money Transfer Operators, Mobile Banking, and Others), by End User (Migrant Labor Workforce, Businesses, and Individual/Personal): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032.

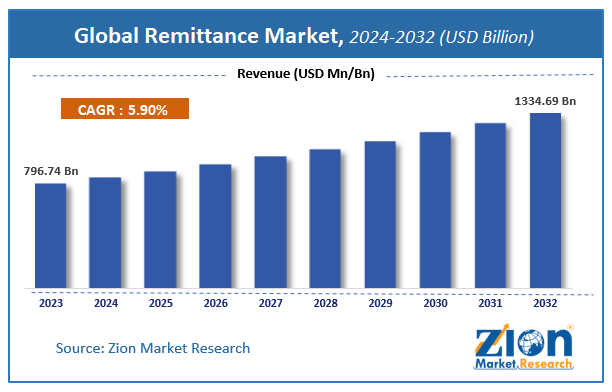

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 796.74 Billion | USD 1334.69 Billion | 5.9% | 2023 |

Remittance Market Insights

According to a report from Zion Market Research, the global remittance market was valued at USD 796.74 Billion in 2023 and is projected to hit USD 1334.69 Billion by 2032, with a compound annual growth rate (CAGR) of 5.9% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the remittance industry over the next decade.

The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

Remittance Market: Overview

Remittance is a method of money transfer that can be sent through wire transfer, draft, cheque, or e-payment mode. These remittances can be utilized for making payments in the form of invoice orders or other kinds. Precisely, the terminology designates the transfer by the person working in one country to his/her family residing in another country. As per the World Bank report, in the year 2018, the global remittance industry accrued revenue of nearly USD 689 billion, and it was projected that the overall market earnings will hit USD 715 billion in 2019. Reportedly, countries like India, Nepal, Egypt, Pakistan, Vietnam, China, Mexico, Bangladesh, Nigeria, and the Philippines were the top ten remittance receivers in 2018.

Remittance Market: Growth Factors

A prominent rise in the migrant population and an increase in the acceptance of banking & financial solutions will propel business growth over the forecast timespan. Apart from this, the minimization of the money transfer service period and reduction in costs of remittance will spur the market growth trends. In addition to this, a rapid surge in smartphone penetration along with an increase in the tech-savvy end-users choosing online remittance services is anticipated to pave the way for the growth of the remittance industry over the forecasting timeline.

Furthermore, an increase in digitization and payment automation will chart a profitable roadmap for the remittance industry over the years ahead. Additionally, inflation witnessed in the number of migrants from emerging economies to developed ones for better job avenues will further define the market progression within the next couple of years.

Individuals shifting from one country to another in search of jobs and education will enhance cross-border financial transactions, thereby driving market trends. Moreover, the use of online remittance solutions provides consumers with a higher level of security and data privacy. This, in turn, will offer high growth opportunities for the remittance industry over the years to come.

Global Remittance Market: Segmentation

The study provides a decisive view of the robot remittances market by segmenting the market based on by type, by platform, by channel, by end user and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By type segment analysis includes inward remittance and outward remittance.

By platform segment analysis includes digital and non - digital.

By channel segment analysis includes banks, money transfer operators, mobile banking and others.

By end user segment analysis includes migrant labor workforce, businesses and individual/personal.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Remittance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Remittance Market |

| Market Size in 2023 | USD 796.74 Billion |

| Market Forecast in 2032 | USD 1334.69 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 167 |

| Key Companies Covered | Societe Generale, Absa Group Limited, MoneyGram International Inc., Western Union, Euronet Worldwide, The Kroger Co., Banco Bradesco, U.S. Bancorp, and Scotiabank |

| Segments Covered | By Type, By Platform, By Channel, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 - 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Dominate Overall Industry Surge By 2032

The expansion of the industry in the sub-continent over the forecast timespan is due to the humungous presence of key financial firms in the sub-continent along with the acceptance of major technologies that help in connecting with the end-users in the region. In addition to this, many people migrate to the countries like the U.S. and Canada for jobs & education and this will further impel the business growth in the sub-continent over the forecast timeline. Apart from this, the presence of key financial service & communication firms like Western Union and MoneyGram will provide new growth avenues for the market in the North American region over the assessment period.

Remittance Market: Competitive Space

Key players profiled in the report and influencing the business growth are

- Societe Generale

- Absa Group Limited

- MoneyGram International Inc.

- Western Union

- Euronet Worldwide

- The Kroger Co.

- Banco Bradesco

- U.S. Bancorp

- Scotiabank.

This report segments the global remittances market as follows:

By Type

- Inward Remittance

- Outward Remittance

By Platform

- Digital

- Non - digital

By Channel

- Banks

- Money Transfer Operators

- Mobile Banking

- Others

By End User

- Migrant Labor Workforce

- Businesses

- Individual/Personal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A prominent rise in the migrant population and increase in the acceptance of banking & financial solutions will propel the business growth over the forecast timespan. Apart from this, minimization of money transfer service period and reduction in costs of remittance will spur the market growth trends. In addition to this, a rapid surge in the smartphone penetration along with an increase in the tech-savvy end-users choosing online remittance services is anticipated to pave a way for the growth of remittance industry over the forecasting timeline. Furthermore, increase in the digitization and payment automation will chart a profitable roadmap for the remittance industry over the years ahead. Additionally, inflation witnessed in the amount of migrants from emerging economies to developed ones for better job avenues will further define the market progression within the next couple of years.

According to Zion market research report, the global Remittance market, which was estimated at USD 796.74 Billion in 2023 and is predicted to accrue earnings worth USD 1334.69 Billion by 2032 is set to record a CAGR of nearly 5.9% over 2024-2032.

North America is likely to make noteworthy contributions towards overall market revenue. The regional market growth over 2024-2032 can be credited to humungous presence of key financial firms in the sub-continent along with the acceptance of major technologies that help in connecting with the end-users in the region. In addition to this, many persons migrate to the countries like the U.S. and Canada for jobs & education and this will further impel the business growth in the sub-continent over the forecast timeline. Apart from this, presence of key financial service & communication firms like Western Union and MoneyGram will provide new growth avenues for the market in the North American region over the assessment period.

The key players profiled in the report include Societe Generale, Absa Group Limited, MoneyGram International Inc., Western Union, Euronet Worldwide, The Kroger Co., Banco Bradesco, U.S. Bancorp, and Scotiabank.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed